Join Our Telegram channel to stay up to date on breaking news coverage

A pre-mined stash of Ethereum valued at approximately $116 million at current rates was suddenly awakened by a crypto whale after lying dormant for almost eight years.

The wallet address in question moved its entire holding of 61,216 ETH to an address on the Kraken crypto exchange. It had been inactive since the pre-mine period of Ethereum when the value of the token was between $300 and $400, indicating a cost at the time of about $20 million.

However, due to the exponential growth of ETH price over the past eight years, the value of these tokens has multiplied to reach more than $116 million. This significant increase in value has prompted questions about the potential impact of this transaction on the market and the overall price trajectory for Ethereum.

NEWS : Pre-Mining Era ETH Worth $116M Moves Wallets: A wallet holding pre-mined Ethereum worth a massive $116 million that lay dormant for eight years made an unexpected move on July 18. It transferred all its 61,216 Ether to… #News https://t.co/H9UHVJzmpL pic.twitter.com/NfKLEPYTxl

— Rewards Farm (@Rewards_Farm) July 19, 2023

Losses On The Radar For Ethereum?

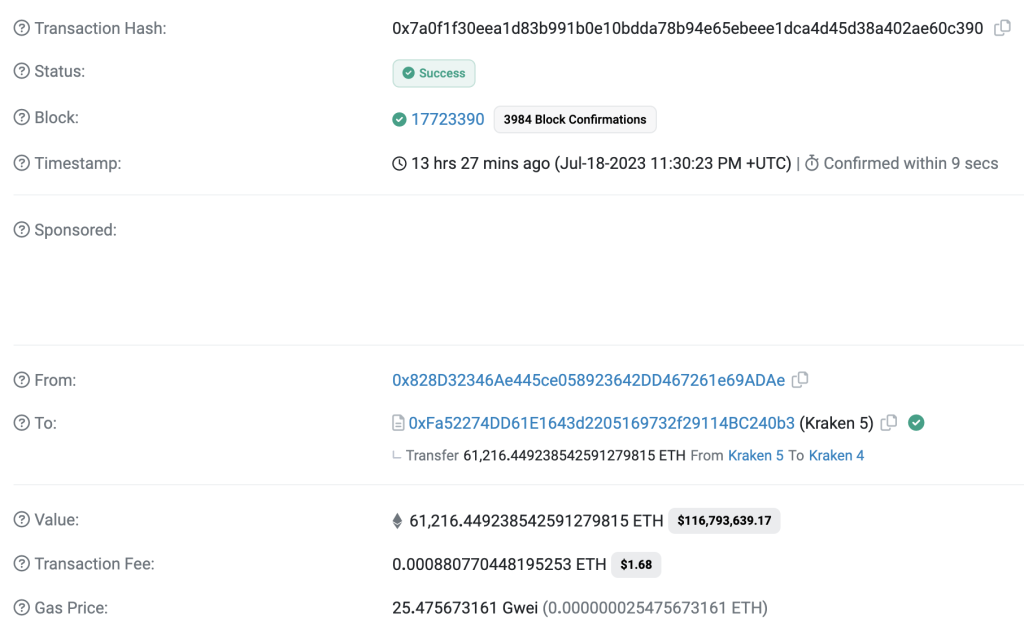

According to data from Etherscan, the 61,216 pre-mined Ether were transferred to a wallet on the Kraken crypto exchange on July 18 at 11.30 pm UTC. The transfer of $116.9 million worth of ETH required a remarkably low transaction fee of $1.68 and a gas price of 25.475673161 Gwei, as indicated in the screenshot below.

This transaction showcases the efficiency and cost-effectiveness of sending such a substantial amount, further highlighting the advantages of utilizing Ethereum’s network.

While the wallet owner remains unknown, the transaction not only highlights the importance of hodling — an investment strategy that prioritizes the long-term accumulation of crypto tokens — but also emphasizes the value of HODL-ling in the volatile world of crypto.

It underscores how patience can lead to significant gains, serving as a testament to the potential rewards that come with a steadfast and long-term approach.

Note that the transfer of a large number of crypto to an exchange is usually regarded as a bearish sign. This is because it usually indicates the intention of the investor to sell the tokens.

At the time of writing, however, Ethereum price was trading in the green at $1,909, up 0.93% in the last 24 hours. This is an indication that the whale has not yet made any move to the deposited ETH.

If he decides to cash in on the $116 million, the resulting headwinds may pull the price below the $1,850 demand zone, embraced by the 50-day simple moving average (SMA), the 100-day SMA, and the 2023 ascending trendline.

Such a move would trigger massive sell orders from other ETH holders taking the price of the second largest token first toward the 200-day SMA at $1,742 and later to revisit the June 15 low at $1,631. This would bring the total losses to 14.73% from the current price.

ETH/USD Daily Chart

Supporting this downward outlook is the recent downward price action displayed by the smart contracts’ token. The relative strength index (RSI) was facing down, reinforcing the bears’ grip on ETH.

Conversely, Ethereum price could turn up from the current price to confront resistance from the $2,000 psychological level. Overcoming this barrier would signal a decisive bullish breakout for the largest altcoin by market capitalization. The next logical move would be a retest of the 2023 high at $2,140 or higher toward $2,500.

Related News

- Best Crypto to Buy Now

- Cathie Wood Still Bullish on Coinbase Even as Ark Sells Another $26.3m Tranche

- Ethscriptions Devs Propose A New Protocol Preventing NFTs From Scam

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage