Leveraged crypto trading is one of the best ways to maximize profits with relatively low upfront investments. It involves borrowing funds to open larger positions than what your actual balance would allow. The potential profits can be significantly higher, but so can the losses.

If you are new to crypto leverage trading, choosing the right platform is key. Not all cryptocurrency exchanges offer leverage and the ones that do vary in terms of fees, tools, ease of use, and security features.

In this guide, we will break down the best crypto leverage trading platforms available on the market.

Best Crypto Leverage Trading Platforms in 2025 Ranked

Here’s an overview of our top picks for the best crypto leverage trading platforms:

- MEXC: Best overall leverage trading platform with up to 200x on popular crypto pairs

- Binance: High liquidity exchange offering up to 125x leverage on futures contracts

- OKX: Feature-rich platform with leverage up to 125x on perpetual swaps

- CoinEx: User-friendly crypto trading platform with a futures calculator

- BloFin: User-friendly exchange with futures trading and built-in leverage calculator

- Kraken: Trusted exchange supporting up to 50x leverage on futures markets

- KCEX: Low-fee futures platform with competitive leverage options and no maker fee

- BingX: Combines social trading tools with leveraged futures trading

- PrimeXBT: Offers crypto leverage up to 200x plus forex with up to 1,000x

- Pionex: A bot-powered platform that supports leveraged futures trading outside the U.S.

What Is Crypto Leverage Trading?

Crypto leverage trading lets you borrow money from a platform to increase your trading position beyond your own funds. For example, if you have $100 and use 10x leverage, you can trade as if you had $1,000. This means that your profits (or your losses) will be multiplied by 10.

Most leverage trading happens through futures contracts, which are agreements to buy or sell a cryptocurrency at a set price in the future. Most futures platforms today offer perpetual futures trading, which means that the contracts don’t expire, so you can hold a position as long as you want. However, these kinds of contracts require periodic funding fees. Depending on market conditions, you may either pay or receive this fee.

Traders use leverage to boost their potential profits. Imagine this: Bitcoin’s price rises 5%. Without leverage, your $100 investment will only earn you $5. But if you have 10x leverage, the same 5% move becomes a 50% gain on your $100, so you’d automatically make $50.

This makes leverage very attractive, especially for experienced traders who want to maximize returns across various trading pairs, like BTC/USDT or ETH/BTC. However, it’s important to remember that leverage trading is extraordinarily risky.

Let’s consider an example. If Bitcoin’s price falls 5% instead of rising in our scenario, your $100 investment loses $5 without leverage. With 10x leverage, the 5% drop means you lose $50, which is half your original investment. If the price drops further, you could get liquidated (forced to close your trade to stop further losses) and lose your entire investment.

The vast majority of leverage crypto exchanges automatically liquidate trades when they cross a certain threshold to prevent losses from exceeding your initial investment.

Trading fees, which vary by platform and can affect your overall profits, are another vital factor to consider when picking the best exchange for you.

Important Terms Linked to Crypto Leverage Trading

Before you jump into leverage trading, it is important to know the main terms linked to it. These include:

- Margin trading: This is the broader term for trading with borrowed money. Your “margin” is the amount of your own money you put up as collateral to open a leveraged trade. For instance, if you want to open a $1,000 trade with 10x leverage, your margin is $100.

- Leverage: The multiple by which your position size is increased beyond your margin is called leverage. If you use 10x leverage, this means that your trade is 10 times larger than your margin.

- Liquidation: If losses on your position come close to your margin, the exchange will automatically close your trade to prevent you from owing more money than you have.

- Perpetual contracts: This is a type of futures contract without an expiry date, which is very common in crypto leverage trading.

- Isolated margin trading: Only the margin allocated to a specific position is at risk. If the position is liquidated, only that margin is lost.

- Cross margin: All available margin in your account can be used to prevent liquidation on any position, which helps share risks across trades.

- Stop-loss order: An automatic instruction to sell if the price hits a certain level to limit losses.

Best Crypto Leverage Trading Platforms

Now, let’s dive into ten of the best crypto leverage trading platforms on the market.

1. MEXC

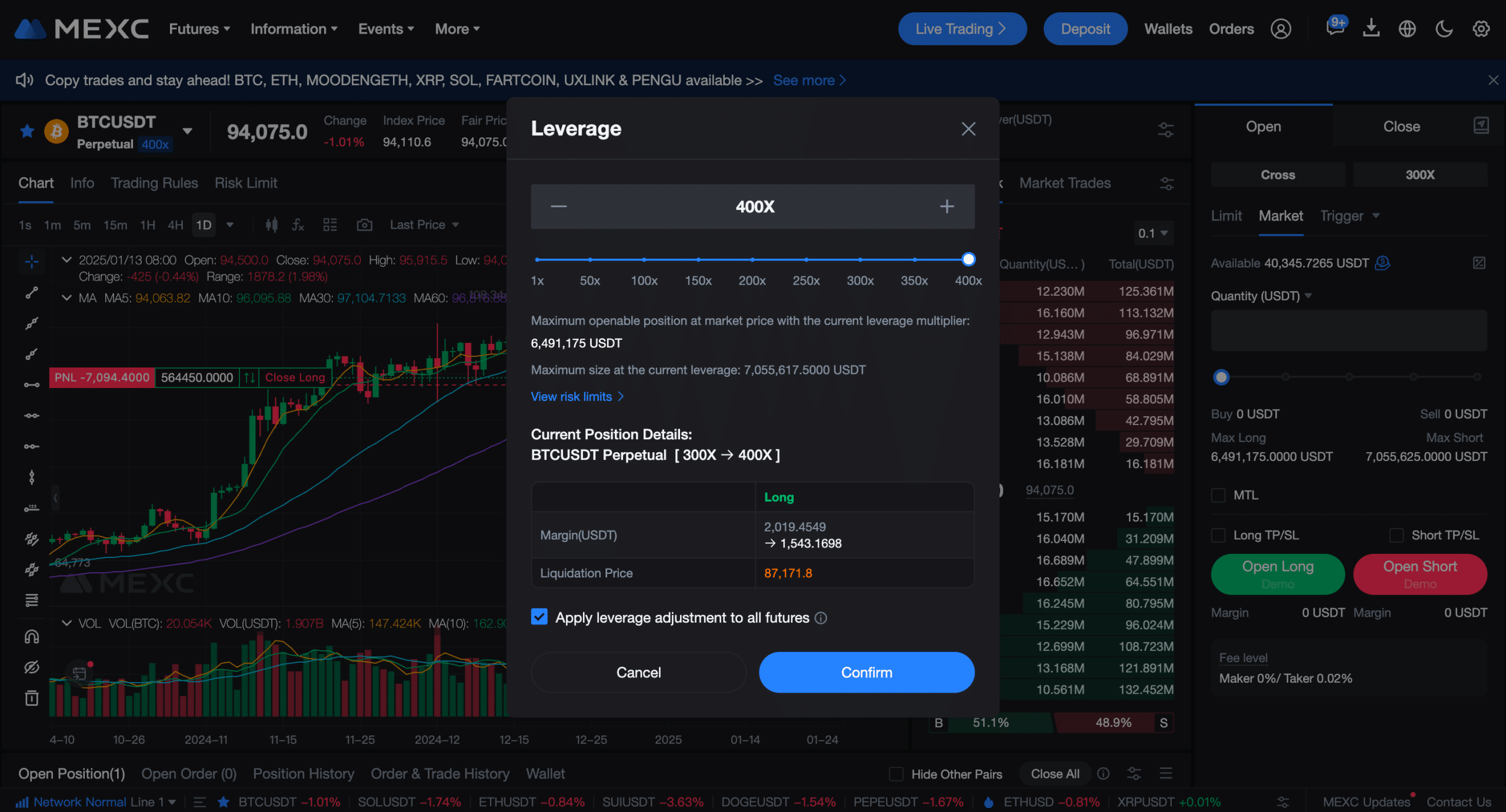

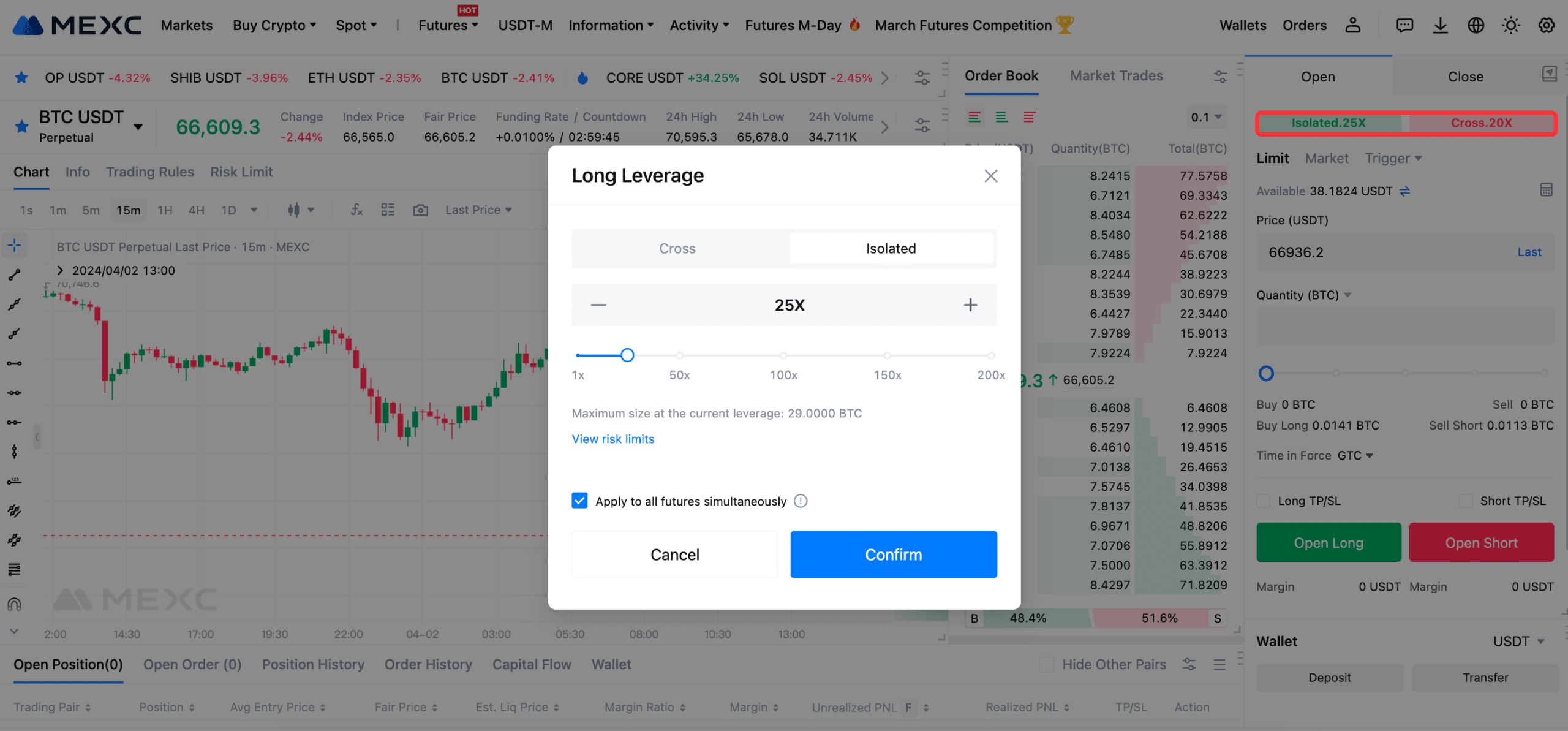

MEXC is a global exchange with a massive selection of crypto assets, advanced trading tools, and high leverage options. It offers up to 400x on futures trading with both USDT- and coin-margined contracts.

The platform has recently introduced a much higher leverage on key BTC/USDT and ETH/USDT futures, which is a big leap from its previous 200x cap. For reference, the vast majority of exchanges that offer leverage trading max out at 100x leverage. Furthermore, MEXC supports over 600 trading pairs and is famous for its rapid BTC/ETH contract listings.

Advantages:

- Huge range of assets: Supports over 2,500 coins and over 2,700 trading pairs.

- Ultra-low fees: Zero spot maker fees and up to 0.01% futures taker fees.

- Discounts for MX token holders

- Top-tier leverage: Futures leverage up to 400x and 125x on coin-margined contracts.

- Advanced tools: TradingView charts, grid, and copy-trading bots, a futures demo mode for practice, and much more.

- Secure trading environment: Implements 2FA, cold storage, proof-of-reserves, and holds a U.S. MSB registration.

Disadvantages

- Complex interface: MEXC has a feature-rich interface, which can be overwhelming for beginners.

- Customer service issues: There are mixed reviews on support reliability and speed.

- Regulatory uncertainty: MEXC is restricted in several countries (including the U.S.) and has occasional account freezes for “risk control” flagged by users.

- Withdrawal limitations: Fiat withdrawal options are limited. Crypto withdrawal fees can be higher than average.

Top Features

- Up to 400x leverage with USDT-M and Coin-M futures

- Zero maker fees on spot and futures trading

- Copy-trading and bots for automated strategies

- Advanced charting tools and demo trading are available

- Wide token variety and futures contracts

Best For:

Experienced traders seeking low fees and high leverage trading, and active and high-volume traders who prefer using bots and copy-trade tools.

2. Binance

Binance is the largest cryptocurrency exchange in the world by a massive margin, and it is well known as the global leader in terms of liquidity. Today, it offers both spot margin and futures trading with up to 125x leverage on major trading pairs.

Binance handles around $76 billion in daily futures volume across over 460 USDⓈ-M and COIN-M contracts, which makes it the world’s top hub for derivatives trading.

More recently, in June 2025, Binance announced new perpetual futures trading for altcoins like LA/USDT and HYPE/USDT, showing continued expansion on the market.

Advantages

- Massive futures selection: Over 250 futures pairs, including USDT and coin-margined contracts.

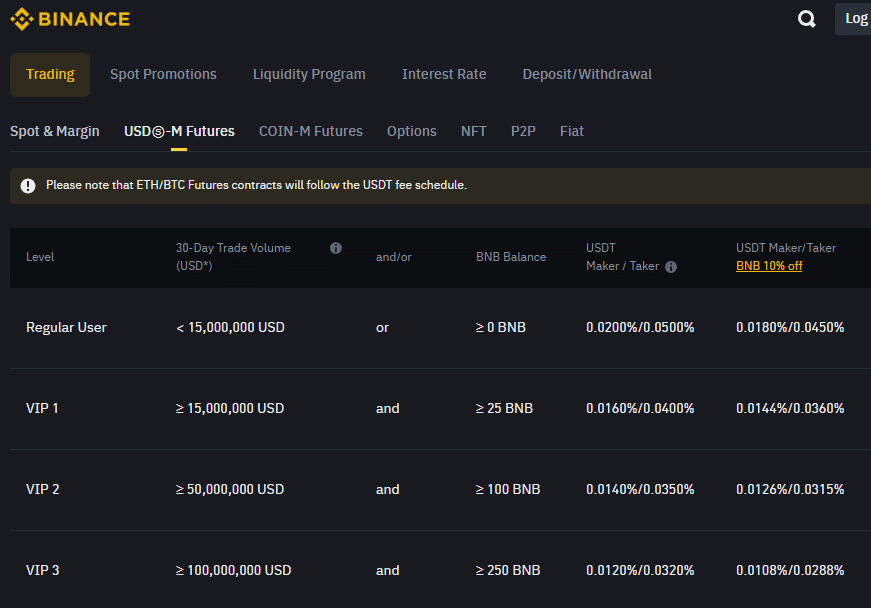

- Competitive fees: As low as 0.02% maker and 0.04% taker fees on futures for VIP users.

- High liquidity: This ensures tight spreads and easy execution of orders.

- Easy-to-use platforms: Binance has simple mobile and desktop platforms with advanced charting tools.

Disadvantages

- Overwhelming for beginners: The free tiers and trading types require practice and learning.

- Occasional withdrawal delays: Usually occur during high volume.

- U.S. restrictions: Some services are limited or unavailable.

Top Features

- 125x leverage on futures

- Diverse trading pairs and perpetual futures

- Advanced charting and a mobile app

- Tiered fee discounts for high-volume traders

Best for:

Aggressive, experienced traders who want maximum leverage, low fees, and broader market access.

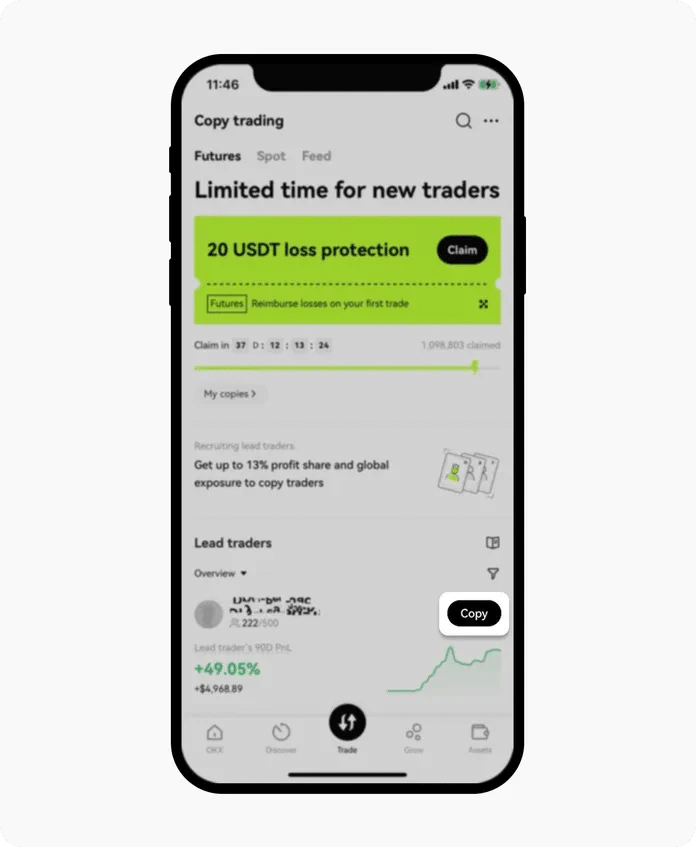

3. OKX

OKX offers up to 100x leverage on both crypto-margined and USDT-margined perpetual futures. The platform recently earned EU MiCA and Dubai retail licenses, which means that it has expanded its regular services even further.

OKX’s perpetual futures platform now features both coin and USDT settlement, auto funding, and position limits improvement, which signals an improved infrastructure and better regulatory compliance.

Advantages:

- Versatile trading options: spot, margin, perpetuals, and options.

- High leverage trading: Up to 125x leverage on most perpetuals.

- Algorithmic trading and bots: OKX supports bots and has strong API support for algorithmic trading.

- Competitive fees: A solid fee structure and occasional fee promotions.

Disadvantages:

- Complex interface: Steep learning curve for beginner traders.

- Limited fiat withdrawals: This depends on the region.

Top Features

- 125x futures leverage

- A variety of market types (spot, margin, options)

- Bot trading and API tools

- Good fee tiering

Best for:

Traders who want a full-featured platform with many instruments and automated trading support.

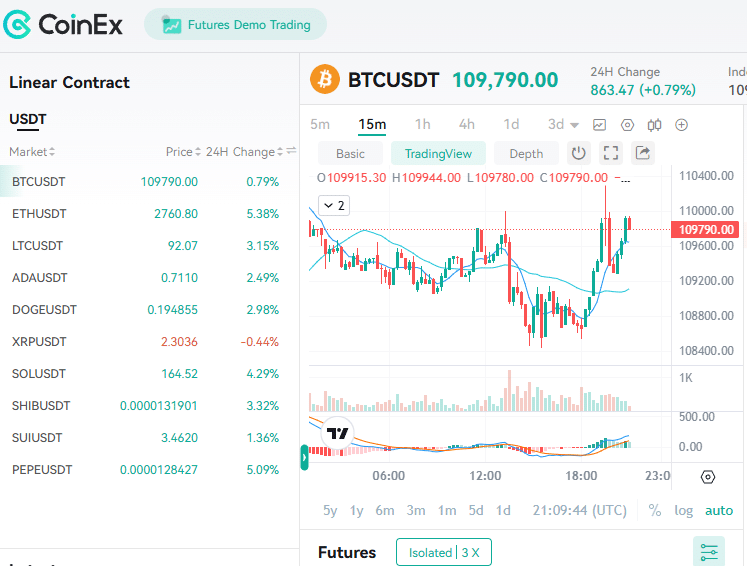

4. CoinEx

CoinEx might not lead in leverage, but it stands out for accessibility. It has a built-in futures calculator that you can use to estimate profit, margins, and liquidation promptly. The fee structure starts at 0.03% maker and 0.05% taker, with further reductions for those with a VIP status.

For your convenience and to give you some practice, CoinEx has a demo trading feature that allows you to try out trading strategies before you dive in with real money. The platform supports a wide range of trading pairs, though it doesn’t quite match up with MEXC or Binance in that regard.

Advantages

- Simple user interface and demo trading: Ideal for beginners.

- Built-in futures calculator: Can be used to estimate P&L and margin.

- Low fees: Fees start at 0.03% maker and 0.05% taker, improving with VIP status.

- Funding fees split between traders: No direct fee to CoinEx.

Disadvantages

- Limited maximum leverage compared to heavy hitters.

- Limited futures contract variety compared to major platforms.

- Smaller global footprint: The platform is expanding, but it is less recognized in major markets like the U.S. or Europe.

Top Features

- Built-in futures calculator

- Transparent fee structure

- Spot, margin, and futures in a single platform

Best for:

Entry-level traders and those who prefer clarity over maximum leverage.

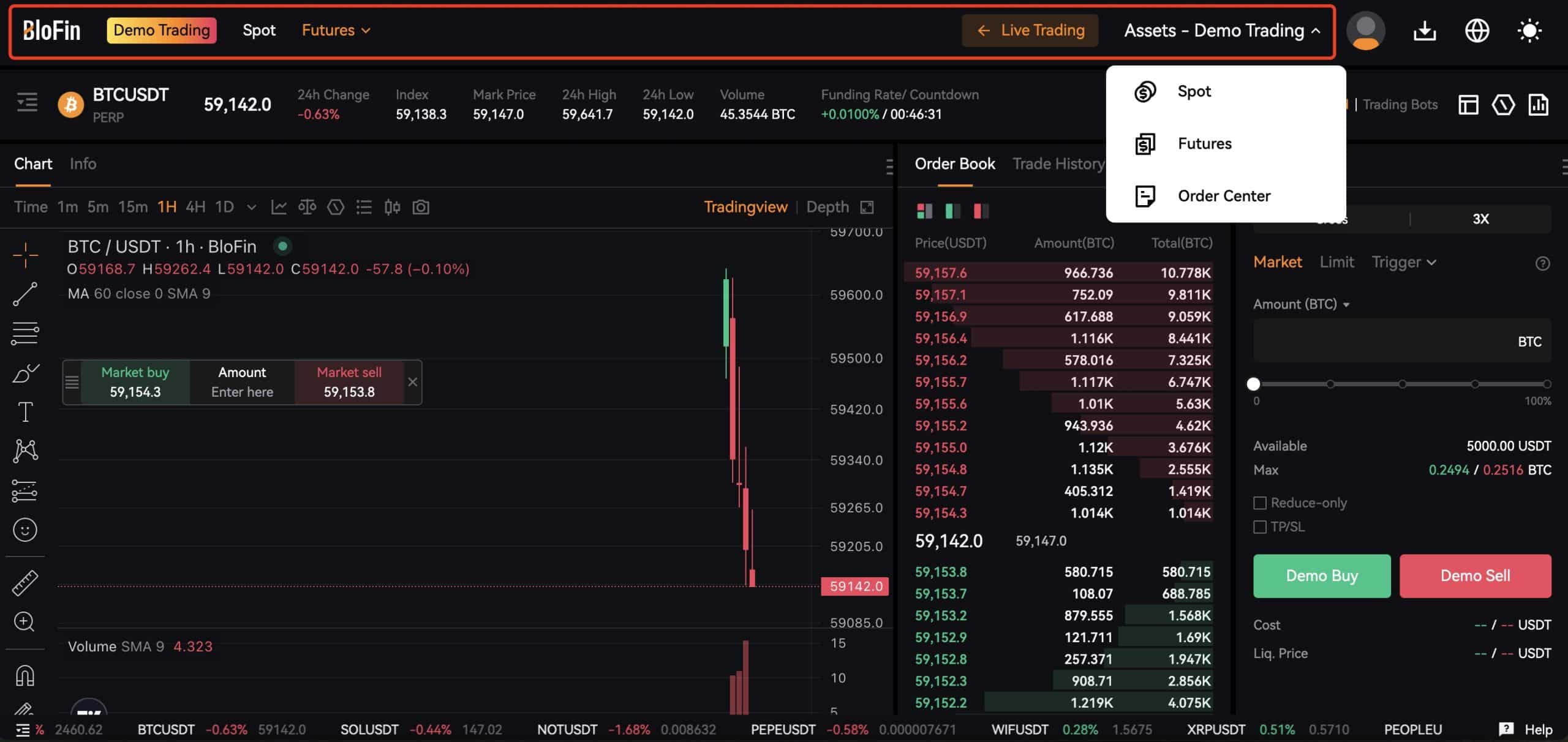

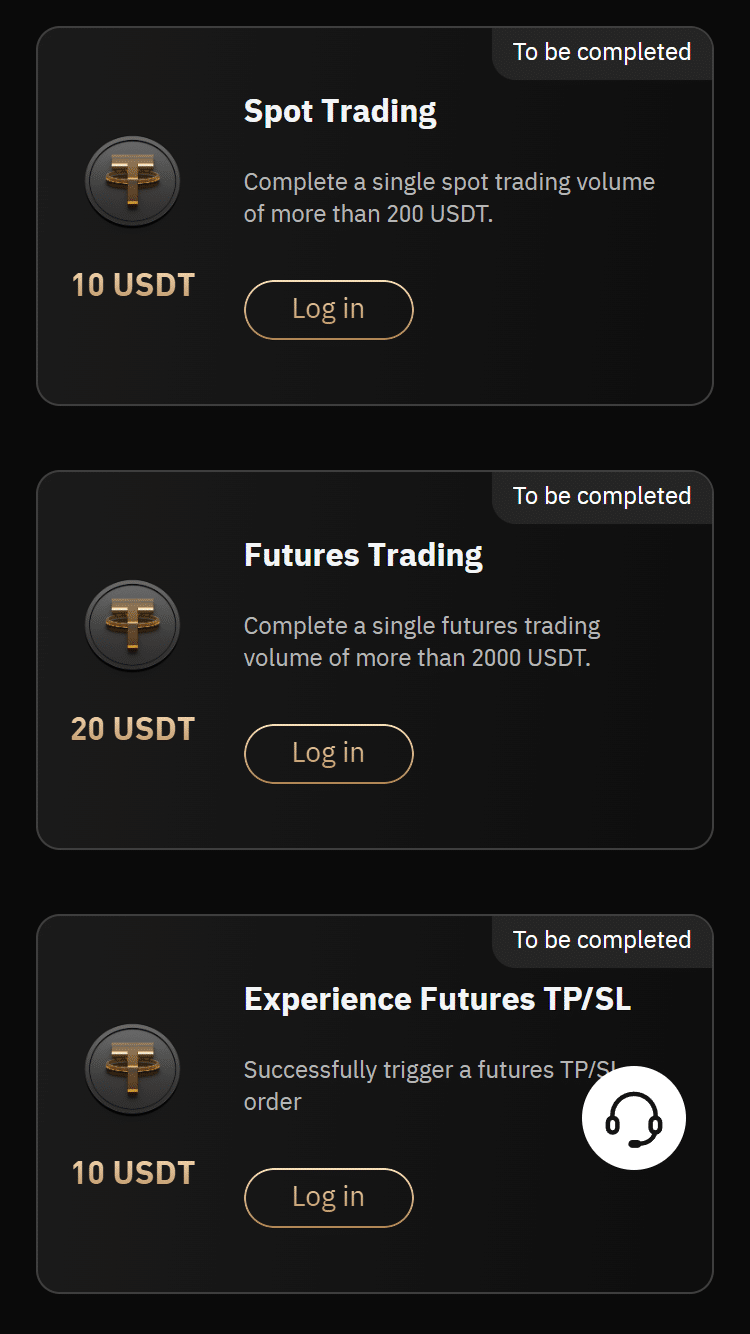

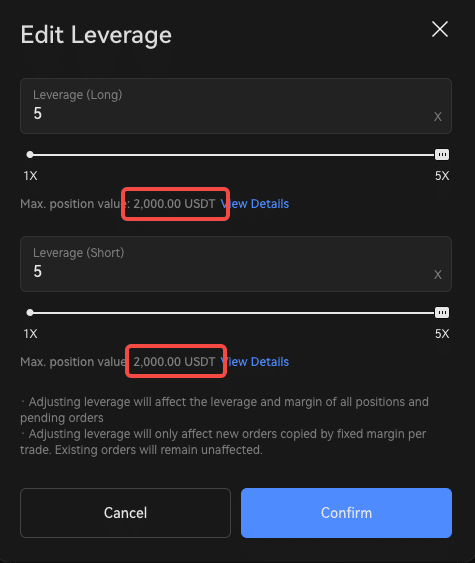

5. BloFin

BloFin offers over 450 perpetual pairs with leverage that goes up to 150x. The platform was founded in 2019 and is based in the Cayman Islands. It integrates TradingView charts with 100+ technical indicators like MACD, RSI, Fibonacci, and more, giving traders a professional-level charting experience.

In addition to this, BloFin includes various order types such as limit, stop-loss, take-profit, and chain-supported bots that traders can use to automate their strategies. It also recently added full copy trading functionality if you want to try out new strategies with no risk.

Advantages

- Excellent pair variety and strong leverage

- Bots support: Available for automated and copy trading.

- Low fees: Competitive rates – 0.02% maker and 0.06% taker, with discounts for VIP tiers and volume traders.

- Copy trading and demo trading: Great for beginner traders.

Disadvantages

- No Fiat spot trading: Fiat on-ramps are in beta, but spot crypto purchases with local currency remain limited.

- Complaints about unfair liquidations: There have been user reports about chart manipulation and unfair liquidations.

- Lower trading volume: Lower trading volume compared to bigger platforms.

Top Features:

- Leverage up to 150x on 300+ perpetual futures contracts

- Integrated trading bots and TradingView signals

- Demo account with a $50,000 USDT test balance

- Apps for all platforms

Best for:

Experienced traders looking for a slew of advanced trading features as well as copy trading.

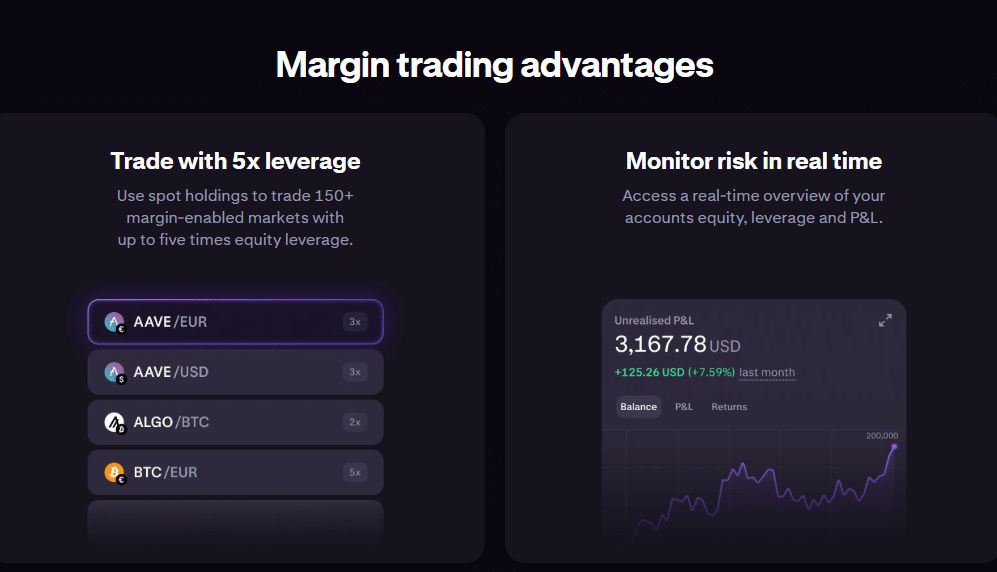

6. Kraken

Kraken is a long-standing exchange that offers spot margin trading up to 5x and futures trading up to 50x. As a U.S.-based veteran exchange from 2011, Kraken offers great security compliance and has better rates reserved for the VIP tiers. It’s a great choice for traders in the U.S. looking for a platform with total regulatory compliance and strong security.

In March 2025, Kraken announced a $1.5 billion acquisition of NinjaTrader, a popular retail futures platform, which signaled its ambition to expand its crypto derivatives offerings.

Advantages

- Regulated growth: The NinjaTrader acquisition expands the platform’s futures capabilities.

- Strong trust and security: U.S.-based, first crypto exchange with a bank charter, ISO 27001 certification, and proof-of-reserves.

- Competitive futures fees: Maker/taker structure starts at around 0.02%/0.05% with funding fees lower than other major exchanges.

Disadvantages

- Modest leverage caps. 5x on margin and 50x on futures, which is lower than most major exchanges.

- Fees for spot/margin can be higher compared to ultra-low-cost competitors.

- Regional constraints. Some features and derivatives are restricted in selected jurisdictions.

Top Features

- Spot margin up to 5x, futures up to 50x leverage

- Unified interface: spot, margin, futures, and staking

- Futures fees as low as 0.01% taker

- High security: audited and regulated

Best for:

Traders who prioritize trust and moderate leverage.

7. KCEX

KCEX is a growing crypto derivatives exchange famous for its low fees and simple fee structure, which makes it very appealing to cost-conscious traders. KCEX offers a solid range of futures trading pairs with leverage options.

KCEX was established in 2021. In September 2024, the platform introduced a Reward Center and launched daily futures trading competitions to boost user engagement and provide an additional incentive for its traders.

Advantages

- Competitive trading fees: KCEX offers 0% maker and 0% taker fees for spot trading and 0% maker and 0.02% taker fees for futures trading.

- High leverage options: KCEX provides leverage up to 100x on futures contracts.

- Wide range of cryptocurrencies: The platform supports 300+ cryptocurrencies, including BTC and ETH, as well as altcoins and Solana-based meme coins.

Disadvantages

- No Fiat on-ramp: KCEX doesn’t support direct fiat currency deposits and withdrawals.

- Limited advanced trading features: No advanced trading features found on some larger exchanges like staking, yield farming, and liquidity pools.

Top Features

- Zero-fee trading for all spot markets

- Up to 100x leverage

- Competitive futures fees

- Copy trading available

Best for:

Traders seeking a low-cost crypto trading platform with high-leverage options and charting tools.

8. BingX

BingX is famous for its copy and social standing. Founded in 2018, the platform integrates futures with up to 150x leverage for major pairs like BTC/ETH. It recently added subsidy vouchers to decrease the loss for small traders, and it has a great VIP program that offers lower fees depending on your trading volume.

In early 2024, BingX launched NFT trading features and enhanced analytics tools, followed by customizable alerts that can help traders make real-time decisions.

Advantages

- Powerful copy trading system: Allows users to automatically replicate the trades of top-performing traders.

- Leverage up to 150x on a wide range of futures contracts.

- Wide selection of trading pairs, including popular cryptocurrencies and altcoins.

- Competitive trading fees, generally around 0.04% taker and 0.02% maker fees.

Disadvantages

- Somewhat limited advanced trading features, such as charting and trading tools.

- Liquidity can be lower on less popular pairs, which can lead to higher spreads or slippage.

- No fiat on-ramp in some regions.

Top Features

- Copy trading and social trading

- Leverage up to 150x on futures contracts

- Diverse crypto trading pairs

- Regular trading competitions and bonuses

Best for:

Traders interested in social and copy trading combined with crypto leverage trading, especially beginners who want to follow experts.

9. PrimeXBT

PrimeXBT was launched in 2018 and is registered in Seychelles. The platform is dedicated to high-octane traders who want to focus on the most popular cryptos like Bitcoin, Ethereum, and Litecoin. It offers 200x leverage on Bitcoin and Ethereum, mixing crypto with 1000x forex leverage. It has a relatively small lineup of crypto offerings, though it supports most of the largest coins.

This is a famous Bitcoin leverage trading platform with lightning-fast execution and minimal slippage. The platform sticks to crypto deposits, though, so there is no fiat onboarding.

Advantages

- High leverage options: Up to 200x for crypto futures and 1000x for forex trading.

- Multi-asset trading: You can trade cryptocurrencies, forex, commodities, and stock indices.

- User-friendly interface combined with advanced charting tools.

- Fast order execution and deep liquidity.

Disadvantages

- High leverage can lead to significant financial setbacks, which makes it suitable for experienced traders only.

- No fiat on-ramp: You must deposit crypto first.

- Limited spot trading options: The platform is more focused on derivatives and margin trading.

- Not available in jurisdictions like the U.S., U.K., and Canada due to regulatory restrictions.

Top Features

- Up to 200x leverage on crypto futures, one of the highest on the cryptocurrency market

- Multi-asset trading

- Advanced TradingView charting and technical analysis tools

- Copy trading feature

Best for:

Experienced traders who are comfortable with high risk and seek a one-stop platform for different asset classes.

10. Pionex

Pionex is somewhat of a hybrid platform. It offers free built-in trading bots on perpetual futures and moderate leverage. U.S. users are blocked from the platform, but its sister exchange, Pionex.US, supports U.S. investors.

Founded in 2019 and registered in Singapore, Pionex offers an easy way for beginners and expert traders to engage in leveraged trading without having to constantly monitor the market. It supports leverage up to 100x on select futures contracts and is highly focused on automation.

Advantages

- Integrated trading bots that are designed to automate trading strategies.

- Leverage up to 100x on futures contracts.

- Low trading fees of 0.05% per trade.

- Supports a variety of futures trading pairs, including major cryptocurrencies.

Disadvantages

- Limited advanced charting and manual trading tools compared to major exchanges.

- Leverage is capped at 100x, which is lower than some competitors.

- Some bots are complex for complete beginners.

Top Features

- Automated trading bots, including grid and DCA bots

- Low and transparent futures trading fees

- Mobile app and web access

- Educational resources and tutorials for beginners

Best for:

Traders who want to combine crypto leverage trading with automated bot strategies.

Pros and Cons of Crypto Leverage Trading

| Pros | Cons |

| Boost in profits: You can earn much more from small price moves. | Higher risk: The losses are magnified just like the profits. |

| More buying power: You can trade larger positions than your funds allow. | Liquidation risk: If the market moves against you too much, your position can be closed forcibly. |

| Access to short selling: You can profit when prices fall by going short with leverage. | Complexity: Requires deep understanding of margin, fees, and trading strategies. |

| Better capital efficiency: You can use less money to hold bigger positions. | Higher fees: Leverage trading often comes with higher trading and funding fees. |

| Flexibility with perpetual contracts: No expiry, so you can hold positions indefinitely if you manage risks. | Emotional stress: Fast price swings and increased stakes can be mentally challenging. |

How to Start Crypto Leverage Trading

If you want to get started with leverage trading, the process is not at all complex. Here is how to do it on MEXC:

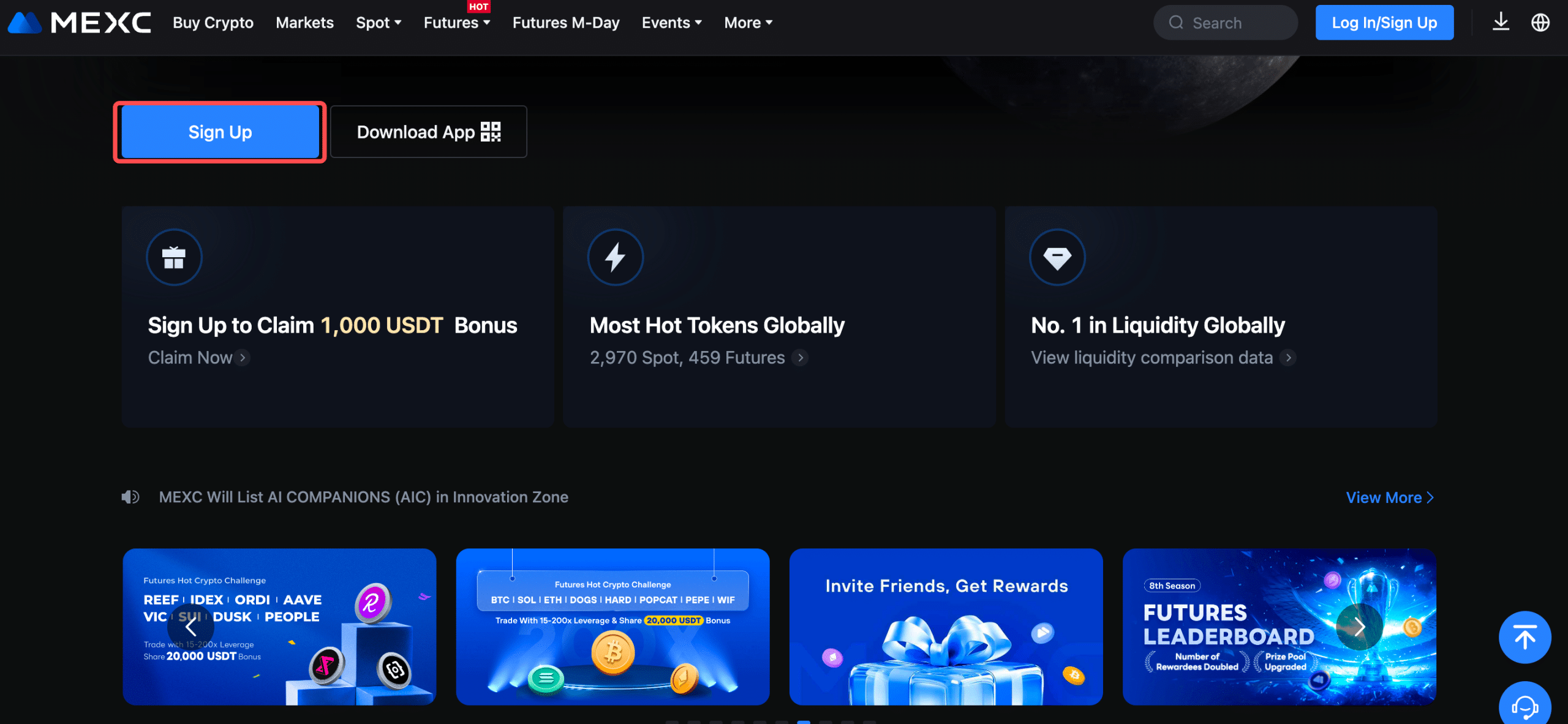

1. Create a Trading Account

Head to the official MEXC site and sign up using your email or phone number. You don’t need KYC right away, so this should only take a minute. However, if you complete KYC, you can unlock higher limits and bonus offers, and the process is very quick.

2. Deposit or Buy Crypto

Next, navigate to the Deposit page to transfer crypto from your wallet. You can also buy crypto directly using your card. MEXC has a demo account preloaded with 50,000 USDT if you want to test leverage trading without investing first.

3. Open a Leveraged Position

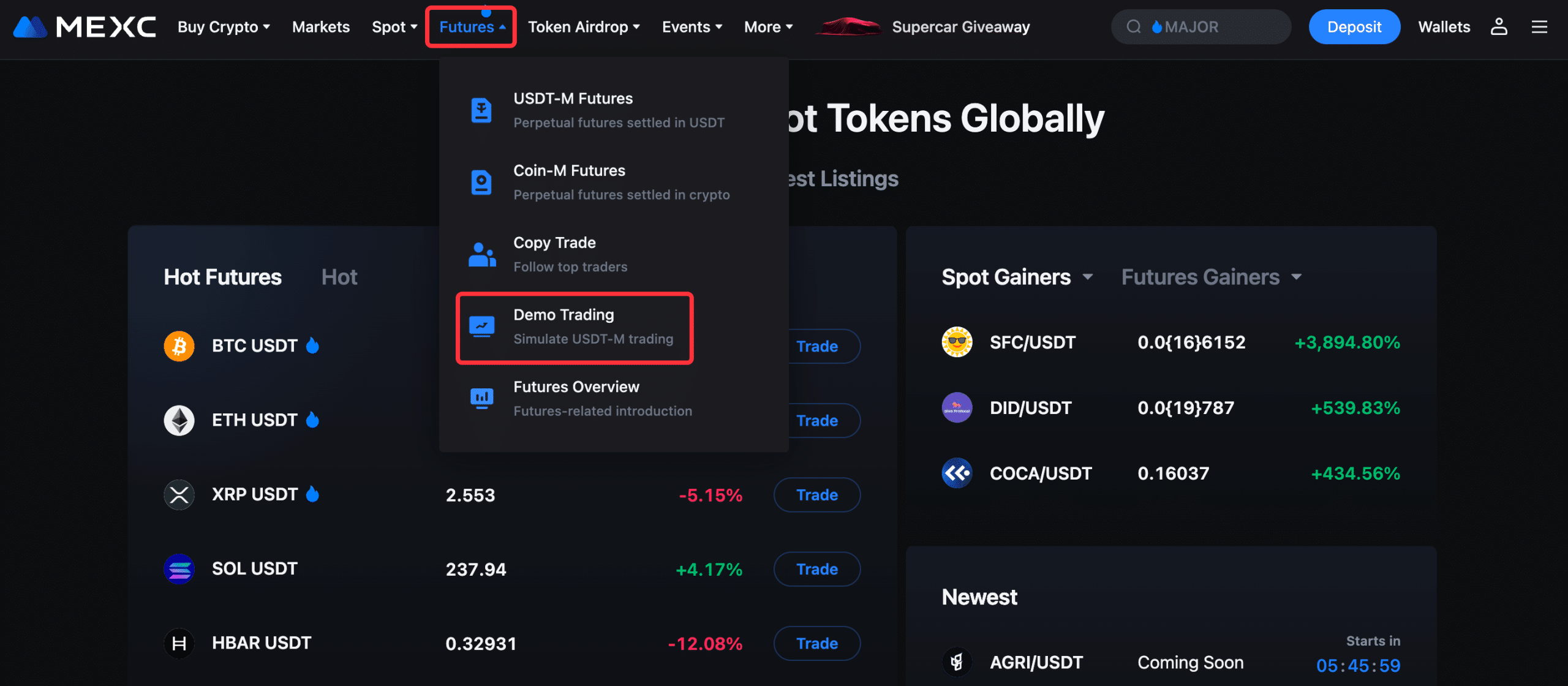

Once you have funded your account, it’s time to open leveraged positions. Visit the Futures section at MEXC. Choose your pair, adjust your leverage, and place a long or short position.

MEXC has included helpful tips and a tutorial that can guide you through your first trade.

Is Crypto Leverage Trading Safe?

Crypto leverage trading is not for the faint-hearted or beginner traders. It is a powerful way to boost your profits, but it is also extremely risky. Small price moves can cause big losses and wipe out your entire investment in seconds. Especially when trading with high leverage, you could get your entire position liquidated in seconds if the market moves against you.

Leverage trading any kind of asset can be dangerous, but using leverage to invest in crypto is especially risky because of its inherent volatility. Prices can swing tremendously in minutes, which makes leverage trading that much more unpredictable.

Finally, funding fees and trading fees can easily eat into your profits or add to your losses over time if you aren’t careful. If you don’t fully understand how futures and leverage work or don’t know how to manage your risk well, leverage trading can quickly become very dangerous.

Conclusion

Crypto leverage trading offers exciting opportunities, but you need expertise, discipline, and a strong risk management strategy to keep yourself safe. It all starts with choosing a reliable, safe platform. You can test different strategies using demo accounts before you even make an initial investment and gradually develop the skills you need to trade more confidently.

Remember: capital preservation is just as important as profit-making, even more so when leverage is involved.

FAQ

Is leverage trading risky?

Yes. Leverage trading can amplify your profits, but it also increases your potential losses. Poor risk management or sudden market swings can easily result in liquidations.

Do I need KYC to trade with leverage?

Not always. Platforms like MEXC, CoinEx, and PrimeXBT allow leverage trading with little to no upfront KYC. However, completing KYC usually unlocks bonus features and other perks.

What's the difference between margin and futures trading?

Margin trading typically involves borrowing funds to trade spot pairs, while futures trading lets you speculate on the price's direction without having to own the asset. Futures often offer higher leverage.

Can I try leverage trading without risking real money?

Yes. Exchanges like MEXC and BingX offer demo accounts or virtual funds so you can practice trading strategies before you commit real assets.

What is a safe leverage level for beginners?

Beginners should start with low leverage, perhaps something around 2x to 5x. This will allow them to reduce the risk while learning more about position sizing, liquidation, and stop-loss management.

References

- Liquidation Level: What It Is, How It Works – Investopedia

- Launch of 400 Leverage on Futures – MEXC

- MEXC Obtained MSB License in the U.S. – Finance.Yahoo

- Exchange Reviews on MEXC – TheReenvest

- Binance Handles $76 billion in Daily Futures Volume – LeverageTrading

- Binance to Adjust Tick Size for Perpetual Futures Contracts – Binance

- User Reports and Comments about Blofin – Reddit

- Kraken Strikes $1.5 Billion Deal for Futures Trading Business – WSJ

- KCEX Introduces Incentives for Traders – GlobeNewsWire