Flash loans are a unique feature of DeFi. They allow users to borrow funds or assets without collateral, but only if the loan is repaid within the same transaction. This concept has changed how people think about loans and financial transactions in the digital era, and even more so in the world of cryptocurrencies.

In this article, we’ll break down how flash loans work, their pros and cons, the top platforms that offer them, and more.

Key Takeaways

- Flash loans let users borrow funds with no collateral, as long as they repay within the same transaction.

- They are commonly used for arbitrage, collateral swaps, and other advanced trading or DeFi operations.

- They are frequently exploited in DeFi attacks, especially when protocols don’t properly guard against rapid, large-volume actions.

What Is a Flash Loan?

Flash loans are unsecured loans that allow users to borrow assets or capital with no collateral for a short time, often a few seconds.

There is a catch here, of course. The key condition for getting a flash loan is that you must pay back the loan in full within the same transaction. If the loan isn’t repaid, the entire transaction will be reversed – no collateral required, no risk for the borrower.

What sets flash loans apart from traditional loans or even other types of crypto loans is their instant nature and the absence of collateral.

Benefits of Flash Loans

- No collateral: Unlike traditional loans, flash loans don’t require any collateral. The smart contract ensures that the borrowed funds are returned within the same transaction; otherwise, the whole transaction is reversed.

- High capital access: Flash loans allow crypto traders and investors to access significant capital without needing to lock up their assets as collateral to do so.

- Instant settlement: Flash loans happen within the same transaction, meaning they can be settled instantly. This allows for quick arbitrage opportunities and asset rebalancing.

Drawbacks of Flash Loans

- Complexity: Flash loans are not beginner-friendly. If you don’t have experience in using this technology, it can be quite challenging at first, especially for those with limited programming skills.

- Risk of exploits: Flash loans can be used for malicious purposes such as price oracle attacks or market manipulation. They have legitimate use cases, but they are often used in sophisticated hacks and exploits.

- Transaction dependence: Flash loans must be executed and repaid within the same transaction. If any part of the transaction fails or isn’t confirmed in time, the entire transaction is canceled, and no funds are transferred.

Can You Use Flash Loans Without Coding?

Flash loans were once only used by developers with coding skills because users had to interact directly with smart contracts – pieces of code that execute on a blockchain and facilitate decentralized transactions.

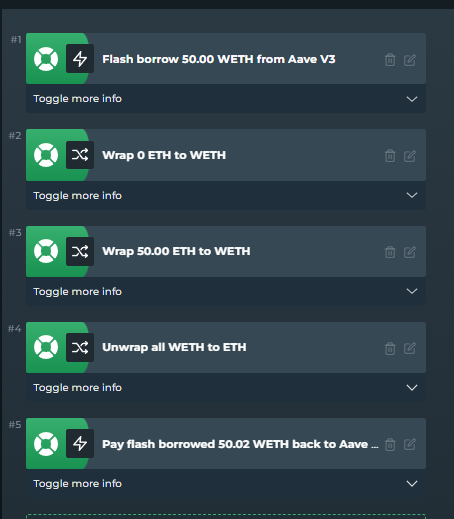

However, platforms like DeFi Saver are already making progress in democratizing the use of flash loans. They enable crypto investors to use a flash loan without having to write a single line of code. Platforms like DeFi Saver offer no-coding interfaces where you can simply access and utilize flash loans for collateral swaps, debt refinancing, arbitrage opportunities, and much more.

DeFi Saver is one of the leading platforms that allows users without coding experience to take advantage of flash loans, but it is far from the only one. Some of the popular alternatives include Furucombo, Equalizer Finance, and InstaDapp. They each offer integrated tools that make it simpler for users to automate complex DeFi strategies like rebalancing portfolios or refinancing loans – all without needing to write smart contracts.

This shift in the market is important because it lowers the barrier to entry and allows both beginners and experienced traders to use flash loans. As the various flash loan platforms compete for users, they will likely continue to add useful features to improve their offerings.

How Do Flash Loans Work?

Now that we have explored what flash loans are and their various applications, let’s delve into the mechanics that power them: how do flash loans work?

Flash loans work within the context of smart contracts on a blockchain, typically Ethereum, Binance Smart Chain (BSC), or other DeFi-enabled blockchains.

Here’s a simplified step-by-step explanation of how flash loans work:

Step 1: Initiate the Loan

To start using a flash loan, a user interacts with a lending protocol that supports flash loans like Aave or Uniswap. These protocols will pool capital from liquidity providers to make loans available.

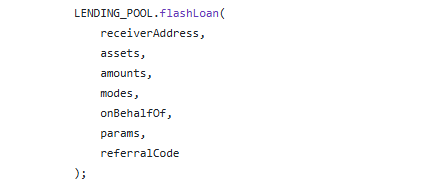

If you were a developer with the requisite knowledge and experience, you would start by designing and deploying a smart contract that interacts with the lending protocol. The following code is part of the MyV2FlashLoan.sol contract, which illustrates how you can request a flash loan from Aave’s Lending Pool. You can find the full example in Aave’s official code examples repository on GitHub:

Step 2: Borrow Funds

Once the transaction begins, the lending protocol transfers the requested amount to your contract. Naturally, no collateral is required because the loan is only valid for the duration of that single transaction. If any part of it fails, the entire transaction will be reverted automatically.

Step 3: Perform the Transaction

With the borrowed assets now in the smart contract, they can be used for various purposes, including arbitrage between decentralized exchanges, collateral swaps, refinancing positions, and liquidating undercollateralized loans. Again, everything must happen within the same transaction.

Step 4: Repay the Loan

By the time the transaction block ends, the loan must be fully repaid with any fees or interest included. If the loan isn’t repaid within the same transaction, the entire transaction will revert. The borrowed capital will instantly be returned to the pool.

Keep in mind that this entire cycle occurs in a matter of seconds. This is what makes flash loans so appealing for time-sensitive opportunities such as liquidation of undercollateralized positions, collateral swaps, and arbitrage.

What Are Flash Loans Used For?

Why would someone take a flash loan that they have to return in seconds? Let’s delve into the top reasons why borrowers choose this type of loan.

Flash Loan Arbitrage

One of the most popular uses for flash loans is arbitrage. Arbitrage is the practice of exploiting price differences for the same assets across different markets. In the DeFi market, the prices of assets like ETH, USDC, or DAI might vary between different decentralized exchanges (DEXs) such as Uniswap or Curve Finance – or even between DEXs and centralized exchanges (CEXs).

For instance, imagine that Ethereum is priced at $1510 on Uniswap and $1500 on SushiSwap. You could borrow a large amount of USDC via a flash loan, use it to buy ETH on Sushiswap, sell the ETH at a higher price on Uniswap, repay the original loan, and keep the profit – all within a single transaction.

The beauty of using a flash loan for arbitrage is that flash loans enable you to use large amounts of capital without upfront collateral.

Hacks and Exploits

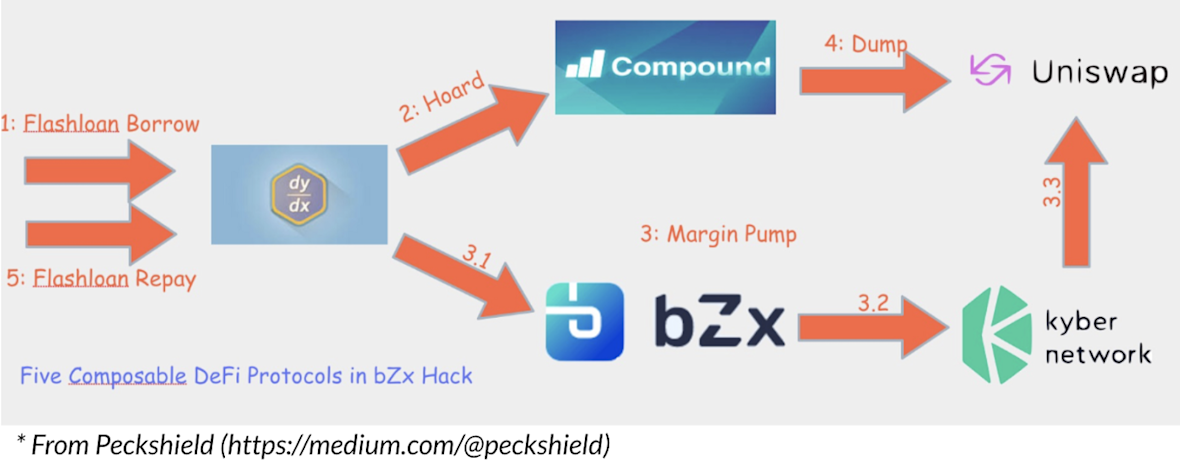

Flash loans are an amazing new tool that has many positive use cases, but they have also been used in some of the largest exploits in DeFi. One of the most common attacks perpetrated with flash loans is a price oracle manipulation attack.

In this kind of exploit, a bad actor uses a flash loan to artificially inflate (or deflate) the on-chain price of an asset. Because DeFi apps often use oracles to track prices, bad actors can then borrow other valuable assets against the manipulated price, effectively draining funds from the platform.

A real-world example of this is the bZx flash loan attack in 2020, where the attacker used a flash loan to manipulate the price of a token on Uniswap. The bZx attack ultimately resulted in a profit of 1271 ETH for the attacker. The key flaw was a bug in bZx’s system that allowed them to bypass risk controls.

Wash Trading

Flash loans can also be used to engage in wash trading. This is a practice that inflates the trading volume of an asset to manipulate its market perception. This tactic can create the illusion of high demand and liquidity, coaxing investors to purchase the asset. Because many token screeners rank tokens by trading volume and liquidity, wash trading can help push fake or scam tokens to the forefront of investors’ minds.

Closing Collateralized Debt Positions

A fourth use of flash loans is in closing collateralized debt positions (CDPs) on platforms like MakerDAO and Aave. Let’s say that you have a loan on MakerDAO that is nearing liquidation. You can use a flash loan to repay the loan in full, therefore avoiding liquidation fees and penalties. This method can be very useful if you want to maintain solvency in the market.

Collateral Swaps

With a flash loan, a user can swap collateral rather quickly. If you are looking to change the collateral backing a loan – say, from one crypto asset to another, you can use a flash loan to perform this operation. The best part about collateral swaps using flash loans is that you don’t need additional funds upfront.

This can be very useful for avoiding liquidation or rebalancing your portfolio in the event of a market downturn.

How to Use a Flash Loan

Now that you have a better understanding of what a flash loan is and how it works, you might be wondering how to use them legitimately. Here is a step-by-step guide on how to use a flash loan:

Step 1: Choose a Flash Loan Platform

The first step is to find reliable flash loan providers where you can access this type of loan. Popular platforms that offer flash loans include Aave, Uniswap, and DeFi Saver, to mention a few.

Step 2: Set Up Your Wallet

Next, you will need a crypto wallet that supports the platform you chose in step one. MetaMask is a popular (and free) choice for interacting with DeFi protocols. Just make sure that your wallet is already funded with some ETH for transaction fees (gas). Note that complex smart contracts like flash loans often incur larger transaction fees than basic transfers.

Step 3: Identify Your Strategy

Before you borrow a flash loan, try to identify your specific use case. Do you need flash loan arbitrage? Do you need to close a debt position? Maybe you want to swap collateral? Knowing your main goal will help you design your strategy.

Step 4: Initiate the Loan, Execute Your Strategy, and Repay the Loan

Now that your plan is in place, you are ready to take the flash loan. Initiate the request for a flash loan using the platform you chose. If you’re using a platform like DeFi Saver, the process is simple and may even be automated.

Once you have everything set up, you can initiate the flash loan and it should complete (or fail) within a few seconds. If for whatever reason the loan isn’t paid back by the end of the transaction, it will fail and you will have to diagnose and fix the issue before trying again.

Should I Consider Using a Flash Loan?

While flash loans can be extraordinarily powerful tools, they aren’t ideal for beginners. They generally require a deep understanding of blockchain technology, smart contracts, and DeFi protocols. They also involve certain risks, especially in volatile markets when prices can change rather quickly. This makes strategies like liquidation and arbitrage very risky.

If you are a professional trader, DeFi developer, or an advanced crypto user, flash loans could be a very useful tool for you. However, if you are new to crypto and don’t have the technical know-how, it is likely best to start small, learn as much as you can beforehand, and simply avoid using highly technical tools like flash loans until you’ve gained more experience.

The Future of Flash Loans

Flash loans have opened the door to many innovative financial strategies within the budding ecosystem of decentralized finance. Users are now becoming increasingly familiar with decentralized apps and DeFi protocols, so flash loans are highly likely to evolve in the near future.

As these tools evolve and become even more powerful, DeFi developers will have to continuously update and improve their security features to protect the protocol against hacks and exploits.

Platforms like Chainlink are already improving the oracle systems to help protect against manipulation, but even the most advanced protocols are still struggling to protect themselves from flash loan attacks. The ecosystem is still in a stage of rapid development, and the need for more security is high.

Flash loans can be an amazing financial tool for those who understand the procedure, risks, and complexities involved. As the DeFi market continues to evolve, we’ll likely see more platforms that offer simple and secure ways to access flash loans.

FAQs

Are flash loans legal?

Yes, flash loans are legal, though they can be used for illegal activities such as theft.

What is the difference between a flash loan and a traditional loan?

The main difference is that flash loans require no collateral and must be repaid within the same transaction. Traditional loans usually require collateral and can be repaid over time.

How long does a flash loan last?

A flash loan lasts only as long as a single blockchain transaction, typically just a few seconds.

Do flash loans need collateral?

No, flash loans do not require collateral because they must be repaid within the same transaction.

Are flash loans risky?

Yes, flash loans can be quite risky, especially for beginners, due to their complexity and the possibility of failure if the transaction isn’t executed correctly. They can also pose systemic risks to major dApps when used in exploits or hacks.

References