Join Our Telegram channel to stay up to date on breaking news coverage

With Bitcoin’s network hash rate reaching a new all-time high, more processing power is allocated to mining. This milestone shows increased interest in and investment in the cryptocurrency, improving the network’s efficiency and security.

Are you trying to expand your cryptocurrency holdings with promising altcoins that have the potential to develop over time? Knowing where to make your bets is more crucial than ever since the market constantly changes. The cryptocurrency market is thriving right now, and initiatives like Stellar, Flare, Aptos, and Amp demonstrate they have more to offer than just price movement. Under the surface, these tokens are subtly gaining traction by addressing real-world issues and enabling the next wave of blockchain technology.

6 Best Altcoins To Invest in Today

Why are these altcoins attracting investors’ attention? How do they differentiate themselves in such a competitive market? This guide dissects each project’s potential, highlighting its growth, the issues it’s addressing, and the reasons it might be an underappreciated gem in the current cycle. You should pay attention to the 6 best altcoins to invest in today, whether you’re looking for clever scalability solutions, efficient payments, or strong utility backing.

1. Stellar (XLM)

Launched in 2014 by Jed McCaleb and Joyce Kim, Stellar is a quick and inexpensive blockchain that links global financial networks. Instead of relying on power-hungry mining, the protocol uses its Stellar Consensus Protocol to enable near-instant cross-border payments, including micropayments, for just a few cents per transaction.

PayPal is expanding access to quick, affordable payment rails for businesses and individuals globally by introducing its PYUSD stablecoin to Stellar ($, introduced June 11, 2025). Conversely, MoneyGram has used Stellar to provide crypto-to-cash services in more than 170 countries, handling close to $30 million in transactions, demonstrating its global reach and financial inclusion.

Stellar + @PayPal = payment structure that delivers. https://t.co/a3o57ybMx7

— Stellar (@StellarOrg) June 11, 2025

After significant pacts (such as Mastercard), XLM jumped to $0.55 in November 2024 before settling back into the $0.26–0.27 range where it is now. The fact that Stellar is trading close to $0.27 indicates that investors trust its network-driven alliances could support long-term adoption.

With the help of financial partners, including Paxos, SG-Forge, Franklin Templeton, WisdomTree, Ondo, and Etherfuse, Stellar is also seeking to tokenize real-world assets, going from $290 million at the end of 2024 to $3 billion on-chain in 2025.

2. Flare (FLR)

Flare’s distinctive feature is its ability to use FAssets to transfer non-EVM native assets into a safe and decentralized DeFi environment. On the Songbird testnet, FAssets V1.1 has already gone live, enabling wider USDT (USD₮0) deployments and composable assets like FXRP.

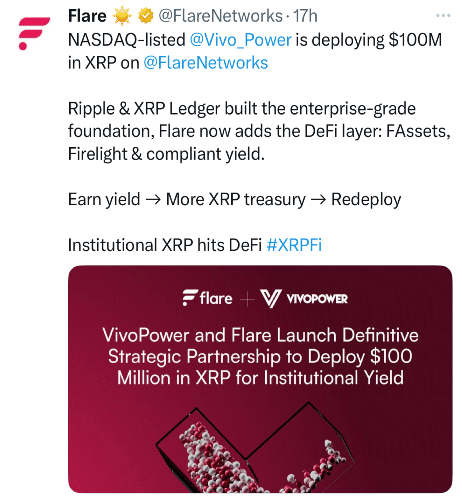

Using its FAssets technology and the Firelight protocol, VivoPower, a NASDAQ-listed company, has deployed $100 million in XRP on Flare, producing yield that feeds back into its XRP treasury. Considered a strong validation of Flare’s architecture, this contract is the platform’s first significant enterprise-scale treasury application.

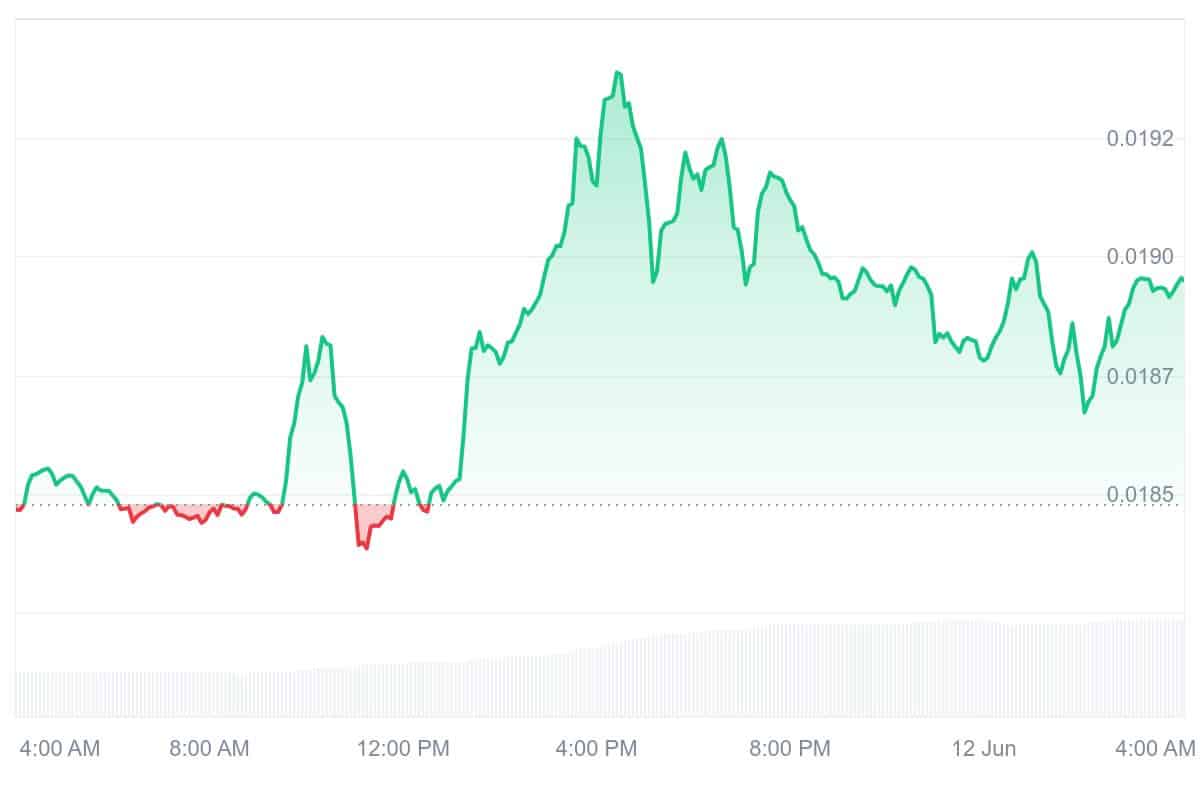

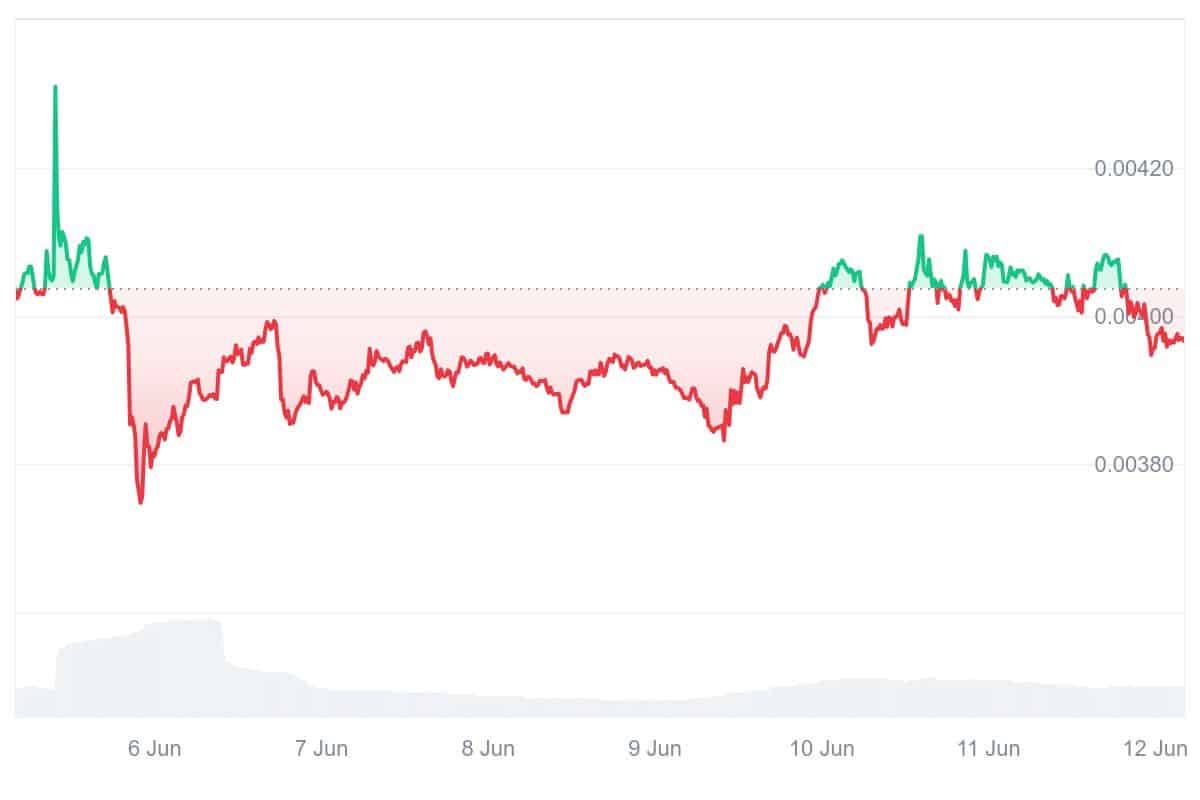

FLR is now trading at about $0.0188, well below its all-time high of over $0.70 in August 2022. However, the fact that it is trading inside a small intraday window of $0.0184 to $0.0194 indicates low volatility and market anticipation of impending events.

Flare’s ecosystem is being fueled by EVM compatibility, on-chain data protocols are drawing startups like LayerZero, Arkham, and Ankr, and it has sponsored multiple hackathons with Google and ETHGlobal.

3. Aptos (APT)

Former Facebook developers created Aptos to solve the scalability and developer experience issues that older blockchains like Ethereum continue to face. It was born out of the ashes of Meta’s unsuccessful Diem project.

In late 2024, Aptos partnered with Myco to decentralize content delivery. With grants, hackathons, and infrastructure to speed up adoption, its foundation supports more than 200 ecosystem projects, with a focus on DeFi, wallets, tooling, gaming, and NFTs.

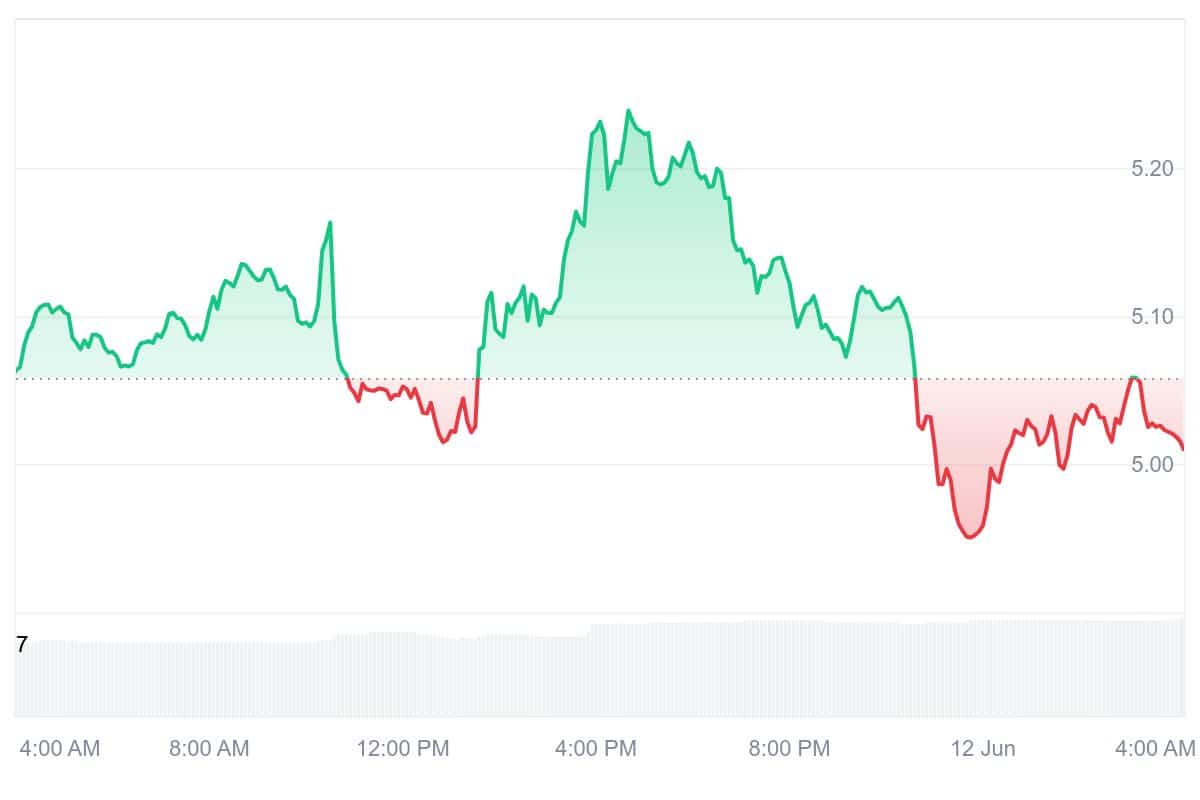

Although it has dropped almost 75% from its January 2023 peak of $19.86, APT is currently trading at about $5.03 and appears to be stabilizing. The range of $4.95 to $5.23 that exists today represents recent consolidation following a decline. The market value of APT is close to $3.16 billion, its fully diluted valuation is roughly $5 billion, and its 24-hour volume is well over $340 million.

Earlier today, @AptosLabs' @SolomonTesfaye_ joined @fintechTVglobal from the NYSE to talk on-chain credit, tokenization, and the next phase of digital assets.

→ Aptos is bringing the world's economy on-chain & enabling the peak of money movement.

Watch: https://t.co/aybpLTd0Fi pic.twitter.com/cbSxXEC061

— Aptos (@Aptos) June 10, 2025

Enterprise usage is also becoming more prominent. For example, the Aptos Ascend initiative, a collaboration between Microsoft, Brevan Howard, and SK Telecom, intends to provide decentralized finance solutions for institutions that include privacy, KYC, and Azure AI connections.

4. Amp (AMP)

AMP distinguishes itself as one of the 6 best altcoins to invest in today by its specific emphasis on collateral guarantee for payments. It protects businesses from fraud, unsuccessful confirmations, and chargebacks by automatically covering failed transfers as ERC-20 collateral on the Flexa Network and progressively beyond.

Behind the curve, AMP is supported by Flexa’s innovative payments protocol with ConsenSys support. It also interfaces with other DeFi systems, like Chainlink, MoonSwap, DODO, Yield, and others, indicating potential for lending, escrow, stable transfers, and more.

With a market capitalization of little under $340 million, a daily turnover of about $10 million, and $68 million TVL locked in collateral pools through DefiLlama, trading activity is nevertheless active. Approximately 41% of its supply, more than 41 billion AMP, is currently staked, which reduces accessible liquidity and increases upside potential in the event of a spike in demand.

Read every word. ⬇️

The future of payments will be #PoweredByAMP. $AMP @FlexaHQ https://t.co/VwFQp2WqoF

— Amp (@ampdotxyz) June 11, 2025

In the future, the characteristics of the token economy are designed to strengthen value. Each transaction facilitated by AMP carries a modest charge that increases ongoing purchase pressure while stakers earn yield, and liquidated collateral reduces the number of tokens accessible. Due to the 41% already invested, this results in both incentive alignment and scarcity.

5. BTC Bull (BTCBULL)

Imagine earning free Bitcoin while riding a charging bull into the next Bitcoin boom. That is BTC Bull‘s thrilling promise. This is not only a meme currency seeking attention; it is a calculated move based on Bitcoin’s rise, intended to give holders a direct advantage when BTC reaches significant milestones.

When BTC hits $150K, you’ll wish you held.

BTC airdrops aren’t a meme. ⚔️ pic.twitter.com/Ee69wHgpcU

— BTCBULL_TOKEN (@BTCBULL_TOKEN) June 10, 2025

The hefty staking offer that increases excitement is even more alluring: early supporters are enticed with APYs that vary from 58% to over 60%, contingent on the presale stage they join. As investors practically watch their balance increase with both BTCBULL and passive BTC incentives, each Bitcoin milestone could trigger supply squeezes due to locked tokens, which restrict the amount of circulating supply.

For investors unsure whether to just hold Bitcoin or follow altcoin pumps, BTCBULL offers a special compromise: it tracks the rise of Bitcoin while providing increased upside through high-yield staking, token burns, and BTC airdrops. What could be more exciting than knowing that every Bitcoin price hike boosts both your Bitcoin and your entertaining digital token?

6. Optimism (OP)

Optimism was developed to address Ethereum’s scalability issue. It acts as a Layer-2 “rollup,” combining enormous volumes of off-chain transactions before posting them to Ethereum. While preserving Ethereum’s fundamental security and decentralization, this significantly reduces gas costs, expedites processing (to blocks of about two seconds), and reduces congestion.

