Anyone interfacing with the crypto world needs a reliable cryptocurrency exchange where they can safely and effectively buy, sell, and trade their crypto assets. As crypto continues to grow, new crypto exchanges are launching regularly. Having the luxury of choice is excellent, but it can make picking the best crypto exchange quite challenging.

Some exchanges are built for beginners. Others offer more advanced tools and have an interface more suitable for experienced, serious traders. Naturally, there are many other important factors to consider, like security and trustworthiness. Some platforms are much more secure than others, and exchange hacks are unfortunately common in the crypto space.

This guide will tell you about the best crypto exchanges in 2025 based on security, user feedback, features, and more.

Best Cryptocurrency Exchanges in 2025

Below are some of the most recommended brokers to trade cryptocurrencies that we have selected based on our research.

- Best Wallet – Best all-in-one wallet and exchange platform

- MEXC – Massive token selection with optional KYC

- Margex – Simplified copy trading and strong security features

- Binance – Largest exchange with pro-level tools and features

- CoinEx – Beginner-friendly with large selection of offerings

- Bybit – Packed with advanced options, automation, and high leverage

- OKX – User-friendly option with extensive DeFi opportunities

- BloFin – Strong selection of derivatives and up to 100x leverage

- KCEX – Security-first platform with low fees

- BingX – Easy-to-use platform with up to 150x leverage

What Is a Crypto Exchange?

A cryptocurrency exchange is like a digital marketplace for cryptos. It’s where you go to buy, sell, and swap crypto coins like Bitcoin, Ethereum, Solana, and more. Think of it like a stock exchange but, instead of trading shares, you are trading tokens.

On most exchanges, you can use fiat currencies like USD or EUR to buy crypto directly. Many platforms also support trading one crypto for another. This is pretty simple on the surface, but features and offerings can vary dramatically between exchanges.

There are two main types of crypto exchanges these days:

Centralized exchanges (CEXs)

Centralized exchanges are run by companies. To use them, you need to create an account, deposit money, and trade through the platform.

Decentralized exchanges (DEXs)

Decentralized exchanges run on trustless code stored on the blockchain, allowing users to swap tokens without a central authority. With DEXs, you can trade directly from your personal crypto wallet, giving you substantially more control over your crypto.

CEXs vs. DEXs

| Feature | Centralized Exchanges | Decentralized Exchanges |

| Examples | Binance, MEXC, Kraken | Uniswap, PancakeSwap, dYdX |

| How It Works | Run by a company | Run on smart contracts |

| User Control | Custodial (the exchange holds your funds) | Non-custodial (you control your funds) |

| Sign-up Required | Yes, usually with KYC | Usually requires a wallet connection |

| Supports Fiat | Almost always | No, only crypto |

| Privacy | Limited (personal info often required) | High (no account or KYC) |

| Ease of Use | Very beginner-friendly | Less user-friendly for beginners |

| Security Risks | Often are targets for large-scale hacks | Safer from external hacks, but higher risk of user error |

| Token Availability | Mostly only lists vetted coins | Access to many new or niche tokens |

| Liquidity | Top exchanges are very liquid | Can be lower, especially for less popular tokens |

| Speed | Fast thanks to the centralized servers | Slower (depends on blockchain congestion) |

10 Best Crypto Exchanges in 2025

Finding the right exchange in 2025 can be tricky. There are now endless options to trade crypto on the market, each offering a diverse set of features and cryptocurrency offerings.

To help you find the best exchange on the crypto market based on your needs, we created a list of the top 10 crypto exchanges on the market.

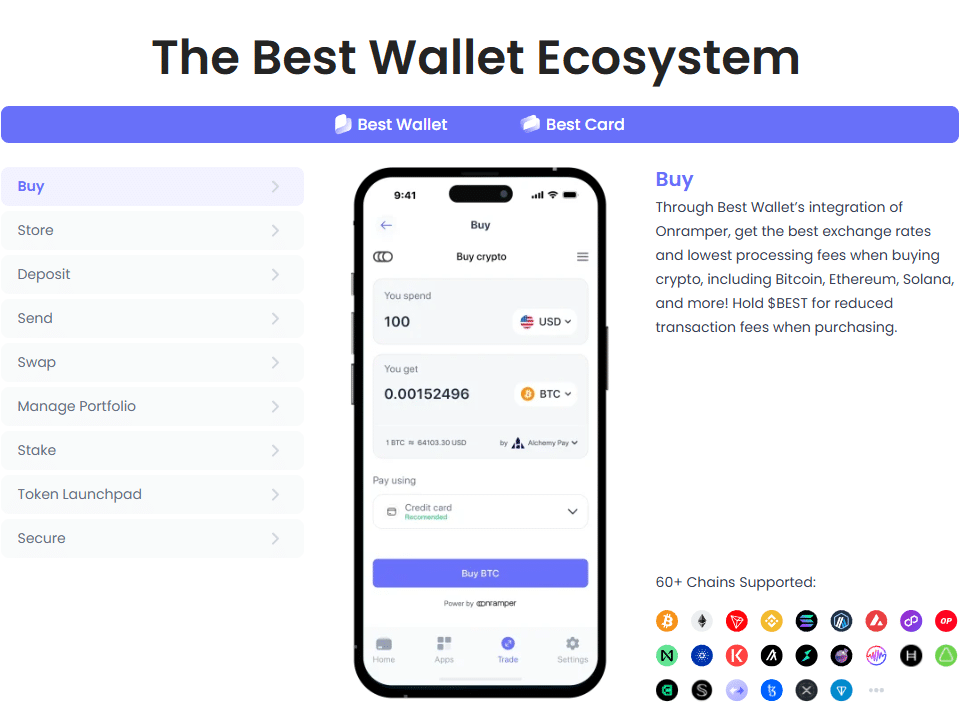

1. Best Wallet

Key Differentiators:

- Integration with multiple exchanges

- Advanced security features, including multi-signature support

- An endless number of features and a user-friendly interface suitable for beginners

Best Wallet is a popular non-custodial crypto wallet with a built-in exchange function. It doesn’t operate like a traditional centralized exchange such as Binance and Coinbase. Instead, it offers swap functionality, which is powered by APIs from third-party DEX aggregators or liquidity providers.

The core of BestWallet is a secure crypto wallet, but it also offers endless extra features that let you swap tokens, stake your cryptos to earn interest, manage your portfolio, and more. Through its various exchange integrations, you can trade on over 60 different blockchains through Best Wallet alone.

As of early 2025, Best Wallet has surpassed 250,000 monthly active users and over 500,000 total users. The platform connects to over 200 decentralized exchanges and over 20 cross-chain bridges, facilitating simple token swaps with great pricing.

Main Features:

- Supports a wide range of cryptocurrencies

- Multi-chain compatibility supporting 60+ networks

- Provides real-time market data and portfolio tracking

- Low fees for most transactions

Ideal For:

- Users seeking a secure and versatile wallet solution with an exchange function

- People who prioritize ease of use/ beginners

Potential Drawbacks:

- Limited advanced trading features compared to dedicated exchanges

- May not support trading certain niche cryptocurrencies

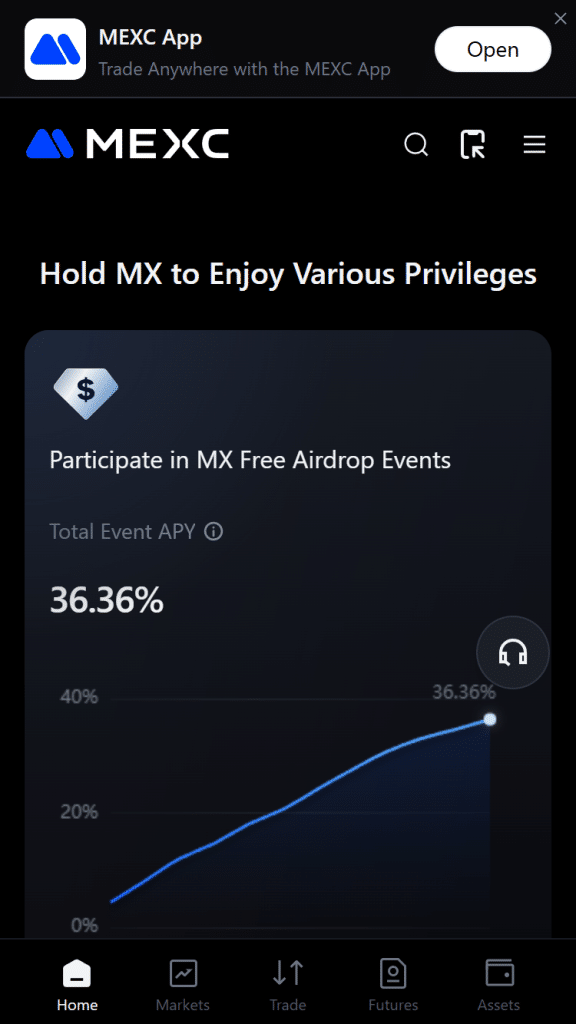

2. MEXC

Key Differentiators:

- Extensive range of 2,900+ cryptocurrencies and 3,100+ trading pairs

- Optional KYC for increased privacy

- High liquidity with a 24-hour trading volume of around $123.87 billion

Founded in 2018, MEXC has rapidly grown into one of the best crypto exchanges on the market. In the first quarter of 2025, MEXC achieved a major milestone by increasing its market share from 12.47% to 13.06%, marking the largest growth among its competitors during that period.

The exchange’s strategic initiatives, such as its Zero-Fee Trading Campaign, resulted in a 170.2% surge in trading volume for the platform.

MEXC has its own native utility token, MX, which is used for trading fee discounts, staking, launchpad participation, and community voting.

Main Features:

- Offers spot, futures, and margin trading

- Supports quantitative trading features

- Provides multilingual support across 170+ countries

Ideal For:

- Traders looking to trade more cryptocurrencies on a single exchange

- Users who prefer optional identity verification

Potential Drawbacks:

