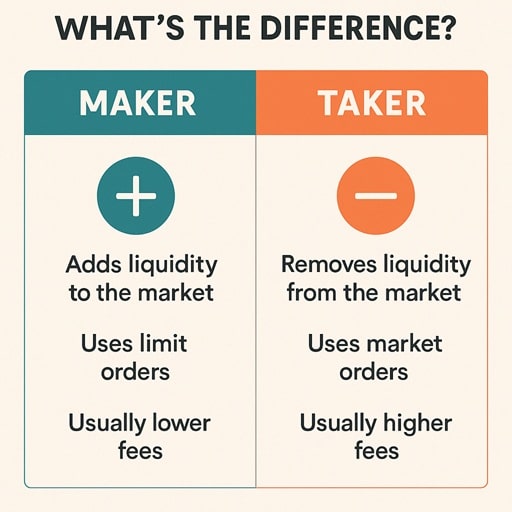

Whenever you trade crypto, whether you’re buying Bitcoin or selling a meme coin, you’ll notice there’s always some sort of fee. However, not all trading fees are created equal. The majority of exchanges split them up into two types: maker or taker fees.

Maker fees and taker fees are based on the way you order, and they can make a very real difference in how much money you actually make (or lose) on a trade.

Whether you’re an active trader or new to trading, understanding how maker and taker fees work can prevent unexpected expenses and help you make better trades.

Key Takeaways

- Maker fees are usually lower and apply when you add liquidity using limit orders.

- Taker fees are higher and apply when you use market orders that fill instantly.

- Many platforms offer tiered fees where the more you trade, the lower your maker/taker fees become.

What Are Maker Fees?

Maker fees are what you get charged when you place an order that adds liquidity to the market. This usually happens when you place a limit order, meaning you set the price you want to buy or sell at, and your order sits on the order book waiting for someone to match it.

Since your order helps to create the market by giving others something to trade against, exchanges reward that activity with lower fees. In some situations, especially for high-volume traders, maker fees can be absent or even negative (i.e., the exchange pays you a small rebate).

So, if you can bear to wait to buy or sell, using limit orders and paying maker fees generally is the wiser and less expensive choice.

What Are Taker Fees?

Taker fees kick in when you place an order that gets filled immediately. It’s like a market order or a limit order that matches an existing one. In other words, you’re taking liquidity out of the order book instead of adding to it.

Because your order is instantly matched with someone else’s, you’re paying for speed and convenience, and that comes at a higher cost. For this exact reason, most exchanges charge higher taker fees than maker fees.

Taker fees aren’t necessarily bad because sometimes speed matters more than saving a few cents. But if you’re trading a lot, those extra fees can add up quickly.

How Do Maker and Taker Fees Work?

The type of order you place determines whether you pay a maker or taker fee, not what you decide to be.

- Limit orders let you set a specific price to buy or sell. If your order doesn’t match instantly and instead sits on the order book, you’re a maker.

- Market orders fill instantly at the best available price. You’re removing liquidity, so you pay a taker fee.

- Stop-limit orders can work either way. If the order triggers and matches an existing one right away, you’re a taker. If it sits on the book first, you’re a maker.

It’s also worth noting that even a limit order can end up being a taker order. If you place a limit buy at a price that’s already available on the order book, it’ll execute right away, and you’ll still pay a taker fee. Simply because it’s a limit order doesn’t always mean you’re a maker.

Fee Structures Across Major Exchanges

Every exchange has its own maker and taker fee system. Some are beginner-friendly, others reward high-volume traders. Here’s a quick look at how some top platforms compare:

| Exchange | Maker Fee | Taker Fee | Notes |

| Binance | 0.10% or lower | 0.10% or lower | Discounts available with BNB or high trading volume |

| Coinbase | 0.40% | 0.60% | Higher for smaller trades; drops with volume |

| Kraken | 0.16% | 0.26% | Tiered fee structure based on 30-day trading volume |

| Gemini | 0.20% | 0.40% | Offers ActiveTrader fee model for lower rates |

Fees often go down the more you trade. Some platforms have as many as 10–15 tiers based on your monthly volume. It’s worth checking where you fall in that range, especially if you’re trading frequently.

The Role of Liquidity in Crypto Markets

Liquidity is what makes a market work smoothly. It’s the difference between buying something now at a fair price and waiting around while the price slips away.

Maker orders help build this liquidity by offering prices for others to match. Takers keep things moving by matching those offers. Together, they keep the market active and efficient.

Without enough makers, the market dries up and prices become unstable. Without takers, orders just sit there collecting dust. That’s why exchanges care so much about this balance and why the fee structure exists in the first place.

Strategies to Optimize Trading Costs

Maker and taker fees might seem insignificant at first, but over time, they eat into your gains, especially if you’re trading often. The good news? There are a few simple ways to lower what you pay.

Use Limit Orders

One of the easiest ways to cut down on fees is to use limit orders instead of market orders. When you place a limit order, you’re more likely to be the maker, which usually means paying a lower fee.

To be extra safe, many exchanges let you enable a “post-only” option. This ensures your order will only go on the order book and won’t execute immediately. If it would fill right away, the exchange will cancel it instead, saving you from accidentally paying a taker fee.

Take Advantage of Trading Volume Discounts

Most exchanges have tiered fee systems based on how much you trade over a 30-day period. The more you trade, the less you pay.

For example, on Binance:

- Users trading under $10,000 per month pay the full 0.10% fee.

- Those trading over $1 million per month can see fees drop to 0.02% or even lower.

If you’re close to a volume threshold, it might be worth timing a few extra trades before the month ends to bump yourself into the next tier.

Choose the Right Exchange

Not all exchanges treat fees the same. Some are very competitive with pricing, while others (like Coinbase) charge more for convenience.

When picking an exchange, look at:

- Fee structure: Do they favor makers? Do they offer discounts?

- User experience: Can you place post-only orders easily?

- Security and reputation: Low fees aren’t worth it on a sketchy platform.

- Trading pairs and liquidity: More liquidity means better fills and lower slippage.

If you’re an active trader, optimizing for fees could save you hundreds or even thousands over time.

Impact on High-Frequency Trading

High-frequency trading (HFT) relies on executing many trades in very short periods of time. In this setup, even tiny fees can make or break a strategy.

Maker and taker fees are especially important here. Most HFT strategies are built to avoid taker fees as much as possible, since paying them over and over again quickly eats into profits. Many high-frequency traders use limit orders and post-only options to stay on the maker side, taking advantage of rebates or lower fees.

Basically, if you’re running an HFT bot, every fraction of a percent counts. Knowing how to manage your position as a maker or taker is key to staying profitable.

Conclusion

Maker and taker fees are a small portion of crypto trading, but they add up over time. No matter whether you’re trading once per week or 100 times per day, understanding how your orders are being charged will save you money and allow you to optimize your strategy.

Using limit orders, keeping an eye on exchange fee structures, and knowing when it is worth paying for faster execution are all part of wiser trading. The more intentional you are about fees, the more you will be in charge of your results.

Maker and Taker Fees FAQs

What determines whether I’m charged a maker or taker fee?

Are maker fees always lower than taker fees?

Can a limit order incur a taker fee?

Do all exchanges use the maker-taker fee model?

How can I ensure my limit order is charged a maker fee?

Do trading fees decrease with higher trading volumes?

Are there any exchanges with zero maker fees?

How do maker and taker fees affect my overall trading profitability?

Can I switch between being a maker and a taker?

Where can I find the fee structure of a specific exchange?

References

- Coinbase: Exchange Fees – Help Center

- Kraken: Fee Structures

- Gemini: ActiveTrader Fee Schedule

- SEC: Trade Execution