Join Our Telegram channel to stay up to date on breaking news coverage

Close to a market cap of 200 Billion, the Ethereum network is for sure investors’ favorite token after Bitcoin. But is it preferred by institutions? Well, while the current price movement is an outcome of retail interest, institutional investments still account for a considerable chunk of ETH’s market cap, and this will only continue to grow. At least as long as the network continues to progress beyond upkeep.

Network Upgrades Will Help Ethereum Attract Institutional Investment

The Merge, Ethereum’s move from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism that took place in September last year, was a major development for the blockchain network. It greatly reduced Ethereum’s energy usage by 99.95%, from 94 TWh per year in May to 0.01 TWh.

As the awareness about this move ripples beyond the industry, it could potentially attract more institutional investors to the crypto space, as well as appease regulators who have been concerned about the environmental impact of blockchain networks.

However, some experts believe that the Merge does not yet solve Ethereum’s scalability issues and that it will take more time for it to accelerate adoption by institutional investors. The Ethereum community will have to wait for the Surge, another upgrade scheduled for 2023, to potentially boost network speed.

What is Surge? Well, “Surge” is a way to refer to the process of “Sharding” by Ethereum, where the whole network is divided into several smaller networks, thus reducing the workload on a single chain. This will enable the network to reduce the cost of roll-ups and bundled transactions and help improve the cost-effectiveness of the layer-2 blockchains. These improvements are said to make the network more effective, rendering it a perfect product to be used by the major industry players.

Here are a few reasons why these upgrades will help the network make a case for attracting institutional investment:

- Reduced Carbon Footprint: Ethereum’s transition from PoW to PoS leads to a significant decrease in energy consumption and carbon footprint, making it more attractive for institutional investors.

- New and Attractive Staking Opportunities: Staking contracts on Ethereum offer positive real yield and liquid staking opportunities for individuals and institutions.

- Deflationary Supply of ETH: Reduced ETH issuance and increased burns put deflationary pressure on ETH, making it a more attractive asset for institutions.

- Improved Security: Enhanced decentralization and cross-team ecosystem collaboration lead to improved security for institutional and retail participation.

- Ecosystem Growth: On-chain applications and Layer 2 solutions are expected to multiply on top of Ethereum, creating more opportunities for institutions.

- Client Diversity and Interoperability: Ethereum offers a wide range of options for institutions to choose how they want to interact with Web3, with full interoperability between different coding languages and companies.

Once the network achieves its potential, it will likely attract investors’ interest -more than it already has- and invite a load of capital, that’ll help boost the development of the platform and repeat the cycle of attracting more institutional attention. Consequently, pumping the price of the token as it becomes capable and reaches a wider consumer base.

Move From Binance To Accelerate Institutional Investment In Crypto

Binance has announced a new feature called Binance Mirror, which will enable institutional investors to keep their collateralized crypto assets used for leveraged positions of the platform in Binance Custody’s cold storage wallets.

This means investors can continue to trade in times when the market is volatile without massive outflows on the exchange and assets will be protected against on-chain hacks, which are common for hot wallets native to most crypto exchanges.

The move is seen as a positive step towards building trust among institutions that their funds will remain safe and Binance becoming an institutional-focused crypto exchange. However, it may not be enough as exchanges will likely have to work with external custodians to completely eliminate risks around collateral ownership.

Will ETH Reach $4k In 2023?

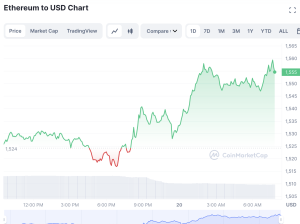

ETH is currently trading at $1,553 with a 24-hour trading volume of $6.67 billion and a market cap that exceeds $190 billion. The token currently borrows support from the 50-day moving average levels, while the MACD indicates a bearish outlook. The token could likely fall by $200 from its current price if it moves anywhere below $1,500, while the upside for the token currently lies near $1,660.

Whether the token will reach $4k is too far-fetched for now, since if it happens, it’ll most likely be an outcome of a bull run. The last time, and the only time, the token managed to go past that mark was in Oct 2021 when the token scaled from $412 an exact year back to $4,055 on October 22.

For now, investors can expect a lower two-digit return on the token, unless the crypto market pump continues to improve, taking ETH along with it to new heights. While ETH’s massive market cap doesn’t allow it to offer outsized returns, here are a few tokens that can.

Ethereum Alternatives With Potential Outsized Gains

Meta Mask Guild (MEMAG)

Meta Masters Guild is a mobile-centric Web 3 gaming guild that aims to create high-quality games integrated with the decentralized gaming ecosystem where players can earn rewards for contributing to the project.

The project uses a single currency, $MEMAG, which can be swapped for GEMS- the platform’s reward token. Players can either funnel their MEMAG earnings back into the ecosystem or cash out as MATIC or USDT. The project also offers other utilities such as staking and NFTs. The developers focus on providing fun games that can be lucrative for crypto gamers and non-crypto gamers alike. They aim to create a stable GameFi economy by maintaining a stable player base and allowing community participation in every phase of the project.

Fight Out (FGHT)

Fight Out is a Web 3.0 fitness app and gym chain that aims to combine real-life workouts with virtual competition in the metaverse. The company is seeking to raise $100 million to disrupt the $96 billion fitness industry. The token for FightOut, $FGHT, is now available for purchase at $0.01665002. The platform offers a unique avatar system that tracks all forms of fitness activity and rewards users for adopting a holistic healthy lifestyle, with a plan to launch 20 gyms initially.

C+Charge (CCHG)

C+Charge is a blockchain-based platform that aims to address the lack of standard pricing and trust issues in the electric vehicle (EV) charging industry by using blockchain technology to reward EV drivers with carbon credits. The platform is currently in its first stage of presale of its native cryptocurrency CCHG, which will be used as a payment method for EV charging. The presale of tokens is currently live for investors where they can purchase CCHG at $0.0130. As the project moves forward, the token’s price is expected to rise and ultimately be traded at $0.0235, which represents an 80% increase from the initial price.

Related Articles

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage