America has been at the forefront of the cryptocurrency arena since Satoshi Nakamoto released the Bitcoin whitepaper. Now that the market is so large and diverse, it’s getting increasingly difficult to pick the most promising cryptocurrencies. However, some coins have built real staying power, especially ones with U.S. roots.

Many of the top-performing coins on the crypto market were created by U.S.-based teams or companies. They often stand out for their technology, staying power, and real-world use. Let’s dive into some of the best crypto coins America has to offer.

Best American Crypto Coins

So, what makes a coin “American”?

It’s quite simple. Usually, this depends on where the team or company behind it is based. If it started in the United States and the project is run from there, we consider it an American cryptocurrency. Many of the top coins made by teams in other countries have a lot of support in the U.S., but they aren’t considered American cryptos.

That being said, we picked the five biggest and most talked-about American cryptocurrencies right now.

1. Ripple ($XRP)

Founded: 2012

Company: Ripple Labs (San Francisco, CA)

Consensus mechanism: Ripple Protocol Consensus Algorithm (RPCA)

Ripple is a real-time payment settlement system powered by the native token XRP. Ripple Labs, the company behind Ripple, is headquartered in San Francisco. The company developed Ripple (XRP) to facilitate rapid and cost-effective cross-border payments, and it has been a leader in that space ever since.

Ripple Labs was founded in 2012 by Chris Larsen and Jed McCaleb. The company developed the XRP Ledger (XRPL), an open-source and decentralized ledger.

Historical growth and development

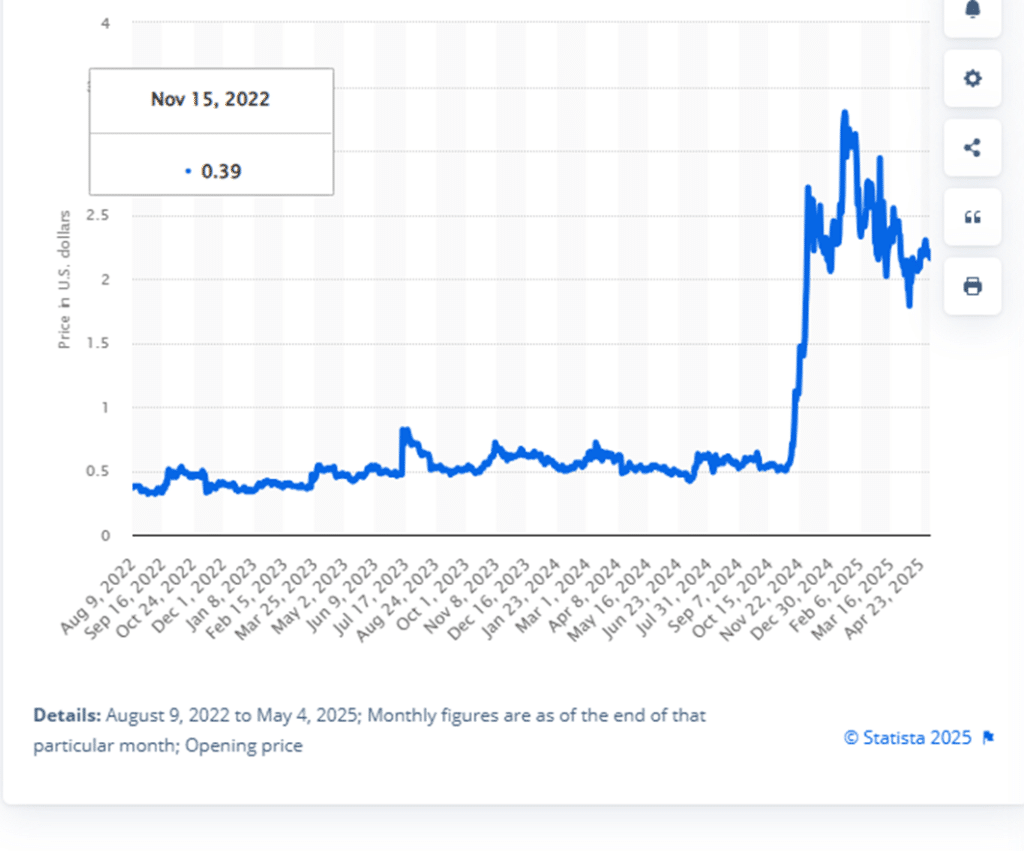

XRP was one of the earliest cryptocurrencies to gain traction. In 2018, it became one of the top 3 cryptocurrencies by market capitalization, behind only Bitcoin and Ethereum.

In 2019-2020, RippleNet grew to include over 300 partners globally, which included giants like American Express and Santander. However, it hasn’t always been smooth sailing for Ripple.

In 2020, the company faced a lawsuit from the U.S. Securities and Exchange Commission (SEC) alleging that the coin was an unregistered security. After a lengthy battle, the SEC dropped its case against Ripple in 2025, ending a four-year legal dispute.

Additionally, President Donald Trump acknowledged XRP’s potential inclusion in the U.S. government’s crypto reserve and expressed his expectations for an ETF tracking XRP to be approved by the end of the year. You can learn more about the reserve from CNBC’s quick breakdown below.

In 2025, the resolution of the SEC case and the potential ETF approval have boosted interest in XRP, helping its value skyrocket in only a few months.

Ripple has also begun working with governments like Palau and Bhutan on Central Bank Digital Currency (CBDC) solutions using XRPL, driving even more interest from crypto investors.

2. Solana ($SOL)

Founded: 2020

Company: Solana Labs (San Francisco, CA)

Consensus mechanism: Proof of History + Proof of Stake

Solana is developed by Solana Labs in the United States. It was launched in 2020 by Anatoly Yakovenko, a former engineer at Qualcomm. Solana is the native token of the Solana blockchain, the most popular Ethereum competitor. The network is renowned for its low-cost, high-speed transactions. It uses a combination of Proof of History (PoH) and Proof of Stake (PoS) consensus mechanisms. Thanks to its unique mechanism, Solana can process up to 65,000 transactions per second.

Historical growth and development

Let’s take a look at the historical growth of Solana:

- 2020: Solana launches its mainnet and introduces its unique PoH mechanism, promising 65,000 transactions per second.

- 2021: SOL surges from under $2 to over $250 during the bull run. The network launches major projects like Serum and Raydium.

- 2022: The Solana network experiences growing pains, such as outages and congestion issues, but remains strong.

- 2023-2024: Improved network stability and stronger trust among users and developers

- 2024: Solana Pay partners with Shopify, enabling merchants to accept USDC payments on Solana.

- 2025: Solana now ranks among the top three chains in developer activity, with over 2,500 monthly active contributors and a 42% year-over-year growth in full-time developers, according to their Electric Capital Developer Report.

Solana’s scalability and efficiency on the market have made it a major competitor to Ethereum and other Layer 1 networks, especially in decentralized finance (DeFi), non-fungible tokens (NFTs), and gaming. The recent surge in meme coin trading on the Solana network has made it even more popular among users. The sheer number of major projects on Solana is staggering and it only seems to keep growing faster and faster.

#Solana Ecosystem pic.twitter.com/EW4CCCxSAD

— Coin98 Analytics (@Coin98Analytics) January 5, 2022

Since late 2023 and early 2025, a wave of meme coins like BONK, WIF, and MEW brought a renewed interest in Solana, especially among the youngest traders in the crypto community. BONK, in particular, saw a 30,000%+ surge at one point.

3. Dogecoin ($DOGE)

Founded: 2013

Creators: Billy Markus and Jackson Palmer

Consensus mechanism: Proof of Work (Scrypt-based)

Dogecoin started as a silly meme in 2013. The crypto coin was inspired by the popular “Doge” meme featuring a Shiba Inu dog. It was created by software engineers Billy Markus and Jackson Palmer as a joke. Despite its humorous beginnings, DOGE has grown into a widely recognized cryptocurrency. This was largely due to endorsements from high-profile individuals like Elon Musk.

Historical growth and development

Dogecoin stayed under the radar for a long time while it was valued at a fraction of a cent. But, in late 2020 and early 2021, it exploded in popularity.

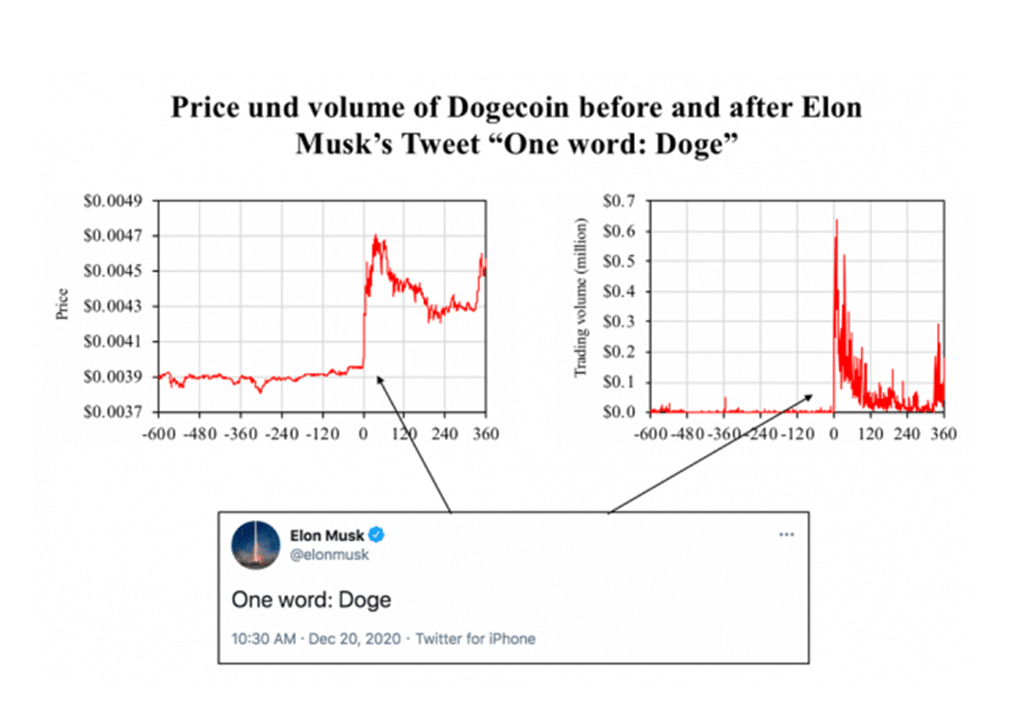

In 2021, Dogecoin found its fame, mostly thanks to the so-called “Musk Effect.” Elon Musk’s frequent mentions and tweets about the U.S. coin have influenced its market value and public perception. He called it his favorite crypto and even suggested it could be the “currency of Mars.” This drove DOGE from $0.004 in January 2021 to an all-time high of $0.74 in May 2021 (an increase of over 18,000% in less than five months).

That same year, DOGE was added to major exchanges like Coinbase. Musk has since stopped mentioning the coin as much, though it is still thriving as one of the 10 largest cryptocurrencies in the world.

In 2025, Grayscale Investments launched a Dogecoin-focused fund. They provided investors with exposure to Dogecoin, signaling a growing acceptance in the financial sector.

4. USD Coin ($USDC)

Launched: 2018

Issuer: Circle (Boston, MA)

Consensus mechanism: Operates on multiple blockchains (like Ethereum and Solana)

USDC is a stablecoin issued by Circle, a U.S.-based financial technology company. It was designed to maintain a 1:1 peg with the U.S. dollar and is backed 1:1 by a stable asset reserve. The assets include cash and short-term U.S. Treasury securities.

Compared to Tether (USDT), USDC is considered to be more transparent and trustworthy these days. Circle provides regular attestations of its reserves, which are audited by major firms. USDT also reports its reserves, though it has still never been fully audited by an independent professional auditor.

Historical growth and development

USDC was a quiet contender in the beginning. However, in 2020-2022, it boomed during the explosion of DeFi and the crypto bull market. Today, it is one of the most trusted stablecoins across major exchanges, wallets, and apps.

Let’s see its major milestones over the years:

- 2020-2021: USDC supply grew from under $1 billion to over $25 billion. This was largely driven by its adoption in lending platforms like Aave and Compound.

- 2022-2023: Circle secured partnerships with Visa, MasterCard, and MoneyGram, which pushed the coin into the financial system.

- 2023: USDC became natively available on several big chains – Ethereum, Solana, Polygon, and more.

- 2025: In April 2025, Circle filed to go public on the New York Stock Exchange under the ticker CRCL.

- 2025: As of Q1 2025, Circle’s reserve report shows over 90% backing by short-term Treasuries, which makes USDC a low-risk crypto to store or trade.

5. Cardano ($ADA)

Launched: 2017

Founders: Charles Hoskinson and Jeremy Wood

Development companies: IOHK, Cardano Foundation, EMURGO

Consensus Mechanism: Proof of Stake (Ouroboros)

Cardano ($ADA) was founded by Charles Hoskinson, a co-founder of Ethereum. This is a third-generation blockchain platform with a focus on scalability, interoperability, and sustainability. It was developed through extensive peer-reviewed research. As such, Cardano uses the complex Ouroboros PoS consensus mechanism.

Historical growth and development

2017: Cardano launched with ADA as its native token.

2020: The network had its Shelley upgrade, introducing decentralization and staking.

2021: Cardano added smart contracts functionality with the Goguen upgrade. The following year, Basho focused on performance, scaling, and sidechains.

2024-2025: Known as the Voltaire era, which introduced decentralized governance and gave ADA holders the power to vote on proposals.

2025: The Plomin hard fork completed Cardano’s transition to a full, self-governed blockchain. Here is what Charles Hoskinson has to say about the “Plomin Era.”

If you want to learn more about Cardano or Hoskinson, you can check out his podcast with Lex Fridman where he goes into immense detail on Cardano and much more. The podcast is extraordinarily long, but it has useful chapters that make it easy to skip around.

Smaller Trending American Crypto Coins to Watch

The following coins may not top the charts like Bitcoin or Ethereum do, but they have strong potential right now.

1. Sui ($SUI)

SUI was developed by ex-Meta engineers. It is famous for its high throughput and low-latency smart contracts. It’s a small U.S. coin, but it is rapidly gaining traction, especially among developers who build high-speed apps and NFTs.

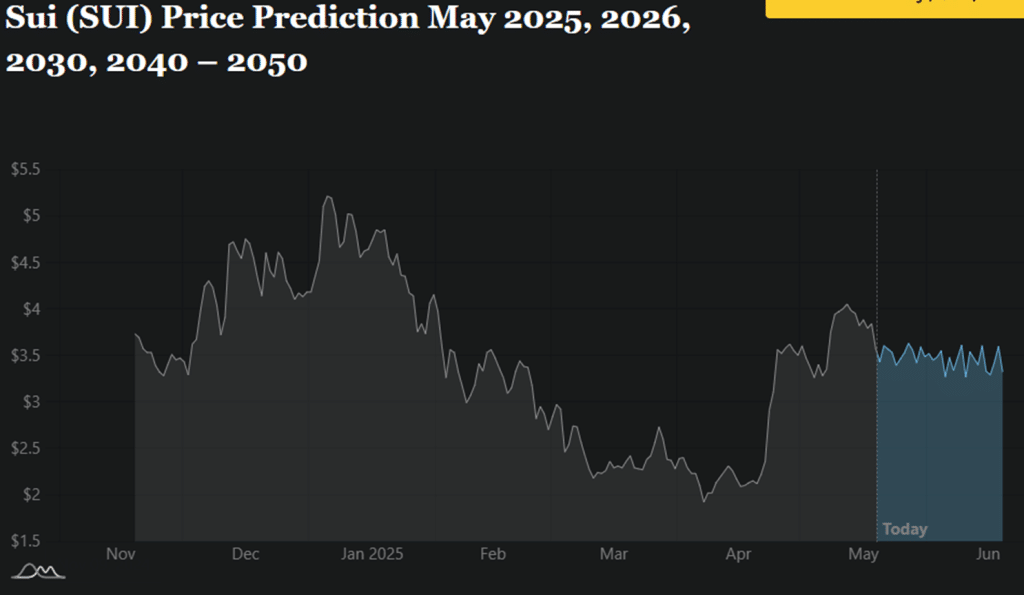

Sui has recently experienced its price climbing from below $2 to around $3.80 in just over a month. Analysts predict that it could reach a minimum price of $4.73 with a potential growth that goes beyond that.

2. Official Trump ($TRUMP)

TRUMP was launched in January 2025 by President Donald Trump. It was one of the most popular political meme coins, gaining a massive amount of attention during the U.S. election cycle and beyond. It is extremely speculative and top holders own a vast majority of the circulating tokens, but it has a high trading volume these days.

The token’s value grew following announcements of exclusive events for top investors, which included private dinners with President Trump himself. Naturally, this has raised ethical concerns about political influence blended with personal financial gain.

3. Ondo ($ONDO)

Ondo Finance focuses on combining traditional finance with decentralized finance. It bridges traditional finance with tokenized, real-world assets like bonds and treasuries. It is backed by ex-Goldman Sachs talent, which makes it that much more appealing to DeFi users and institutions.

