Chris Larsen, the famous co-founder of Ripple Labs, has seen his wealth skyrocket in recent years. Larsen is an American business executive who co-founded several successful Silicon Valley technology startups, including E-Loan, Prosper Marketplace, and finally, Ripple Labs. As of 2025, Chris Larsen’s net worth is estimated at between $7 billion and $8 billion.

As one of the top holders of XRP tokens, Chris Larsen had an estimated net worth of $59 billion in 2018, according to Forbes. His fortune has dropped significantly since, mostly due to XRP’s price volatility and regulatory battles with the SEC. XRP has lost over 80% of its peak value, losing Larsen and other top holders a massive amount of wealth. Even so, Larsen remains one of the wealthiest crypto billionaires today.

In this article, we will cover how Chris Larsen built his fortune and what his role in the crypto industry encompasses.

Breaking Down Chris Larsen’s Net Worth

Chris Larsen’s net worth is subject to significant fluctuations due to the volatility of the cryptocurrency market. A substantial portion of his wealth, over half of his assets, is tied to his XRP holdings, which are highly susceptible to market shifts. This volatility, combined with his diverse investments and business ventures, makes his total net worth difficult to estimate at any given time.

Below is a breakdown of Larsen’s net worth as of 2025.

| Asset or Income Source | Contribution to Net Worth |

| Stake in E-Loan | 20% in 1998 |

| Californians for Privacy Now investment | $1 million |

| E-Loan sale profits | $0-$60 million |

| Prosper Marketplace sale profits | Tens of millions of dollars |

| Stake in Ripple Labs | 18% in 2024 |

| XRP holdings | ~2.7 billion worth $5.8 billion |

| XRP sale profits | Nearly $1 billion |

| San Francisco political donations | $3.6 million |

| Other political contributions | $1+ million |

| Total Net Worth | $7-8 billion |

Chris Larsen Net Worth: Early Life and Education

Chris Larsen was born on November 19, 1960, in San Francisco, California. His father worked as an aircraft mechanic at San Francisco International Airport, for United Airlines planes. His mother was a freelance illustrator.

Larsen studied at San Francisco State University, where he obtained his Bachelor of Science degree in international business and accounting in 1984. In 1991, Chris Larsen obtained his MBA from the Stanford Graduate School of Business, but he had already been an entrepreneur at heart for years by that point.

Larsen’s entrepreneurial journey started at a young age. In the following interview, he shared that when he was 15 years old, he had an auto dent repair company in his front yard.

In the interview, he also mentions restoring classic cars with both of his sons. He lives a very private life and is married to Lyna Lam, with whom he resides in San Francisco.

Chris Larsen’s Career From Online Lending to Crypto Billionaire

When Larsen graduated from San Francisco State University in 1984, he started working for Chevron, doing financial audits for the company in Indonesia, Ecuador, and Brazil. Larsen pursued his MBA at Stanford and, after graduation, he founded a mortgage business in California. Let’s see how his career progressed over time.

The Founding and Success of E-Loan

In the early 1990s, Chris Larsen started working at Mortgages First, a mortgage lender in Palo Alto, California. This is where he met his future business partner, Janina Pawlowski.

Frustrated with the mortgage industry at the time, the duo decided to leave their jobs in 1992 to start their own business. By 1996, they had shifted their focus to creating an online platform for mortgage lending. They raised $450,000 from friends and family for their mortgage lending website, and moved from their small office in Palo Alto to a more affordable space in Dublin.

A year later, in 1997, the E-Loan website launched, allowing customers to search and apply for mortgages and personal loans directly, without needing brokers. This became one of the first online mortgage lenders in the United States. Later, E-Loan expanded to offer car loans and home equity as well.

E-Loan was thriving, but its success wasn’t without challenges. In 1998, the company faced funding challenges, which led to a change in leadership. Pawlowski, who had served as CEO, swapped roles with Larsen and became the company’s president.

E-Loan’s IPO and Sale

By 1998, E-Loan had annual revenues of $6.8 million. At the time, E-Loan was in talks with Intuit about a $130 million buyout. This was an incredible success for a company that only existed for about a year, automatically turning Chris Larsen and his partners into millionaires. However, just before the deal was finalized, Yahoo CEO Timothy Koogle proposed a deal to buy a 23% stake in E-Loan, offering them $25 million.

While this would have resulted in a smaller payout for Larsen and Pawlowski, they decided to take Koogle’s offer since it allowed them to maintain control of the company. The deal with Yahoo also brought in venture capital from Softbank and Sequoia Capital.

In 1999, Larsen offered Pawlowski the role of CEO again, but she declined, choosing to remain the company’s president. That same year, E-Loan filed for an initial public offering (IPO), going public in June 1999.

When E-Loan went public, Chris Larsen owned a substantial portion of the company. At the time, he and his co-founder Pawlowski held a combined 40% stake in the company. After raising capital and the IPO, their individual stakes would have been diluted, but it is likely that Larsen retained a significant portion of his ownership.

In its first quarter of the year, E-Loan processed $470 million in mortgage loans. By the second quarter, it achieved $4.6 million in revenue. Despite losing $13 million in the third quarter, its overall revenue had grown by 200% compared to the previous year.

By October 1999, E-Loan employed around 350 people, processed 5,000 loans, and captured 25% of the online mortgage market – making it the clear market leader among online mortgage lenders.

In February 2000, E-Loan’s market capitalization was estimated at $1 billion. The company became the first to offer consumers’ FICO credit scores for free, all under Larsen’s leadership.

If Larsen owned 20% of the company, his stake would have been worth approximately $200 million based on this valuation. However, the IPO would have resulted in the dilution of his shareholdings, and his earnings from the offering would depend on how many of his shares he sold during the IPO. Still, we can safely assume that his portion of the sale would have been in the realm of tens of millions of dollars.

By May 2004, E-Loan had sold over $18.9 billion in consumer loans and was profitable for eight consecutive quarters. In 2005, Larsen stepped down as its CEO to start his next venture, Prosper Marketplace. He remained as Chairman until E-Loan was sold to Banco Popular later that year.

In November 2005, Popular, Inc., the parent company of Banco Popular de Puerto Rico, acquired E-Loan for around $300 million. The terms of the sale were not widely publicized, and sources share different numbers for the purchase.

If Larsen held his 20% of the company at this point, his portion of the sale would have been $60 million. Still, this is only an estimate, as the exact percentage of ownership has not been publicly disclosed.

The Success of Prosper Marketplace

In 2005, Chris Larsen co-founded his next venture, Prosper Marketplace, partnering up with John Witchel, a successful entrepreneur and software developer. The platform, which Larsen led as its CEO, was designed as a peer-to-peer lending marketplace, where borrowers could request loans and investors could fund them directly. The idea was to bypass traditional financial institutions and simplify the process.

Initially, Prosper Marketplace used a Dutch auction system, allowing lenders and borrowers to determine loan rates. By 2008, the business had funded over $120 million in loans, with an average loan amount of $7,000. The company was widely recognized for its innovation and made it onto Fast Company’s list of the “most innovative companies of the year.”

Nevertheless, Prosper Marketplace faced severe challenges in the following years. The U.S. Securities and Exchange Commission (SEC) required changes to Prosper’s business model. In response, in 2008, Prosper shifted to a pre-set rate system based on borrowers’ credit risk.

By the end of 2011, Prosper had facilitated $271 million in peer-to-peer loans and attracted major investments from top companies like Jim Breyer and Tim Draper. In 2012, Larsen supported the Occupy Wall Street movement, but chose to step down as CEO, appointing Aaron Vermut to the role. Larsen remained the company’s chairman.

In 2020, Prosper shifted its focus to becoming a digital bank and consumer lending platform. The company was later acquired by a private equity firm called Vista Equity Partners, in a deal valued at $1.5 billion.

To this day, how much of the $1.5 billion was allocated to shareholders, including Chris Larsen, remains a secret. Based on typical ownership percentages, though, it is reasonable to estimate that Larsen’s payout was at least tens of millions of dollars, depending on his final stake. If his share was around 5-10% of the business, his payout would be between $50 million and $100 million.

In an interview with Talks at Google, Larsen shares that he was frustrated with the success of Prosper and E-Loan, because both companies were US-only and couldn’t be transported to other markets. This is what prompted him to found his next venture, which became famous on a global level. You can watch the full video here:

The Birth of OpenCoin and Ripple Labs

In 2011, Jed McCaleb, the software developer who created Mt. Gox, started working on a virtual currency system using a rather unique approach – consensus validation. The project later became known as the Ripple protocol. In the project’s early stages, McCaleb brought in David Schwartz and secured funding from Jesse Powell. He hired Arthur Britto as the chief strategist and partnered with Chris Larsen to found the business, who became the company’s CEO.

In September 2012, Larsen launched OpenCoin with McCaleb as the two primary co-founders. OpenCoin started as a company that developed a new payment protocol known as Ripple, based on an earlier concept created by Ryan Fugger.

Ripple’s primary goal was to enable direct, instant transfers of money between two parties, without the fees and delays associated with traditional banking systems. Its versatility allowed for the exchange of not only traditional currencies, but also alternative assets such as gold, rupees, and airline miles.

Ripple’s key feature was its common ledger, which was managed by a network of independent servers that constantly compared transaction records to maintain security. The servers could belong to anyone, including market makers and banks, which made it a decentralized platform.

OpenCoin also developed a digital currency similar to Bitcoin, aimed at allowing financial institutions to transfer money quickly and with minimal fees. The XRP Ledger (XRPL) was officially introduced in 2012, featuring its native cryptocurrency, XRP. The founders reportedly allocated 80 billion XRP tokens to OpenCoin, the business, and split the rest between them.

In May 2013, OpenCoin successfully raised a second round of angel funding, attracting investors such as Andreessen Horowitz, Google Ventures, and IDG Capital Partners.

By September of the same year, OpenCoin rebranded as Ripple Labs, Inc. with Chris Larsen continuing as its CEO. The company also made the source code behind Ripple’s peer-to-peer node open source, a move that made Ripple Labs a leader in the development of the consensus verification system.

In 2014, Ripple reached another major milestone when it became the second-largest cryptocurrency by market capitalization, trailing only Bitcoin. That same year, MIT Technology Review recognized Ripple Labs as one of the 50 Smartest Companies. Fast Company also ranked Ripple among the World’s Top 10 Most Innovative Companies in the field of money in 2015.

"In the payments space, Ripple is becoming the de facto leading player." @belimad https://t.co/c3LYRBIZdU pic.twitter.com/BSCPdC6w7q

— Ripple (@Ripple) November 30, 2015

In late 2016, Chris Larsen stepped down from the position of CEO of Ripple Labs. He currently serves as executive chairman of the business. He was replaced by Brad Garlinghouse, the company’s current CEO.

Larsen’s Stake in Ripple and XRP Holdings

Chris Larsen is one of the largest individual holders of XRP, the cryptocurrency created by Ripple. He held nearly 5.19 billion XRP, or about 17% of the total supply as of Ripple’s early years, which made him one of the wealthiest people in the crypto industry at the time. McCaleb was also a significant shareholder, but he sold large portions of his XRP holdings over the years. By 2018, Larsen was the richest person in the cryptocurrency market.

In 2019, Larsen’s personal stake was 5.19 billion XRP. Based on the coin’s value at the time, he held over $37 billion worth of XRP in his portfolio.

According to Forbes’ list of richest crypto billionaires, Chris Larsen held the seventh spot in 2024, standing in the ranks of Jean-Louis van der Velde, Paolo Ardoino, Fred Ehrsam, and Michael Saylor, among others. His estimated net worth at the time was $3.2 billion, while his stake in Ripple was reported at 18%. At the time, he reportedly held over 2.8 billion XRP tokens and had made nearly $1 billion from prior XRP sales and other investments.

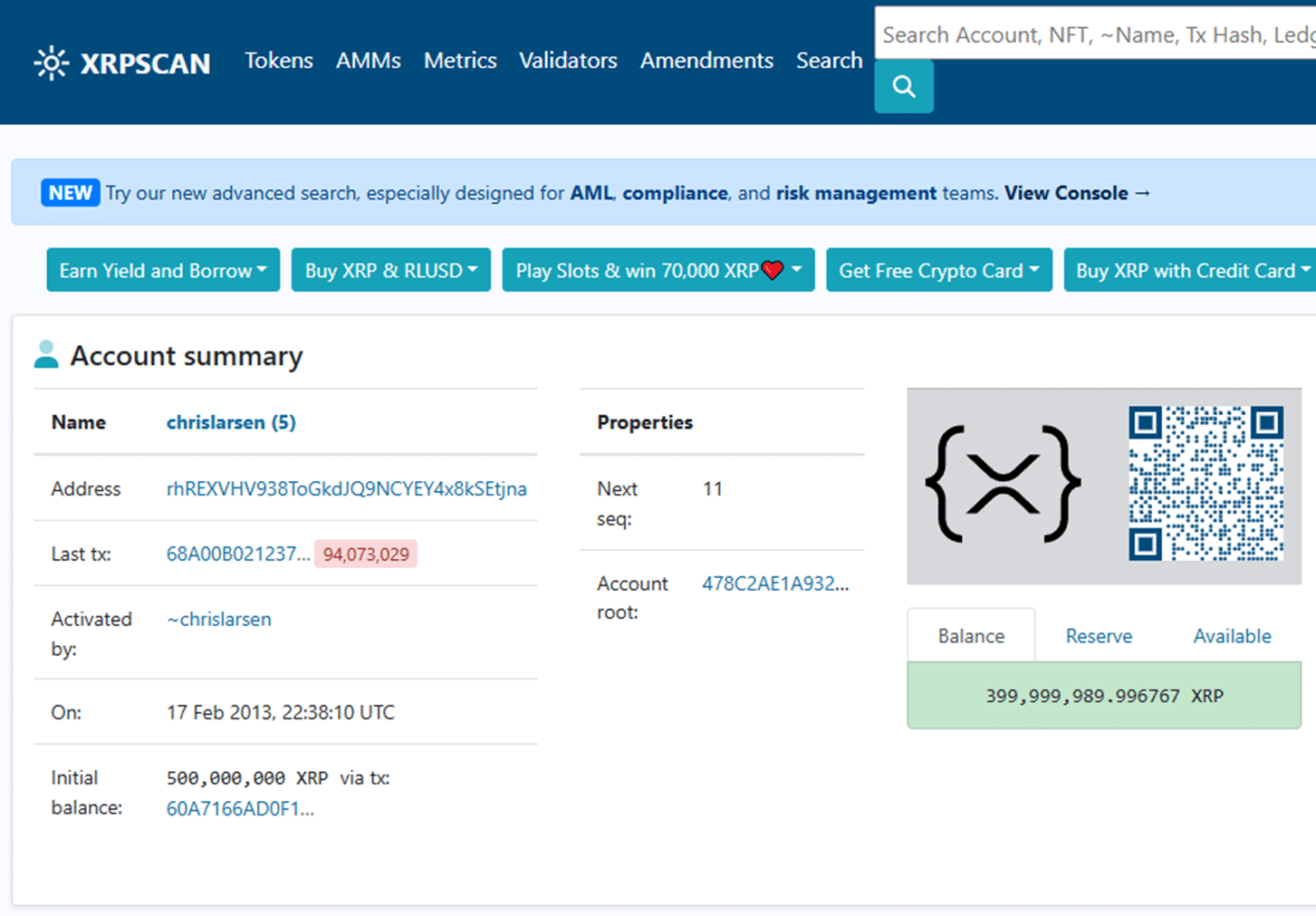

In January 2025, Chris Larsen (now a Ripple chairman) sold about $116 million of XRP. According to his public wallet, chrislarsen, he has 399,999,989.996767 XRP as of April 2025 in this wallet alone, valued at over $850 million. However, Larsen has six public XRP addresses.

According to Coinpedia Fintech News, Chris Larsen holds around 2.7 billion XRP tokens, valued at over $5.8 billion.

XRP has been one of the biggest winners in the crypto market recently, at least partially thanks to Donald Trump’s victory in the presidential election. In only three and a half weeks since Donald Trump was elected president, XRP’s value surged by 440% and touched $2.86, its highest price since the initial coin offering boom in 2018.

One of the biggest beneficiaries of the rise of XRP has been Chris Larsen. According to Forbes, half of his net worth these days is tied up in XRP tokens, which helped his wealth surge 278% from $3.3 billion to $9.2 billion after election day. The XRP value has fluctuated and dropped since, which undoubtedly affected Larsen’s net worth.

Chris Larsen’s Political Advocacy

In the early 2000s, Larsen became a vocal advocate for financial privacy. In 2001, he supported a bill by California Assemblywoman Jackie Speier that would require consumer consent before financial institutions could share or sell personal information.

The bill initially faced opposition, but that didn’t stop Larsen. Larsen co-founded Californians for Privacy Now, investing $1 million of his own money to support the initiatives. His efforts helped collect 600,000 signatures, which led to the bill’s passage in 2003. Larsen’s influence and investment were likely instrumental in the passing of the California financial privacy law.

Over the last few years, Larsen has become a major force in U.S. politics, shelling out millions for political candidates and causes he believes in. For example, in October 2024, Chris Larsen donated $10 million worth of XRP to Future Forward, a super PAC supporting Vice President Kamala Harris’ presidential campaign.

It's time for the Democrats to have a new approach to tech innovation, including crypto. I believe @KamalaHarris will ensure that American technology dominates the world, which is why I’m donating $10M in XRP in support of her. https://t.co/vb9KJA87JK

— Chris Larsen (@chrislarsensf) October 21, 2024

Larsen has also made other political donations, including $1 million to Pennsylvania Democratic Governor Josh Shapiro and $250,000 to Nancy Pelosi’s Victory Fund.

According to The San Francisco Standard, Larsen has spent over $3.6 million in San Francisco politics, as well as millions more toward federal and state campaigns. He has given six-figure contributions to AbundantSF, GrowSF, and Neighbors for a Better San Francisco, as well as other moderate groups.

Media Presence and Industry Engagement

Chris Larsen has made several notable appearances as a speaker and panelist at industry events. These include the IIF Annual Memberships Meeting in 2014. He has also contributed articles on banking systems and other technical topics to publications like American Banker.

In the early 2000s, Larsen established the Chris Larsen Scholarship Fund at his alma mater, San Francisco State University. In 2004, he was recognized as Alumnus of the Year for his contributions to the school.

By 2014, Larsen was a member of the Young Presidents’ Organization and was a board member on advisory boards of Credit Karma, the Electronic Privacy Information Center, and more.

Larsen has also served as an advisor to the Silicon Valley Community Foundation’s policy committee, advocating against payday lending.

In addition to his personal contributions to the industry, Larsen has made significant contributions through Ripple, as well. Ripple donated $1.1 million to the COVID-19 emergency fund of Tipping Point and $100,000 to the fund of Silicon Valley Community Foundation. Larsen and Ripple donated $1 million each to five local San Francisco food banks, as well.

In 2019, the Larsen family donated $25 million to San Francisco State University’s College of Business, leading to the naming of the Lam Family College of Business in their honor.

Lessons to Learn from Chris Larsen’s Story

Chris Larsen’s journey from co-founding E-Loan to creating Ripple and becoming a billionaire is truly inspiring. His success was driven by his ability to recognize and adapt to market changes. Whether it was his success with online mortgage lending to his incredible success in crypto with Ripple, his ability to recognize the potential of emerging technology has been key to his achievements.

Larsen’s fluctuating net worth is also an important reminder of how volatile the crypto market can be. Despite its nerve-racking volatility, Larsen has maintained his position as one of the wealthiest people in the industry.

Even though his wealth is mostly sourced from his XRP and Ripple holdings, Larsen hasn’t put all of his eggs in one basket. His portfolio includes several successful ventures, and he has likely made investments in different assets and cryptocurrencies. He knows that diversifying your investments can pay off, building his wealth and improving his financial stability.

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

FAQs

What is Chris Larsen's net worth in 2025?

As of 2025, Chris Larsen's net worth is estimated at between $7 billion and $8 billion. His wealth primarily comes from his involvement in Ripple.

Is Chris Larsen still Ripple's CEO?

No. Chris Larsen is no longer the CEO. He stepped down as Ripple CEO in 2016 and currently serves as the executive chairman of the company.

What is Chris Larsen doing today?

Today, Larsen is focused on his role at Ripple as executive chairman. He is also an active advocate for crypto regulation and the future of decentralized finance.