Join Our Telegram channel to stay up to date on breaking news coverage

Recent market turbulence has been fueled by several factors, including broader economic uncertainties like geopolitical tensions and the Trump administration’s revival of tariffs on Canada and Mexico. Despite the short-term volatility, experts like Matt Hougan, Chief Investment Officer at Bitwise Asset Management, remain optimistic about Bitcoin’s long-term potential.

Best Altcoins to Watch Today

Tokens from other asset classes are also experiencing a surge, particularly cost-effective alternatives that appeal to a wide range of investors. As the crypto landscape shifts, many are keeping a close eye on emerging opportunities, making it crucial to identify the Best Altcoins To Watch Today.

1. Zcash (ZEC)

Zcash has built a strong reputation for its focus on privacy. It offers users the ability to conduct shielded transactions that hide the sender, recipient, and transaction amount. This is achieved through advanced cryptographic methods, particularly zk-SNARKs, which ensure that financial data remains confidential. This privacy-first approach has made Zcash a valuable option for individuals and businesses that prioritize anonymity in their financial dealings.

Recently, the network has taken a significant step toward transitioning to a hybrid Proof-of-Stake (PoS) model. Zcash founder Zooko Wilcox has joined Shielded Labs as head of product to help accelerate this shift. The move is designed to improve scalability, sustainability, and overall network efficiency while reducing the downward pressure on ZEC prices caused by traditional Proof-of-Work (PoW) mining. This shift could lead to a more stable price environment for ZEC in the long run.

what is the zcash-devtool?

a platform for hacking on @Zcash https://t.co/8m9jzfwN4T pic.twitter.com/RAVqaln6OY

— Electric Coin Co. (@ElectricCoinCo) March 26, 2025

ZEC has demonstrated strong performance despite its price fluctuations. Over the past week, it has surged by 18.38%, reinforcing its history of high returns. Looking at long-term performance, ZEC has averaged an impressive 110.09% annual growth over the last decade. Notably, one of its most remarkable spikes occurred in 2017 when it skyrocketed by 958.09%, making it one of the top-performing assets of that year.

In terms of adoption, the major cryptocurrency wallet MetaMask has pledged $150,000 to develop a MetaMask Snap specifically for Zcash transactions. This integration aims to make Zcash’s privacy features more accessible, potentially driving greater adoption within the broader crypto ecosystem. As Zcash continues to evolve, its commitment to privacy and scalability improvements positions it as a strong contender in the cryptocurrency space.

2. JUST (JST)

JUST has carved out a crucial role in the decentralized finance (DeFi) sector by providing a fair and transparent lending system on the TRON blockchain. It operates through a dual-token system: USDJ, which serves as a stablecoin, and JST, which functions as the governance token. JST holders play an active role in maintaining the platform, paying transaction fees, voting on governance proposals, and ensuring smooth operations.

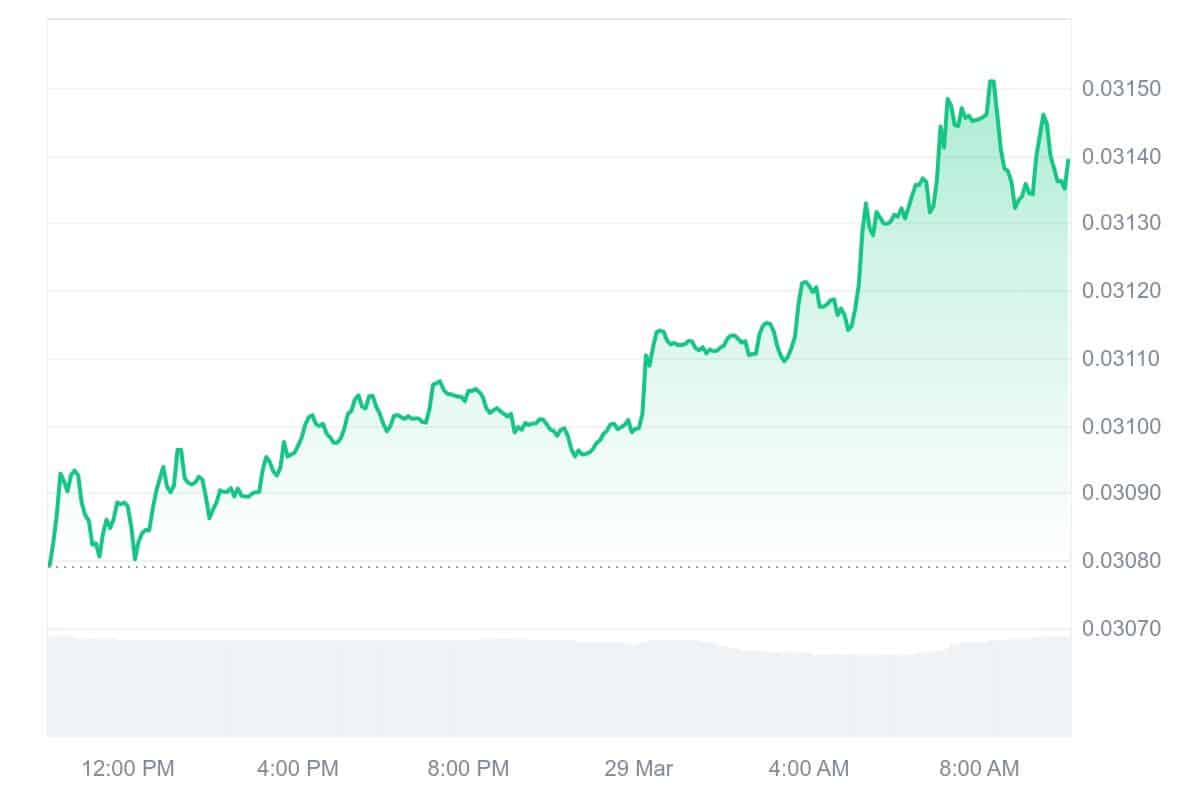

At present, JST is valued at approximately $0.03139, with its price fluctuating between $0.03161 and $0.03004. Despite facing minor downward pressure, investor confidence remains strong, highlighting the token’s resilience. The JUST platform’s seamless stablecoin lending system fills a significant gap within the TRON DeFi ecosystem, making it an essential player in the space.

JUST has also been making strides in the lending sector. The JUST Foundation recently provided insights into market activity within #JustLendDAO, its lending protocol. TRX leads the platform with a supply value exceeding $3 billion, followed by STRX at $1.86 billion and BTC at $760.65 million. These figures reflect JUST’s growing influence and solidify its position in DeFi lending.

Exciting times ahead in DeFi! #JustLendDAO is here to lead the way, dedicated to creating a seamless and efficient #DeFi experience. We’re unlocking the true potential of decentralized finance for everyone. https://t.co/2N8OJ2A6Rx

— JUST DAO (@DeFi_JUST) March 28, 2025

Additionally, JUST announced the launch of USDD 2.0 Market Supply Mining Activity III. This initiative allows users to earn rewards by supplying $USDD on JustLend DAO. Running from March 29, 2025, to April 26, 2025, participants can receive an 8% APY, though the rate will be adjusted daily based on market conditions. This program offers a lucrative opportunity for users to grow their holdings while bolstering liquidity within the USDD ecosystem.

3. MX Token (MX)

MX Token plays a central role in the MEXC ecosystem, serving as a governance token that empowers users to participate in decision-making, vote on business developments, and vote in team elections. Additionally, MX holders gain access to exclusive events like Launchpad, Kickstarter, and M-Day, where they can receive free airdrops and vote on new listings.

Despite market fluctuations, MX has remained strong, recording a 30% price surge over the past month. This upward trend signals increasing investor interest and confidence in the token’s potential. One of its most notable recent developments is its deeper integration with the Binance Smart Chain. This expansion enhances MX’s interoperability, making it more accessible within the larger cryptocurrency landscape.

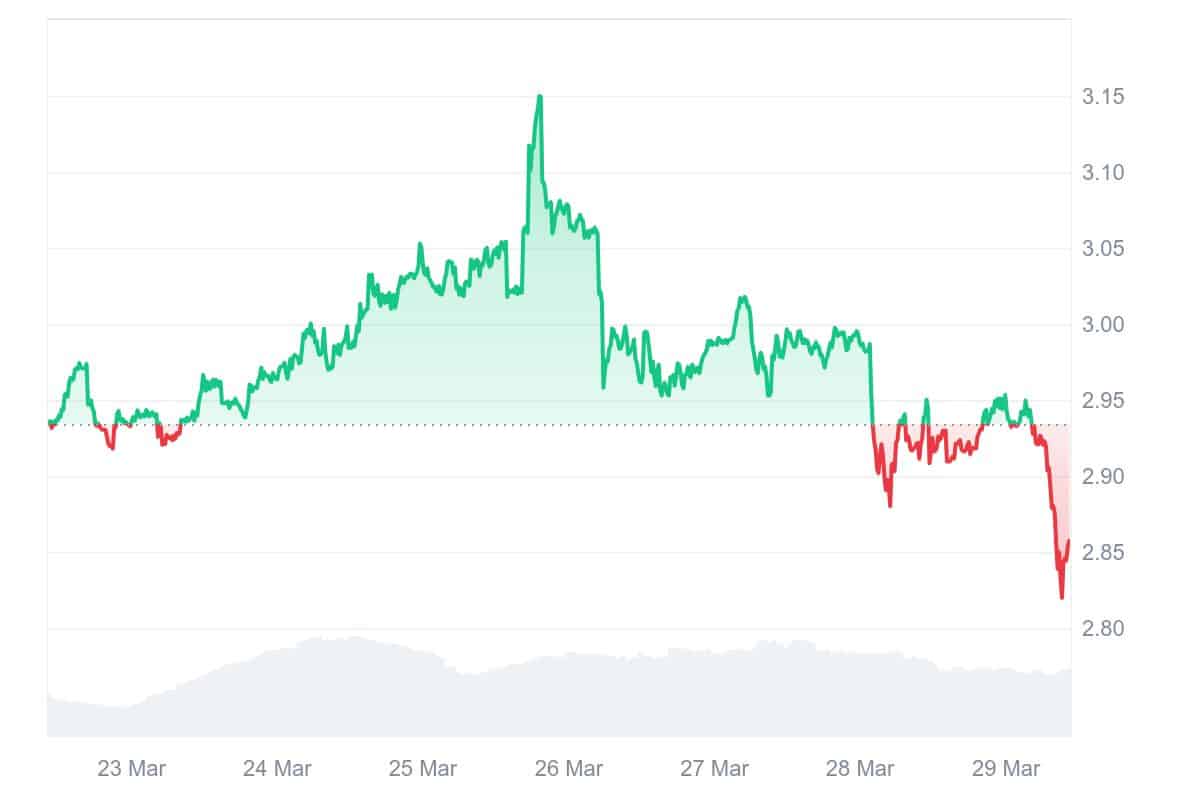

Currently, MX is priced at $2.85, with a daily high of $2.953 and a low of $2.82. The 24-hour trading volume is approximately $15.47 million, demonstrating a moderate level of liquidity. Its market capitalization of around $271.34 million positions it as a mid-cap cryptocurrency with room for growth.

The first round of #MEXC DEX+ Rising Star ends in less than 24hrs!

🏆Top 3 projects: $TIM, #GHIBLIDOGE, & $SPX

Trade your favorite project to No. 1 on DEX+ and clinch a listing on MEXC 👉https://t.co/jNALqfW1fx https://t.co/2GMABceLVo

— MEXC (@MEXC_Official) March 29, 2025

The MX Token is more than just a governance tool—it plays a crucial role in driving user engagement and community participation on the MEXC Exchange. Thanks to a unique combination of governance privileges, airdrop participation, and strategic partnerships, MX is growing within the crypto market.

4. Solaxy ($SOLX)

As MX continues to grow, investors are rushing to buy a new Solana layer 2 project called Solaxy (SOLX). Solana boasts a $65 billion market capitalization and a theoretical throughput of 65,000 transactions per second, yet its rapid growth has led to congestion issues that slow performance during peak periods. The same features that attracted millions—fast transactions and low fees—have now become a challenge for the network.

Solaxy is stepping in to solve this problem by enhancing Solana’s efficiency with transaction bundling and off-chain processing. The project has already gained strong investor support, raising over $28.4 million in funding.

You never know what you'll run into in the Solaxy. 🪐

One thing is for sure though.. You'll never find another $SOLX 🛸🔥 pic.twitter.com/14RLEfFdtc

— SOLAXY (@SOLAXYTOKEN) March 28, 2025

While designed to integrate with Solana, Solaxy will first launch on Ethereum, and a bridge connecting both blockchains is being developed.

Beyond improving scalability, Solaxy also offers passive income opportunities through SOLX staking, with an impressive 144% annual yield. Moreover, 99Bitcoins, a popular crypto channel on YouTube with over 725K subscribers, says SOLX might soar 10x after launch.

Investors can still join the presale at $0.001678 per token, which can be purchased using BNB, ETH, USDT, or a bank card. With a price increase set in just over a day, securing SOLX now could be a strategic move.

5. Akash Network (AKT)

Akash Network stands out as a decentralized, open-source marketplace for cloud computing resources. By offering a permissionless platform where developers can buy and sell computing power, Akash provides a cost-effective and flexible alternative to traditional cloud services.

One of the biggest advancements within the ecosystem is the launch of AKT 2.0. This update is designed to enhance network efficiency by optimizing transaction processing and ensuring stable payments. By adjusting take rates and introducing steady payouts, AKT 2.0 aims to create a more balanced incentive structure for both providers and users.

The price of AKT has seen significant fluctuations over the past year. It reached a peak of $6.22 but also dipped as low as $1.06. Currently, AKT is trading approximately 83% below its all-time high of $8.08, which was recorded in April 2021. While volatility remains a factor, the network’s continuous development and strategic partnerships indicate strong long-term potential.

Live on AkashChat: Llama-3.3-Nemotron-Super-49B-v1

This is the most recent AI model released by NVIDIA — optimized to improve reasoning, coding, and task performance while using less memory and supporting longer inputs.

Available today to use for free in AkashChat. pic.twitter.com/sqrgOSFP0V

— Akash Network (@akashnet_) March 28, 2025

Akash Network has also strengthened its presence through collaborations with major blockchain and AI projects, including Cosmos. These partnerships have expanded its utility, making it a key player in the blockchain cloud computing space. By providing a decentralized infrastructure for developers, Akash is redefining the way cloud computing operates and continues to push the boundaries of what’s possible in the crypto industry.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage