Join Our Telegram channel to stay up to date on breaking news coverage

Today, the global cryptocurrency market stands at an impressive $2.28 trillion, even with a slight dip of 0.35% in the last 24 hours. Notably, market sentiment remains neutral, as indicated by the Fear & Greed Index sitting at 50. I

nterestingly, a remarkable 80% of cryptocurrencies have gained value, highlighting both resilience and opportunity. Leading the charge are top gainers like Ordi, Litecoin, Basic Attention Token, and MultiversX. In this article, we’ll delve into their price movements and uncover the trends fueling their success.

Biggest Crypto Gainers Today – Top List

In this vibrant market, 80% of cryptocurrencies have gained value in the last 24 hours, while only 20% have seen losses. Ordi shows impressive liquidity, Litecoin strengthens its payment position, Basic Attention Token reshapes digital advertising, and MultiversX enhances its utility with recent integrations. Let’s examine their price movements and the trends driving their success.

1. Ordi (ORDI)

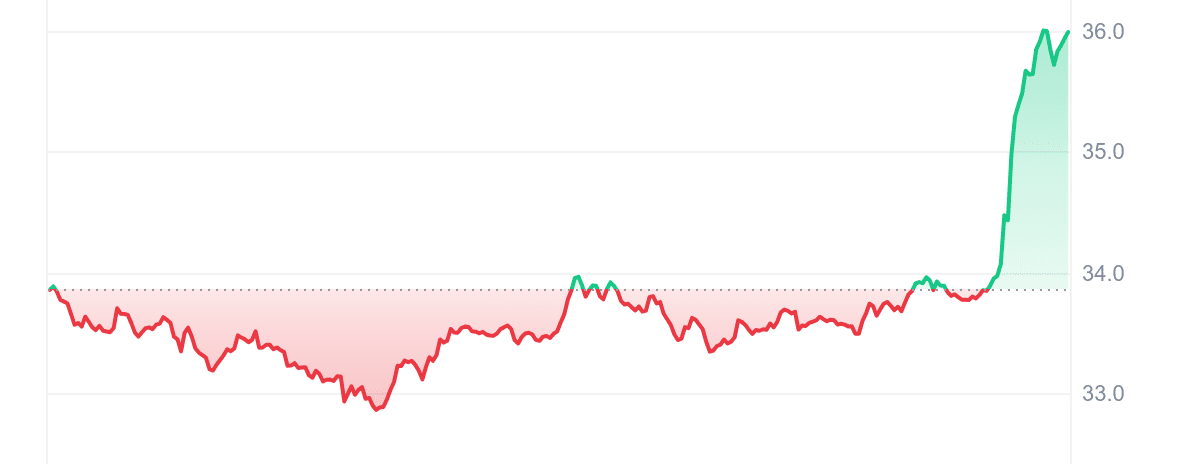

The first token on today’s top crypto gainer’s list is Ordi. This token surged by 6.04% in the last 24 hours, bringing its price to $35.94. One key factor behind its strong performance is its high liquidity, reflected by a 0.4267 volume-to-market cap ratio, ensuring it has plenty of market activity.

When it comes to market trends, ORDI seems stable for now. The 14-day RSI is 59.59, indicating a neutral market, meaning it’s neither overbought nor oversold. With 16 green days in the last 30 (53%), its momentum is generally positive. Moreover, its 30-day volatility is low, standing at just 11%, making it less susceptible to wild price swings.

But what makes ORDI unique? Ordinals is a fascinating system that tracks satoshis (Bitcoin’s smallest units) through a numbering scheme, allowing for the attachment of arbitrary assets, such as NFTs or stablecoins. Built as an open-source project, it consists of a wallet, index, and block explorer for deeper interaction with Bitcoin’s blockchain.

Over the long term, ORDI’s performance has been nothing short of remarkable. To start with, the token is trading a solid 165.79% above its 200-day SMA, showcasing strong momentum. On top of that, it has delivered an astonishing 934% price increase in just the past year. As if that weren’t enough, ORDI also managed to best a whopping 95% of the top 100 crypto assets, making it one of the exceptional assets in the market.

2. Litecoin (LTC)

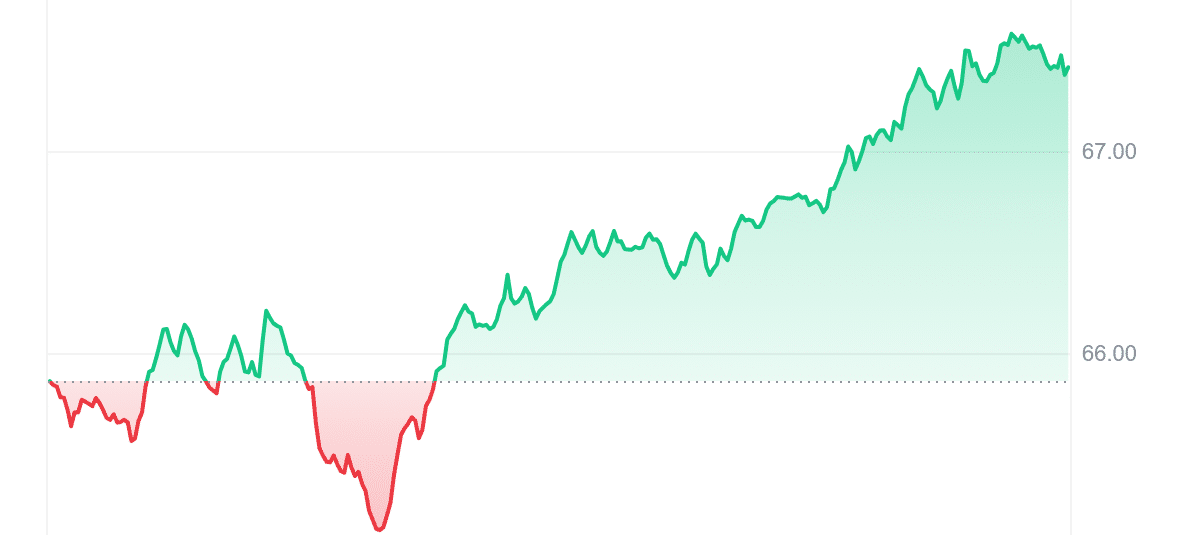

The second token on our list today is Litecoin, a long-standing leader in the crypto payment space. Over the past 24 hours, LTC’s price has increased by 2.24%, bringing it to $67.30. However, what truly sets it apart is its rising dominance in the payments arena.

In fact, according to recent data from BitPay, Litecoin now accounts for a staggering 37% of all crypto transactions, surpassing major players like Bitcoin and Ethereum. This surge in usage is largely due to its ability to offer fast and low-cost payments.

As for liquidity, Litecoin remains strong, with a 0.1482 volume-to-market cap ratio. Its market momentum is neutral, as indicated by the RSI of 64.80, suggesting it may trade sideways for now. Additionally, 57% of its trading days in the past month have been positive, and its low volatility at 4% highlights its stability.

JUST IN: The streak continues! With the latest stats from @BitPay for September showing #Litecoin is by far the most used cryptocurrency for transactions! $LTC has been #1 all year!! ⚡️ What's in your wallet! pic.twitter.com/ZkYCtA1G28

— Litecoin (@litecoin) October 4, 2024

Designed for efficiency, Litecoin was built to be faster and cheaper than Bitcoin, with a block time of just 2.5 minutes and near-zero transaction fees. This makes it particularly attractive for micro-transactions and point-of-sale payments, especially in regions where affordability is key.

In the long term, Litecoin is trading 6.14% below its 200-day SMA but has still managed to increase by 2% over the past year. Although it only outperformed 25% of the top 100 crypto assets, its growing role in transactions keeps it relevant. For those seeking a reliable, fast, and cost-effective crypto, Litecoin remains a solid contender.

3. Flockerz (FLOCK)

Flockerz is soaring high right now, having raised a whopping $400,000 in its ICO within its first month. This feathered meme coin, complete with a propeller beanie, is obviously attracting investors everywhere.

The excitement lies in its unique vote-to-earn mechanism. Every time community members voice their opinions, they earn rewards, empowering $FLOCK holders to shape the project’s direction. Thus, it proudly claims the title of “The People’s Meme Coin.” You can get in on the action for $0.0057012 per token, but act fast—this price will rise in less than a day.

All roads lead to Flockerz. Vote-To-Earn is going to change the way meme coins empower their community. pic.twitter.com/cqf1jaNPZJ

— Flockerz (@FlockerzToken) October 5, 2024

Flockerz stands out with its decentralized autonomous organization (DAO), allowing holders to influence key decisions while earning $FLOCK. Unlike many meme coins controlled by a single leader, Flockerz offers a functioning DAO that exceeds Shiba Inu’s planned model.

Additionally, Flockerz provides remarkable staking rewards. Participants can earn an astounding 4,058% return, potentially doubling their investment in just a week. However, these rewards are decreasing as more investors join, emphasizing the urgency to act.

With potential 100x returns, this decentralized gem shouldn’t be missed. It’s not too late to join the presale, with around 2.4 billion $FLOCK available—20% of the total supply. Visit the official website and become part of the Flockerz community today!

4. Basic Attention Token (BAT)

Next up is the Basic Attention Token, a coin with a unique purpose in the world of digital advertising. Over the last 24 hours, BAT posted a slight uptick of 2.09%, bringing its price to $0.175325. But what makes BAT stand out isn’t just its price movement—it’s the way it reshapes how ads are delivered and rewarded.

BAT fuels the Brave Browser, allowing users to earn rewards simply for paying attention to ads. This token-powered model gives users 70% of the ad revenue while advertisers enjoy a more efficient, fraud-resistant way to reach their audience. It’s a win-win situation where unnecessary intermediaries are cut out, leading to more effective ad spend.

Looking at its market data, BAT shows high liquidity, with a 0.0453 volume-to-market cap ratio. With an RSI of 45.54, BAT is in neutral territory, indicating potential sideways trading ahead. Furthermore, 57% of the past month’s trading days were positive—a good sign for short-term performance. In terms of volatility, BAT keeps things calm, with just 7% volatility over the past 30 days.

We asked the community, and the community has spoken! 📣

Our #ECHO drops will take place on Thursdays. This way, you can count on $BAT'hurdays to deliver.*Except for themed dates, like Halloween and similar occasions 🦇🎃 https://t.co/F4SEn2oVl8

— BAT Community (@BAT_Community) October 2, 2024

However, BAT’s long-term performance is where the story gets mixed. Currently trading 28.60% below its 200-day SMA, its price has only seen a modest 1% increase over the last year, and it’s outperformed just 23% of the top 100 assets. While these numbers may not scream “bull run,” BAT’s strong fundamentals and its critical role in transforming digital advertising keep it in the spotlight for investors.

5. MultiversX (EGLD)

Lastly on today’s list of top gainers is MultiversX, which surged 2.90% in the last 24 hours. Notably, this price movement follows exciting news. EGLD is now integrated with the Bit2Me card, allowing users to make purchases at over 30 million merchants globally while earning cashback. This increased utility seems to be driving demand and boosting interest.

Currently, EGLD is trading at $25.99, and it shows strong liquidity with a 0.0319 market cap-to-volume ratio. Moreover, the 14-day RSI sits at 60.87, indicating a neutral position, suggesting that the token may continue to trade sideways. Interestingly, EGLD has had a 60% positive trading rate over the past 30 days, reflecting its steady short-term performance. Additionally, with a 6% volatility, it offers some stability for cautious investors.

Get cashback offers when using Uber, Delsey, Ubeeqo and more, with the @bit2me_global card.

LATAM's leading exchange has added $EGLD as a payment currency in its card services — enabling its use at any POS worldwide. pic.twitter.com/bV3TEBtTye

— Multiversᕽ (@MultiversX) October 1, 2024

On a technical level, MultiversX excels with its Adaptive State Sharding, ensuring impressive scalability while keeping fees low. The network can process 100,000 transactions per second, and EGLD plays a vital role in securing and governing this ecosystem. Thanks to staking, validators maintain the network’s integrity, offering robust security and reliability.

However, in the long term, EGLD still trades 31.37% below its 200-day SMA of $37.79, suggesting room for a potential rebound. It has increased by 7% over the past year, surpassing 29% of the top 100 crypto assets during this time. Yet, with the recent Bit2Me integration and its expanding use case, MultiversX is positioned for promising future growth.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage