If you want to invest in cryptocurrencies, you will likely have to use a crypto exchange at some point, but not all exchanges are built the same. Decentralized exchanges (DEX) allow users to swap tokens with each other without a centralized middleman.

DEXs quickly became an important foundation for the entire decentralized finance (DeFi) ecosystem, forming the base that every other app is built on. Like DeFi in general, DEXs reflect the core idea of crypto: open, borderless, and permissionless finance.

Key Takeaways

- DEXs let you trade directly from your crypto wallet, so you never hand over custody to a third party.

- Trades are automated through code on the blockchain, removing the need for centralized oversight.

- Many DEXs rely on liquidity pools funded by individual users, enabling peer-to-peer trading without traditional order books.

What Is a Decentralized Exchange or DEX?

A decentralized exchange (DEX) is a crypto trading platform that lets users swap tokens without relying on a central authority to manage the process. The trades are facilitated by trustless code, typically on a blockchain like Ethereum, BNB Chain, or Solana, to mention a few.

Instead of relying on an order book or a company that matches buyers and sellers, most DEXs use automated market makers (AMMs). AMMs are smart contracts that hold token pools and allow users to trade directly against them. Some DEXs also offer additional trading tools like limit orders to give traders more control.

Pros and Cons of DEXs

Decentralized exchanges promise more control, privacy, and access to a wide range of tokens. However, they also come with their own set of challenges, as shown in the table below.

| Pros of DEXs | Cons of DEXs |

|---|---|

| DEXs are non-custodial. You trade directly from your wallet without relying on a third-party to hold your funds. | Smaller, illiquid pools can suffer from high slippage, sometimes giving you a worse deal. |

| No KYC is required. You can trade without sharing personal details. | If you make a mistake, you’re on your own. |

| Anyone with a wallet and internet connection can trade instantly with no verification needed. | Requires basic knowledge of wallets, gas fees, and smart contracts. |

| Since they are powered by trustless smart contracts on blockchains, there is no central authority. | Blockchain transaction fees can be high, especially on congested networks. |

| Assets remain in your control and aren’t exposed to exchange hacks (unless you provide liquidity). | Newer or unaudited DEXs can be at higher risk of exploits. |

| DEXs have a massive variety of small tokens that greatly exceed the offerings from centralized exchanges. | On-chain trades can be exploited by bots, leaving you with a worse cost basis. |

How Do Decentralized Exchanges Work?

Decentralized exchanges run on smart contracts, which are lines of code stored on the blockchain that execute trades automatically when certain conditions are met. When you trade, you are swapping tokens directly with the liquidity pools (large reserves of tokens supplied by other users).

There is no company in charge. No one holds your crypto assets but you, and you trade directly from your wallet.

Here is a simple breakdown of how DEXs work:

- Liquidity providers deposit tokens into a pool to earn a share of transaction fees

- When you make a trade on a DEX, you interact directly with this pool

- AMMs then use smart contracts to adjust prices based on supply, demand, and the balance of tokens in the pool

This process is entirely automated, removing the need for a middleman. All you need to do is connect your wallet, select your trade, confirm your transaction, and the smart contracts will handle the rest.

By cutting out the central authority, DEXs let users trade in a decentralized, peer-to-peer manner. In comparison, a centralized exchange (CEX) is managed by a centralized entity, like a company that controls the platform, matches trades, and holds your funds.

Comparison: DEXs vs. CEXs

| Feature | DEX | CEX |

| Control of Funds | Non-custodial (You control the funds) | Custodial (The exchange holds the funds) |

| Privacy | High (No KYC required) | Lower (Requires KYC and personal information) |

| Liquidity | Often lower, depending on the token and pool | Higher (Deep liquidity from a larger user base) |

| Fees | Gas fees and small transaction fees | Variable trading fees (and withdrawal fees may apply) |

| Selection of Tokens | Much broader, including many new or niche tokens | Focused on vetted and established tokens |

| Speed of Transactions | Can be slower due to blockchain congestion | Often faster as trades happen off-chain |

| Security | More secure in theory, no central point of failure | Dependent on the exchange’s security measures |

| Customer Support | Minimal, mostly community-based | Extensive support |

| Examples | Uniswap, SushiSwap, 1inch, PancakeSwap | Binance, Coinbase, Kraken, Gemini |

8 Most Popular Decentralized Exchanges

Decentralized exchanges have become a central part of the cryptocurrency ecosystem, allowing users to retain control over their assets and trade directly from their wallets. With the exponential growth of decentralized finance (DeFi), several DEXs have emerged stronger than others, each offering unique features. Below, you will find a list of the top DEXs that are leading the charge in the decentralized space.

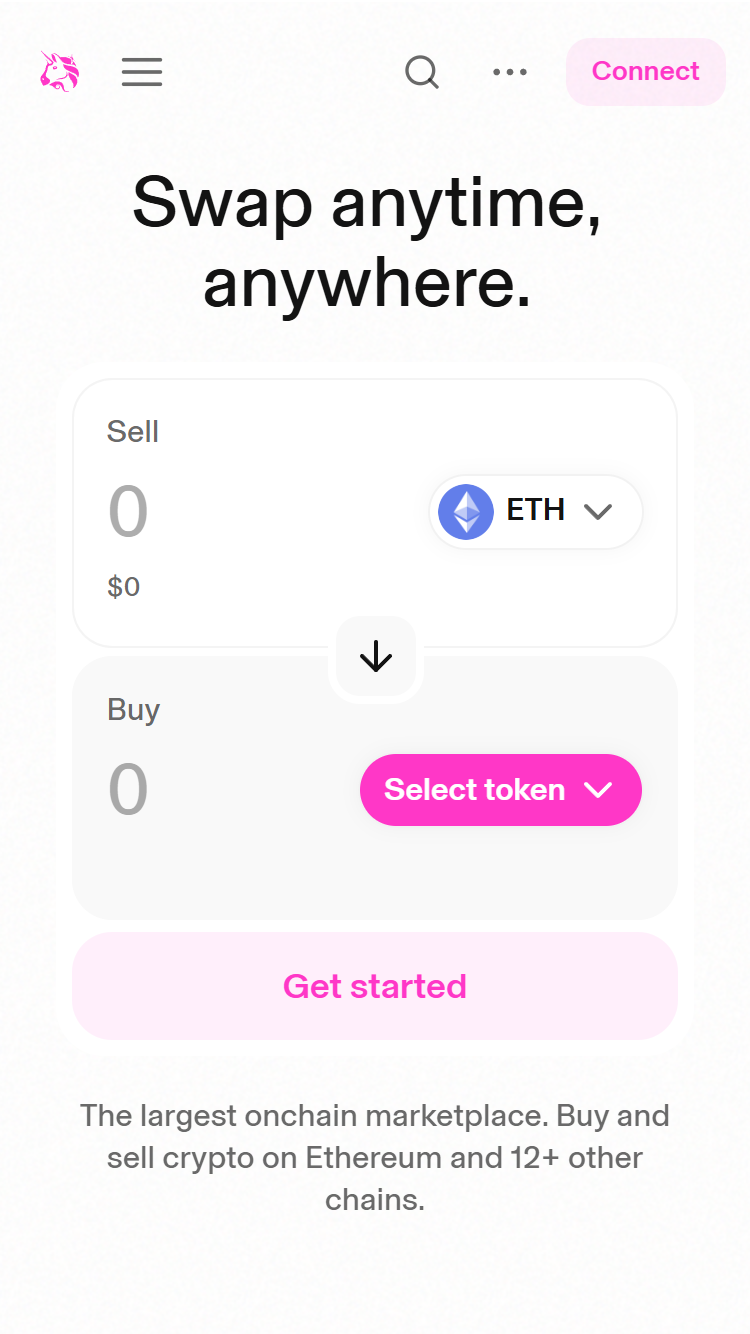

1. Uniswap

Uniswap is one of the largest and most well-known decentralized exchanges, famous for its AMM model. It allows users to trade directly from their wallets without needing an intermediary.

Why people like it: Uniswap is known for its simplicity and user-friendly interface. It also has a wide range of supported tokens and is highly liquid, which makes it ideal for both small and large trades.

Downsides: Relatively high gas fees on Ethereum, especially during network congestion, though this can be avoided by trading on Layer 2 chains. The liquidity for smaller tokens can also vary.

Chains supported: Primarily Ethereum, but also operates on Polygon, Optimism, and Arbitrum.

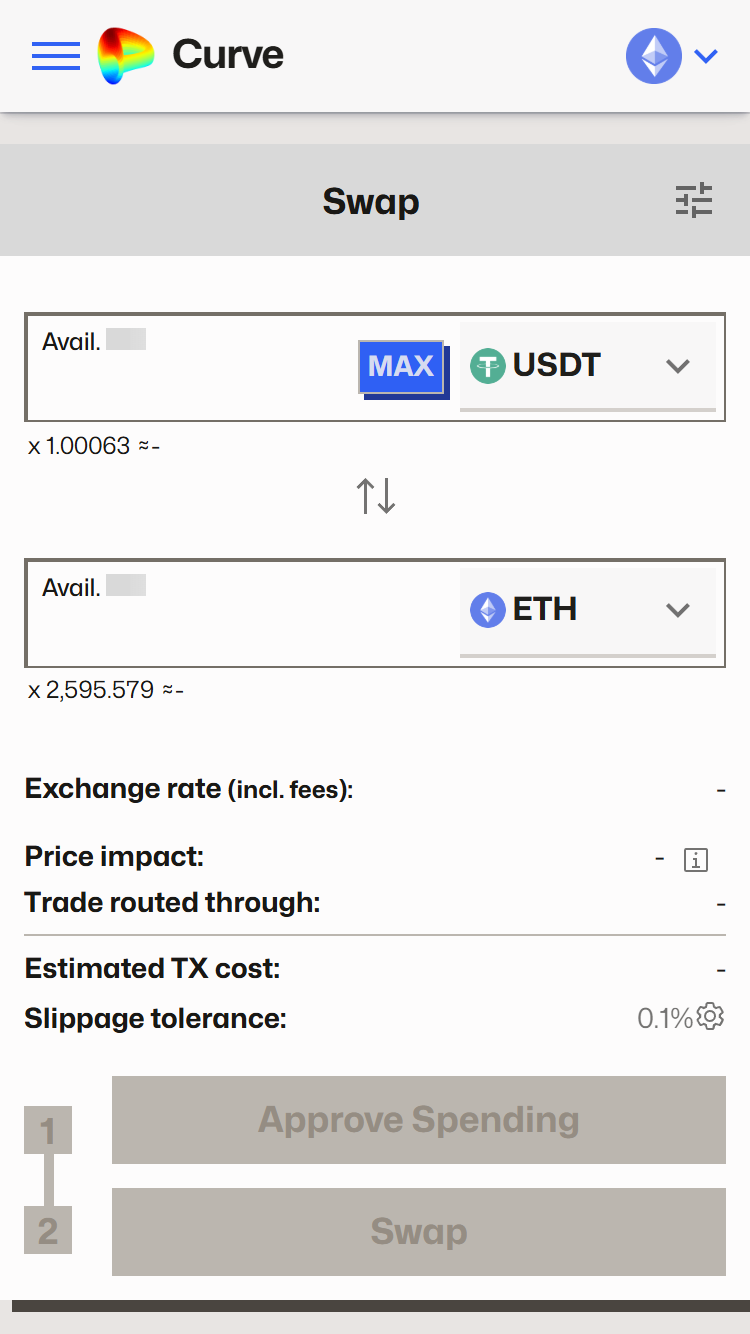

2. Curve Finance

Curve Finance is a DEX focused on stablecoin swaps and low-slippage trades. It specializes in highly efficient pools made up of tokens designed to maintain the same value, such as different versions of the same stablecoin or wrapped assets.

In May 2025, the platform suffered a DNS attack and confirmed migration to a new domain: curve.finance. A spokesperson told CryptoNews that user funds remain secure and safe. He also shared a post on X, saying that there is no point in moving back to the old URL, namely curve.fi.

Yes. .fi will be down for too long / no point of moving back. Also registrars who can hold .fi are somewhat not as great as those who can deal with .finance

— Curve Finance (@CurveFinance) May 13, 2025

Why people like it: Curve Finance is known for its low fees and low slippage when swapping stablecoins. It attracts users who are primarily looking to trade assets like USDT, USDC, DAI, and stETH.

Downsides: Limited selection of tokens outside of stablecoins or wrapped tokens.

Chains supported: Ethereum, Polygon, Fantom, Avalanche, Arbitrum, and more.

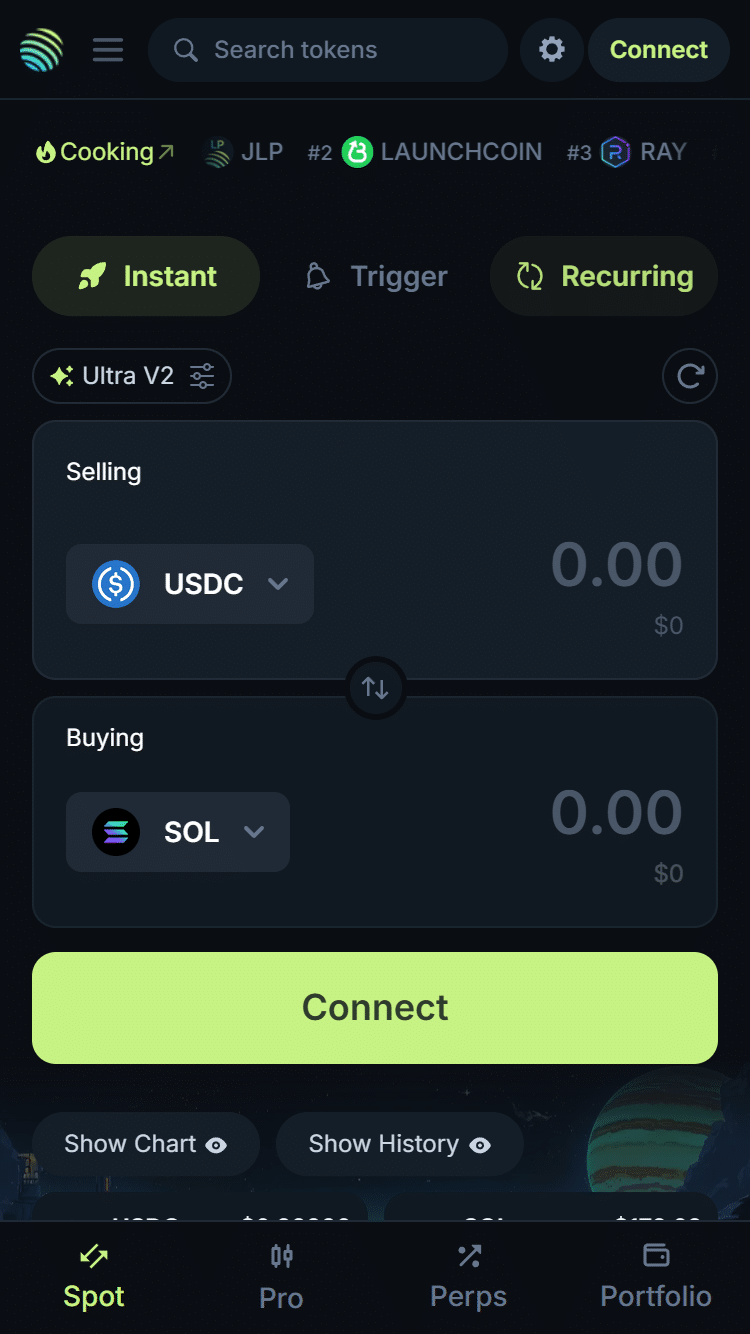

3. Jupiter

Jupiter is a DEX aggregator that finds the best prices for users across decentralized exchanges, mainly on the Solana blockchain. It pulls liquidity from different sources, giving you access to the best rates available.

Why people like it: Jupiter makes trading on Solana easier with its great prices and low fees. Its aggregation model ensures that users get the best deal by routing their orders across multiple liquidity pools.

Downsides: Jupiter is limited to the Solana ecosystem and doesn’t support assets on other chains like Ethereum or Binance Smart Chain.

Chains supported: Primarily Solana.

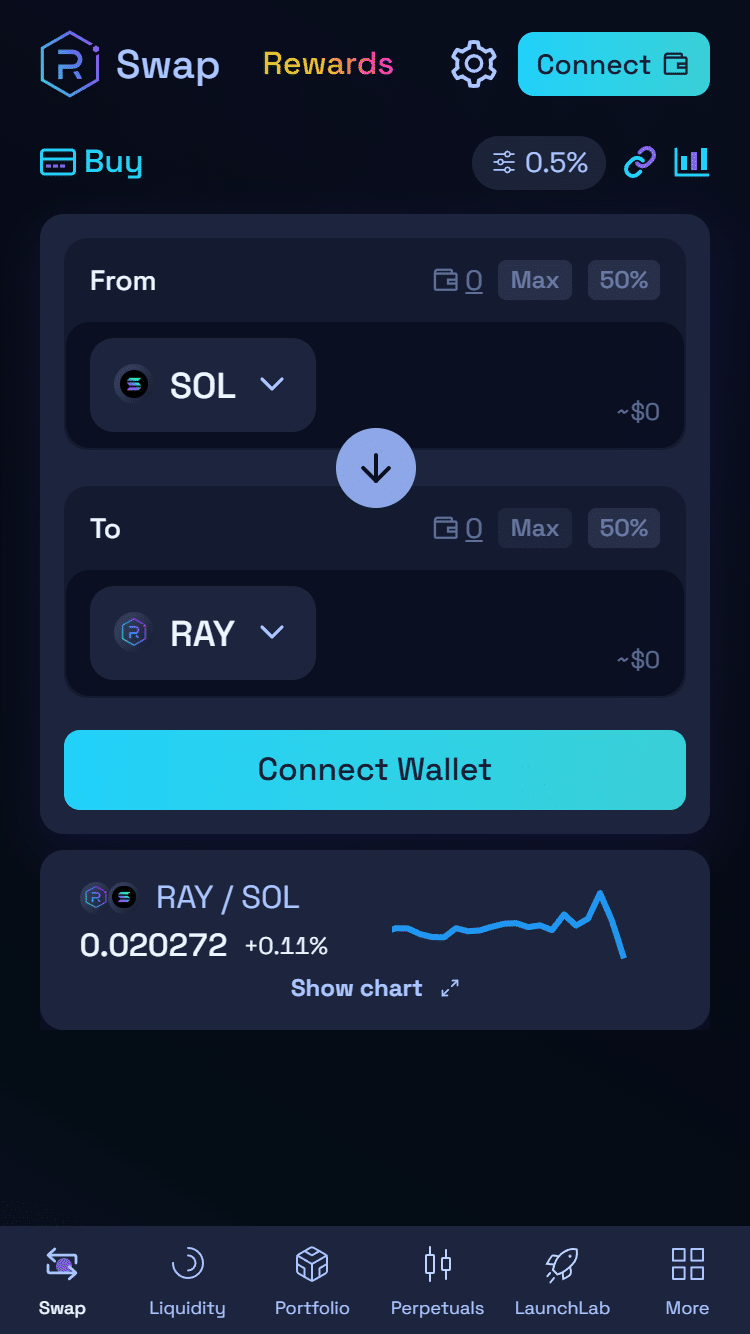

4. Raydium

Raydium is another Solana-based DEX that combines AMM with a centralized order book for added liquidity. It was designed to optimize the Solana network’s fast transactions and low fees.

Why people like it: Raydium provides quick, low-cost trades and liquidity for a range of assets. It integrates with the Serum order book, which helps offer better liquidity than most other Solana DEXs.

Downsides: The limited ecosystem means that Raydium doesn’t support assets outside of Solana’s network.

Chains supported: Solana.

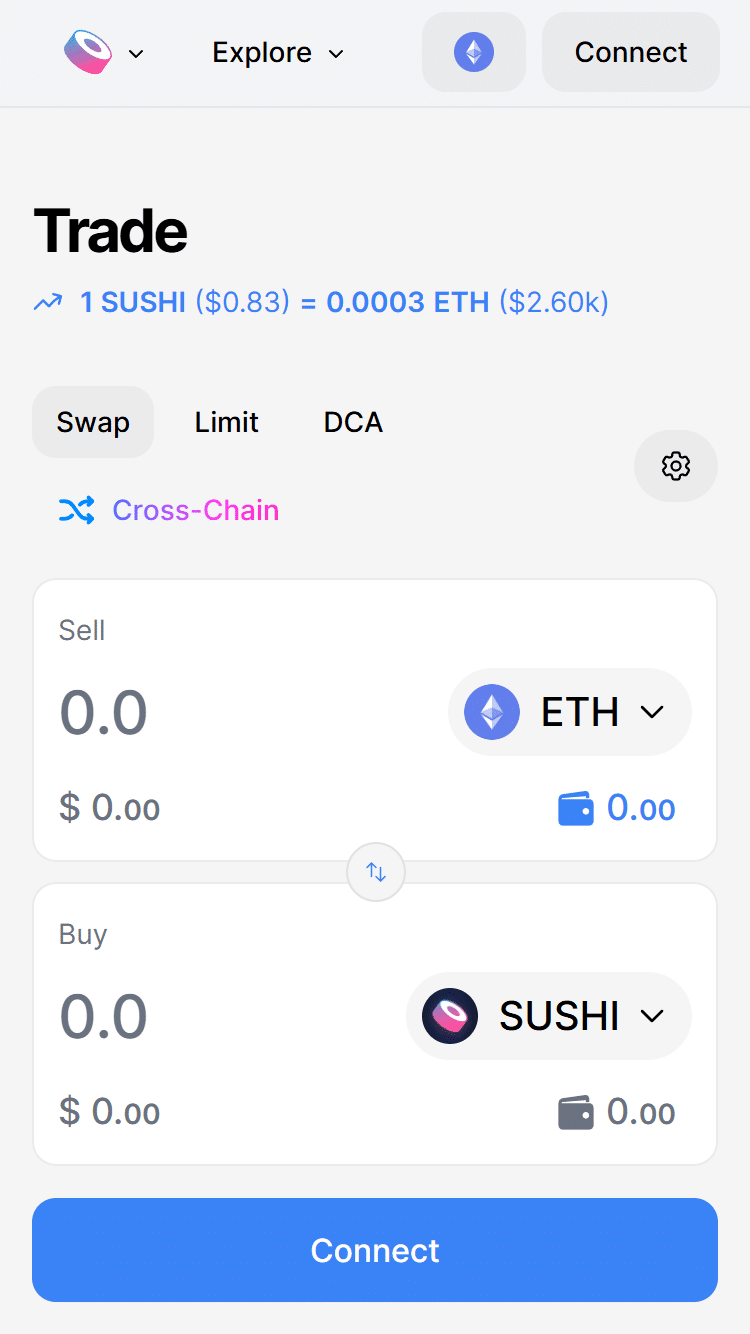

5. SushiSwap

SushiSwap is a fork of Uniswap with additional features like yield farming, staking, and community governance. SushiSwap has grown into a very popular DEX with a focus on community involvement.

Why people like it: SushiSwap offers much more than just trading. Users can participate in yield farming, staking, and governance. The DEX also supports multiple chains, which makes it quite versatile.

Downsides: Liquidity can be lower for less popular tokens compared to Uniswap. The platform is rich in features, which some may find overwhelming.

Chains supported: Ethereum, Polygon, Fantom, Arbitrum, Avalanche, and more.

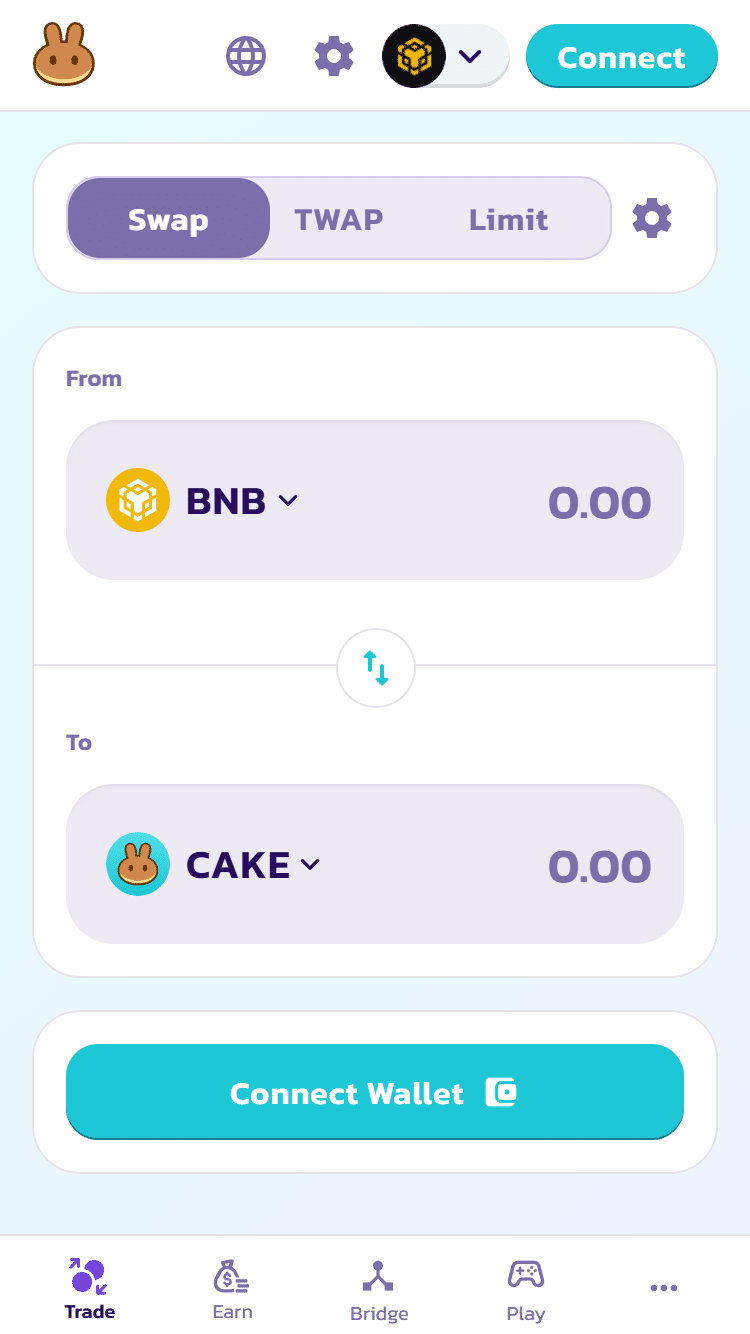

6. PancakeSwap

PancakeSwap is the most popular DEX on Binance Smart Chain (BSC). It uses an AMM model and offers similar features to Uniswap, but comes with lower fees and faster transactions thanks to BSC.

Why people like it: PancakeSap offers low fees and a large token selection. It is highly popular in the DeFi community. and it is the biggest trading hub on BSC.

Downsides: Since it is based on BSC, PancakeSwap is limited to the BSC ecosystem. Some users feel that BSC’s centralization is a downside compared to Ethereum’s decentralization.

Chains supported: Binance Smart Chain.

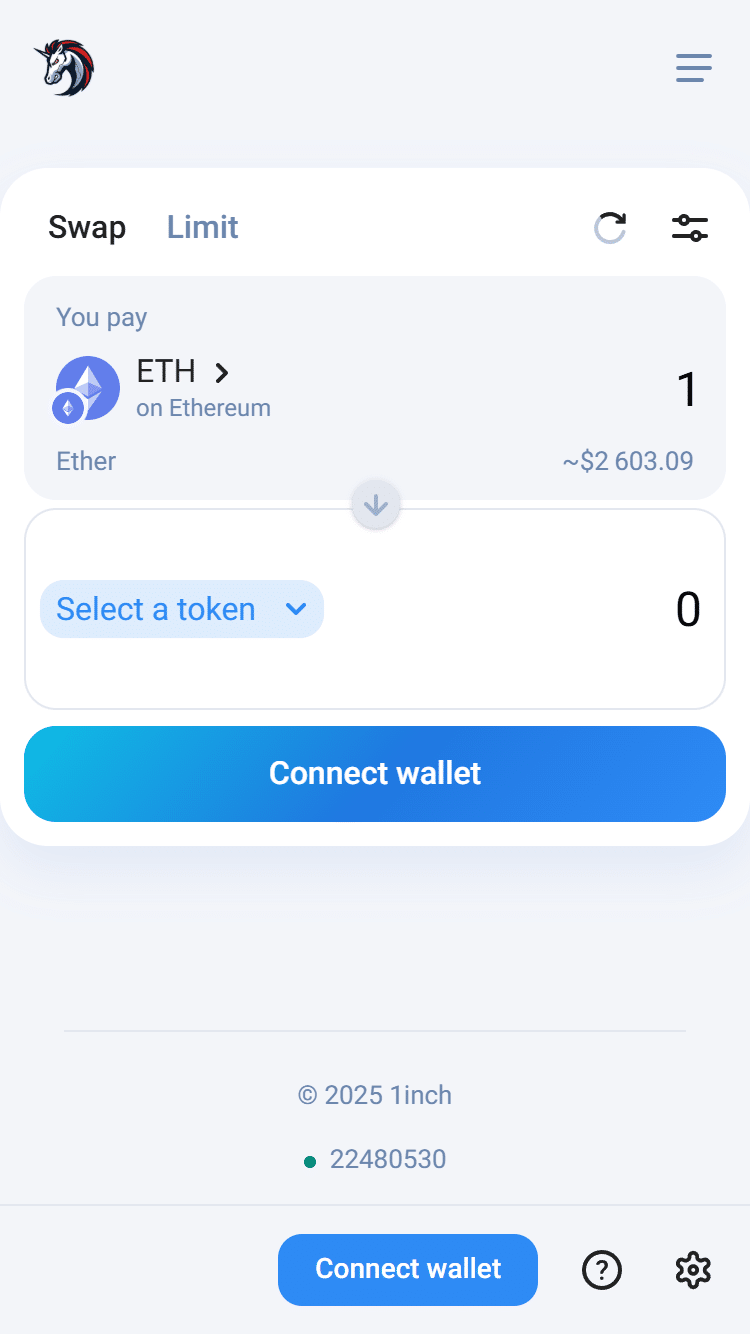

7. 1inch

1inch is a DEX aggregator, similar to Jupiter, that sources liquidity from multiple decentralized exchanges. It finds the best prices of digital assets by splitting orders across multiple platforms.

Why people like it: 1inch helps users save on fees and slippage by routing trades through multiple DEXs.

Downsides: While 1inch optimizes trades, it can be more complex than a single DEX and therefore isn’t always ideal for beginners.

Chains supported: Ethereum, Polygon, BSC, Arbitrum, Fantom, and more.

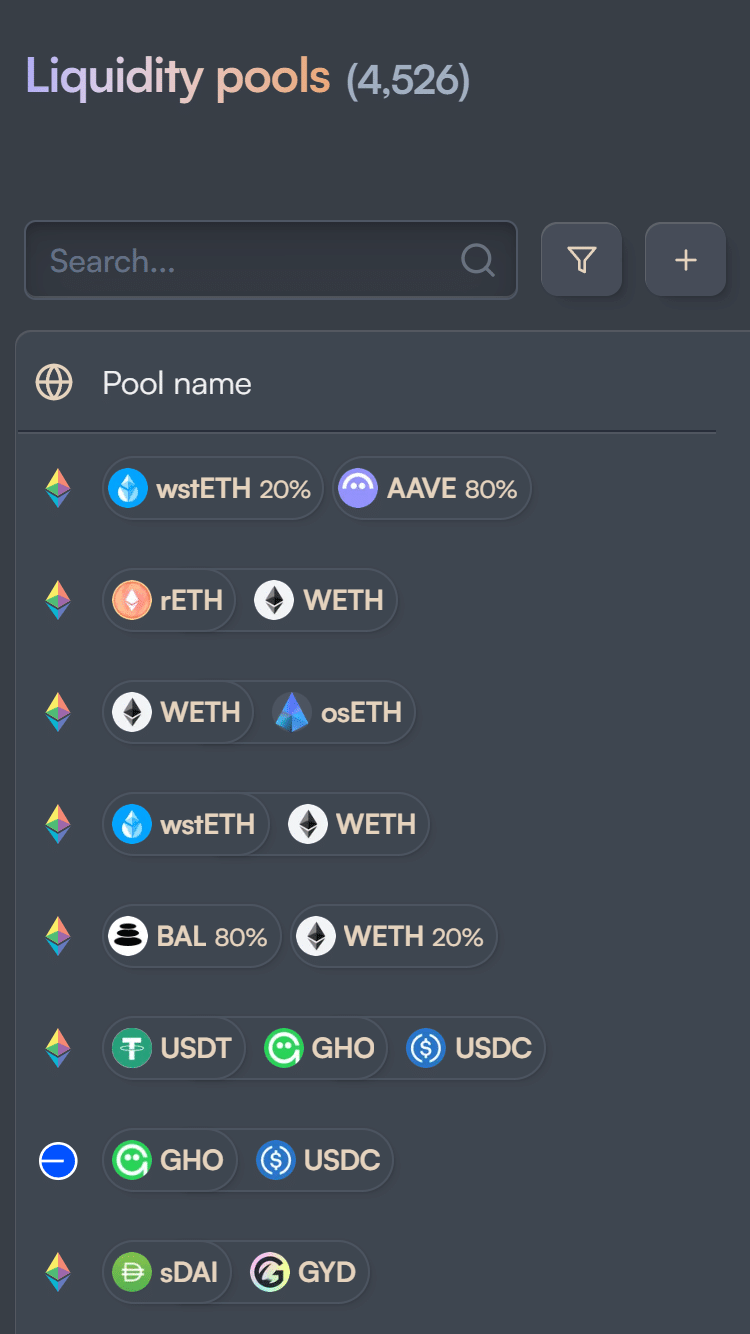

8. Balancer

Balancer is an AMM DEX that allows users to create customized liquidity pools with different token ratios. It supports pools with more than two tokens and different weights, which makes it unique.

Why people like it: Users can earn fees by providing liquidity to more flexible pools and potentially earn better returns with multiple tokens.

Downsides: Balancer’s many features and massive selection of pools can be a bit too complicated for beginners. The DEX has a smaller (albeit dedicated) user base than Uniswap or SushiSwap.

Chains supported: Ethereum, Polygon, Arbitrum, Optimism, and more.

What Are the Risks of Using DEXs?

Decentralized exchanges provide significant advantages like privacy and more control over your funds. However, they also come with risks that users need to be aware of. Here are some of the most common risks associated with using DEXs:

Frontrunning and Sandwich Attacks

Front-running happens when a malicious actor sees your trade on the blockchain and places their own trade ahead of yours to take advantage of the price change. This is a common problem when large transactions are made on a DEX, especially when liquidity and network congestion are low.

The sandwich attack is the most common type of frontrunning. It occurs when an attacker places two trades around your transaction. They buy before your trade to increase the price, and sell immediately after, profiting from the price shift. Once the dust settles, you end up paying more or receiving less than expected, leaving you with a worse cost-basis due to the attack.

How to protect yourself: One of the best ways to avoid frontrunning and sandwich attacks is by carefully setting your slippage tolerance. On most DEXs, you can set a slippage tolerance to limit how much the price can move during your trade. When the slippage exceeds your limit, the transaction will fail, preventing you from falling victim to price manipulation. Note that trading with small pools with low liquidity will require a higher slippage tolerance than usual (say 3% instead of 0.5%), so you may have to find a balance.

Phishing Scams

Phishing scams involve attackers tricking you into giving away your login information or private keys. This can happen via social media impersonations, fake emails that look like they are from a legitimate DEX, and fraudulent websites.

How to protect yourself: Always double-check the URL of the website you are visiting to make sure it is the correct one. Bookmark official DEX websites and never click on links from suspicious sources. Don’t share your private keys or recovery phrases with anyone. A legitimate exchange won’t ask for this information. Finally, never click suspicious emails.

Fake Website Scams

Similar to phishing, fake website scams involve counterfeit sites that mimic the real DEX platforms. They have similar URLs and pretty much the same interface. Some of these scammers even use Google Ads to advertise their fake URL above the real one so it’s generally smart to never click these search ads.

How to protect yourself: Always verify the website’s domain. For instance, Uniswap’s official site is https://uniswap.org. Check for HTTPS and ensure the website is well-known and has been verified by the community.

Smart Contract Vulnerabilities

DEXs operate through smart contracts and are designed to be secure, but vulnerabilities can still exist in the code. Exploiting bugs and flaws in the contract can allow hackers to steal funds from liquidity pools.

How to protect yourself: Use well-established DEXs with a strong track record of security audits.

Impermanent Loss

When you provide liquidity to DEXs, you might experience impermanent loss. This happens when the value of your deposited assets changes relative to each other. If this happens, you may end up with fewer gains and even losses compared to simply holding the asset in your wallet. Note that this only applies to liquidity providers and does not affect users who are simply trading.

How to protect yourself: Choose table pairs (e.g., USDC/DAI) for liquidity provision to reduce the risks of impermanent loss.

How to Use a DEX in 6 Easy Steps

Are you new to using a decentralized exchange to trade cryptocurrencies? The process can seem daunting now, but it is actually fairly straightforward once you get the hang of it. Here is a step-by-step guide on how to use a DEX like Uniswap:

1. Buy Crypto From a Centralized Exchange

If you don’t own cryptocurrency, you will need to trade fiat for crypto on a centralized exchange first. Platforms like Binance, Coinbase, and Kraken allow you to buy popular cryptocurrencies like Bitcoin and Ethereum using fiat currencies. Note that you will need at least a little bit of Ether (ETH) to pay for gas fees if you want to use a DEX on the Ethereum network. If you want to use one on Solana, you will need a bit of $SOL instead.

2. Transfer Your Crypto to a Wallet

Once you buy your crypto assets, transfer them to a personal wallet that your favored DEX supports. MetaMask and TrustWallet are popular options and essentially all DeFi platforms support them. If you don’t have a crypto wallet, set one up and make sure to back up your recovery phrase securely. You can find a full guide on crypto wallets here.

3. Choose a DEX

Once your wallet is set up, visit the DEX you want to trade on. Let’s take Uniswap as an example. To get started, navigate to Uniswap’s DEX.

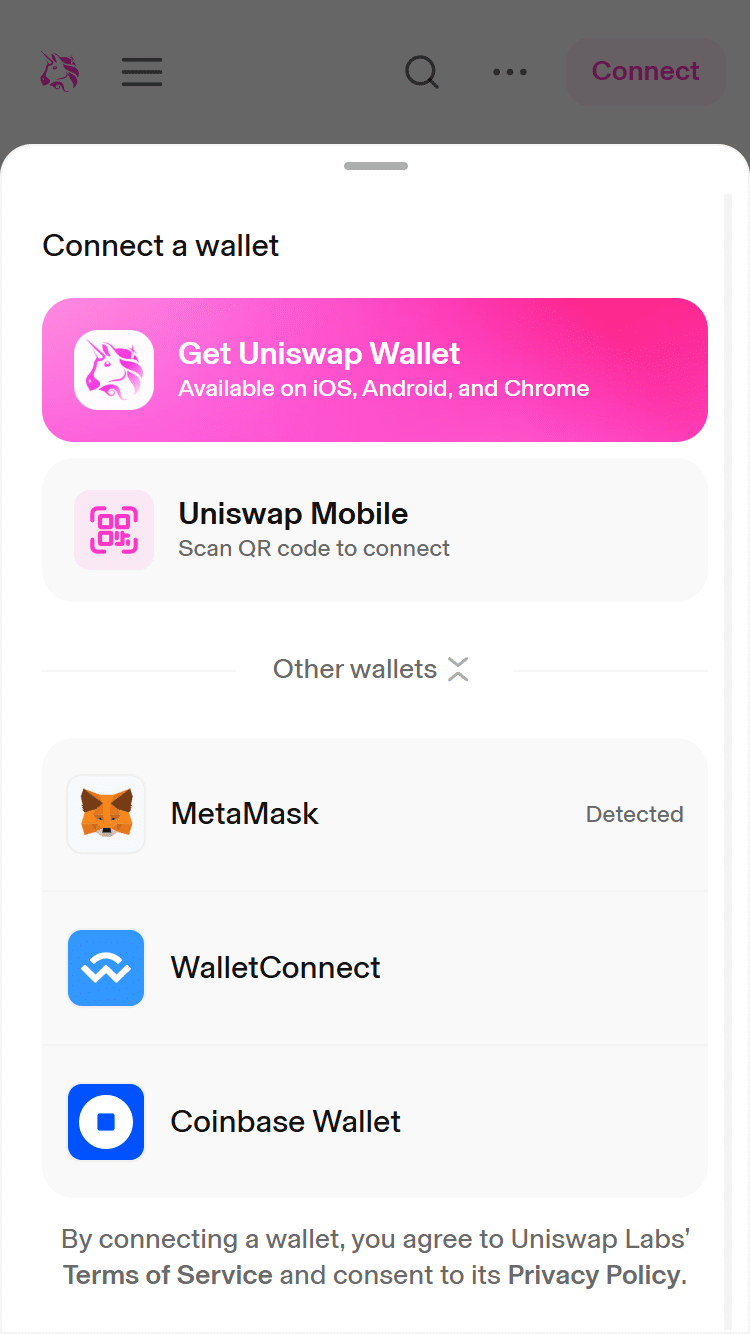

4. Connect Your Wallet

On the DEX platform you chose, click on ‘Connect Wallet’ and choose the one you are using. Follow the prompts to connect your wallet to the platform.

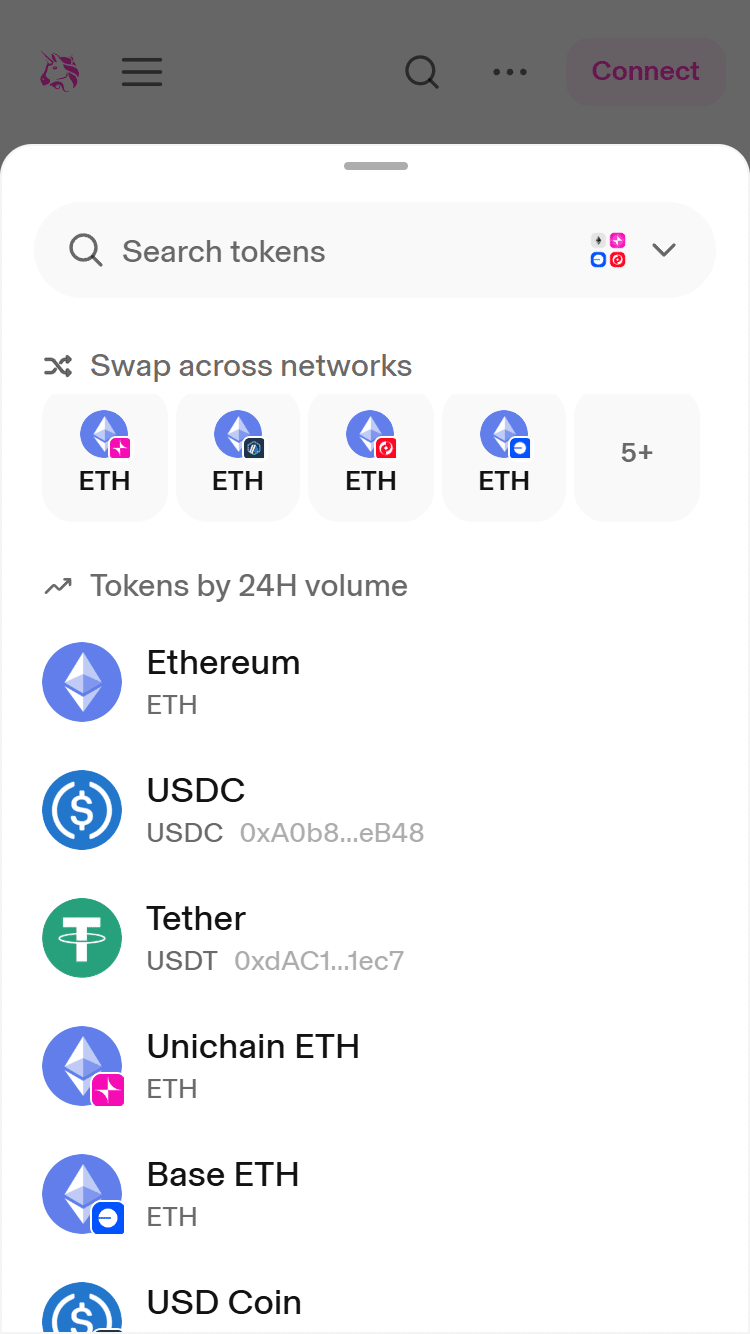

5. Start Trading

Once you are connected, you can choose the tokens you want to trade. Enter the amount you want to swap, and the DEX will automatically calculate the slippage and potential fees. Remember, fees vary across DEXs and are based on network congestion. Make sure to check your slippage tolerance before submitting any trades.

6. Confirm the Transaction

Once you have entered in the amount you want to swap and set your slippage tolerance, it’s time to click “Swap.” Your wallet should prompt you to approve a spending limit, which allows it to access the tokens for the swap.

After approving that, a second prompt will appear to confirm the actual transaction. When you complete your trade, you’ll receive a transaction confirmation in your wallet. Note that if you’re receiving a new token, you may need to manually import its details for it to appear on your wallet’s portfolio page. You can follow MetaMask’s guide to learn how.

Conclusion

Decentralized exchanges represent a shift in financial power from centralized entities to individual users. By allowing traders to retain full control of their assets and interact directly through blockchain-based smart contracts, DEXs challenge the traditional norms of finance and open the door to a more inclusive, censorship-resistant economy. They reduce reliance on intermediaries, offer global access without registration or KYC in many cases, and promote transparency by operating on open-source protocols.

However, DEXs also bring new responsibilities and risks. Users must manage their own wallets and private keys, navigate complex interfaces, and deal with challenges like slippage, impermanent loss, and smart contract vulnerabilities. Despite these hurdles, the decentralized exchange landscape is rapidly evolving, with improved user experiences, layer-2 scalability, and cross-chain compatibility on the horizon.

DEXs play a foundational role in the broader scope of decentralized finance (DeFi). As adoption grows and more capital flows into the space, DEXs are likely to become as critical to digital asset markets as traditional exchanges are to legacy finance.

FAQs

Is it safe to use a decentralized exchange?

Mostly, yes, as long as you stick to well-known platforms like Uniswap, Curve, or Jupiter and know how to avoid scams. DEXs are self-custodial, which means you're responsible for your funds, so make sure to use the correct website and watch out for scams.

What is slippage, and why does it matter?

Slippage is the difference between the expected price of a trade and the price you actually get. It matters most in low-liquidity pools and volatile markets.

Are DEXs cheaper than centralized exchanges?

Sometimes yes, but not always. DEXs don't charge deposits or withdrawal fees, and many have low swap fees. But, gas fees on major blockchains can be high during congestion.

Can I use a DEX on my phone?

Yes. Wallet apps like Trust Wallet, Coinbase Wallet, and MetaMask Mobile let you use DEXs directly from your phone. Some DEXs also have mobile-friendly interfaces built in.