A lot of new projects spring up in the DeFi industry every year each of them offering alternative solutions different from the traditional financial institutions. As long as DeFi is all about decentralization and having no intermediary between the customer and the platform, they use another medium of exchange other than traditional money.

Each DeFi project issues a native cryptocurrency to power its ecosystem and conduct transactions between its network. Hence along with the development of the DeFi industry, the number of DeFi coins has grown significantly. Some of these DeFi coins start at low prices and experience exponential growth once the project develops.

In this guide, we will introduce the best DeFi coins to buy in 2024, which have a lot of potential for growth in the future. We will also discuss the benefits and risks of investing in the DeFi sector and discover the best platform to buy DeFi coins effectively and quickly.

10+ Best DeFi Coins to Buy in 2024

Here are the top DeFi coins as of 2024:

- Maker – Decentralized Crypto Lending Platform

- Curve – Decentralized Exchange with Focus on Stablecoin Trading

- Aave – DeFi Platform that Enables Lending and Borrowing of Cryptocurrencies

- Uniswap – Leading DEX with a Number of Features to Earn through Crypto

- Avalanche – Top DeFi Crypto by Market Capitalization

- Compound – Decentralized Money Market Protocol

- Sushiswap – Native Token of Popular Decentralized Exchange

- DYDX – Decentralized Exchange that Supports Perpetual Trading

- Synthetix – Decentralized Platform for Derivatives Trading

- Loopring – Layer 2 DeFi Scaling Solution

Top DeFi Coins To Buy Reviewed – Full List

With hundreds of DeFi coins available to buy, you may be confused about which one to buy and which coins to avoid in 2024. In this section of our guide, we have analyzed the 15 best DeFi coins our experts have picked as excellent investments for 2024. Read on to find the most attractive projects to add to your DeFi portfolio.

Maker – Decentralized Crypto Lending Platform

MakerDAO is a decentralized autonomous organization that provides a DeFi landing platform. The project issues two types of coins – DAI, which is a stablecoin, and MKR, which has governance purposes.

As DAI is a stablecoin it is pegged to the USD and always equals $1. Anyone can use MakerDAO to open a vault, lock in crypto collateral, and generate a stablecoin DAI as a debt against it. Users can borrow DAI worth up to 66% of their collateral.

MakerDAO was founded in 2014 by CEO Rune Christensen, a US cryptocurrency entrepreneur based in California. Holders of Maker’s native token MKR have a say in the future and operation of the decentralized credit platform, voting on risk parameters.

DeFi coin MKR is a decentralized ERC-20 token produced on the Ethereum platform. Anyone holding MKR tokens has voting power and can contribute to developing the smart contracts underlying MakerDAO.

MKR was the first tradeable DeFi token on the Ethereum network and a 10x altcoin in 2021, going on a bull run from $600 to $6000. The MKR price has decreased to $660 after the recent collapse of the general crypto market. So, this can be a good time to buy MKR tokens at a low price until the next bullish cycle starts.

The DeFi Reddit for MKR – the r/MakerDao subreddit – has over 36,500 subscribers.

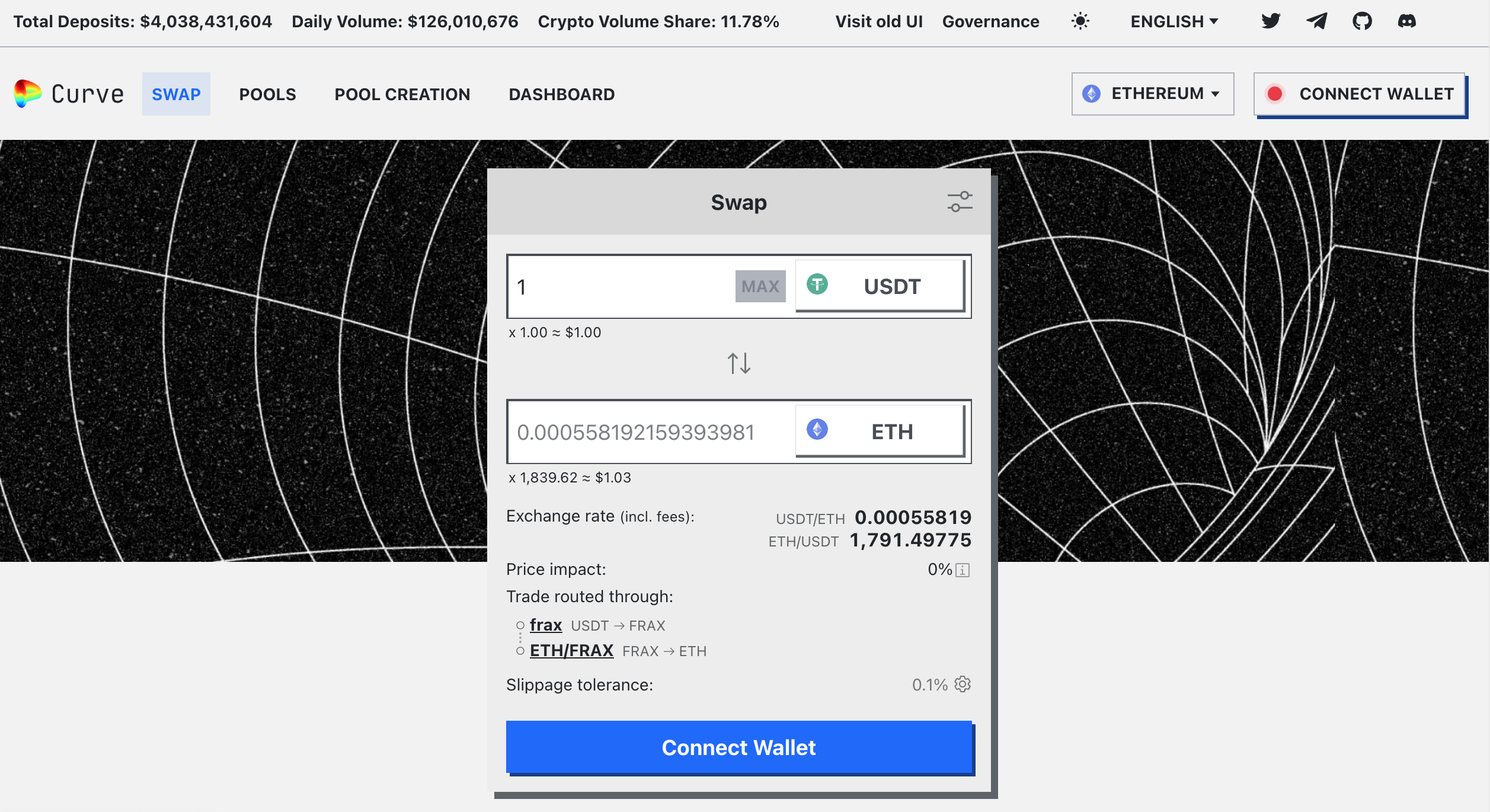

Curve – Decentralized Exchange with Focus on Stablecoin Trading

Curve Finance provides a decentralized exchange built on the Ethereum blockchain that concentrates on stablecoin trading with low slippage. Its decentralized exchange is called Curve.fi, and uses an automated market maker system. The advantage of this exchange is that it focuses on making swaps between tokens easier and with lower transactions.

Apart from it, Curve DAO issues a governance token called CRV which aims to manage the Curve Finance ecosystem. The Curve DAO token (CRV) is popular with investors as it can be staked to earn fees on Curve.fi.

Staking has become one of the largest emerging sectors in cryptocurrency, and the APY outperforms most high-street bank savings accounts and investment funds. Crypto staking rewards, in a sense, are a decentralized form of passive income with a better ROI than earning interest on fiat money and no need to rely on a bank.

CRV entered the market in 2020 with an initial price of above $10, but the coin’s value dropped soon as the market entered a deep bear cycle. DeFi investors are optimistic that it will have a bull run in the future, which will see it retest double-digit levels. CRV is closely related to another of the best DeFi coins, Convex Finance (CVX) which allows stakers to earn trading fees without locking CRV.

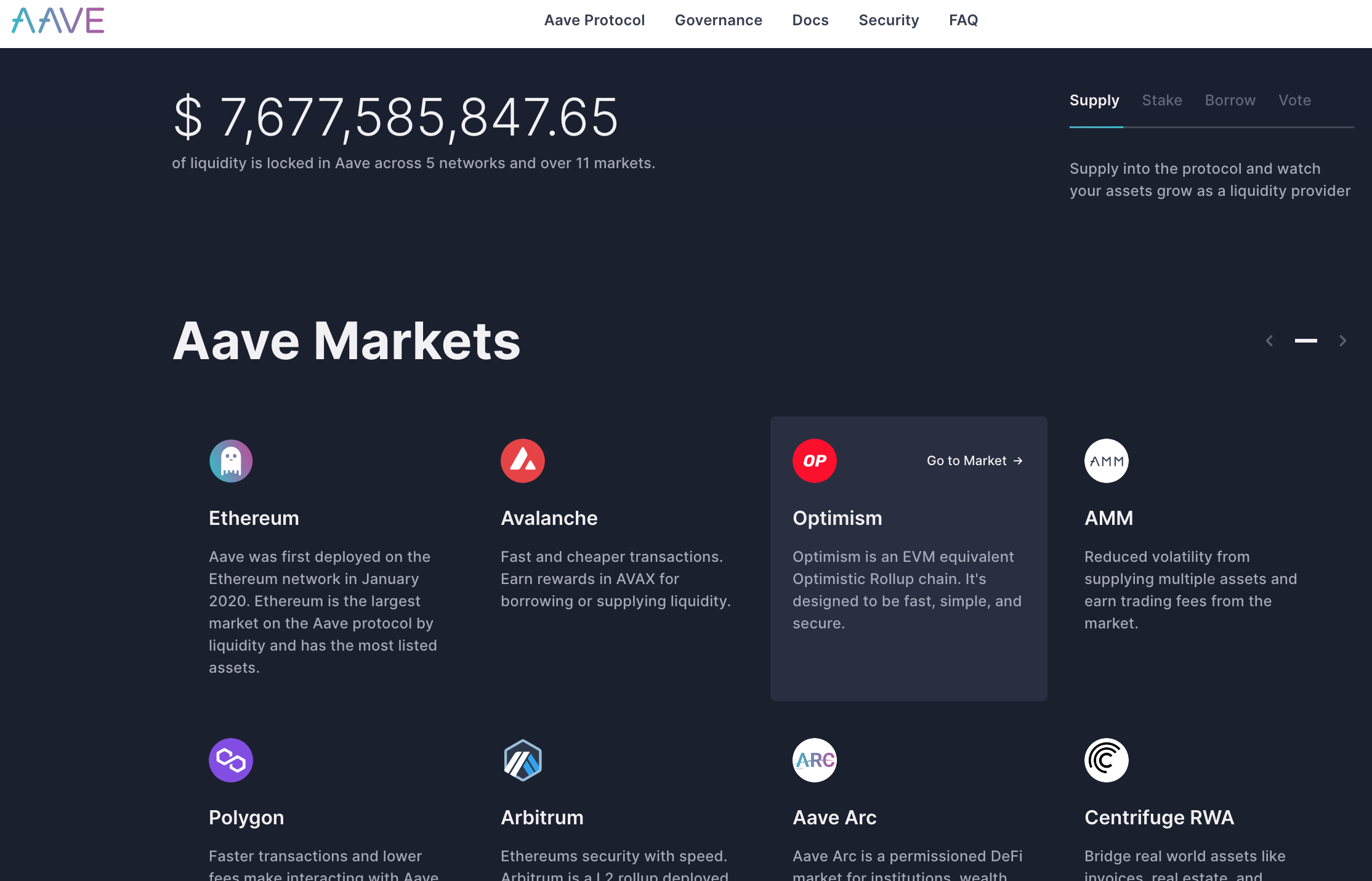

Aave – DeFi Platform that Enables Lending and Borrowing of Crypto

Like Maker, Aave is also related to the lending sector of decentralized finance and is rated among the top 5 DeFi coins in terms of TVL (total value locked). The Aave DeFi protocol is an open-source, non-custodial liquidity protocol where users can borrow and supply crypto assets, earning yield on any they supply.

The protocol also enables users to take out, known as Flash Loans in DeFi – based on the amount of collateral they put up. To govern its ecosystem, Aave has launched a native token called AAVE. Having this governance token, people can vote on the future direction of the Aave DeFi project, changes, and upgrades.

AAVE’s ICO was conducted in 2017, and it started with a price of $52 for each coin and $16 million in funding, AAVE today has a market capitalization of over $926 billion, according to CoinMarketcap.com and is the 48th largest crypto asset by market cap.

Though such popular coins as Bitcoin, Ethereum, Binance Coin (BNB), Cardano (ADA), Ripple (XRP), Solana, Polkadot, and various stablecoins (USDT, USDC, BUSD) and meme coins (Dogecoin, Shiba Inu) have higher market caps than Aave, they aren’t thought of as DeFi coins.

Hence, regarding DeFi coins and decentralized applications (Dapps) that disrupt business models, Aave is one of the larger, more established projects and one of the best DeFi coins on Coinbase. Click ‘DeFi’ in the menu on Coinmarketcap to filter for the best DeFi coins.

After hitting its all-time high of $629, AAVE has been in a bear market, dropping its price below its listing price of $52 by the end of 2022. Though the coin’s value recovered to $64 during 2023, some investors that like ‘buy the dip’ with a ‘buy low, sell high’ strategy see it as one of the best DeFi coins in 2024.

The DeFi Reddit for Aave, r/Aave_Official, has over 16.400 subscribers.

Uniswap – Leading DEX with a Number of Features to Earn through Crypto

Uniswap is one of the market’s first and most popular decentralized exchange platforms. The DEX allows users to trade cryptocurrency directly peer to peer (P2P) without intermediaries, the first of its kind in 2018 to use an automated market maker (AMM) and smart contracts instead of order books.

Any user can swap instantly between ETH and another ERC-20 token, and the whole process takes place on-chain without any fees going to any platform owners, as would happen on a centralized crypto exchange. Uniswap has a native token called UNI which has a couple of use cases and is used to provide liquidity to the platform and for governance purposes.

Like AAVE, the UNI coin has been in a bearish downtrend since late 2021. The coin is currently traded at $5, more than 8 times lower than its all-time high in May 2021. Still, many investors believe in the future of Decentralized exchanges and their potential for mass adoption.

Decentralized exchanges form an important part of DeFi, so it makes sense to invest in the native token of a DEX – the native tokens of other crypto exchanges. And Uniswap is considered one of the best DeFi coins to buy in terms of TVL, popularity among DeFi enthusiasts, innovative solutions, etc.

The Uniswap Protocol Reddit r/UniSwap has over 68.200 readers.

Avalanche – Top DeFi Crypto by Market Capitalization

Avalanche is a DeFi crypto project that offers users a platform to develop decentralized applications and custom blockchain networks. Known as one of the primary rivals of pre-merge Ethereum, Avalanche boasts a high transaction speed, reaching above 6500 transactions per second.

This project was founded by Ava Labs in a bid to provide a more scalable DeFi solution than Ethereum. Avalanche became an answer to this by designing three interoperable blockchains.

The Exchange Chain is where the native tokens – AVAX – are created and exchanged. The Contract Chain hosts smart contracts and has its own Avalanche Virtual Machine. Finally, the platform chain is here to coordinate network validators.

This specialized division of tasks allows Avalanche to provide complete DeFi solutions without compromising with decentralization. It is one of the reasons why Avalanche is one of the top DeFi coins on CoinMarketCap.

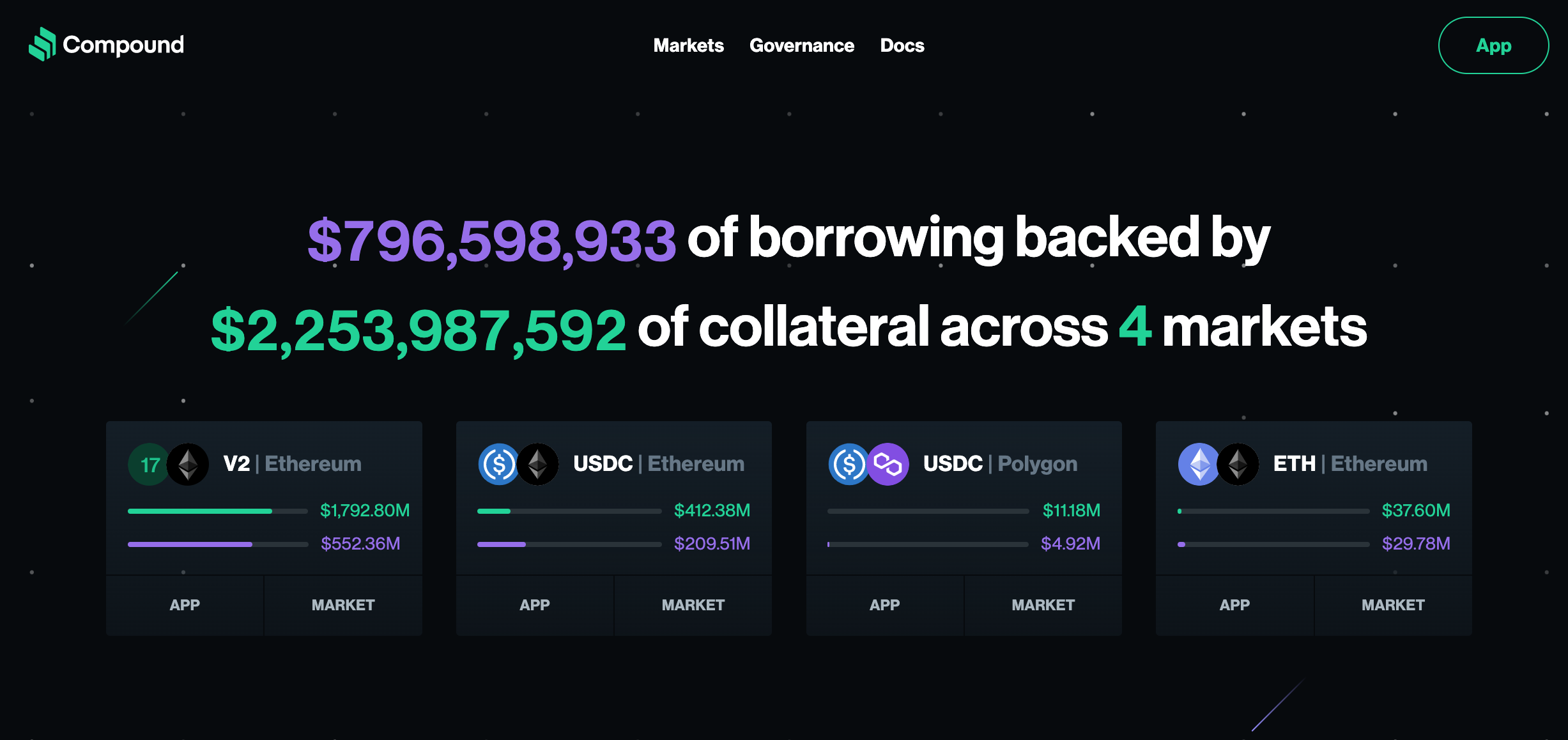

Compound – Decentralized Money Market Protocol

Compound is another popular DeFi platform ranked the #116 largest cryptocurrency by its market capitalization. Built on the Ethereum blockchain, Compound provides a decentralized, algorithmic money market protocol that helps users to earn interest by lending cryptocurrencies.

Meanwhile, users can borrow cryptocurrencies as a loan against their crypto asset collateral. Compound supports The protocol supports a number of popular cryptocurrencies, including Dai (DAI), Ether (ETH), USD Coin (USDC), Ox (ZRX), Tether (USDT), Wrapped BTC (WBTC), Basic Attention Token (BAT), Augur (REP), and Sai (SAI).

Founded in 2017 by Compound Labs and having $8 million in funding, Compound currently has a market cap of over $272 million. Though Compound’s idea is not new in the DeFi sector, its innovative use of algorithms to create liquid money markets and adjust interest rates in real-time, and the ability to create large liquidity pools, made it stand out from alternatives and attracted high investor interest, including from Coinbase and Polychain Capital.

Compound’s native token is COMP, which is used to reward users for lending COMP tokens, borrowing, and repaying loans. COMP token is currently in the deep bearish market with a price of $36.54, but this may change once the crypto market takes the next bullish run. So, it is a good time to buy a COMP token if you will believe in the project’s future.

For more information, visit our Compound price prediction.

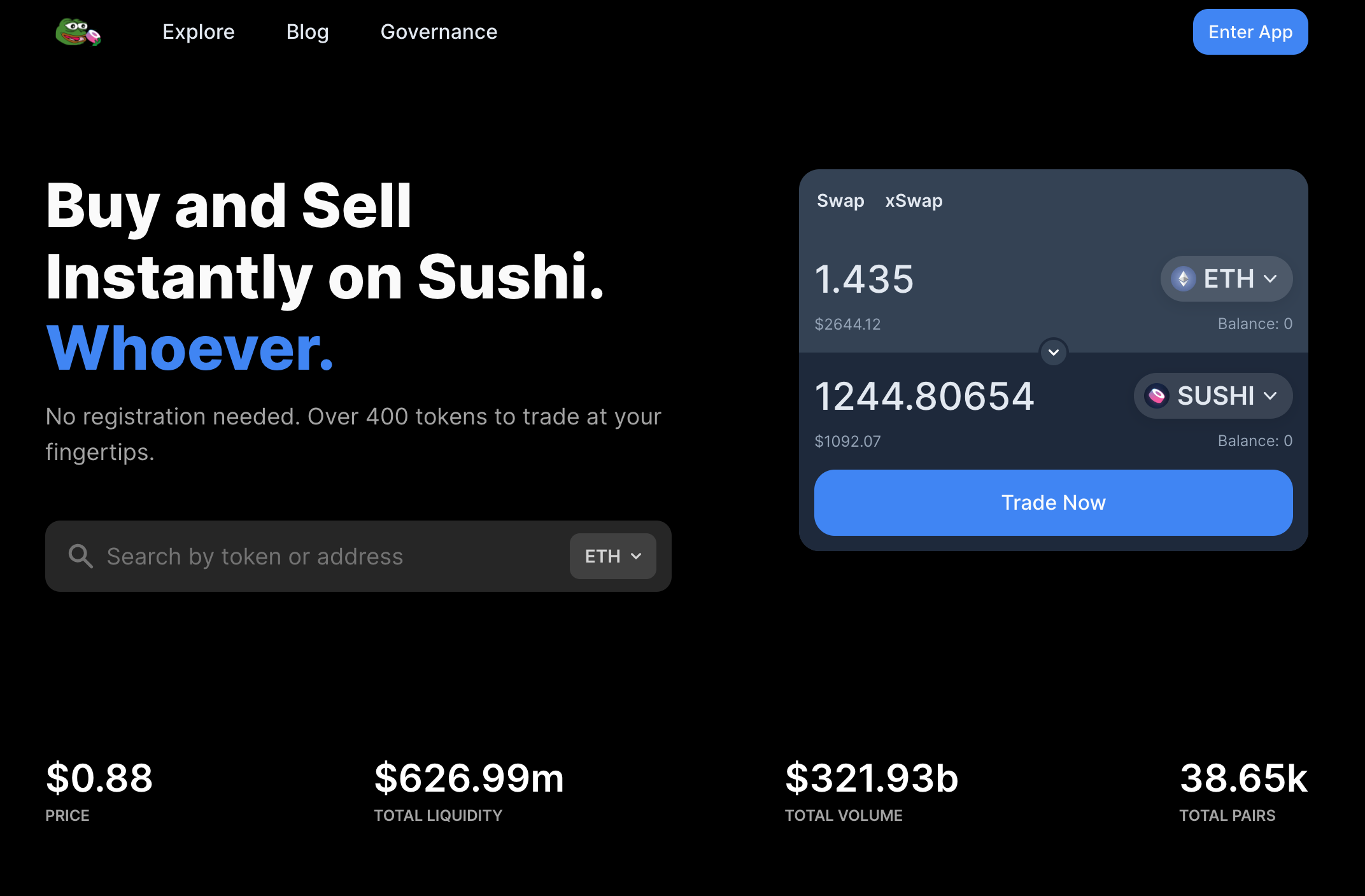

Sushiswap – Popular DeFi Coin to Buy in 2024

SushiSwap was a fork of Uniswap that emerged in Sept 2020, and similar to Uniswap, it is a fully decentralized exchange that relies on liquidity pools and the automated market maker. The trading is conducted only through the code, meaning no central authority or middleman is needed to execute or keep track of the trade.

The platform’s native token is SUSHI which is used for governance and utility purposes. Users holding SUSHI can vote on the projects regarding the development of Sushiswap. SUSHI is also used to reward DEX users who provide liquidity to the Sushiswap’s pools.

SUSHI went on a massive bull run, being one of the best DeFi coins to invest in during late 2020 – early 2021, rising from under $1 to over $20. However, the prices started to decrease when one of the network’s founders Chef Nomi, sold all his stake in the company, tokens worth $14 million.

SUSHI was once called an exit scam and pump and dump / Ponzi scheme due to the volatile rise and then crashed – there’s a saying in crypto ‘scams pump the hardest‘. Although Chef Nomi did later return the funds and control of the Sushiswap project, the project changed its CEO. The current CEO of the project is Jared Grey, who has recently announced about no long-being “inspired” because of the crypto crackdown.

With all this happening around the Sushiswap, it is still one of the most popular DeFi projects, and its native token, SUSHI is believed to be a good long-term investment. SUSHI’s price is currently down to below the $1 mark, so this can be a good time to add some SUSHI tokens to your portfolio.

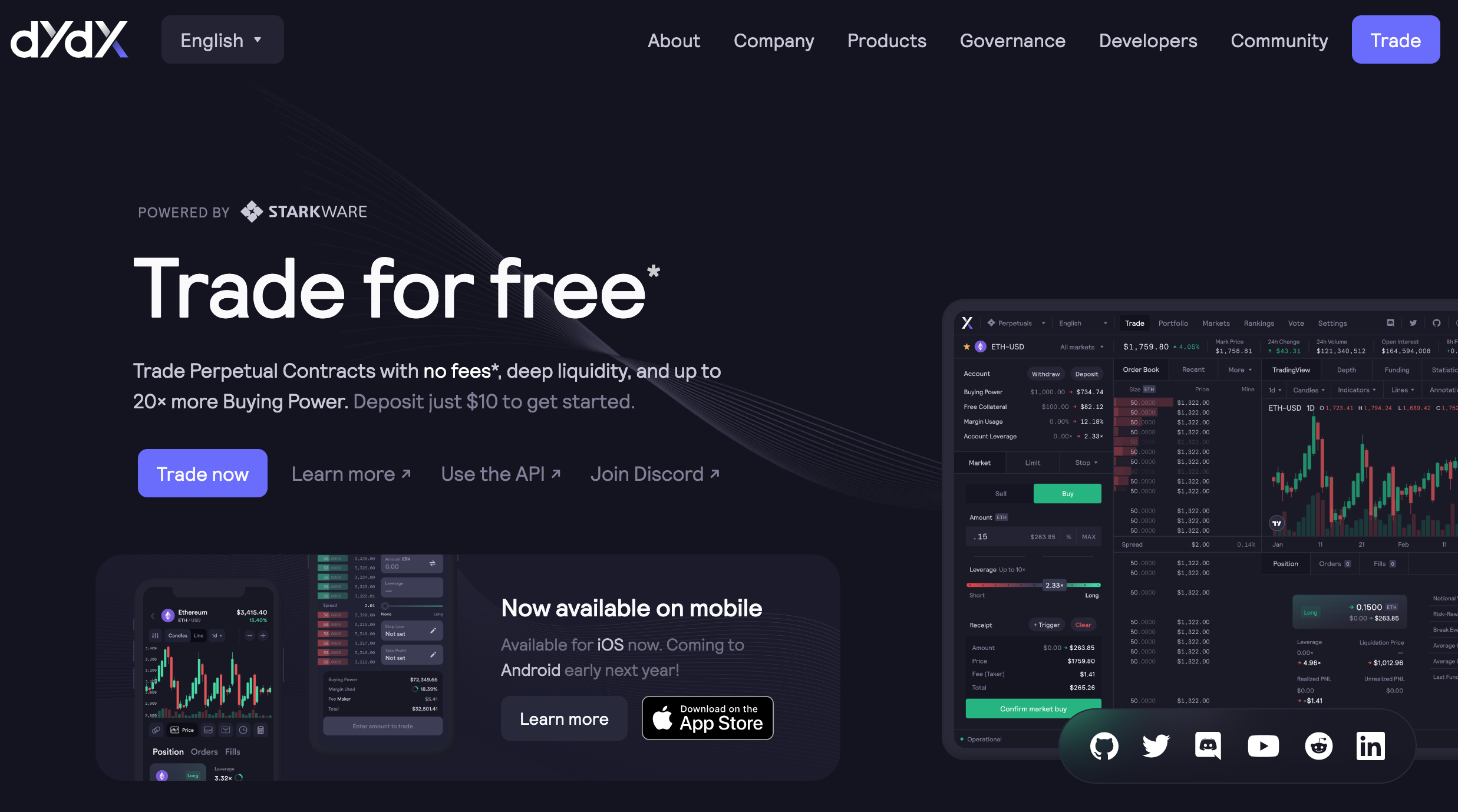

DYDX – Decentralized Exchange that Supports Perpetual Trading

dYdX is a layer-2 (L2) non-custodial DEX trading platform that provides multiple trading tools for advanced traders. The platform supports perpetual futures trading, margin trading on leverage, and spot trading. It runs on audited smart contracts on Ethereum and combines off-chain order books with an on-chain settlement layer.

dYdX fee structure is also quite attractive. First of all, traders don’t need to pay any gas fees for trading on the platform, as all the transactions are executed on Layer 2. Trading fees, such as maker and taker fees, are quite low, and there are also low minimum trade sizes. dYdX enables traders to go long or short with 25x leverage on BTC-USD, ETH-USD, LINK-USD, UNI-USD, AAVE-USD, and other trading pairs.

The DeFi project also has a native token with the symbol DYDX. It is an ERC-20 governance token and helps to manage the project. DeFi coin DYDX got listed on exchanges in 2021 with a price of $13 but went on a bullish run during that year and hit $26. The coin’s value is down to 2.2 at the time of writing, associated with the downtrend in the general market.

Since it can also be staked within Binance Earn, DYDX is one of the best DeFi coins on Binance.

Synthetix – Decentralized Platform for Derivatives Trading

Synthetix is another decentralized exchange platform that brings new ideas into the DeFi sector. It supports creating synthetic assets for trading, which derivates traders can use to make money on price fluctuations of commodities, stocks, indices, cryptocurrencies, and fiat currencies.

The main idea is not to own the asset physically but to be able to speculate on their price changes through the assets called synths. The users can leave collateral on the platform called Kwenta in the form of ETH or Synthetix’s native token – SNX, and create the synth of a certain asset.

Synthetic charges transaction fees for the exchange of Synths, and a part of those fees are rewarded to the SNX stakers. So, SNX is used as collateral and can be staked to generate rewards from the transaction fees. SNX token went official in 2018 but started gaining value in 2019.

Taking advantage of the bullish cryptocurrency market run, SNX hit its all-time high in 2021, reaching $26.10, according to CoinMarketCap. Currently, the coin’s value is down to $2.2, so this can be a good time to buy some SNX coins for your portfolio diversification.

Synthetix was governed at first by a non-profit foundation, which was replaced in 2020 by three decentralized autonomous organizations (DAOs). SNX holders use these DAOs to vote on protocol changes and make decisions about the protocol’s future.

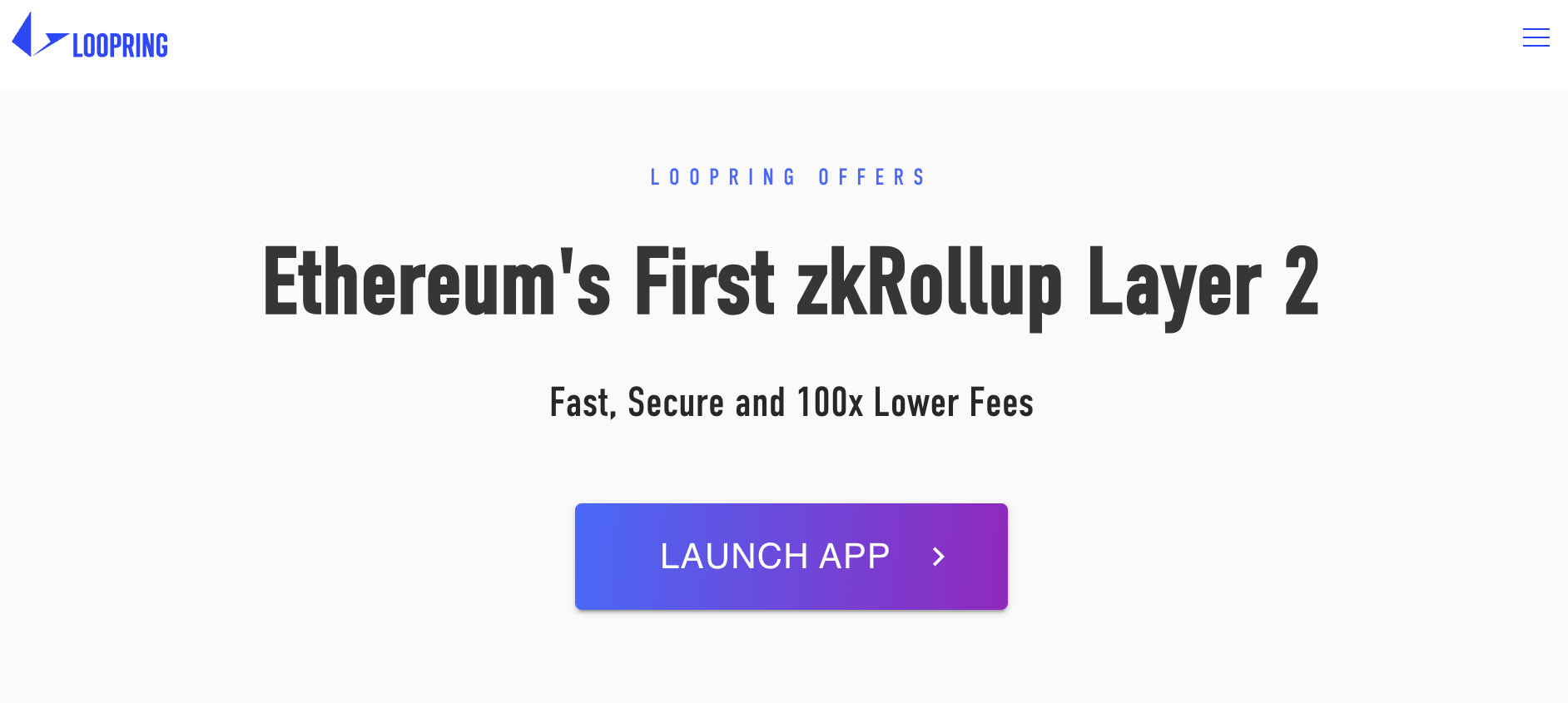

Loopring – Layer 2 DeFi Scaling Solution

The Loopring protocol has a unique say in the DeFi sector. While other platforms are already built as decentralized exchanges or lending platforms, Loopring gives the opportunity to build such platforms. So, developers can use its services to create their own DEX (decentralized exchange), while Loopring provides an interconnected system of trading platforms for traders to access from one dashboard.

Loopring uses a Layer 2 scaling solution called Zk-rollups to provide faster transactions and decrease the gas fees users must pay. Loopring users deposit their assets on-chain into a zkRollup smart contract to build a high-throughput, non-custodial DEX.

To power its ecosystem, Loopring issues a native token called LRC. It is a utility token with many use cases on Loopring’s protocol, including voting, staking, liquidity, and an insurance fund. One of the good things about this token is that it has a deflationary system.

Deflationary tokens are usually reduced over time as a number of tokens are burnt when making transactions reducing their circulating supply. This can be useful for the coin’s growth as long as it will make the coin’s supply scarce – which by the laws of supply and demand, should mean demand increases.

Its current circulating supply is 1,331,430,935 LRC coins, and with a market cap of over $349.5 million, it is ranked #90 largest crypto by market cap. LRC coin went official in 2017 and has experienced 2 large bullish cycles so far. The first time coin’s value hit $1.4 from $0.1; the second time, it hit its all-time high of $3.3.

What are DeFi coins, and How Do They Work?

Along with the development of Bitcoin and other decentralized currencies, a new section of finance emerged called decentralized finance. The apps created as part of the Decentralized finance require no intermediary or middleman to run their project, and the code controls everything.

Each DeFi project creates its own native cryptocurrency to power its network. Hence, the coins created to serve a DeFi project are called DeFi coins. They have multiple use cases within the project’s ecosystem. DeFi coins can have utility or governance applications, such as they can be used to run transactions, distribute rewards, grant voting powers for the DAOs, or be staked and gain rewards.

DeFi Crypto Market Cap

The DeFi cryptocurrency currently has a market capitalization of over 43 billion USD, according to the calculations of the Trading View platform. As part of 2021 and 2022, the general crypto market entered a deep bearish cycle known as “crypto winter”; the prices significantly dropped during that time.

The DeFi crypto market closed in 2022 with an overall market cap of 30 billion USD. However, since the beginning of 2023, DeFi coins have been regaining their value again, and the market cap bounced by 50% since then. According to TradingView, since entering 2024, the DeFi crypto market has spiked to a total of $85 billion.

How We Ranked the Top 15 DeFi Coins

Our top list of the best DeFi coins draws from a range of metrics for investors looking to diversify their portfolios:

Real-World Use of DeFi Application

Part of the DeFi is generating an income outside the traditional centralized means. Projects like the ones we reviewed above offers ways to earn a passive income.

Potential for Growth

Most of these DeFi coins have not yet broken the top 10 cryptocurrency list but have good potential for growth. Currently, the DeFi crypto market cap is in a corrective phase, and those buying the dip can make high returns if the coins recover in the years to come.

Presales

Presales are another excellent way to make money with DeFi tokens. The first coins listed in our guide are still in the presale stage, where they offer investing in the coin at an extremely low price compared to their listing prices. As a matter of fact, many of the DeFi coins in our list are among the top crypto presales launching soon.

Passive income

Some of the DeFi coins mentioned in our list are stackable. It means you can earn rewards with them by simply locking up in a certain liquidity pool when you won’t use them.

Past Performance

We have also considered the coins’ price performance, and some of the DeFi coins in our list have lived through 1 or 2 bear cycles, so they can be good assets for portfolio diversification.

Why DeFi Coins and Tokens Can Be a Good Investment?

DeFi coins are the basis of a new infrastructure called decentralized finance. It has already been proved that decentralized products can work, so the question is how they can be improved. While Ethereum once was the only programmable blockchain with high gas fees and slow transactions, this has changed significantly.

Many new blockchains have been created for faster transactions with lower gas fees. Apart from it, DeFi coins are getting more real-world use cases within the innovative products offered as alternatives to their traditional competitors.

If DeFi can offer solutions that make everyday life easier for people, it can attract a lot of the population and get mass adoption in the future. Many celebrities, billionaires, and investors also invest in DeFi and encourage buying DeFi coins, including Mark Cuban and Jack Dorsey, while the CEO of Galaxy Digital, Mike Novogratz, has called crypto ‘the next internet’ and tied DeFi to web3.

Risks of Buying DeFi Coins

DeFi coins stand out with low market capitalizations, and their price is only controlled through the demand and supply factor. Hence there can be highly volatile price fluctuations after a massive selloff or buy. Pumps will go much higher, and they are more likely to fully retrace as they didn’t build any support on the way up.

It is very important to monitor the market closely and understand all the factors that can influence the price of a certain DeFi coin and the general market condition. The next important thing is to be able to understand the right buy and sell signals and not to sell too early when the next crypto bull run does come.

Portfolio diversification is another important step to take to manage risks. For example, in May 2022, the entire DeFi market cap was dragged down alongside the rest of the crypto markets when one DeFi coin, Terra (LUNA), dropped from $90 to under $2 in the space of 48 hours. Hence, you must diversify your portfolio and avoid investing all your money in one asset.

Where to Buy DeFi Coins

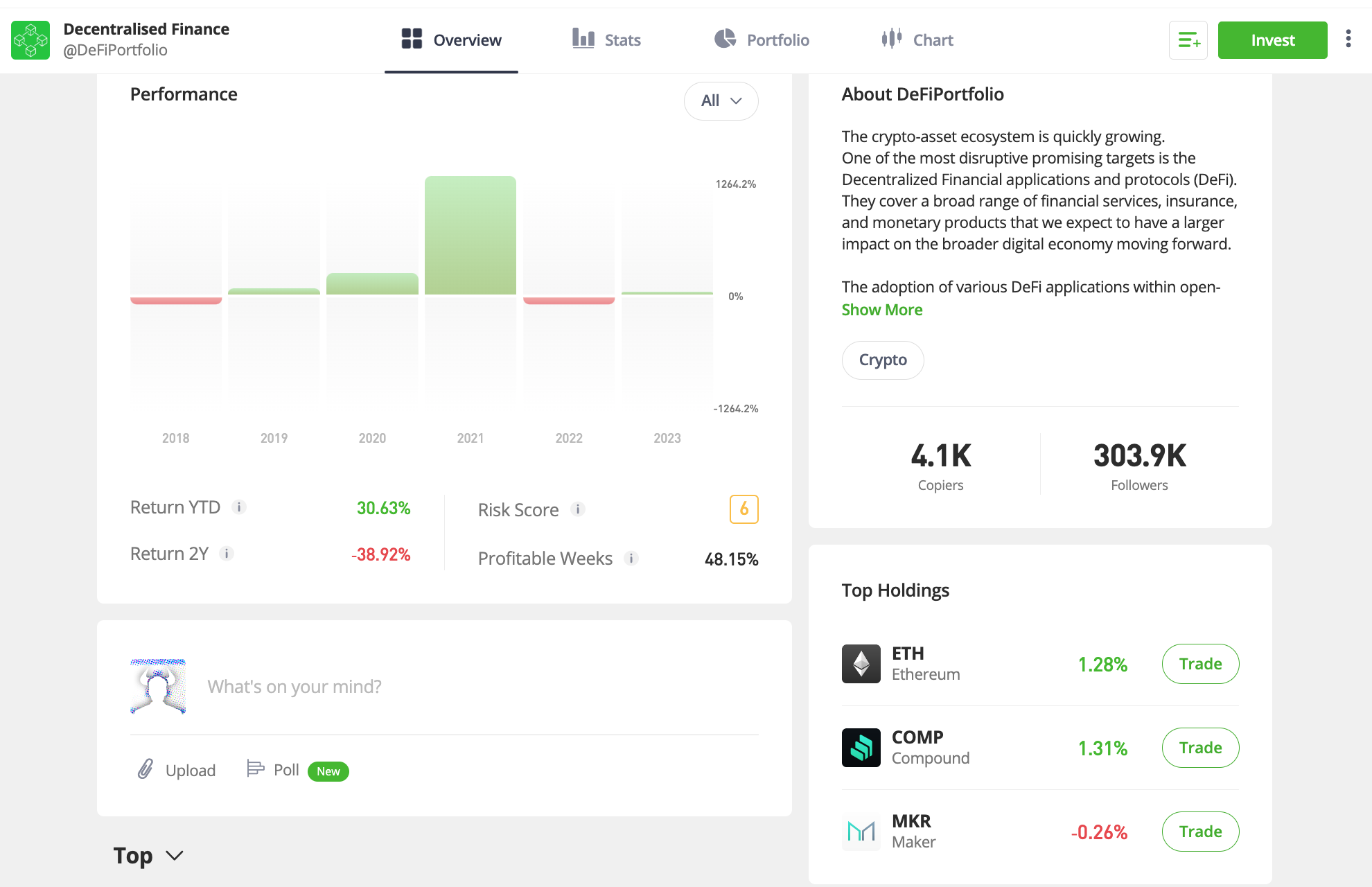

When it comes to finding the best broker to buy DeFi coin, eToro is certainly our top pick. It is an FCA-regulated brokerage platform with advanced security mechanisms to provide safe and efficient trading.

The broker also offers a number of trading tools, and the DeFi Portfolio is one of them, which includes selected crypto assets that are a part of the DeFi sector. It is an excellent for those who wish to invest in the DeFi sector and diversify their portfolio instead of putting all the eggs in one basket.

Generally, investing in DeFi coins is a quick and straightforward process with eToro. Here is a step-by-step guide on how to buy DeFi coins on this platform.

How to Buy DeFi Coins Step by Step

- First, you must visit eToro’s website and create an online account.

- Fill in the information eToro requires for creating an account, such as your name, surname, email, phone number, etc.

- Visit your email and verify your registration.

- Pass the ID and address verifications provided the appropriate documents (ID, a copy of passport, driver’s license, etc.)

- Use the payment method of your choice (bank cards, bank transfers, or e-wallets, like PayPal) to deposit funds in your account.

- Type the name of the DeFi coin you want to buy in the search area and click on the first results to visit its page.

- Click the invest button, fill in the number of tokens you want to buy, and finalize the transactions, after which the coins will be transferred to your eToro account.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Take note that in order to buy DeFi coins in the presale stage, visit the website of the coin you want to invest in and follow the instructions to buy the tokens.

Also, check out the list of the best DeFi 2.0 coins this year.

Conclusion

The DeFi market is getting more popular every day, and the trend is very likely to continue in the future. So, to help you find the right DeFi coins to invest in, in this guide, we ranked and reviewed the best DeFi coins on the market as of 2024.

Our list included a mix of well-established coins that have been around since 2018 and have survived two bear markets, plus some coins have been around since 2020, and then DeFi token presales that are still new and in development but stand out with unique ideas to revolutionize the DeFi space.

We have also explained the meaning of DeFi coins, discussed the risks and benefits of investing in them, and introduced the best platform to buy DeFi coins – eToro. All of the coins included in our list – except those still in the presale stage – are available to buy on eToro quickly, easily, and with low fees.

FAQs on DeFi Tokens

What are the best DeFi coins to buy right now?

Some of the best DeFi coins, like Maker are the best ones to buy. These projects offer versatile decentralized services within the DeFi sector that can attract huge attention and bring them value. Some well-established DeFi coins to buy include Maker, Aave, Curve, dYdX, Compound, Uniswap, SushiSwap, Loopring, and Synthetix.

Is Bitcoin a DeFi coin?

Bitcoin is a decentralized cryptocurrency used to store value and as a means of exchange while operating on its own blockchain. However, DeFi is a much larger concept and covers a number of financial services, including taking loans, earning interest, minting NFTs, becoming a liquidity provider, staking, etc. Hence, DeFi coins are considered the ones that are built to power specifically DeFi projects.

Is XRP a DeFi coin?

While XRP is built as a bridge between traditional financial institutions and decentralized financial services or applications, it is not considered much of a DeFi coin.

Which coin is the king of the DeFi market as of this year?

We can consider Ethereum as the king of DeFi as most DeFi projects are built on the Ethereum blockchain. Before the launch of other programmable blockchains (such as Cardano, Solana, etc.) Ethereum’s dominance in DeFi was 100%.

What are the most popular DeFi coins?

Some of the most popular DeFi coins right now are the ones powering decentralized exchanges or lending protocols, such as AAVE, SNX, COMP, DYDX, MKR, CRV, UNI, SUSHI, etc. However, many others are still in development but have good potential for becoming the next big DeFi coin, like Maker.