Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum price dropped slightly in the last 24 hours to trade at $2,757 as of 5:45 a.m. EST on trading volume that went down 10% to $30.45 billion.

The decrease in the ETH price comes even as BlackRock’s spot Ethereum ETF (exchange-traded fund) purchased $163.6 million worth of the altcoin.

Ethereum Price Prediction

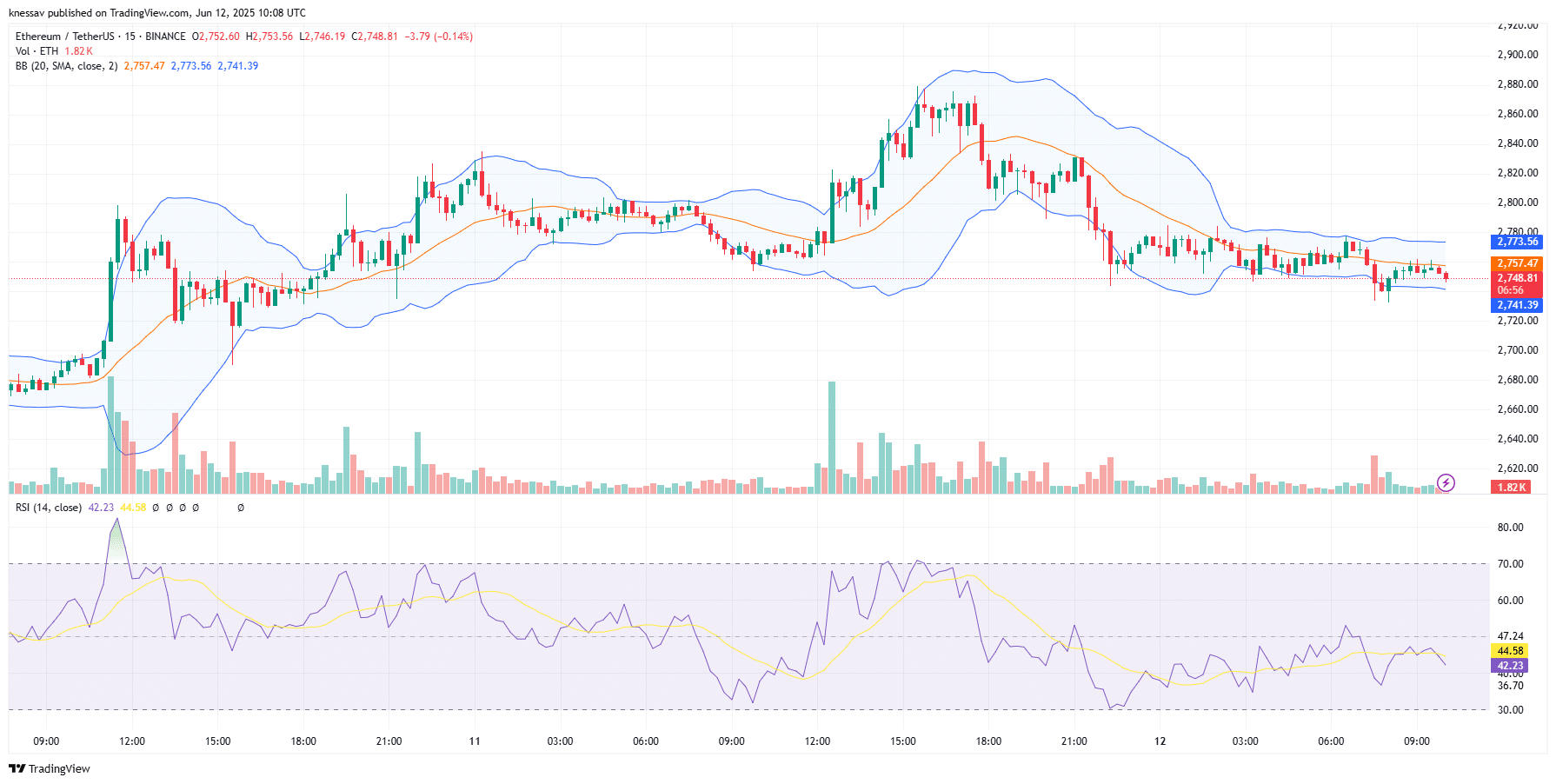

The price surge seen yesterday allowed ETH to briefly soar past several major resistance levels and reach the value of $2,873. However, the coin’s value started to decline after several hours, initially stopping at $2,800, but soon after that, it broke the support and went down to around $2,750.

A few hours prior to the time of writing, ETH broke this support as well, but it lingered close to it, fluctuating between $2,740 and $2,750, with occasional attempts to surge back up, albeit with little success for now. Its Bollinger Bands, which saw a sharp widening during yesterday’s surge and the subsequent sharp decline, have since narrowed as the coin started to stabilize.

ETH/USDT chart analysis (Source: TradingView)

The project’s Relative Strength Index (RSI) value also shows that the bullish wave has passed. After soaring from the oversold zone to the overbought area yesterday afternoon, the RSI started to drop as traders took profit.

It did not take long for it to reach the oversold zone again, and in the past 12 hours or so, it has been seeing small fluctuations. The overall trend has seen the RSI grow to the value of 50 in the neutral zone, but over the last six hours, it saw another drop to the edge of the oversold zone at around 35.

For now, traders seem to be waiting to see what will happen next, with uncertainty preventing many from taking action.

Promising Alternative To Ethereum

With uncertainty surrounding Ethereum, investors looking for a new opportunity are buying Bitcoin Hyper (HYPER) — a new meme coin ICO that claims to offer the first-ever Bitcoin Layer-2 chain.

The project launched its presale in mid-May, and so far, it has attracted enough attention and capital to raise over $1.14 million, as investors have high hopes for it, and what it could mean for the state of the Bitcoin ecosystem.

The reason for that is because HYPER claims it can bring greater scalability to the Bitcoin network. This is expected to significantly improve the speed of transactions in Bitcoin’s ecosystem, while also reducing the associated cost, as there will no longer be extended waiting times.

The project noted that its HYPER token will be used for transactions, staking, as well as governance. Currently, it is available in presale, priced at only $0.01185 each. However, its price is expected to increase again in less than 7 hours, leaving investors with little time to buy in at its current value.

Even after the price increases, however, it will still be worth investing in, as experts like Crypto Boy, a crypto YouTuber who has over 61.3k subscribers, said that this could be the next 100x gem.

If you wish to join others who bought HYPER at its low ICO price, buy now before the next presale price increase in a few hours.

Visit Bitcoin Hyper’s website.

Related News:

- SPX Pumps 5%, But Experts Say This Trading Bot Token Could Soar 10X

- SOL Slides 2% As Investors Shift Their Attention To The Viral Solaxy Presale

- Trending Coins on GeckoTerminal

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage