Join Our Telegram channel to stay up to date on breaking news coverage

Kraken, a global crypto exchange launched over 13 years ago, has set a new standard for exchange accountability following its latest Q1 2025 announcement. Powered by cryptographic data structures, the Kraken Proof of Reserves 2025 report lets users track the coverage of their crypto holdings.

Released on March 31, 2025, Kraken’s latest PoR includes both client liabilities and stored assets to cover those liabilities. Keep reading as we discuss the importance of Proof of Reserves for centralized platforms and what makes Kraken one of the best transparent crypto exchanges.

Kraken Proof of Reserves for Q1 2025 Reveals 114.9% BTC Backing

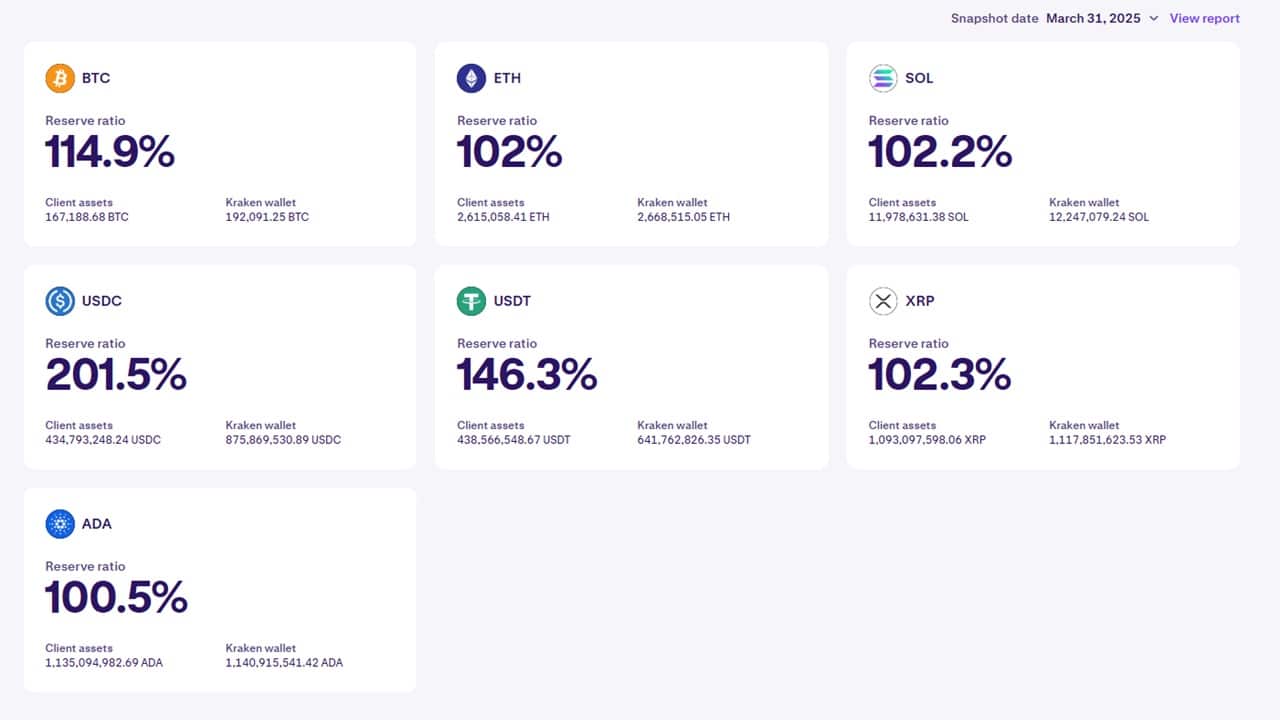

The Kraken PoR in March 2025 includes complete coverage of some of the exchange’s top crypto assets. As of March 31, Kraken Bitcoin reserves amounted to 192,091.25 BTC, allowing the company to back 114.19% of its clients’ assets, amounting to 167,188.68 BTC.

In addition to Bitcoin, Kraken covers some of the best altcoins to buy, including ETH, SOL, USDC, USDT, XRP, and ADA. Here’s a breakdown of each crypto asset’s reserve ratio based on the Kraken Proof of Reserves 2025 audit:

- Bitcoin (BTC) – 114.9% reserve ratio

- Ethereum (ETH) – 102% reserve ratio

- Solana (SOL) – 102.2% reserve ratio

- USD Coin (USDC) – 201.5% reserve ratio

- Tether (USDT) – 146.3% reserve ratio

- Ripple (XRP) – 102.3% reserve ratio

- Cardano (ADA) – 100.5 % reserve ratio

Upholding a high level of crypto platform accountability, Kraken ensures that all client holdings are over-collateralized and secure. The PoR also covers spot holdings, staking balances, margin positions, and futures balances.

How Kraken Raises the Bar in Crypto Exchange Transparency

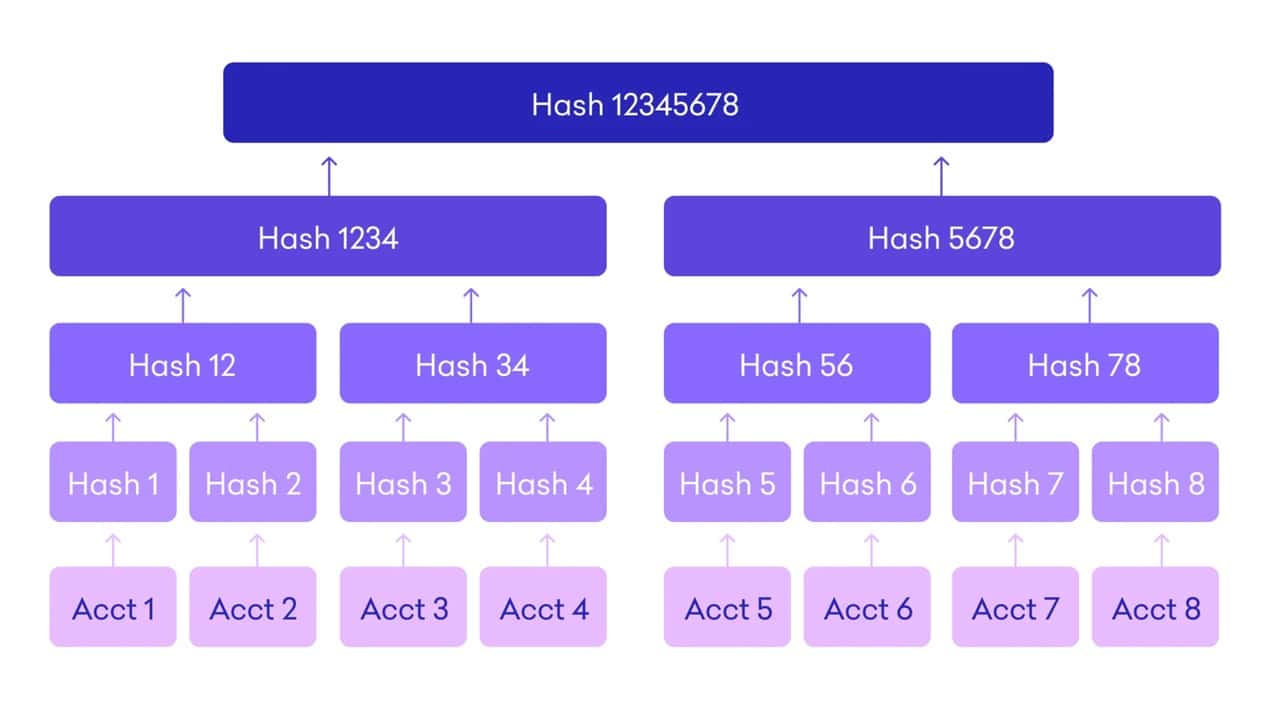

There are several reasons why investors consider Kraken to be the leading transparent crypto exchange in 2025. For one, Kraken’s PoRs use Merkle tree crypto verification to give auditors a clear picture of client account balances

Based on Kraken’s What is Proof of Reserves guide, this Merkle Tree aggregates and verifies the integrity of Kraken’s digital asset dataset. This allows Kraken users to independently verify their balances in the PoR, adding to the platform’s overall accountability.

Beyond Kraken’s held assets and the reserve ratio for each cryptocurrency, the PoR features full liability inclusion, showcasing client liabilities to fully represent the exchange’s solvency. In contrast, other digital asset exchanges and custodial crypto wallet services offer partial audits that may not be consistently updated.

The Significance of Proof of Reserves After The FTX Fallout

The collapse of the FTX crypto exchange and the bankruptcy of crypto lender Celsius in 2022 eroded public trust in crypto custodial services. Both companies misappropriated customer assets, failed to return clients’ crypto holdings, and caused multibillion-dollar losses to retail and institutional investors.

Unlike Kraken, which started publishing PoR reports in 2014, neither FTX nor Celsius implemented an independent and comprehensive Proof of Reserves audit. FTX and Celsius may have promised their users full coverage of their crypto holdings, but Kraken’s self-verifiable PoR crypto proof allows individuals to see the full breakdown of where their funds are stored.

Today, users have plenty of options for securely storing their tokens. In the aftermath of FTX and Celsius, decentralized crypto wallets are becoming increasingly popular as they give users complete control of their private keys. As such, custodial services like Kraken and other centralized exchanges bolster their attestations with PoRs to remain competitive.

Kraken’s Transition to a Quarterly PoR Scheme

The Kraken Proof of Reserves March 2025 announcement mentioned that the company would conduct quarterly audits of the PoR. Previously, the exchange published the Proof of Reserves twice a year, audited by an independent, leading global accounting firm.

With the new quarterly PoR reporting scheme, Kraken gives its clients more confidence in its solvency and accountability. The more frequent audits also provide greater peace of mind for retail and institutional investors.

Additionally, Kraken aims to include more crypto assets in future PoR reports. In the 2021 audit, the exchange only included Bitcoin and Ethereum. In the following years, it started to include more cryptocurrencies, including Ripple and Solana coins, as well as stablecoins like Tether (USDT) and USD Coin (USDC).

Encouraging Accountability in the Crypto Custodian Industry

As one of the world’s oldest and largest crypto exchanges, Kraken has always led the industry in digital asset security and transparency. Now, the company’s quarterly independent PoR enables every individual to track how their crypto holdings are stored.

The latest Kraken PoR March 2025 report showcases 114.9% BTC, 201.5% USDC, 146.3% USDT, and other positive reserve ratios on altcoins. With Kraken’s more frequent PoR audits and broader asset coverage, we believe the exchange will encourage greater crypto asset transparency among other centralized exchanges and custodians.

Sign up for a trading account with Kraken today and start investing in 300+ cryptocurrencies through spot markets, staking rewards, and more!

References:

- Proof Of Reserves | Full Reserves (Kraken)

- Kraken completes newest Proof of Reserves, raising the bar for crypto platform transparency (Kraken Blog)

- What is Proof of Reserves? A Beginner’s Guide (Kraken Blog)

- Bankrupt Crypto Lender Celsius Sued by SEC and CFTC, Former CEO Arrested (Investopedia)

Join Our Telegram channel to stay up to date on breaking news coverage