The native currency of the FTX derivatives exchange platform is FTX token, which has the ticker FTT. According to the whitepaper, serves as the exchange’s backbone and propel the platform forward. The coin, which was originally intended for trade incentives, now serves additional purposes inside the ecosystem.

Users get a discount on trading fees based on the number of FTT tokens they own. FTT can used as collateral for futures trades, and to offer liquidity to the exchange in exchange for VIP rewards.

If you’ve made a good ROI over the 2021 bull market with FTT, this guide as part of our sell cryptocurrency series explains how to sell FTX token and take profit on a portion of your holdings.

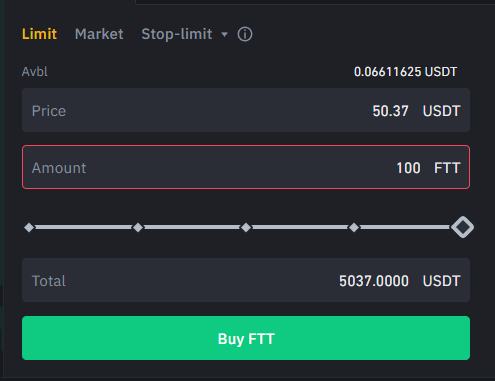

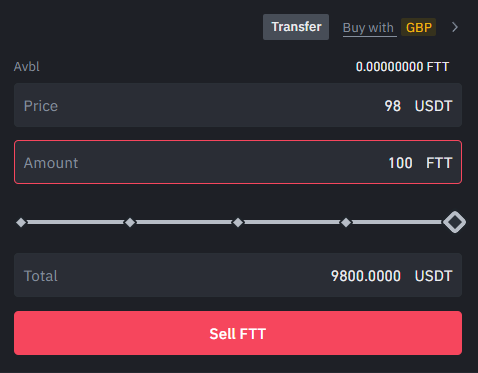

FTT hasn’t been listed on eToro yet but since its a popular altcoin we expect it to be added soon. eToro is an FCA, ASIC and CySEC regulated exchange that makes it easy to sell cryptocurrency to fiat, supporting bank transfers, Skrill, Neteller, Paypal and other payment methods. As well as Binance, you can trade and sell FTX token on ByBit, KuCoin, Coinbase and Bitfinex. You can also trade FTTUSDT perpetual futures on Binance and ByBit. Those are two options if you want to short sell FTT on leverage, and FTX exchange itself. It isn’t yet available at many other CFD brokers. FTX Token (FTT ) is one of the world’s most valuable cryptocurrency, with a market capitalization of approximately six billion dollars. Fifty-six dollars is the current price of FTX Token. Throughout a twenty-four-hour period, prices may vary from fifty-seven dollars to fifty-five dollars. On the FTX cryptocurrency exchange, FTT is the utility token. It may be used as collateral against futures contracts or to minimize trading costs on the exchange. It may also be staked to earn interest and win NFTs. The CEO of FTX is an MIT graduate who previously worked at Jane Street Capital before co-founding the company with Gary Wang. Former Google software engineer Wang is the company’s CTO. The market capitalization is about six billion dollars. FTT is not accessible on any of the main cryptocurrency exchanges in the United States. The well-known cryptocurrency exchange has had a fantastic few months. Following a flurry of announcements, the price of its utility token, FTT, has surged by more than one hundred and thirty percent in only six weeks. Binance FTT price chart 2020 – 2022 Trading in crypto derivatives, including options and futures, is available at FTX. FTX utilizes leveraged tokens instead of conventional margin trading, which allows traders to double their profits or losses. Customers may take a leveraged position without having to deal with the hassles of full margin trading. Because of the limitations on retail derivatives trading, FTX.US offers a restricted range of services. Derivatives are sophisticated trading instruments that include trading contracts to purchase or sell a coin without having to possess the underlying asset. Traders may use them to predict whether a market will increase or collapse. FTX was founded to address a variety of issues that previous derivatives exchanges have, including low liquidity, lengthy trading procedures, and clawbacks. When money is seized from different investors to fund another person’s bankruptcy, clawbacks occur. FTX is a major bitcoin derivatives exchange around the globe. Users may access a variety of services on the exchange, including leveraged tokens, futures, and an over-the-counter trading facility. Because of its recent success, FTX has become the preferred crypto investing platform for many institutional customers. Other well-known exchanges like Binance are among the exchange’s major competitors. With so many cryptocurrencies to select from, it’s critical to purchase coins with strong fundamentals and the potential to grow in value over time if you’re investing for the long term. Even so, always invest money you can afford to lose since the cryptocurrency market is notoriously unpredictable and dangerous. FTX seems to be positioned for long-term success as an exchange, which speaks well for FTT. It has a fantastic team and a well-defined business strategy that outlines both the issues it wants to tackle and how it intends to solve them. And, unlike many other cryptocurrencies, it has a clear application. Furthermore, the new partnership with Ledger X may help FTX.US expand its product offerings and set itself apart from the country’s more established crypto exchanges. FTX is now successful worldwide, but its client base in the United States is restricted due to product limitations. However, as US officials examine how to effectively tighten crypto exchange rules, all kinds of derivatives trading are likely to be scrutinized. Crypto exchanges collaborate with authorities to ensure regulatory compliance. Another problem is that FTT is difficult to get in the United States. U.S. citizens are not allowed to deal in FTT, according to FTX’s website. While it is feasible to purchase FTT on a decentralized market, dealing in unregistered tokens has extra risks. Limit order to buy 100 FTT (worth $5000) at Binance When investing inFTX Token, there are a few things to keep in mind. Investing in a cryptocurrency linked to a respected exchange may seem to be a sensible option. However, it is essential to take into account all variables. The core team of FTX includes well-known crypto celebrities such as Gary Wang and Sam Bankman-Fried, the project’s creators. Bankman-Fried worked as a trader at Jane Street Capital before founding FTX, and he is now the CEO of Almeda Research. Wang has worked with companies like Facebook and Google in the past. Both of them are MIT grads. FTT incorporates several unique features, including clawback protection, a centralized collateral pool, and global stablecoin settlement, according to the business whitepaper. The coin, according to FTX, is capable of handling large transaction volumes and will stay stable during times of high market volatility. A fixed supply limit of three hundred and forty-five million dollars has been set for the coin. The majority of today’s crypto exchanges use collateralized assets that are distributed across several wallets. Traders may find it difficult to execute transactions as a result of this. Stablecoins are used to settle FTX derivatives, and just one global margin wallet is required. These kinds of innovations may increase FTX usage, resulting in increased demand for the FTT token. You may cash out your FTT at the same exchange where you purchased it: Setting a limit order to sell at near $100 on Binance In the United States, crypto taxes do not yet exist. The US is proposing a new infrastructure law that would require crypto companies operating in the US to file tax returns. Because cryptocurrency is decentralized, imposing tax responsibilities on its owners may be difficult. The use of cryptocurrency for illicit purposes has long been a source of worry for US officials. As a result, they are attempting to create laws that would include and protect against such actions. Around the world, there are many controlled and decentralized exchanges. Crypto exchanges are often used to make cryptocurrencies available to investors and enthusiasts. They also offer platforms for crypto traders to trade such asset types. Despite having a single goal, these platforms may provide a variety of services. This implies that, in addition to buying and selling cryptocurrency, these exchanges may provide other services. As a result, your requirements will determine which exchange is best for you. Some crypto exchanges have managed to stand out and connect with thousands of individuals across the world, even though there are many. This is not because the services they provide are unique, but rather because they go above and beyond to ensure their customers’ satisfaction. The top crypto exchanges are distinguished by a set of recognizable characteristics. User-friendly interface, security, effective customer service, a growing community, and a tutorial on how to utilize the exchange are among these criteria. In light of the above, several exchanges have been able to pass these characteristics on to their users to provide the best service possible. Other exchanges have fallen short of these benchmarks, with fewer signups and lower daily trading volume than the former. A few exchanges let their clients utilize copy trading or trading bots services, providing premium services to its users. Traders who aren’t cut out for manual trading may replicate deals from other experts or use bot trading to automate the process. We’ve compiled a list of the top cryptocurrency exchanges and brokers available: If you’re going to invest and sit back, you’ll have to keep an eye on the price of FTT, particularly if you don’t have a goal price in mind. It may be difficult to keep track of an asset’s price since you need to be aware of what’s going on in the crypto market to decide whether to sell or retain your FTT holdings. Essentially, the investing strategy you choose determines your ability to sell your FTT assets. If you choose a short-term approach, you must wait until the appropriate moment comes to exchange your FTT. As a result, there is no one-size-fits-all approach to selling. When your investing plan says so, it’s the appropriate moment. Given the volatile nature of the crypto market, a lot may happen in the time between when your investment reaches the goal you set. A piece of negative news may have an impact on any open positions or holdings you have. This is why anytime you wish to invest, you should always do research. Even when the transaction is heading in the wrong direction, the analysis keeps you in check. You may have to wait longer than required to strike your target. FTT and other cryptocurrencies are kept in digital wallets. Cryptocurrency investors and holders may store their digital assets in a variety of ways. Some people keep their money in software wallets, while others put it in hardware wallets, also known as cold storage wallets. They may also leave their tokens on the exchange after they buy them. eToro have a free wallet with an unlosable private key that supports 120+ cryptos. Update – As of 2025, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Crypto trading is an activity that requires a high level of commitment from traders. Aside from examining charts, traders usually keep up with significant market developments by reading news reports. Combining such tasks may be exhausting. If he splits his attention between other commitments and the charts, one or both of them may suffer. He is prone to making expensive trading errors on occasion. With the introduction of trading bots, automated trading has come to the rescue of these traders, making trading simple for them. As a result, they are not required to participate actively in the trading process. Trading bots automate the trading process, allowing traders to focus on other tasks. To buy cryptocurrency and sell it at optimal prices, trading bots use algorithms. They do, however, need some human interaction to operate well. They cannot operate independently; instead, a trader must activate a trading range based on his approach, which these bots rely on. Trading bots can to react to market opportunities quicker than humans. Suddenly, Bitcoin has piqued everyone’s attention. Of fact, you may have acquired a similar passion, but you are concerned about the outcome. When investing in cryptocurrency, one must exercise caution. A crypto investor is supposed to have a variety of additional characteristics. It’s important to realize that no one influences the market. As a result, it must be maneuvered with care. Greed is a significant issue that most traders face. A trader is one step closer to being an expert if he can resist the temptation to be greedy. The market may be extremely unexpected at times. During such times, a crypto trader should stay away from the market. Also, as a trader, you should never trade vengeance. This entails attempting to recover from a loss after it has occurred. Trying to make up for losses by trading may result in even greater losses. The best thing to do at this point is to take a step back and rethink your strategy before returning to the market, not to recoup your losses. When you make a profit, you may sell your FTT tokens. Before selling your FTT in 2025, keep the following in mind: If you are an international FTX client, owning FTT has many advantages, including lower costs and the opportunity to earn income on your investments. Regulatory changes are the token’s greatest danger if you’re not an FTX client and want to invest in it. Stronger restrictions on crypto derivatives in the United States and across the globe may stymie FTX’s ambitions to expand its presence in the US market and have an effect on its overseas operations. However, if FTX is successful in working with authorities as planned, the price may rise much higher. FTT has a market value of more than six billion dollars and a daily trading volume of more than thirty million dollars. Because it is a digital asset, it can be easily purchased, saved, and sold. Apart from the brokers mentioned above, FTT may soon available on more exchanges. You can close positions to sell FTT on eToro once its listed there – that’s an easy-to-use platform. You may exchange the asset for USDT or your home country’s fiat money, then withdraw to your local bank account. FTT may be kept in either a hardware or software wallet. If you want to purchase a cryptocurrency, you should do it after doing your research and not because the asset seems to be lucrative. Invest just what you can afford to lose, as the saying goes. The crypto market is very volatile, and it cannot be traded based on hope or conjecture. This article may serve as a reference guide for you to refer to anytime you wish to invest in FTT. Read more:

We suggest selling FTT through an exchange in this tutorial since you will be assured safety and get your fiat. There are a variety of different ways to sell. P2P is another option, although it's a little dangerous.

When you utilize a broker like eToro, you can sell your FTT in minutes with only a few clicks. Withdrawal alternatives are also available on the exchange.

To sell FTT, you may utilize a variety of brokers. Expert traders who have looked into choices, however, believe the following to be the finest. Capital, eToro, Libertex, Coinbase, Plus500, Binance, Revolut, AvaTrade, Changelly, and Cryptorocket are the names of the exchanges.

Currently, there are no taxes associated with owning FTT.

You'll need an exchange that allows you to pay using your local bank or a third-party payment provider to sell your FTT for USD. Coinbase, eToro, Binance, and AvaTrade are some of the finest options.

Capital, eToro, Libertex, Coinbase, Plus500, Binance, Revolut, AvaTrade, Changelly, and Cryptorocket are among the exchanges where FTT may be purchased.

You'll need an account with eToro or one of the other exchanges mentioned above to rapidly sell your FTT. It doesn't take long to set up your account. If you already have FTT, you may transfer them to the exchange's wallet and sell them there right now.

To sell FTT for cash, set up a withdrawal channel on eToro or any of the other exchanges mentioned above. Make sure you've chosen your preferred currency. When you make a withdrawal, the exchange assists you in converting your money to cash and deposits them into the appropriate channel.

Only four cryptocurrencies are supported by PayPal: Bitcoin Cash, Bitcoin, Litecoin, and Ethereum.

Some wallets allow you to sell your FTT on the spot. You must integrate a payment mechanism and complete the required steps to sell FTT on wallets to sell them.

On exchanges like Coinbase or eToro, you may often exchange your FTT for other cryptocurrencies. The real value of FTT sold reflects on the crypto you select after you've completed an exchange. On this Page:

How to Sell FTX Token in May 2025

Best Exchange to Sell Cryptocurrency

[fin_table id=”14127″]

Compare Crypto Brokers & Exchanges

[side_by_side_comparison id=”14147″ type=”Crypto”]

What Is FTT?

Buying FTT

How to Purchase FTX Tokens

What Is The Best Way To Sell FTX Token?

Cryptocurrency Taxation in the United States

The Best Cryptocurrency Exchanges

When Is The Best Time To Sell My FTT?

FTT Storage in the Best Wallets

Trading Strategies for Automated Trading

How to Invest in Cryptocurrency Safely

Is it a good idea to sell FTX Token in 2025?

Conclusion

FAQs

Where Can I Buy FTT?

How Simple Is It to Sell FTT?

Which Brokers are the Best for Selling FTT?

What are the Taxes on FTT Sales?

Where can I sell FTT in US Dollars?

What Exchanges Offer FTT for Purchase?

How to Sell FTT Quickly

How to Make Money Selling FTT

How to Make Money Selling FTT on PayPal

What is the best way to sell FTT from your wallet?

How to Exchange FTT for Cryptocurrencies