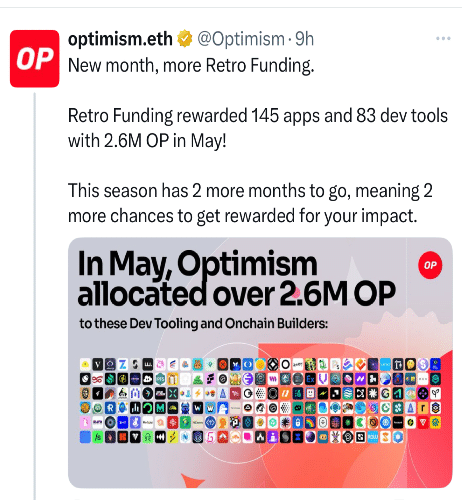

Before Ethereum L1 improvements, OP suggested a community vote at the beginning of June to improve Pectra compatibility. EIP-4844 was included in their ECotone version, which reduced transaction prices on the OP Mainnet by up to 90%.

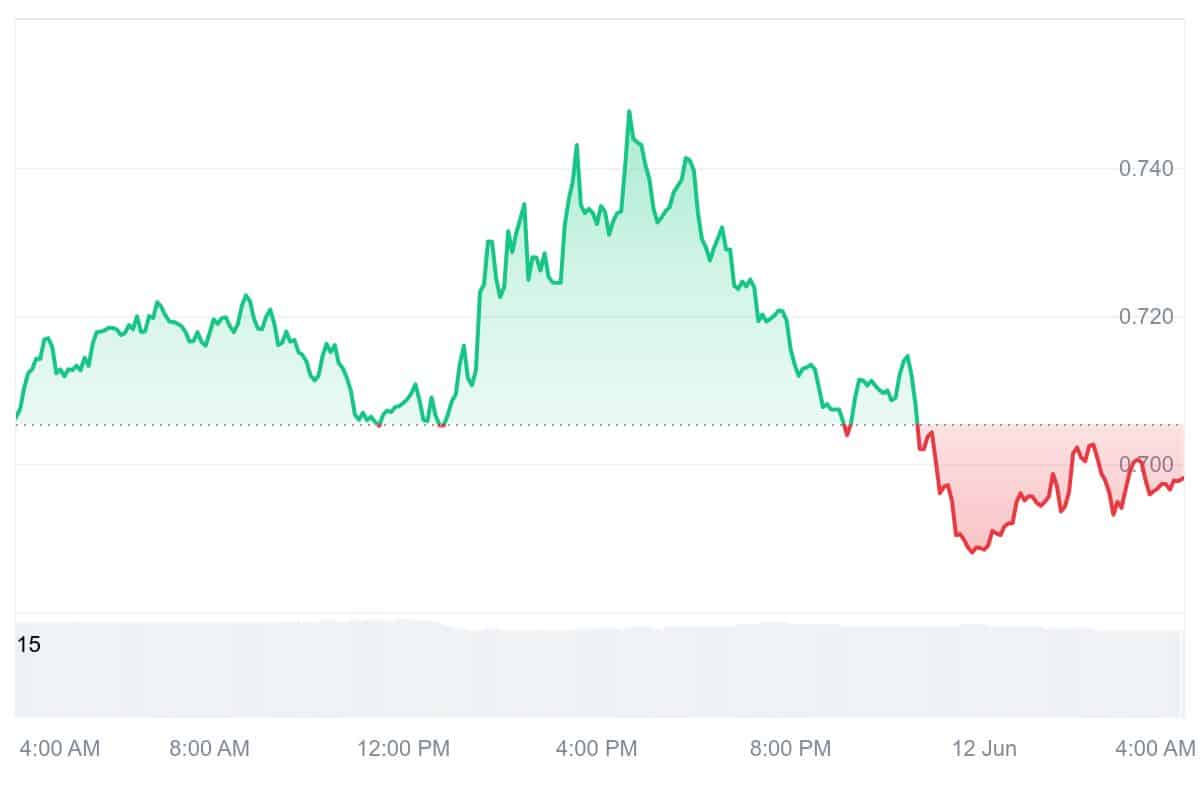

Despite a modest recovery from a cycle low of about $0.55 earlier this year, OP has lost roughly 62 percent so far this year. Technical analysis shows support is down at $0.55–0.58, and strong resistance forms at $0.61–0.64. Based on short-term estimates, the price will drop to $0.49 before rising again.

In early 2023, Coinbase introduced Base as the first OP-Chain, attracting millions of users to the ecosystem. Optimism has been explicitly expanded upon by decentralized tools like Mode and Fraxtal, game platforms like Zora, and the Oracle network Chainlink.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage