Join Our Telegram channel to stay up to date on breaking news coverage

With investors looking to protect themselves from the current market downturn, it is especially important to find digital assets that pose little to no threat to their portfolios. Below, we’ll look into some of the best cryptocurrency for lower risk returns as well as the factors that could be contributing to their price gains.

1. Lucky Block (LBLOCK)

First on our list of the best cryptocurrency for lower risk returns is LBLOCK. The digital asset is the native token for Lucky block – a blockchain gaming platform that combines a play-to-earn model with a high-quality token.

LBLOCK is the gateway to Lucky Block’s ecosystem of games. Users can buy Lucky Block to play games on the platform, instead of the traditional ticketing system.

LBLOCK is the gateway to Lucky Block’s ecosystem of games. Users can buy Lucky Block to play games on the platform, instead of the traditional ticketing system.

At press time, LBLOCK current price is $.0009291. This represents a drop of 14.5% in the past month.

Because of the current enthusiasm around Lucky Block, we choose LBLOCK as our top digital asset to invest in. The platform’s creators are hosting a prize pool and non-fungible token (NFT) giveaway with a total prize pool of $2 million up for grabs.

Users can enter the Lucky Block prize pool by purchasing tickets for $5 or holding $500 worth of LBLOCK tokens. As for the NFT giveaway, users become eligible when they buy one of Lucky Block’s Platinum Rollers’ Club NFTs. Both giveaways are expected to last until the end of this week, so investors can still get on board.

Only 4 days left until the next draw! ⏰

Let us know if you've already purchased the tickets ⬇️

And if you haven't already, go to https://t.co/ZG3icHqoL0 and grab a few 🎟️#NFT #NFTCommunity #crypto #cryptocurrency #blockchain #BSCGem #cryptogames pic.twitter.com/ucb6Cnso3U

— Lucky Block Casino (@luckyblockcoin) June 13, 2022

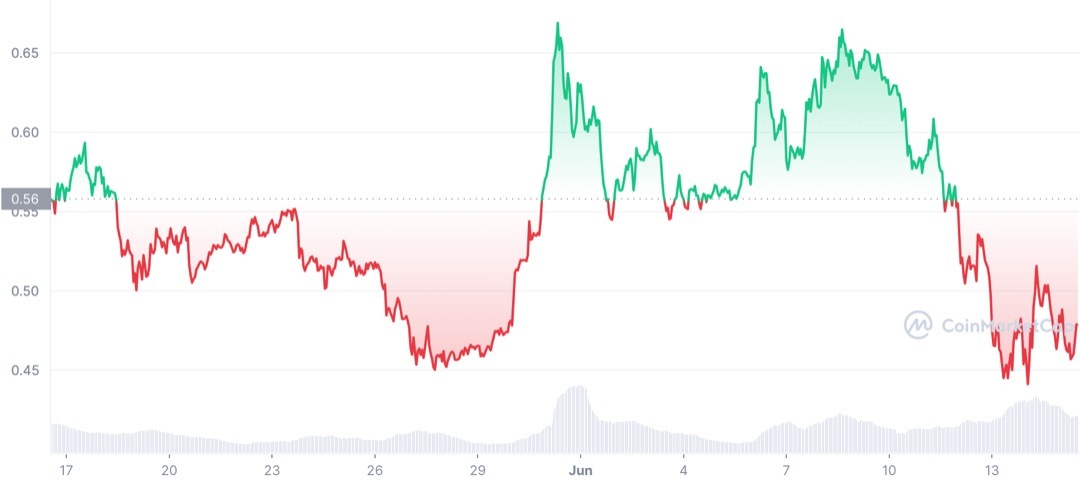

2. Ripple (XRP)

XRP is one of the best cryptocurrency for lower risk returns. The digital asset has grown to become the market’s standard for cross-border transactions, in line with its developer’s goal of becoming a better alternative to the Society for Worldwide Interbank Financial Telecommunication (SWIFT) money transfer network.

Retail investors looking to find gains can consider XRP now as a recent report from CoinShares revealed that institutional investors have continued to buy Ripple. Institutional investment usually precedes significant price increases, therefore XRP could see significant gains in the near future.

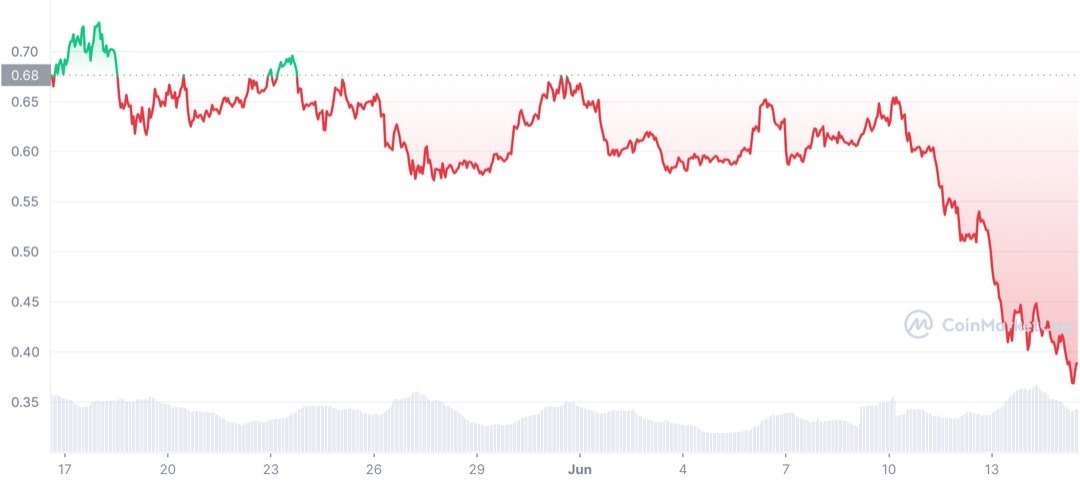

3. Cardano (ADA)

ADA also features on our list of the best cryptocurrency for lower risk returns. The digital asset powers Cardano – one of the market’s largest and most prominent blockchain protocols.

Cardano has been on many investors’ watchlists since the blockchain implemented smart contracts as part of last year’s Alonzo hard fork. The platform is set for its latest upgrade – Vasil.

Vasil, expected before the end of the month, has been touted to improve Cardano’s scalability while reducing transaction processing times. If the hard fork works like Cardano’s developers claim, it would further cement the blockchain as a viable platform for decentralised application (dApp) development.

#Cardano is anticipating a new wave of upgrades with the Vasil HFC event on the 29th of June 2022

Upgrades on Plutus- #Cardano's smart contract platform (CIPs)

are among the most anticipated components of this HFC event

Here’s a breakdown of each one of those upgrades:🧵👇 pic.twitter.com/bmU4U2bRkt

— Sooraj (@SoorajKSaju) April 18, 2022

And, as a proof-of-stake coin, ADA remains a great investment for passive investors. They can buy Cardano and stake the coin to enjoy returns with little stress.

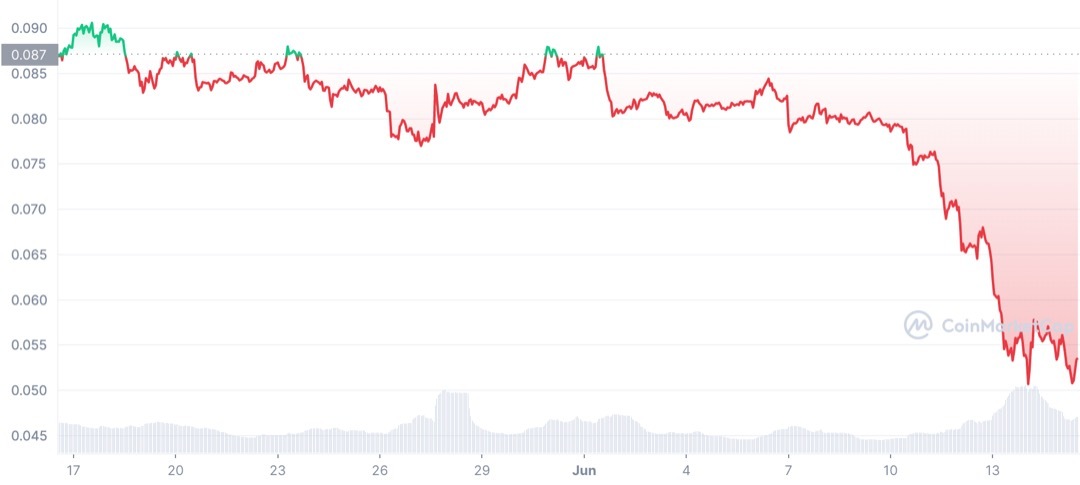

4. Dogecoin (DOGE)

Dogecoin has ridden a wave of celebrity endorsements and other developments to become one of the most popular and valuable cryptocurrencies in the market.

Despite the decline, a Dogecoin insider recently stated that the first Dogecoin library, Libdogecoin, is almost ready to be released. The insider reported that the library will aid developers to build projects and applications on Dogecoin, essentially placing the digital asset in the same mix as top blockchains like Ethereum and Solana.

Libdogecoin 0.1, one of the projects on which @michilumin and @KBluezr have been working on, is getting closer to a release.

It will be a library allowing to build for #Doge without having to deal with low level implementation.

Easier integration, easier adoption, more utility! https://t.co/qUZlwZ4STV

— Mishaboar (@mishaboar) June 14, 2022

Dogecoin’s creators have been working hard to make the asset – and its network – more functional. This way, there will be even more reasons to buy Dogecoin.

5. Polygon (MATIC)

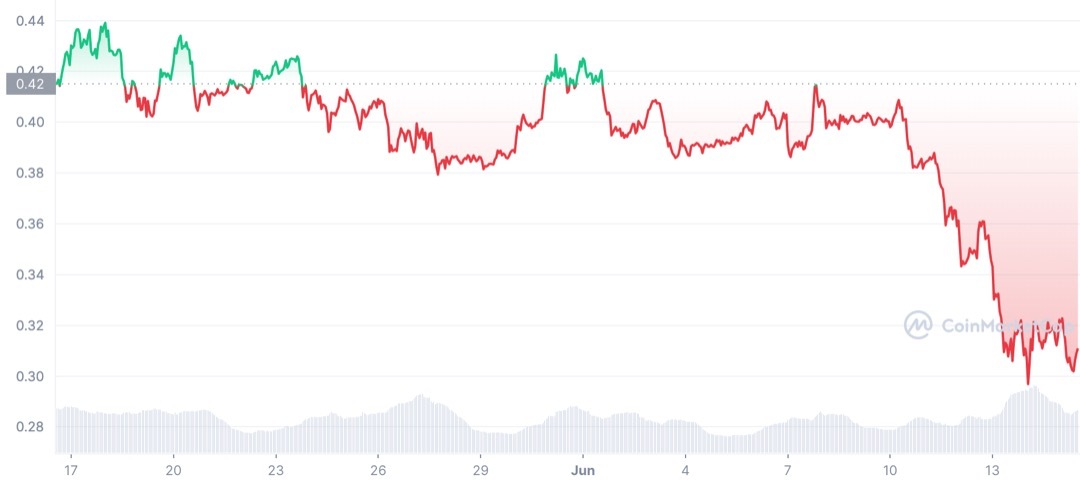

Rounding out our list of the best cryptocurrency for lower risk returns is MATIC – the native token for Polygon.

Currently, MATIC trades at $0.3879. This is a reduction of 44.1% in the past month.

Investors looking to buy Polygon will be excited about recent developments on the network. The platform recently onboarded USDC, adding the stablecoin from payment processor Circle to make Web3 payments faster. With Polygon expanding its functionality beyond just serving as a gateway to Ethereum, investors can feel more confident about its trajectory going forward.

Read More:

Join Our Telegram channel to stay up to date on breaking news coverage