On November 3, 2024, MetaWin, an online casino platform, faced a serious cyberattack that led to the loss of $4 million from its hot wallets. This high-profile breach, which exploited the platform’s fast withdrawal functionality, has intensified concerns around security within the rapidly expanding crypto-gambling industry.

MetaWin is an online platform that combines cryptocurrency with gaming and social engagement, creating a space where users can participate in various activities for cryptocurrency rewards. The platform offers a mix of play-to-earn games and contests, utilizing blockchain technology to ensure transparency and fair outcomes. Users can engage in skill-based and chance-based games, providing multiple ways to potentially earn rewards. MetaWin’s blockchain integration aims to add a layer of security to the gaming experience by allowing provably fair results.

The platform also includes community features, enabling users to interact, join challenges, and compete on leaderboards. This social aspect encourages user participation and interaction across different activities. By combining cryptocurrency incentives with a focus on community, MetaWin seeks to appeal to those interested in both gaming and blockchain technology.

Exploitation of MetaWin’s Hot Wallets Sparks Security Overhaul

The hacker behind the MetaWin attack targeted vulnerabilities in the platform’s hot wallets, which are primarily used to enable rapid transactions. The attacker leveraged weaknesses in the platform’s quick withdrawal process, allowing them to withdraw funds without authorization. Traces of the stolen Ethereum (ETH) and Solana (SOL) led to exchanges like KuCoin and HitBTC, as the hacker attempted to cover their tracks by navigating a web of 115 different addresses.

Blockchain investigator ZackXBT played a key role in tracking the movement of the stolen assets across blockchain platforms. Although the identity of the hacker remains unknown, the breach has highlighted the risks associated with hot wallets. While these wallets provide users with convenient access to funds, they lack the heightened security of cold storage alternatives, making them more susceptible to attacks.

Following the breach, MetaWin promptly suspended all withdrawal activities to prevent further loss. Richard “Skel” Skelhorn, MetaWin’s CEO, assured users that most of the stolen funds were successfully replaced, allowing 95% of users to regain access to their assets. Skelhorn went a step further by contributing some of his own funds to help offset the losses, a gesture aimed at restoring user trust and stabilizing the platform.

In response to the attack, MetaWin has committed to strengthening its security protocols with a focus on implementing more robust measures to safeguard user funds. The company worked swiftly, partnering with law enforcement agencies and security experts to investigate and address the breach, signaling its commitment to transparency and resilience in the face of cyber threats.

Hot Wallets: Balancing Accessibility and Security

Hot wallets, which keep funds online for quick access, are commonly used by exchanges, DeFi platforms, and online casinos like MetaWin due to their convenience. These wallets facilitate seamless transactions, an essential feature for online casinos where fast deposits and withdrawals are integral to the user experience. However, their online connectivity also makes them particularly vulnerable to cyberattacks.

In contrast, cold wallets, stored offline, provide stronger protection against hacking attempts. While less convenient for instant transactions, they greatly reduce the risk of unauthorized access, as they aren’t connected to the internet. The recent MetaWin incident highlights the importance for crypto platforms, especially those in higher-risk sectors like online gambling, to reevaluate their security practices, particularly their reliance on hot wallets.

Some experts suggest hybrid wallet systems, where a portion of funds is kept in cold storage for security while maintaining sufficient liquidity in hot wallets for daily operations. Others recommend enhanced security protocols, such as multi-signature wallets, to add layers of protection even for wallets accessible online.

MetaWin Breach Reflects Growing Vulnerabilities in the Crypto Sector

The MetaWin incident underscores an increasing trend of security challenges across the crypto industry. In October alone, the sector saw over $129 million lost to various security breaches, including flash loan attacks and exit scams, according to Cryptorank.

On October 30, a complex phishing campaign targeted several decentralized applications by exploiting vulnerabilities in the Lottie Player animation library. This breach enabled attackers to inject malicious phishing links on websites utilizing Lottie Player, including platforms such as 1inch and TEN Finance. Users who clicked these links were redirected to phishing sites, where hackers used the “Ace Drainer” phishing software to empty their connected wallets.

The MetaWin attack has reignited discussions about the risks associated with hot wallet reliance and the necessity for comprehensive security frameworks within crypto gambling platforms.

This attack on MetaWin parallels recent breaches, such as the $50 million hack at Radiant Capital and the $13 million theft from the M2 crypto exchange. Together, these incidents expose vulnerabilities within the digital finance ecosystem, underlining the urgent demand for advanced security strategies. The MetaWin ordeal serves as a stark reminder of the risks facing online casinos and other crypto platforms, calling attention to the need for more resilient protective measures.

As the digital finance landscape continues to grow, so do cyber threats, with hackers becoming increasingly sophisticated in their techniques. To counter these risks, many platforms are expected to shift toward hybrid wallet models that combine the accessibility of hot wallets with the security of cold storage options. Adhering to regulatory standards and performing thorough security audits will also be instrumental in fortifying the industry against future breaches.

With MetaWin’s swift recovery from the attack, the platform has demonstrated its commitment to user safety and operational resilience. However, the incident has left an indelible mark on the industry, serving as both a cautionary tale and a call to action for stronger security across the crypto ecosystem.

In today’s volatile crypto landscape, ensuring secure storage is crucial, especially with rising incidents of hacks and scams. Despite a flood of new wallets on the market, only a select few earn users’ trust. Among them, Best Wallet stands out, gaining popularity for its cutting-edge approach to crypto storage and management.

Best Wallet – An Innovative Alternative for Managing Digital Assets

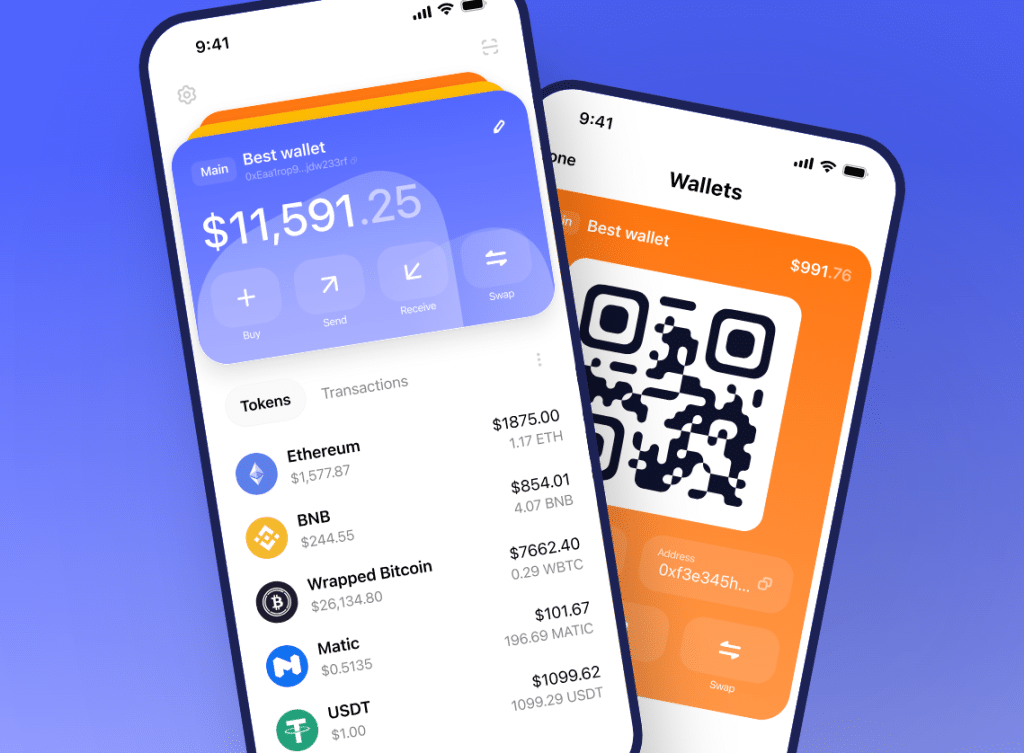

Best Wallet aims to transform traditional crypto wallet usage, offering features beyond just storing assets or connecting with Dapps and DEXs. Although relatively new, the wallet has quickly attracted a growing user base thanks to its user-friendly interface and enticing announcements of upcoming features.

Designed as a comprehensive investment hub, Best Wallet offers real-time market insights, notifications of upcoming tokens and airdrops, portfolio management, and seamless transactions. The platform’s ambition to redefine Web3 interactions has garnered significant media attention, signaling its rise in popularity.

In the Best Wallet ecosystem, users gain access to additional tools like Best DEX, Best Bot, and a future BEST airdrop, providing a rich suite of services. While the core team remains anonymous, their roadmap is already progressing, suggesting a blend of ambitious and practical development in a dynamic crypto space.

Key Features of Best Wallet

Multi-Wallet and Multi-Chain Support

With Best Wallet, users can create multiple wallets within the app itself, simplifying the management of diversified crypto assets without needing separate accounts. The wallet also includes its own decentralized exchange, Best DEX, which offers access to a broad range of cryptocurrencies with low fees and decentralized trading tools—all without requiring registration.

Portfolio Management

The wallet includes a portfolio management tool that lets users track real-time profits and losses, view purchase prices, and monitor current values. Customizable labels and search functions streamline fund management, keeping users informed about their holdings and helping them make better investment decisions.

Market Insights

To support informed trading, Best Wallet provides a dedicated market insights section, delivering up-to-date information on crypto prices, market cap, volume, and more. This tool also offers updates on new projects and presales, helping users identify promising, undervalued opportunities in the market.

Airdrop Notifications

Best Wallet includes a feature for tracking popular upcoming airdrops, ensuring that users never miss out on these earning opportunities. By staying informed of airdrop schedules, users can participate in projects early, potentially securing extra value from new tokens.

User Experience with Best Wallet

Best Wallet’s interface is streamlined and efficient, with a simple design that caters to a wide range of users. The DEX, a core part of the platform, maintains an intuitive layout, while a minimalist color scheme enhances user navigation and accessibility.

For anyone exploring secure crypto storage and management within the Web3 world, Best Wallet presents itself as a strong choice. While users should research before choosing any wallet, Best Wallet stands as one of the leading options in today’s crypto market.

Visit Best WalletRelated News

Lucky Block Casino - Decentralized Gambling Platform

- Bet With Crypto - BTC, ETH, USDT, LBLOCK and More

- Live Dealers - luckyblock.com

- Rated Best New Crypto Casino - No KYC

- Thousands of Slots, Blackjack, Roulette Games