- It can be overwhelming to beginners due to the extensive offerings

- Limited fiat on-ramp options

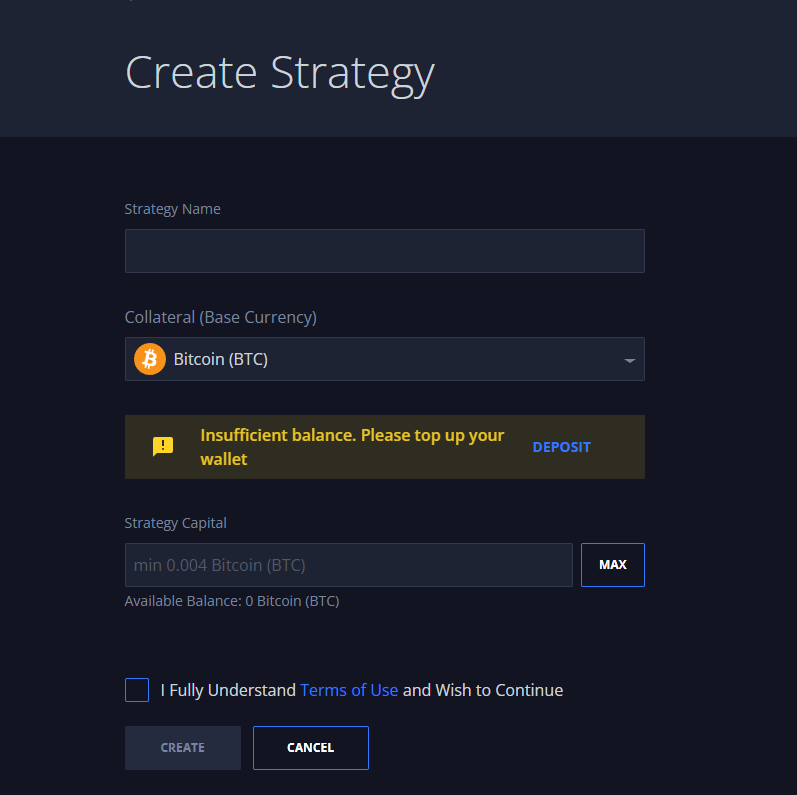

3. Margex

Key Differentiators:

- Specializes in perpetual futures trading with up to 100x leverage

- Copy trading feature based on traders’ ROE and equity

- Strong security measures, including 100% cold wallet storage

Established in 2019 and headquartered in the Seychelles, Margex is known as one of the best exchanges for crypto derivatives trading. The exchange has a user-friendly interface and focuses heavily on security and transparency.

Margex is widely recognized for its copy trading feature, which allows you to try out trading strategies without risking real money. On the site, you can create trading strategies, watch useful tutorials, and follow different traders in their leaderboards.

Main Features:

- User-friendly interface suitable for beginners

- Offers staking with up to 5% APY

- Competitive trading fees

Ideal for:

- Traders interested in high-leverage futures trading

- Beginners who wish to trade crypto

- Users looking for copy trading options

Potential Drawbacks:

- Limited selection of cryptocurrencies compared to other major crypto exchanges

- Not regulated, which may be a concern for some users

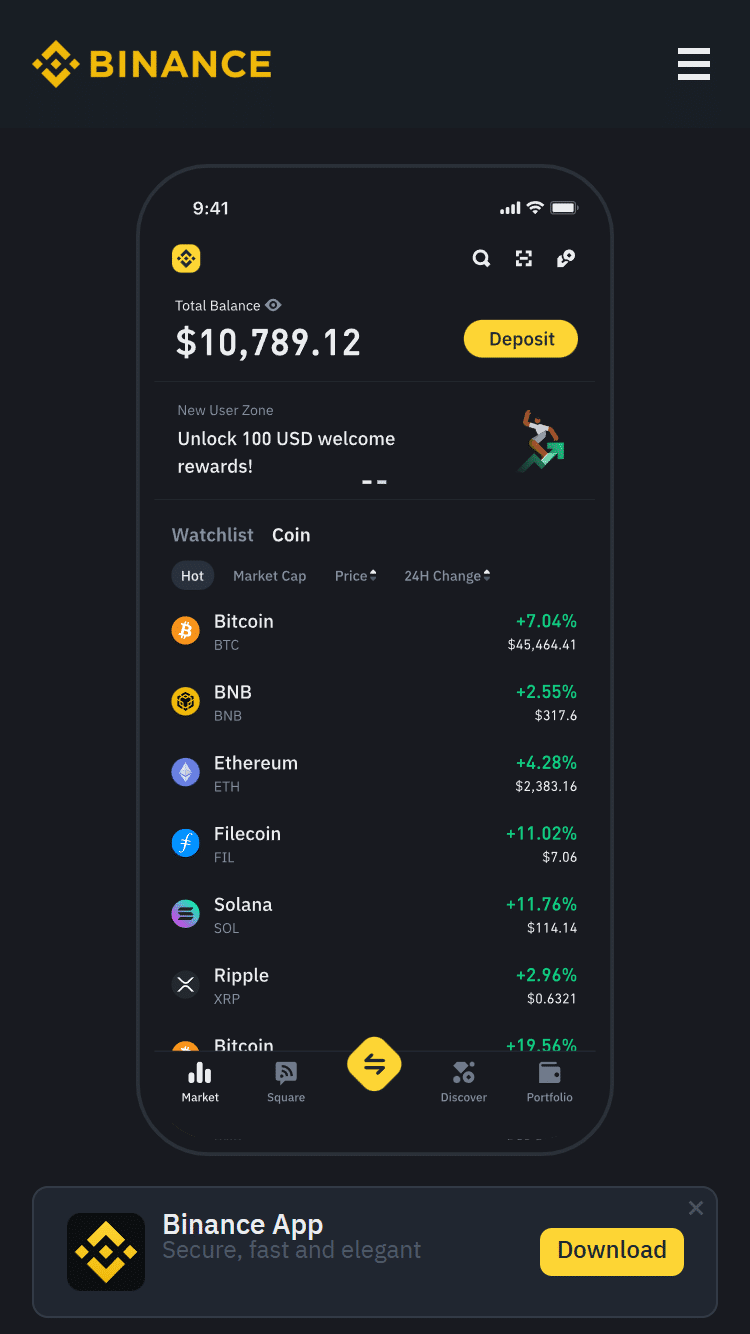

4. Binance

Binance was founded in 2017 by Changpeng Zhao (CZ). Within just a few years, it became the world’s largest global exchange. In 2023, Zhao stepped down as CEO after pleading guilty to anti-money laundering violations and was succeeded by Richard Teng, a former regulator in Singapore.

Under Teng’s leadership, Binance has been more focused on boosting compliance and has secured regulatory approvals in 20+ jurisdictions.

Today, despite all the scandals, Binance remains the biggest cryptocurrency exchange in the world. Binance’s native token BNB is one of the most widely used exchange coins on a global level. It was initially launched on Ethereum and now powers the BNB Smart Chain (BSC).

Main Features:

- Massive selection of cryptocurrencies

- Provides educational resources and earning opportunities

- Advanced tools for trading and analytics

Ideal For:

- Beginners and professional traders

- Crypto traders seeking a one-stop platform for all their crypto needs

Potential Drawbacks:

- The exchange has faced serious regulatory challenges, which have affected fiat support

- A wide range of features may be daunting for beginners

5. CoinEx

Key Differentiators:

- Part of the ViaBTC group, which ensures strong backing

- User-friendly platform

- Offers airdrops and referral rewards

CoinEx was founded in 2017 by Haipo Yang. The crypto platform has since built a comprehensive ecosystem, including CoinEx Wallet, CoinEx Smart Chain, and CoinEx Charity.

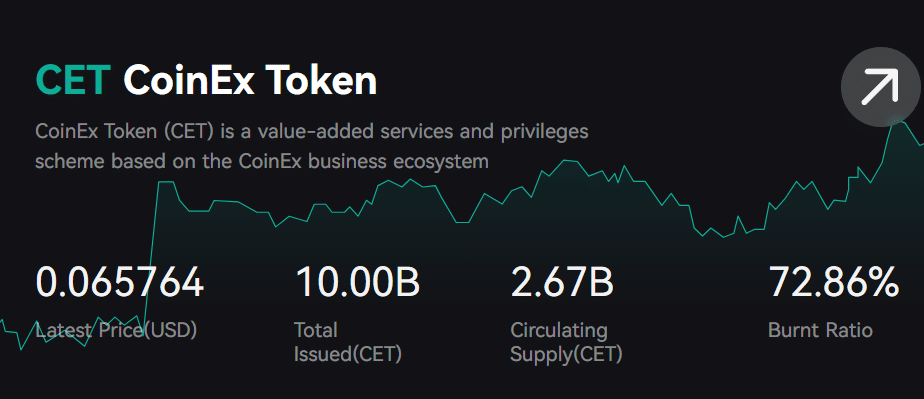

In 2018, CoinEx launched its native token CET. They initially issued it as an ERC-20 token on the Ethereum network, but CET later migrated to the CoinEx Smart Chain (CSC) in 2021. Today, users can pay trading fees with CET to receive discounts, which reduces costs by up to 90% for high-volume traders.

Coinex employs a deflationary model for CET, committing 20% of its daily platform fees to buy back CET, which is then burned at the end of each month. This strategy helps reduce the circulating supply and increase the token’s value.

These days, the exchange has over 10 million registered users from over 200 countries and regions. In early 2025, CoinEx underwent a major brand upgrade, adopting the slogan “Your Crypto Trading Expert.”

Main Features:

- Provides spot and futures trading

- Supports a wide range of cryptocurrencies

- Emphasizes security and compliance

Ideal for:

- Beginners who are just entering the crypto market

- Users looking for airdrops and referral programs

Potential Drawbacks:

- Less advanced trading features compared to other platforms

- Lower liquidity for certain trading pairs

6. Bybit

Key Differentiators:

- Second-largest crypto exchange with over 60 million users

- A wide range of trading options, including spot, margin, futures, and options

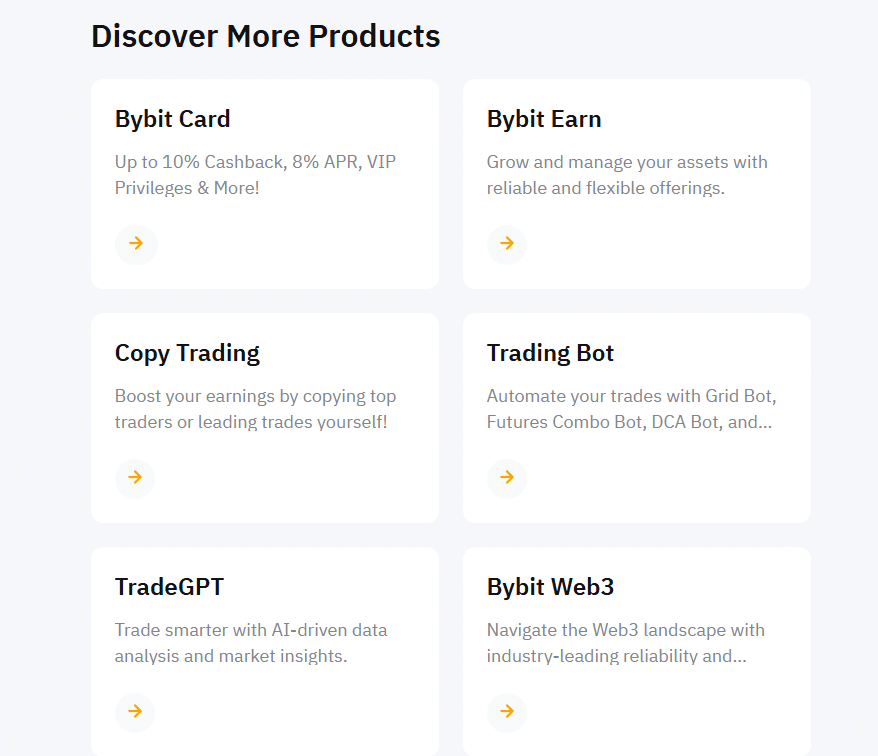

- Advanced automation tools like copy trading and trading bots

Bybit is the world’s second-largest crypto exchange by trading volume. It was founded in 2018 by Ben Zhou, a former forex broker. Initially based in Singapore, the company relocated to Dubai in 2023 to align with the region’s progressive crypto regulations.

Bybit boasts over 60 million users worldwide, making it the second-largest exchange, trailing only Binance. The platform supports trading for over 650 cryptocurrencies and offers a suite of financial products. It is especially popular with margin traders and investors looking to trade a wide range of cryptos.

To boost its global presence, the exchange has engaged in high-profile sponsorships. It partnered with the Oracle Red Bull Racing Formula 1 team in a multi-year deal reportedly worth $150 million, which ran through the 2022-2023 seasons.

In February 2025, Bybit experienced a major security breach which resulted in the theft of around 400,000 Ethereum. The company has since managed to replenish its reserves (within 72 hours) by securing emergency funding from companies like Falcon X and Galaxy Digital.

Main Features:

- High liquidity and competitive trading fees

- Robust security measures

- Educational resources for traders

Ideal For:

- Traders who prefer an exchange with diverse trading options

- Users interested in automated trading strategies

Potential Drawbacks:

- May have limited fiat deposit options in certain regions

- Advanced features can be complex for beginners

7. OKX

Key Differentiators:

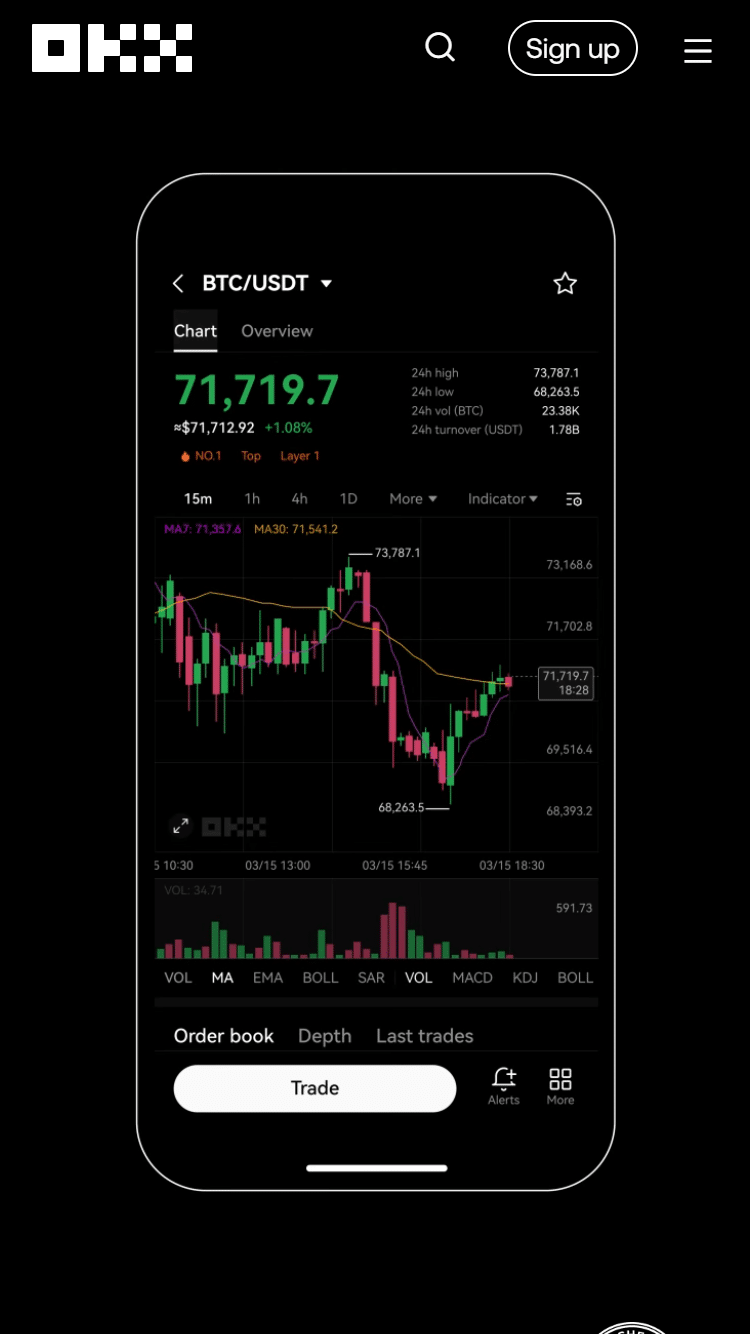

- Comprehensive suite of trading options, including spot, margin, futures, options, and perpetual swaps

- Advanced financial services like DeFi integration, mining, and lending

- Supports trading in over 400 digital assets

OKX, formerly known as OKEx, is a crypto exchange based in Seychelles. The exchange was founded in 2013 by Star Xu. It was initially launched as Okcoin and rebranded to OKEx in 2017 and OKX in 2022.

Like many crypto exchanges of its size, OKX also has a native token. OKX’s utility token, OKB, gives users trading fee discounts, access to OKX Jumpstart token sales, and other exclusive features. The token uses a quarterly buyback-and-burn model to reduce OKB’s supply.

⚡ 5 quick facts about our utility token #OKB:

1) 53M OKB tokens have been burned since inception—it’s deflationary by design

2) OKB’s price is up significantly so far in 2023—as much as 100%

3) OKB is ranked 8th on @coingecko by market cap— 246M circ. supply valued @ ≈$12.6B pic.twitter.com/KOolLYDeIf— OKX (@okx) March 1, 2023

As of the first quarter of 2025, OKX announced the integration of OKB into its native Layer 2 network, X Layer.

Main Features:

- Low fees for trading

- Advanced security protocols

- User-friendly interface

Ideal for:

- Beginners and experienced traders

- Users interested in DeFi and staking opportunities

Potential Drawbacks:

- Some services are unavailable in certain regions due to regulatory restrictions

- Limited fiat on-ramp options

8. BloFin

Key Differentiators:

- Specializes in crypto derivatives trading (offers perpetual and futures contracts with up to 100x leverage)

- Strong security measures, including cold storage solutions

- User-friendly interface with advanced trading tools

BloFin was founded in 2018 by Matt Hu. This is a centralized cryptocurrency exchange headquartered in the Cayman Islands. The platform rapidly grew in popularity for its focus on derivatives trading.

Over the years, BloFin has expanded its offerings to accommodate many different cryptocurrencies. BloFin has its own token called BIO, which is primarily used to access its DeFi-integrated tools, reduce platform fees, and participate in governance.

Main Features:

- Offers up to 100x leverage

- User-friendly interface

- Wide range of cryptocurrencies for derivatives trading

Ideal For:

- Traders seeking to trade crypto on a platform with high-leverage options

- Users seeking a secure platform for futures contracts

Potential Drawbacks:

- Limited spot trading options

- The more complex features are not suitable for beginners

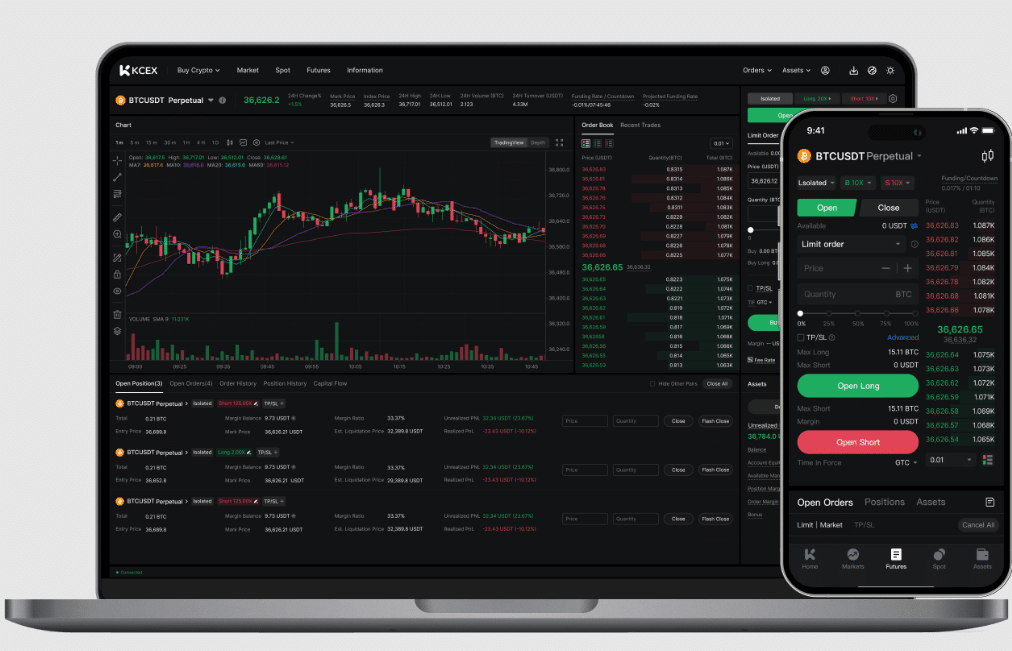

9. KCEX

Key Differentiators:

- Highly focused on security

- Advanced security protocols like SSL, 2FA, and anti-phishing measures

- Offers solid trading experience with low fees

KCEX is a relatively new platform for crypto trading, though it has been growing remarkably fast. It was founded in 2021 and, as of 2025, has over 5 million users worldwide. KCEX reports a 24-hour spot trading volume of $1.63 billion and a futures volume of $1.31 billion, totaling $2.94 billion.

To date, the exchange has expanded its services to over 100 countries. It has also introduced daily futures trading competitions, as well as a new reward center to promote trading activity.

Main Features:

- High liquidity

- User-friendly interface

- Supports a solid variety of cryptocurrencies

Ideal for:

- Traders seeking a secure, reliable platform

- Users looking for low-fee trading options

Potential Drawbacks:

- Limited advanced trading features

- KCEX doesn’t support fiat currency deposits or withdrawals

- No native utility token, so there are no platform-specific benefits like other exchanges

10. BingX

Key Differentiators:

- Many trading options, including spot, derivatives, copy trading, and asset management

- User-friendly interface suitable for beginners

- Emphasis on social trading features, allowing users to follow and replicate strategies of successful traders

BingX was founded in 2018. It has since grown into a prominent global crypto exchange. As of 2025, the platform serves over 20 million users worldwide and offers access to over 990 cryptocurrencies and over 1,000 trading pairs. Traders who like to use extraordinarily high leverage will love BingX, which offers up to 150x.

In 2024, BingX became the official crypto exchange partner of Chelsea FC.

The exchange recently launched its BINGX token to incentivize the growth of its ecosystem. Through this token, they reward users using airdrops and staking, and they also provide access to exclusive trading events. The token is still in its early stages.

Main Features:

- Advanced options and features like 150x leverage

- Cross and isolated margin mode

- Beginner-friendly platform

Ideal for:

- Beginners and experienced traders

- Users interested in copy trading and high-leverage options

Potential Drawbacks:

- Advanced features may be complex for beginners

- Regulatory restrictions apply in certain regions

Comparing the Best Crypto Exchanges

| Exchange | Key strengths | Best for | Drawbacks |

| Best Wallet | Secure wallet + basic trading | New users, HODLers | Limited trading tools |

| MEXC | Huge selection, optional KYC | Altcoin traders and privacy fans | Not ideal for beginners |

| Margex | High-leverage futures, copy trading | Leveraged traders | Fewer listed coins, lack of regulatory oversight |

| Binance | All-in-one platform | All user levels | Regulatory issues and steep learning curve |

| CoinEx | Easy to use, part of ViaBTC group | Beginners | Basic trading features, low liquidity pairs |

| Bybit | Advanced trading tools, automation | Pros and active traders | Limited fiat options |

| OKX | DeFi access, 400+ assets | Crypto-savvy users | Region-limited services |

| BloFin | Secure futures trading, 100x leverage | Futures trading | No spot trading, not ideal for beginners |

| KCEX | Security-first approach | Security-conscious users | Newer platform, less visibility |

| BingX | Copy trading and user-friendly UI | Both beginners and experienced traders | Regional limitations, advanced options |

What to Look for in the Best Crypto Exchanges

Crypto exchanges are not built the same. Some are super easy and perfect for beginners. Others are loaded with features and perfect for advanced traders. And of course, there is also the matter of costs and security.

Here are some of the most important factors to consider when choosing the best crypto exchange.

1. Security and Trustworthiness

You are trusting the exchange with your money, so the first thing to do is check how it protects your funds. This should be your first filter. You are dealing with real money, and in crypto, you can’t call the bank to reverse a bad decision.

Ask yourself the following questions:

- Has the exchange ever been hacked?

- Do they store most funds in cold wallets (offline)?

- Is 2FA (two-factor authentication) mandatory?

- Can you whitelist withdrawal addresses?

Tip: Look for exchanges that are transparent about security audits, bug bounty programs, and insurance coverage. For instance, Binance has an emergency fund called SAFU set aside to protect users’ funds in case of the worst-case scenarios. If you are using a DEX, the risk is different. You are in full control, which is powerful but also dangerous. A single typo in a wallet address or an interaction with a scam website can lead to a total loss of your crypto.

2. Fees: Obvious and Hidden

Fees can be transparent, but they can also sneak up on you, especially if you move coins around or trade often.

CEXs usually charge the following:

- Trading fees (maker/taker) model

- Deposit or withdrawal fees

- Spreads (differences between buy/sell prices)

DEXs usually charge the following:

- Network gas fees (especially high on major networks like Ethereum)

- Swap fees (often smaller, but can add up)

Tip: If you are trading often, platforms like Binance and Kraken offer lower fees. Casual traders might not notice much difference until they start withdrawing. Always check the fee pages and do a few test trades with smaller amounts.

3. Available Coins and Tokens

Each exchange offers a unique selection of coins. Some will focus on the largest and most popular assets, like Bitcoin or Ethereum. Others will give you early access to trending tokens like $ORDI or meme coins like $DOGE.

CEXs are generally slower to list new tokens because of security or legal concerns, though there are plenty of trustworthy CEXs with massive selections (like Binance).

DEXs give users access to thousands of obscure or brand-new tokens (keep in mind that this also means more scams).

Tip: If you want to diversify your portfolio or hunt for new DeFi tokens, a DEX wallet can be very useful. Still, you should always double-check token contracts using CoinGecko or Etherscan.

4. User Experience (UX)

Let’s be honest: some exchanges look like they were designed in 2012. If you are just starting out with crypto, this matters more than you might think. When you find a new platform, answer these questions:

- Is the interface confusing?

- Is it intuitive?

- Is there a mobile app for easy access?

- Can you easily see your balance, trade, and withdraw?

Platforms like Coinbase and Gemini are perfect for beginners, while Binance Pro and Bybit cater more to experienced users with advanced charts and other options.

Tip: Don’t stick to an exchange simply because it is popular with traders. If it is too confusing or complex for you, there is always a better alternative.

5. Fiat Support

If you want to buy crypto using your local currency or cash out to your bank account, you will need a fiat on-ramp and off-ramp.

CEXs often support cards, bank transfers, Apple Pay, and other methods (though some don’t).

DEXs don’t support fiat at all, so you’ll need to first buy crypto from a CEX, a crypto wallet with a built-in fiat on-ramp, or a service like MoonPay.

Tip: Check if your country is supported at the exchange and what the limits are. Keep in mind that some exchanges have high fees or delays for fiat transactions.

Also, look for regulatory issues. For instance, Binance has limited fiat support in some regions due to local crackdowns. Since 2021, various countries have either restricted Binance’s operations or kicked it out entirely. This has directly impacted their fiat support, meaning users in certain regions can use their local currencies for trading now.

6. Liquidity

Liquidity refers to how easily you can buy or sell crypto without affecting the price. The more users and volume an exchange has, the better the liquidity.

CEXs like Binance and Kraken handle billions in volume daily. This is why, on such platforms, you can get tight spreads and instant trades.

DEXs may have lower liquidity, especially for new tokens, which leads to price slippage.

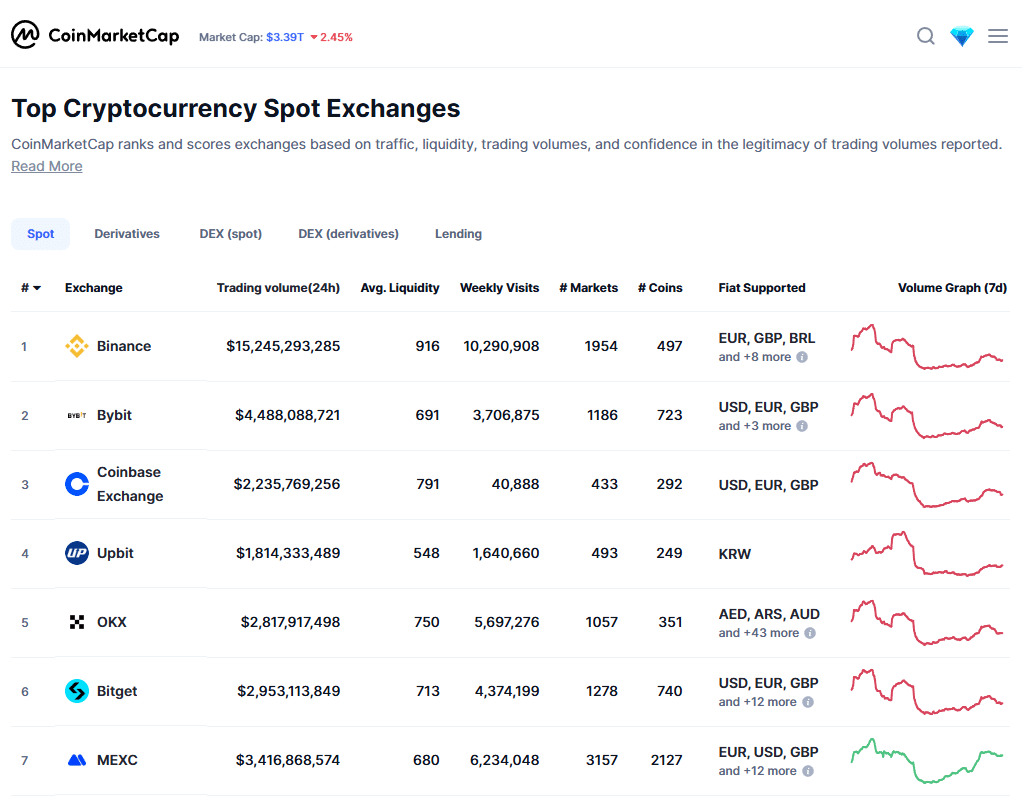

Tip: Look at 24h trading volume on sites like CoinMarketCap or CoinGecko. Higher is usually better, though it doesn’t matter much beyond a certain point, so watch out for especially low trading volumes.

7. GEO Availability and Regulation

Some exchanges don’t offer services in every country (especially the U.S. and Europe). Others might limit their features depending on the user’s location.

Like other financial companies, CEXs are subject to licenses and regulations depending on where they are operating. This is great for security, but you don’t want to get cut off from your crypto exchange account so avoid using any exchanges not available in your area.

DEXs, on the other hand, don’t care where you are from (or who you are, for that matter). However, they also offer zero protection if something goes wrong with your trades or crypto assets.

Tip: Always read the terms. Some exchanges like KuCoin will let you trade globally but may not fully comply with local laws. If things go wrong for the exchange, this can be tricky for you as well.

8. Customer Support

Crypto trading isn’t always smooth. Deposits get stuck, withdrawals get delayed, 2FA doesn’t work, and so on. When that happens, good support can make all the difference.

CEXs often have chatbots, live agents, and ticket systems. Their quality depends on the platform.

DEXs have essentially no customer support whatsoever. If you mess up, you are on your own. In this case, your best bet is to find help from communities on Reddit or Discord.

Tip: If you are using CEXs, try reaching out to support with some basic questions before you deposit serious funds. You can see how long the platform takes to respond and how helpful its support agents are.

9. Extra Features

Some platforms offer more than just buying and selling, which is ideal if you are a more experienced trader. Some nice-to-have features include:

- Staking or yield farming: Earn passive income on your crypto

- Copy trading: Follow top traders automatically

- NFT marketplaces

- Derivatives like futures and margin trading

Tip: Don’t get distracted by too many bells and whistles. Start with the basics if you lack experience and branch out as you gain confidence.

Choosing The Best Crypto Exchange for You

Choosing the right platform for crypto trading depends on what your priorities are. Do you prioritize privacy or asset variety, or maybe advanced features? The exchanges above offer flexible options that will help you stay in control of your digital assets.

Whether you are looking to store crypto securely, transfer crypto with low fees, or simply expand your portfolio of assets, there is a platform tailored to your needs. All you need to do is take the time to understand each platform’s strengths and drawbacks before you make your final choice.

FAQs

Are all crypto exchanges regulated?

No. Larger exchanges usually comply with local laws and require ID verification, while some smaller and offshore platforms may offer more flexibility but less oversight. In the end, it depends on the platform you choose.

Can I use more than one exchange?

Yes. Many users diversify across platforms to take advantage of different features or better fees. This can also add a layer of safety in case one exchange experiences downtime or other problems.

What fees should I expect on crypto exchanges?

Exchanges typically charge trading fees (often 0.1% - 0.5%), withdrawal fees, and sometimes deposit fees, depending on the payment method. You should always check the platform's fee page before you use it to trade crypto.

How do I transfer crypto between wallets and exchanges?

You will need the destination wallet address. Copy it carefully and paste it into the withdrawal section. Always double-check the address and network used.

What's the difference between custodial and non-custodial exchanges?

Custodial exchanges hold your funds and private keys. Non-custodial exchanges let you keep full control, often using wallets like MetaMask or hardware devices.

References

- Service changes in the Netherlands – Binance Support

- Binance crackdown – FT.com

- SAFU fund – Binance Academy

- MEXC review – Cointelegraph

- MEXC leads Q1 market share – Globenewswire

- MEXC trading fee campaign – MEXC Blog

- Origin and Development of Coinex

- CET token overview – Coinex

- RedBull Racing loses ByBit sponsorship – Sportcal

- KCEX review – Cryptovanguards