Join Our Telegram channel to stay up to date on breaking news coverage

The best crypto under 1 dollar allows investors to add cheap tokens with a potential upside to their portfolio.

In recent news, Bitcoin witnessed a 10% surge in value. Thus shedding light on the potential consequences of an imminent decision by the US Securities & Exchange Commission (SEC). This decision revolves around approving exchange-traded funds (ETFs) that would directly invest in Bitcoin.

Bitcoin’s dominance rate, which signifies its share of the overall cryptocurrency market, is steadily rising. This uptrend poses a potential challenge to the earlier 2021 rally of alternative cryptocurrencies, which had outperformed Bitcoin.

According to data from the charting platform TradingView, the dominance rate reached 52.45% on Monday, marking its highest point since April 2021. This upward trajectory aligns with the bullish breakout observed in June, effectively ending a period of range-bound trading between 38% and 48%.

6 Best Cheap Crypto To Buy Now Under 1 Dollar

Purchasing low-cost tokens can be an enticing investment opportunity for investors. These assets, often priced under one Dollar, have the potential for an upward trend. The following assets offer such potential:

1. Tron (TRX)

TRON positions itself as a platform for content creators to connect directly with their audiences. This approach reduces dependence on centralized intermediaries, such as streaming services, app stores, and music platforms.

The ultimate goal is to minimize commission fees and, in turn, potentially lower costs for consumers. This becomes especially relevant in the entertainment sector’s increasing digitization, where TRON’s early adoption of blockchain technology could provide a competitive advantage.

DWF Labs, a leading digital asset market maker, and Web3 investment firm, recently announced a strategic partnership with TRON in a significant move to bolster support for blockchain ecosystems. This partnership aims to harness DWF Labs’ expertise as a liquidity provider to strengthen TRON’s ecosystem and facilitate its growth.

In addition, TRON’s CEO, Justin Sun, has unveiled the company’s new mission of creating a Metaverse free port. This vision strives to promote global economic inclusion for the entire world population. TRON serves as an accessible financial hub within the Metaverse. Thus, It aspires to provide compliant financial services while adhering to local jurisdiction requirements.

Our integration with @GoogleCloud's #BigQuery is a game-changer. 🎉 With powerful data analysis capabilities, this partnership offers real-time insights into #TRON's on-chain activities. ⛓️💻

Explore our network like never before! 🚀@LeFigaroBourse: https://t.co/6JHafuWAGv pic.twitter.com/UqhVHmkn4E

— TRON DAO (@trondao) October 16, 2023

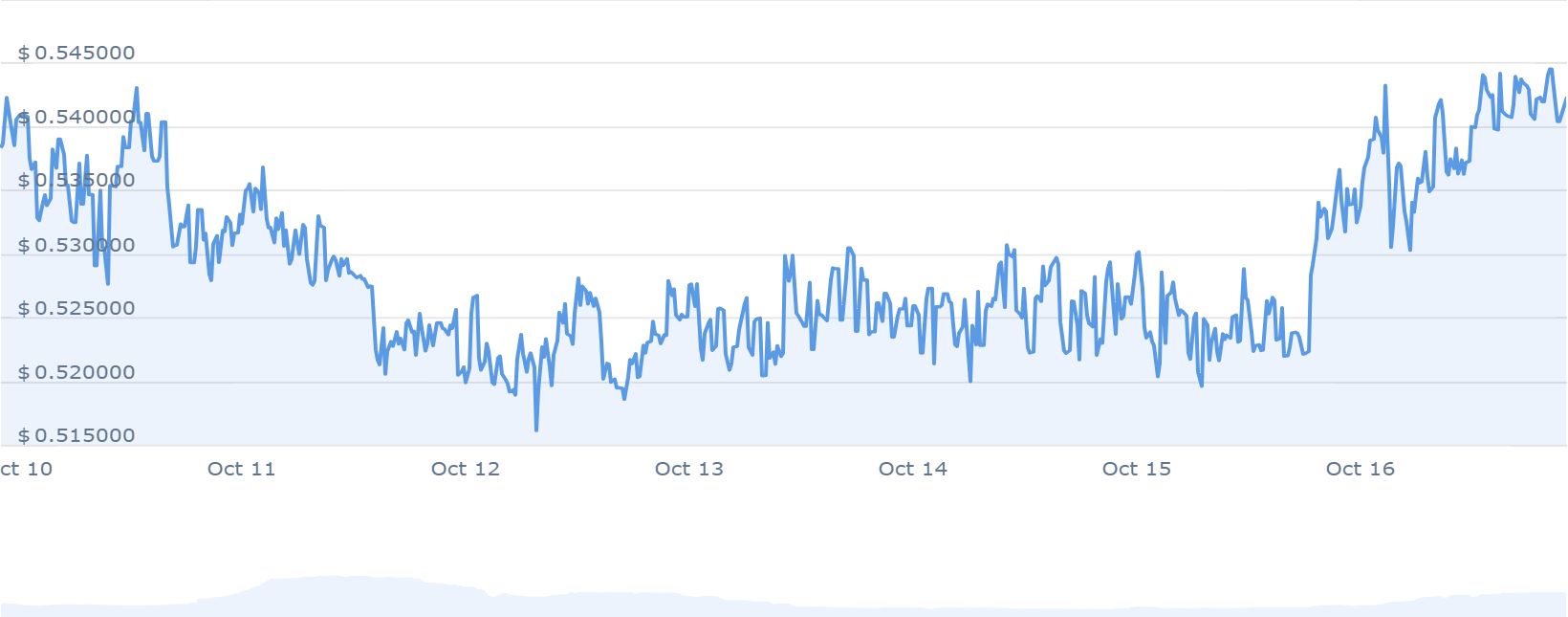

TRON has a current live price of $0.088845, with a 24-hour trading volume of $239,594,286. Over the past 24 hours, the token has seen a 2.47% increase in value, with a CoinMarketCap rank of #10. Furthermore, the token boasts a live market capitalization of $7,900,858,417 and a circulating supply of 88,928,559,177.

2. Curve Dao Token (CRV)

Curve has garnered significant attention because it is an Automated Market Maker (AMM) focused on stablecoin trading. The Curve DAO and CRV token launch has further enhanced its appeal. CRV tokens serve a governance function distributed to users based on their liquidity commitments and ownership duration.

Furthermore, the growing DeFi trading landscape has solidified Curve’s presence as AMMs manage substantial liquidity and generate user profits. As a result, Curve is well-suited for individuals engaged in various DeFi activities. This includes yield farming, liquidity mining, and those seeking to maximize returns by holding relatively stable stablecoins.

Substantial liquidity is a primary requirement to establish a successful decentralized exchange (DEX). Therefore, Curve issues the Curve DAO token (CRV) to incentivize liquidity providers. Participants contributing liquidity to Curve receive CRV rewards and a fair share of trading fees generated on the platform.

Notably, Curve’s support for specific DeFi lending and borrowing protocols grants liquidity providers the opportunity to earn interest from these contract operations. The low risk of impermanent loss, especially in stablecoin-based pools, makes Curve an option for liquidity providers looking to park their funds.

Deleverage at https://t.co/EjL8SInail is finally up! You can do so even when you are under the liquidation price pic.twitter.com/ZkFENzIKow

— Curve Finance (@CurveFinance) October 16, 2023

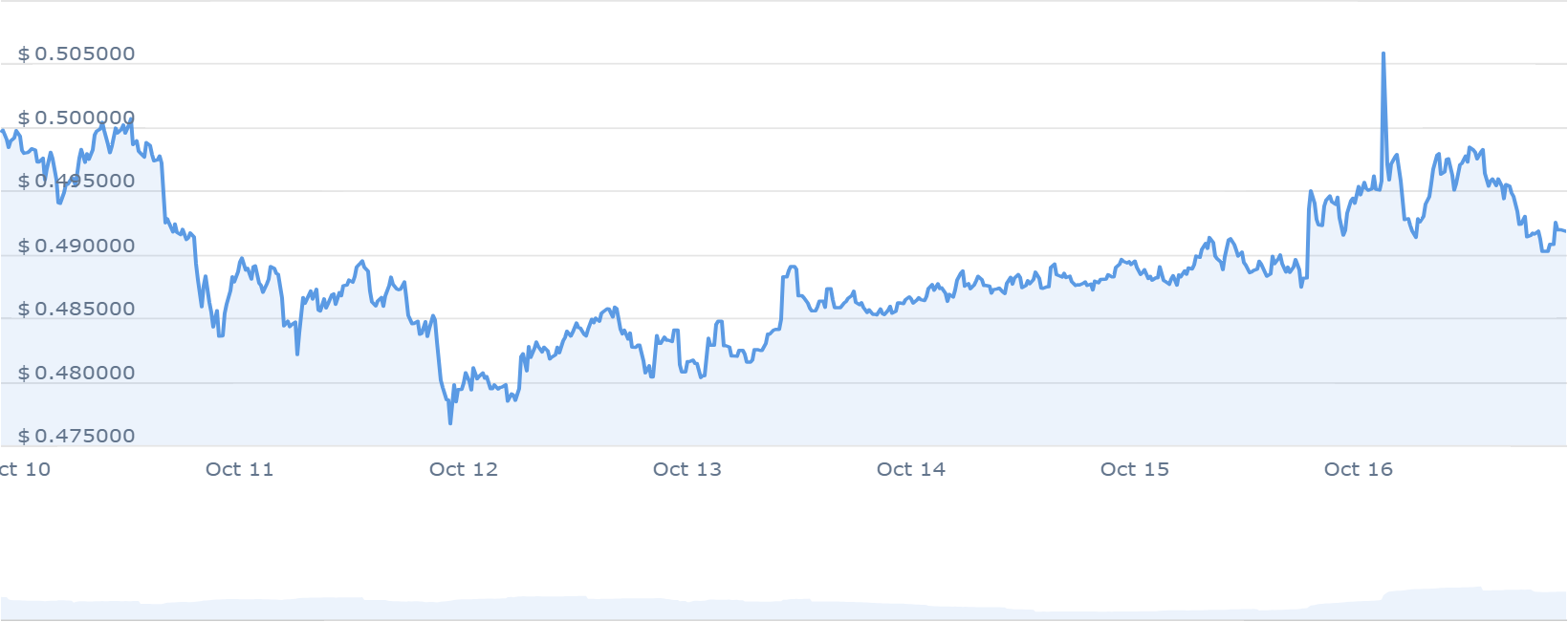

Recent data shows that Curve DAO Token is priced at $0.445369, with a 24-hour trading volume of $159.49 million. Moreover, the market capitalization stands at $399.23 million, showing a market dominance of 0.04%. Over the last 24 hours, the CRV token has experienced a 0.41% price increase.

3. Launchpad XYZ (LPX)

Launchpad XYZ has garnered attention within the cryptocurrency trading community. It aspires to reshape the way investors make decisions in Web 3.0. Therefore, it aims to provide users with comprehensive data through its advanced dashboard, enabling them to make informed cryptocurrency investments.

One key feature of Launchpad XYZ is its incorporation of market sentiments from prominent crypto investors and analysts. This gives users insights into where influential parties direct their investments, aiming to guide their decision-making. The platform also seeks to educate users, empowering them to make independent trading choices and avoid relying solely on third-party information.

Ignite your trading prowess with #Apollo, our custom A.I.

Decode digital assets for invaluable insights and informed decisions 🔥🤖 #AI #Web3 #Alts #Blockchain pic.twitter.com/LHkvxo1kBm

— Launchpad.xyz (@launchpadlpx) October 16, 2023

The native token of the Launchpad XYZ ecosystem, LPX, offers more than just exposure to the project’s growth. It has multiple use cases, particularly for users staking a minimum of 10,000 LPX tokens. These users have access to various premium features, such as reduced trading commissions on the Launchpad XYZ decentralized exchange.

Likewise, users are guaranteed access to new NFT mints at competitive prices and early access to exclusive presales. Moreover, there are discounts on products and services provided by Launchpad XYZ partners. Also, early-bird access to play-to-earn games in beta mode allows users to monitor game development and make informed decisions regarding in-game crypto tokens.

In summary, Launchpad XYZ is a platform designed to facilitate more informed cryptocurrency trading decisions. It offers features that cater to novice and experienced traders, with LPX tokens as a key component in unlocking these premium features.

Visit Launchpad XYZ.

