Join Our Telegram channel to stay up to date on breaking news coverage

Decentralised finance (DeFi), meant to replace the way we conduct our daily financial transactions, has boomed in recent months. According to the DeFi aggregator website, DeFiPulse, over $95.17 billion total value locked (TVL) is currently circulating in the nascent sub-sector.

With so much money at stake, decentralised exchanges (DEXs for short) have served as the preferred channel to access this burgeoning space. DEX platforms have seen a meteoric surge in the past few months as more investors rush for DEX coins to buy. This article highlights some of the best-performing DEX at the moment and the DEX coins to buy with growth potential.

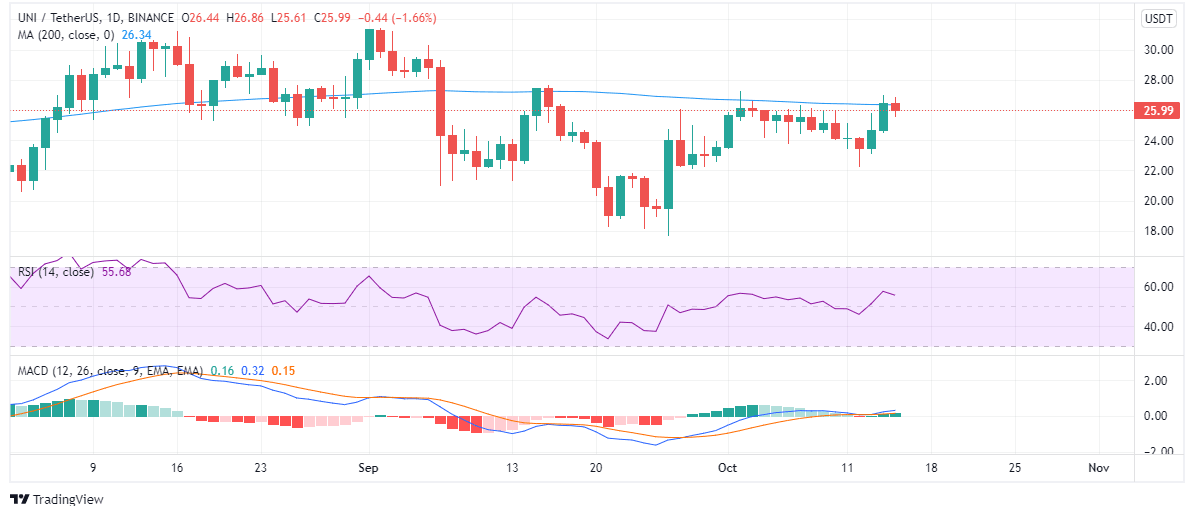

1. UniSwap (UNI)

Our top pick, UniSwap, is one of the top DEX coins to buy in the long term. Enabling the trading of DeFi tokens in a decentralised manner, UniSwap is an automated market maker (AMM) and a very popular choice for DeFi users. Following the boom in DeFi trading activities, UniSwap has launched a series of its platform, with version 3 currently holding the second most valuable DEX platform.

The platform also serves as a Launchpad and hub for DEX protocols with digital marketing-focused blockchain Ojamu launching its OJA token on the UniSwap platform.

UniSwap’s trading volume is up 40.53% in the last 24 hours as more investors look to plug into DeFi and tap into the massive benefits. The native token UNI has also posted an impressive performance. The ERC-20 token is up 4.14% and trades at $25.99 on the daily chart. With over $25 billion in a fully diluted market cap, UNI is one of the best DEX coins to buy.

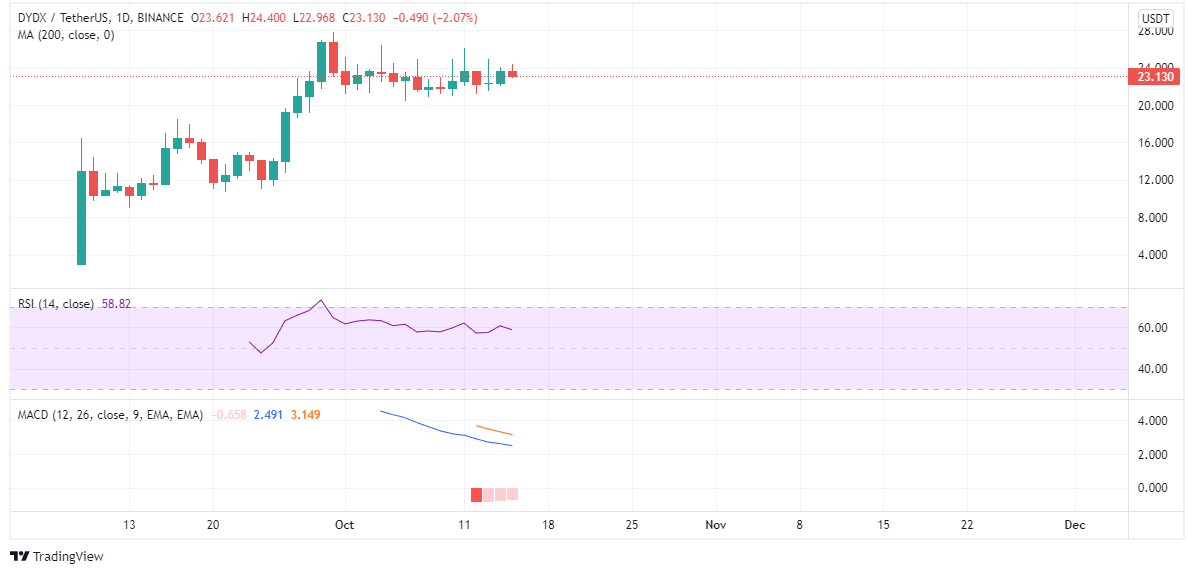

2. dYdX (DYDX)

dYdX is included in the list of our DEX coins to buy given the increased user traffic on the platform. The DEX platform is a decentralised margin protocol that enables users to lend, borrow, and make price predictions on the future prices of cryptocurrencies.

Functioning as a centralised exchange, dYdX supports spot, margin, and perpetual contracts trading while spicing it up by eliminating know-your-customer (KYC) policies or requiring users to register.

Users get to trade with zero gas costs, lower trading fees, reduced minimum sizes while never handing over the funds to a centralised authority, as these are stored on smart contract applications. In essence, dYdX combines the security and transparency of a DEX with the speed and user-friendliness of a centralised exchange. DEX platforms like dYdX have seen increased user traffic due to the growing regulatory action against crypto trading in certain regions.

After the crypto trading ban by the Chinese government, trading volume hit $10 billion on the decentralised trading protocol. This saw the value of its token nearly hit a 100% increase in one week as it surged to $27. However, the digital token has since retraced some of its gains, and it trades at $23.130, up 2.34% on the daily trading chart. With so much capital inflow, dYdX sits on the top of the most valuable DEX coins to buy at the moment, with over $4 billion in trading volume in the last 24 hours.

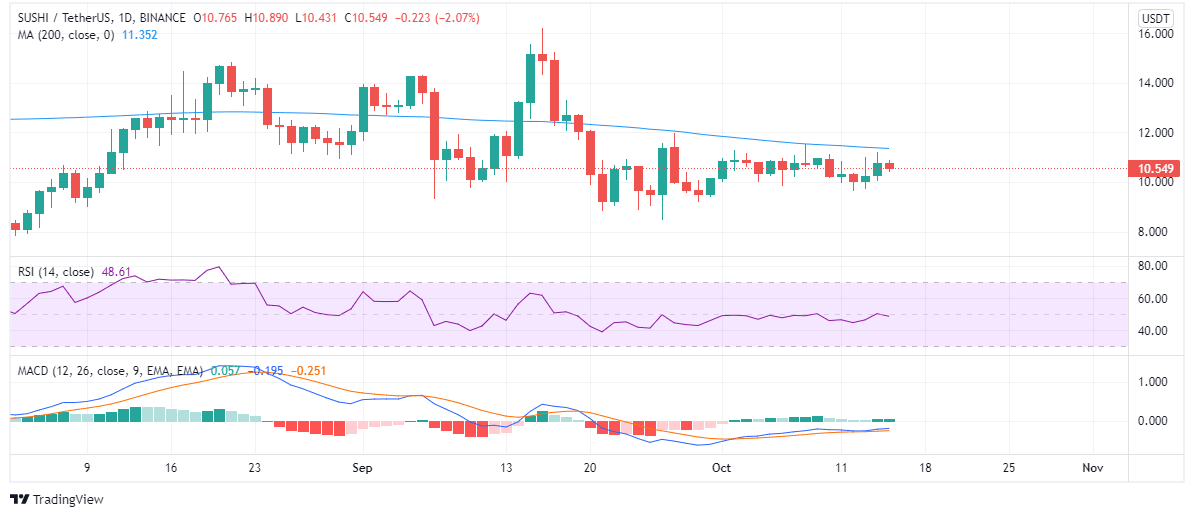

3. SushiSwap (SUSHI)

If you are looking for DEX coins to buy for massive gains, you should also consider UniSwap fork SushiSwap. Looking to break the DEX monopoly enjoyed by VCs, SushiSwap seeks to be a more advanced version of the UniSwap protocol.

It also performs similar functions and enables users to provide liquidity, make atomic swaps, and trade without providing any form of identification. A DeFi trader only requires tokens to provide liquidity or even create a market for any pair of tokens.

SushiSwap offers a more flexible AMM system and rewards users from its 0.3% cut from transactions. Price-wise, SUSHI has performed impressively over the year and hit an all-time high (ATH) of $22.91 on March 31. Although it has since retraced to less than its record high, SUSHI is up 2% in the last 24 hours and trades at $10.549. This rally comes on the back of a new initiative termed ‘DeFi for the People.’

The UniSwap fork recently joined forces with smartphone-focused blockchain platform Celo blockchain to enable more DeFi penetration. The joint partnership will see $12.6 million in liquidity mining rewards accessible in CELO and SUSHI for smartphone users.

4. PancakeSwap (CAKE)

Although not resident on the Ethereum protocol, PancakeSwap is one of the most popular DEX protocols in the DeFi space. Based on Ethereum rival Binance Smart Chain (BSC), PancakeSwap allows users to provide liquidity, stake their tokens, and swap tokens seamlessly.

Powered by cutting-edge smart contract tech, each token swap is rerouted to the best price automatically. Also, crypto stakers earn LP tokens as a reward for providing liquidity on the platform. Aside from this, users can also earn more CAKE by participating in the protocol’s single-asset PancakeSwap Syrup Pools.

Building up an entire ecosystem, PancakeSwap launched support for non-fungible tokens (NFTs) where users can buy and sell verified PancakeSwap collectibles. Other key functionalities include a lottery system, prediction market, and an initial Farm Offering (IFO).

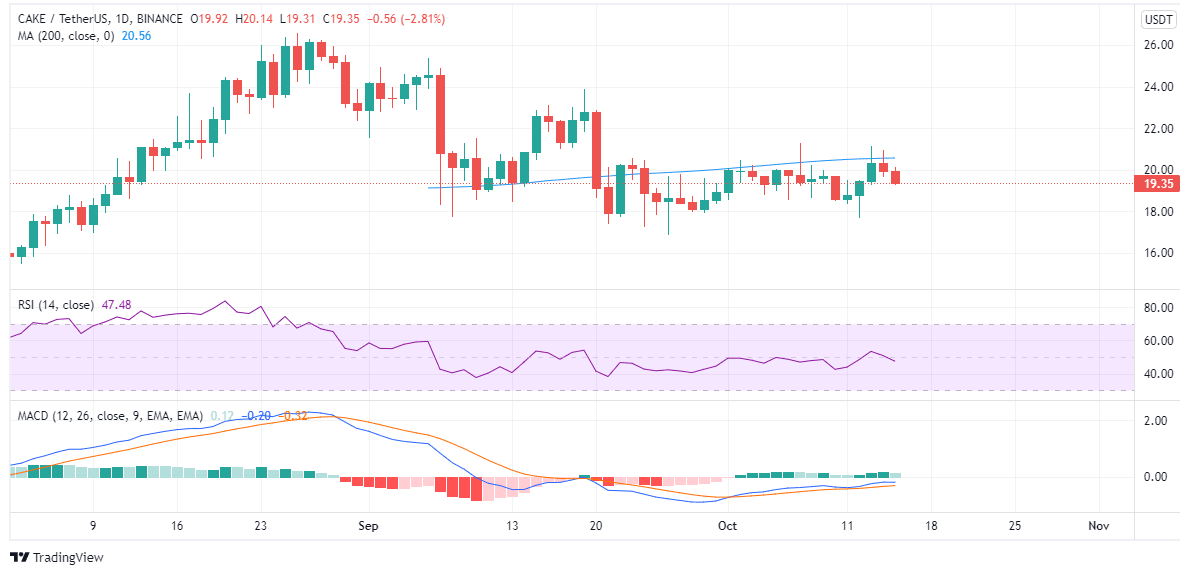

Price-wise, CAKE is still battling a bearish atmosphere as it is down 5.57% on the daily chart. It trades at $19.35 after seeing a surge in value at the beginning of September. Although the dip may seem like a bad take on CAKE long-term potential, the platform’s growing ecosystem makes it one of the viable DEX coins to buy. This is because NFTs are a major hit this year, and if the digital collectibles are a hit, CAKE would likely surge in value.

5. 1Inch (1INCH)

Rounding up our top DEX coins to buy list is DEX aggregator 1Inch. 1Inch works as a middleman by scouring several DEX platforms for the best crypto prices. It then reroutes customers’ trades through these exchanges to ensure they get the lowest price while trading on the platform.

The protocol’s teeming popularity has seen it integrate with several protocols since its launching in 2019. One of the most recent is with layer-two protocol Arbitrum. The DEX aggregator looks to tap into the lower cost and faster transaction throughput the multi-chain solution for Ethereum offers.

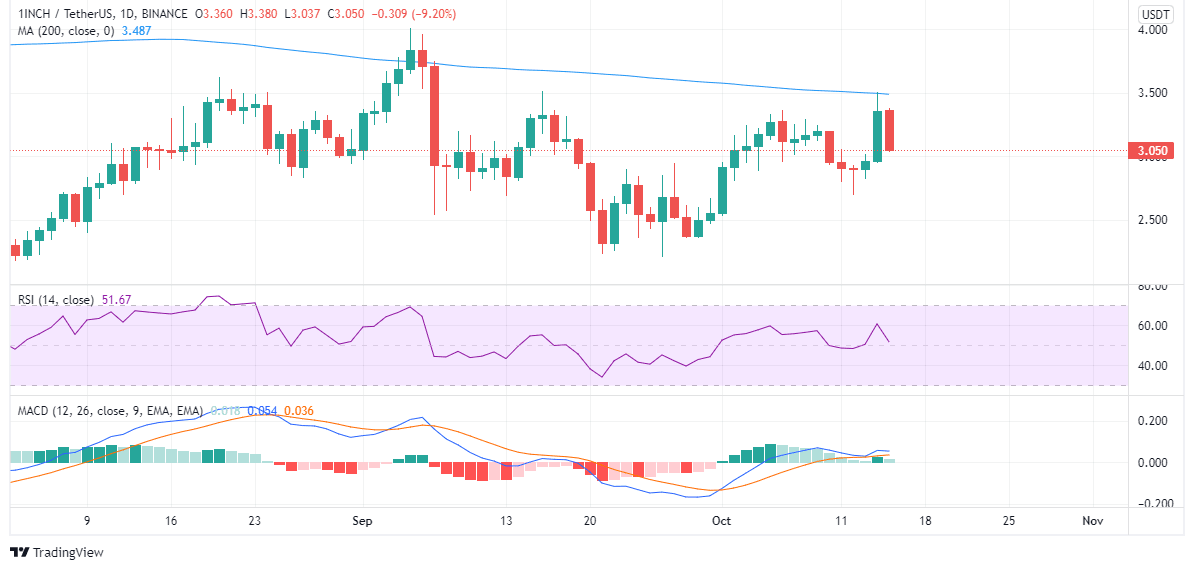

Also, Oasis.app has integrated with the 1Inch platform to tap into the protocol’s deep liquidity and cost-effective trades. Price-wise, 1Inch is in a bind and has shed some of its gains. It’s down by 0.54% and trades at $3.05. However, a bullish push in the coming weeks would likely see the digital token surge.

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage