Solana futures are a hot topic in crypto trading circles because they allow traders to bet on the future price of SOL, the native token of the Solana blockchain, without actually owning the coin. This is a big deal if you are an investor looking to dive into the market without dealing with wallets and transfers. While they are still relatively new, Solana futures are already available on major exchanges like Binance, Bybit, and OKX, to mention a few.

Traders use crypto futures for different reasons. Some use them to hedge risks, while others use them to amplify their leverage or simply chase quick profits on price swings.

Understanding Solana Futures

Futures are financial contracts that allow you to agree to purchase or sell an asset at a set price on a specific date in the future. They have many use cases, but they are mostly used to bet on whether the price of the asset will go up or down. While these contracts were initially only used for commodities like oil and wheat, you can now trade futures for many other types of assets, including Bitcoin, Ethereum, and Solana.

Solana (SOL) futures are a type of crypto futures contract. You don’t need to own any SOL to trade them. Instead, you are just speculating on Solana’s price movement before the expiration date.

For example, if you think SOL will go up next week, you can “go long” by buying futures contracts. If you think it will drop, you can “short it” by selling contracts and looking to buy them back later at a lower price.

Most of the time, crypto exchanges allow you to trade crypto futures with leverage. Some platforms offer up to 100x leverage, which can amplify your gains significantly (as well as your losses), but most traders stick to much lower leverage levels to manage their risks.

Futures are popular with short-term traders. They let users capitalize on the market volatility without needing to buy or sell the actual token. However, if you trade SOL futures, you should know that you are taking high risks, especially when leverage is involved. If the market moves against you too much, your trade can be liquidated very quickly, forcibly closing your position and potentially losing your entire margin.

How Solana Futures Work

Just like Ethereum futures or Bitcoin futures, Solana futures come in different types. The most common type is perpetual contracts, which don’t expire. They use a funding rate system to keep the contract price close to the spot price, requiring traders to pay funding fees periodically to keep their positions open. Perpetual futures are popular on platforms like Binance and Bybit, where they offer up to 100x leverage.

Other futures contracts have expiration dates, often lasting a month or a quarter. These are called fixed-term contracts. For example, CME Group offers cash-settled Solana futures that expire monthly.

Each SOL futures contract may define a minimum price fluctuation, also known as “tick size,” to standardize trading movement. For example, some platforms use a $0.01 tick size per SOL.

Contract Size, Margin, and Settlement

Contract sizes vary by exchange. CME offers standard SOL futures with a contract multiplier of 500 SOL and Micro SOL futures with a multiplier of 25 SOL.

The two main types of futures contract settlements are:

- Cash-settled futures: The profit or loss is paid in cash. At the time of the contract expiry or when the position is closed, the difference between the contract price and the actual market price is calculated. Users don’t get actual SOL assets.

- Physically-settled futures (traditional): In these rare cases, the actual SOL asset is delivered when the contract expires. If you are long on the contract, you receive actual SOL. If you are short, you deliver the SOL asset.

Most Solana futures are cash-settled, which means that no actual SOL changes hands. Instead, the profits or losses are settled in cash.

Trading Solana futures requires maintaining a margin, a fraction of the contract’s value used as a security deposit. Leverage allows traders to control larger positions with less capital, which can boost their potential gains and losses.

For instance, if you anticipate that SOL’s price will grow from $150 to $170, you can enter a long position with a futures contract. If the price increases as you expected, you profit from the difference. If the price falls, you suffer a loss.

Trading Strategies

Why do traders use futures these days?

Several strategies can convince you to trade SOL futures, including:

- Speculation: Betting on price movements to profit from market volatility.

- Hedging: Protecting existing SOL holdings against potential losses.

- Arbitrage: Exploiting price differences between spot and futures markets or across exchanges.

The History of Crypto Futures

Crypto futures are a relatively new addition to the world of finance, but they have been growing incredibly fast. It all started in December 2017, when the Chicago Board Options Exchange (CBOE) launched Bitcoin futures. This was a major milestone and marked the first time a regulated exchange in the United States of America offered a crypto derivative.

However, CBOE later pulled out of the market (2019) due to low trading volume and regulatory concerns.

CBOE wasn’t the only exchange offering crypto futures, however. The Chicago Mercantile Exchange (CME) has remained committed. CME launched its own Bitcoin futures in December 2017, just a week after CBOE, and quickly became the hub for crypto futures.

In February 2021, CME expanded to offer Ether futures and options, followed by micro futures for both BTC and ETH later that year.

The next big wave came in March 2025, when CME launched Solana (SOL) futures. This marked its first expansion into Layer 1 altcoin futures beyond BTC and ETH.

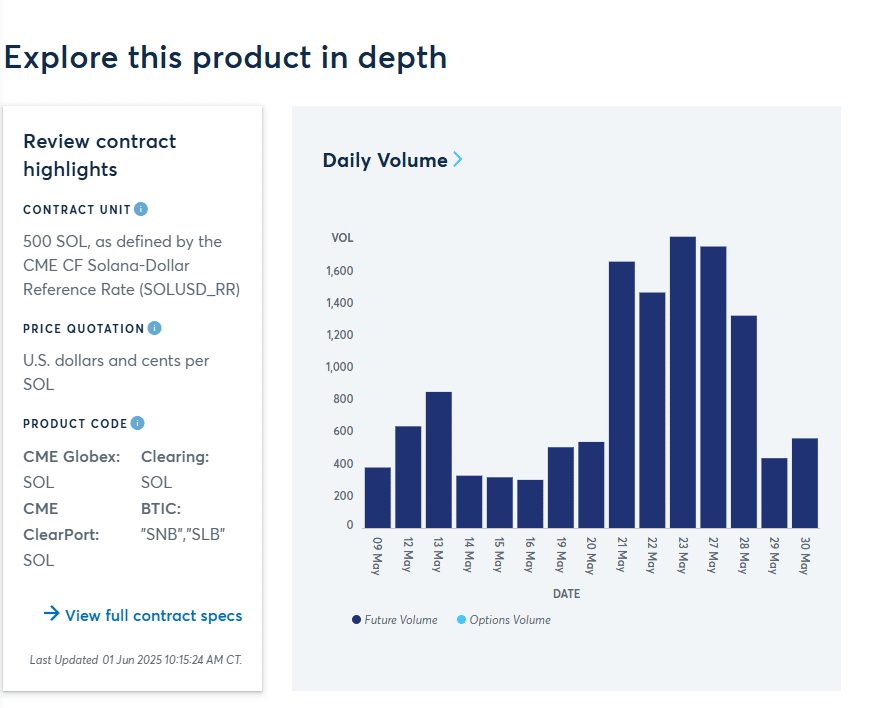

The exchange’s SOL contracts are cash-settled and based on the CME CF Solana-Dollar Reference Rate, which is calculated daily using pricing data from major crypto exchanges.

Pros and Cons of Trading Solana Futures

Solana (SOL) futures offer traders a unique way to gain exposure to the price movements of the coin without actually owning the token. This opens new profit opportunities, but it also introduces new risks. Let’s take a closer look at the main advantages and drawbacks of trading Solana futures compared to investing directly in the asset.

Pros

There are many different reasons to trade Solana futures over simply holding Solana. Here are the main five pros:

Leverage for Bigger Gains

Futures contracts let traders use leverage, which means that they can control a larger position with a smaller initial investment. This boosts the potential for bigger returns as long as the market moves in your favor.

Ability to Short the Market

Unlike spot trading, futures allow you to go short. This means that you can profit from price declines. This is ideal during bear markets or in situations where you believe SOL will dip in the short term.

No Need for Wallets and On-Chain Activity

Most Solana futures are cash-settled, so there is no need to manage private keys or deal with a crypto wallet. With futures, you can simply trade with transparent pricing.

Hedging Tool

If you already hold some SOL in your portfolio, you can use futures to hedge against downside risk. Advanced crypto traders and institutional players often use short futures positions to protect their SOL holdings.

Better Tax Treatment

In certain countries, including the U.S., futures may be taxed differently compared to spot crypto trades. Section 1256 of the IRS code, for instance, gives more favorable tax rates to regulated futures contracts.

Cons

Naturally, trading Solana futures comes with plenty of downsides, too. Here are the main cons you should be aware of:

High Risk Due to Leverage

Leverage is fantastic if the price moves your way. However, it is a double-edged sword. It can magnify your gains, but it can also magnify your losses, and liquidations can happen extremely quickly.

No Ownership of the Actual SOL

With futures, especially cash-settled contracts, you won’t own any real SOL. This means that you can’t stake it, transfer it, or participate in the Solana ecosystem in any way.

Complexity

Futures can be much more complex than spot trading. Traders need to have an understanding of margin requirements, funding rates, liquidation risks, and more. While you can contact a cryptocurrency expert to get some investment guidance, it is always best to be knowledgeable about your investments. This can be a major hurdle for beginners.

Fees and Funding Costs

Perpetual contracts often come with funding fees that are exchanged between long and short positions. Over time, these can take a big chunk off your profits, especially in sideways markets.

Expiration and Rollover

For standard futures (not perpetual), traders must manage expiration dates and roll over positions. This makes them more complex and time-consuming.

Popular Solana Future Exchanges

As the interest in Solana grows in the crypto market, so does the demand for futures trading options. Solana futures can currently be traded across many of the most popular cryptocurrency exchanges. Each platform offers different contract types, margin options, and fee structures so it’s important to pick the best one for you. Below you will find the top 5 platforms that offer SOL futures.

1. Binance

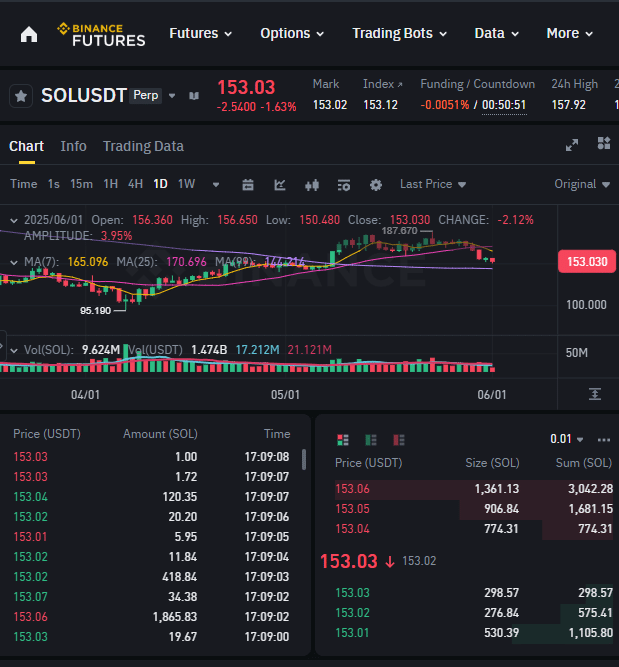

Binance is a leading crypto exchange known for its extensive range of trading opportunities. It offers USDT-margined perpetual contracts for Solana, which allows traders to speculate on SOL’s price movements. These contracts come without expiration dates.

As of recent data, Binance Futures has a 24-hour trading volume of around $3.37 billion for SOL/USDT perpetual contracts. This means there is deep liquidity and quite active market participation.

2. Bybit

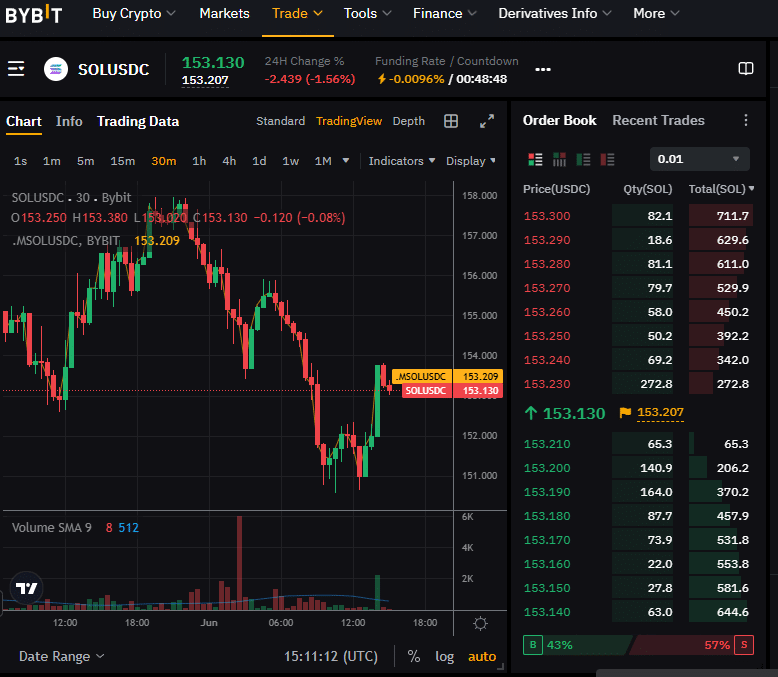

Bybit is a cryptocurrency derivatives exchange that appeared on the market in 2018. It provides a platform for trading countless different crypto derivatives, which include SOL/USDT perpetual contracts.

Bybit is popular for its user-friendly interface, competitive fees, and massive selection of offerings. The exchange reports a 24-hour trading volume of around $3.28 billion, making it one of the largest futures trading platforms in the world.

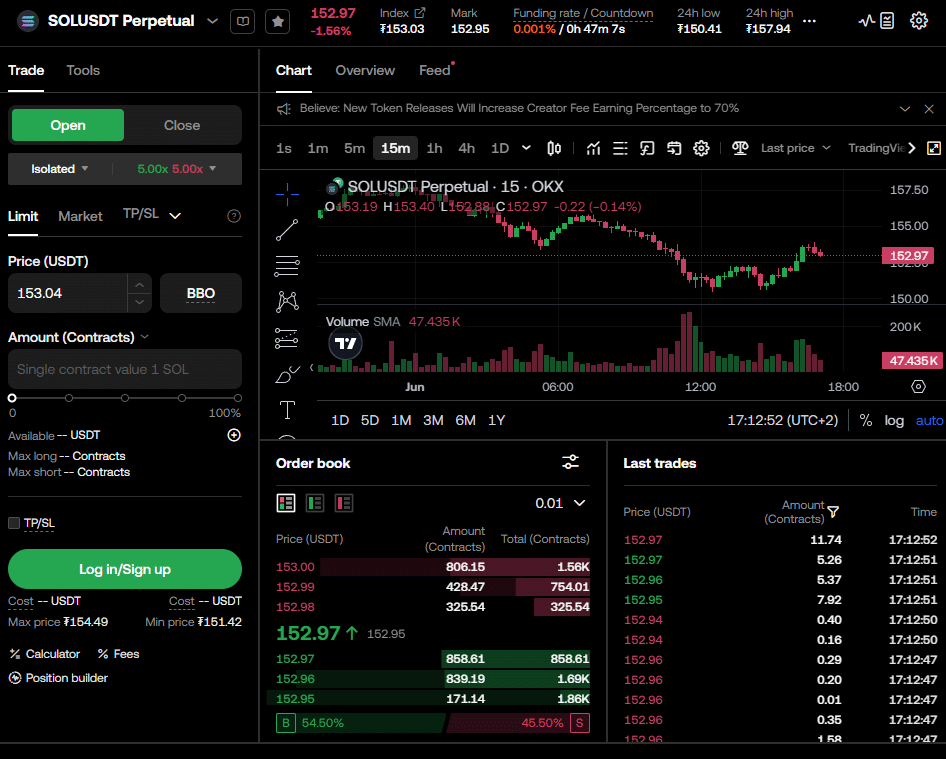

3. OKX

OKX is a successful cryptocurrency exchange with a large selection of both crypto futures and spot trading offerings. It provides both USDT-margined perpetual and expiry futures for Solana, which makes it a strong choice for both institutional and retail traders.

4. CME Group

The Chicago Mercantile Exchange (CME) Group remains the leading marketplace for derivatives. In March 2025, CME launched regulated, cash-settled Solana futures. On its first day, CME’s Solana futures recorded a trading volume of $12.1 million. This is modest compared to Bitcoin and Ethereum futures, but it’s still impressive given how new they are.

If you wish to trade SOL futures at CME Group today, there are two options available: standard contracts for 500 SOL and micro contracts for 25 SOL. The futures are regulated and available for trading on CME Globex and clearing through CME ClearPort.

What Are Solana Futures Options?

Solana futures options are financial derivatives that give traders the right, but not the obligation, to buy or sell Solana futures contracts at a predetermined price (the strike price) before a set expiration date.

Like with regular Solana futures, you won’t be trading the token directly. You won’t even trade a regular futures contract. Instead, you’d be trading an option on a futures contract of SOL, a second-layer derivative.

Let’s take a look at the main reasons why traders choose Solana futures options:

Hedging Volatility

Solana is known for its large price swings. Options allow investors to hedge existing SOL holdings or futures positions against downside risk.

Leverage with Limited Capital

Buying an option usually costs less than buying SOL or a full futures contract, but it still lets you benefit from price changes.

More Ways to Trade

Options simply give traders more flexibility. They can bet on the price going up, down, or just experiencing significant volatility, all without owning the asset.

No Need to Hold SOL

Like with regular Solana futures, you can trade Solana’s price movements without having to buy tokens.

The Risks of Solana Futures Options

Even though Solana futures options have many benefits, there are also certain risks that come with trading them. First of all, there is simply much less liquidity in the Solana options market. This can make it harder to enter or exit trades, and you will likely experience price slippage.

Furthermore, some of the top platforms that offer these options are offshore or not fully regulated, which generally means there is more risk. If the exchange goes down or has issues, you could lose money since there is often no safety net.

Final Thoughts on Solana Futures

Solana futures options can be a profitable tool for an experienced trader. They offer a way to profit from price movements or protect other investments, all without making direct investments in the coin.

Still, these derivatives can be extremely risky and difficult to master, especially for beginners. If you are thinking about trading SOL futures, consider starting small, learning how they work before you dive in headfirst, and always using a trusted exchange with transparent pricing and reliable services.

FAQs

How do perpetual Solana futures differ from fixed-term ones?

Perpetual futures have no expiration date and will stay open indefinitely. Fixed-term futures settle on specific dates—monthly, quarterly, or otherwise.

Is leverage available when trading Solana futures?

Yes. Most platforms offer leverage, some even up to 100x. This can increase the potential gains, but it also amplifies the risks of bigger losses.

How are Solana futures typically settled?

They are usually cash-settled, which means that gains and losses are paid in fiat or crypto like USDT. There is no need to physically deliver SOL.

Are Solana futures suitable for beginners?

No. Solana futures and futures in general are better suited to experienced traders. They come with high volatility, margin risks, and complex mechanics.

Why would I trade Solana futures?

You can do this to hedge existing SOL holdings, speculate on price movements, or use advanced trading strategies with leverage and short positions.