4. Nexo (NEXO)

Nexo is driven by its mission to enhance the value and utility of digital assets through a diverse suite of products. These products encompass advanced trading solutions, liquidity aggregation, and tax-efficient asset-backed credit lines.

NEXO Token is the platform’s native digital currency, built on the Ethereum blockchain as an ERC-20 token. The primary role of this token is to provide access to different tiers within Nexo’s Loyalty Program. It is traded on open markets, offering users specific features. Such offerings include preferential borrowing rates, cash-back incentives, fee-free withdrawals, and improved yield rates.

In partnership with Mastercard, Nexo has launched the world’s first crypto-backed credit card, Nexo Card. The card enables clients to spend the fiat equivalent of their cryptocurrency holdings without selling them.

https://twitter.com/Nexo/status/1713544271897227335?s=20

Regarding the price forecast for the NEXO Coin 2023, experts suggest a maximum price projection of around $1.20. Additionally, they anticipate a potential average price of $1.06, provided favorable market conditions prevail.

5. XRP (XRP)

Roblox, the prominent online gaming platform, recently adopted Ripple (XRP) as a new payment method for in-game purchases. This development underscores Roblox’s recognition of the increasing interest in cryptocurrencies. Moreover, this move aligns with broader trends in the gaming industry by exploring blockchain and cryptocurrency integration.

The introduction of XRP as a payment option diversifies the methods available for users to make in-game purchases, potentially enhancing the gaming experience. In addition, Roblox’s adoption of XRP signifies a substantial step toward cryptocurrency acceptance among younger audiences. Thus contributing to a broader understanding of digital currencies in the gaming sector.

XRP has shown resilience recently, with a remarkable streak of 25 consecutive weeks of positive inflows, even amid legal challenges. Analysts have pointed to a bullish pattern in XRP’s price chart, potentially leading to a surge, with predictions of reaching $1.5.

#RippleSwell Agenda is live! Over the course of two days you'll hear from Ripple customers, team members and industry thought leaders discussing how financial institutions and businesses are leveraging crypto and blockchain technology. Request your invite: https://t.co/62JfZMUOrb pic.twitter.com/WMQigQgmMS

— Ripple (@Ripple) October 16, 2023

This outlook is based on an analysis of XRP’s weekly chart, which has exhibited a broadening pattern since May 2022. Additionally, XRP managed to break above a multi-year descending trendline during a rally in July, remaining above this critical trendline even during subsequent corrections.

6. Stacks (STX)

Stacks is a blockchain layer that enables smart contracts and dApps to utilize Bitcoin on the blockchain. Hence, leveraging Bitcoin’s status as the largest and most valuable decentralized asset while preserving its security features.

One objective of the Stacks layer is to unlock the potential of a substantial amount of Bitcoin capital, estimated to be around $500 billion. It seeks to achieve this by integrating Bitcoin as a settlement option for decentralized applications.

The Stacks blockchain has already seen the development of several popular applications. Notable among them is Stackswap, a decentralized exchange (DEX) that allows users to trade cryptocurrencies without the need for intermediaries.

🟧 Scaling the Bitcoin economy

🟧 Upholding Bitcoin's security and decentralizationBy @veradittakit – Blockchain Investor at @panteracapital pic.twitter.com/KK6iR8ZsEZ

— stacks.btc (@Stacks) October 15, 2023

CityCoins, another application, enables cities to create their tokens, with citizens having the option to donate STX and potentially win native city coins. This concept has been adopted by cities such as Miami and New York City. Moon, a platform offering prepaid or virtual Visa cards for cryptocurrency payments, further expands the usability of cryptocurrency in the global commerce landscape.

Since its launch and initial coin offering (ICO), Stacks has achieved significant success, with over 300 dApps built on its platform. In addition, it has effectively bridged the gap between Bitcoin and smart contracts, offering new possibilities for holders of Bitcoin (BTC) and Stacks (STX).

Experts have identified Stacks as a digital asset to watch in the coming year. According to analysis, Stacks is anticipated to maintain a maximum price of approximately $1.15 as the broader crypto market gradually recovers its value. Furthermore, projections for the last quarter of the year suggest that the average price for STX may reach around $1.02.

Read More

Join Our Telegram channel to stay up to date on breaking news coverage