4. Hedera ($HBAR)

Hedera Hashgraph offers a decentralized public network that uses a unique hashgraph consensus algorithm. It is famous with companies like IBM and Google. It supports faster decentralized applications.

HBAR reached its all-time high of $0.57 in September 2021 and hasn’t been able to regain its former glory just yet. However, in January 2025, it managed to hit $0.33, and it has held up better than many other top coins during the tariff troubles.

5. NEAR Protocol ($NEAR)

NEAR stands out for user-friendliness and scalability. It is often compared to Solana and Avalanche. NEAR Protocol is a scalable Layer 1 blockchain designed for developers to build decentralized apps.

Like the vast majority of top cryptocurrencies, it is trading far below its all-time high, reached in 2022. However, it has nearly tripled since its dip around the end of 2023.

What to Look for in the Top American Crypto Coins

It’s harder to choose the best cryptos to invest in than ever. There are now hundreds of American coins, which makes it hard to separate quality from hype. Here are some of the key factors that you should consider when choosing what crypto to invest in:

- Strong fundamentals. Good projects offer real solutions to real problems. Think: does the coin solve a specific challenge in finance, data storage, or beyond? Does it come with a competitive edge, like fast transactions or more security?

- Credible team. The founders are really important when you choose which crypto to invest in. Look for experienced teams with a history of delivering on tech and working in blockchain.

- Transparency. This is one of the most important factors for many crypto investors. Has the project been audited? Is its code open source? Has it faced legal scrutiny or some past controversies?

- Roadmap. A good project will share its goals and timelines. Look for roadmaps with detailed upgrades and partnerships, and check if they actually hit the milestones.

- Utility. Why does the token exist? Is it just speculative, or does it have real applications? Coins that have real utility are more likely to hold value. However, there are countless exceptions that offer little utility, including many meme coins.

- Community engagement. Check Twitter, Discord, and Reddit to see if there is an active community for the coin.

Regulation and Risks for U.S. Cryptocurrencies

Under the current U.S. administration, the enforcement of securities laws against crypto projects has slowed down substantially. The SEC and DOJ have changed their focus from blanket crackdowns to more targeted action. They are now more focused on especially obvious fraud or money laundering and have given crypto projects some room to breathe.

There are currently several pending bills that aim to bring more regulatory clarity to crypto, such as the GENIUS Act, which is focused on stablecoins. Following upcoming legislation could be extremely helpful for traders looking for the best investments, as some coins may benefit more than others.

Meanwhile, regulators continue to discuss plans for a full regulatory framework for crypto, including how tokens should be classified and taxed. This is ongoing but moving rather slowly. In other words, U.S. crypto regulation remains in flux. However, it is now less aggressive compared to recent years.

Even though enforcement is more relaxed now, the next administration could change that entirely. If a more crypto-skeptical team takes over, we can expect stricter enforcement and tighter rules.

Still, money talks in American politics. Pro-crypto groups have become one of the biggest sources of political donations. Super PACs like Fairshare and organizations like Stand with Crypto have raised and spent over $100 million on candidates who promote blockchain innovation and fight crypto regulation in general.

This kind of cash certainly changes the conversation. Based on this, it is unlikely that the United States will take a hardline stance anytime soon.

American Crypto Coins Aren’t Going Anywhere

American crypto projects hold a strong place in the global market in terms of innovation, with billions in market cap to back them up. The market now has well-established names like XRP and Solana, as well as rising players like ONDO and TRUMP. These days, there is a mix of coins worth watching and investing in.

However, beyond this hype, it is still important to look deeper when you plan to invest or trade cryptocurrencies. The U.S. regulatory environment remains a wildcard, and while enforcement has eased for now, we don’t know how long this will last.

FAQs

What are the top American crypto coins by market cap?

The largest American coins by market capitalization in 2025 are Ripple, Solana, Dogecoin, USD Coin, and Cardano.

Is investing in U.S. crypto coins safe?

All crypto investments come with a risk. Look for coins with strong teams, active communities, and strong standing in terms of regulations.

Why are some coins more popular than others?

Popularity depends on many factors, including use case, performance, brand recognition, and hype from social media or celebrities.

References

- Ripple SEC case – Barrons

- Ripple partners with The Republic of Palau – Ripple

- The Musk Effect – Blockchainresearchlab

- Ripple price chart – Statista

- Electric Capital Developer Report – Solana

- USDC reserves report – Circle

- SUI price prediction – Coingape