Curve is a program that operates an automated market service focusing on stablecoins using different cryptocurrencies. Curve, one of the newest decentralized financial protocols based on Ethereum, allows users to trade using pools of cryptocurrencies rather than a central order book, allowing them to earn fees on their deposits.

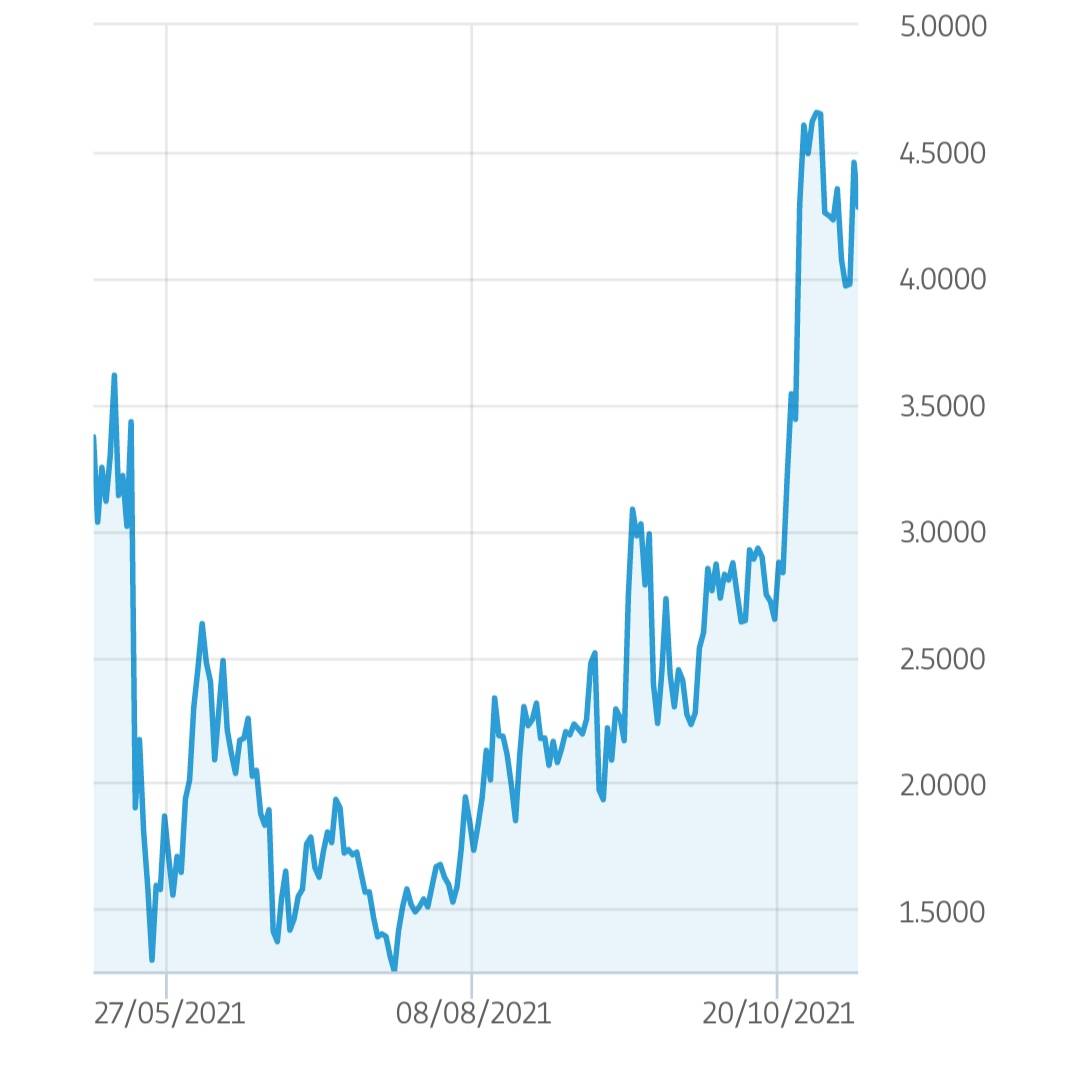

Curve, like Balancer and Uniswap, allows cryptocurrency users to earn fees on their assets while also allowing traders to purchase and sell them at lower rates. Curve differs from comparable platforms in that it focuses on stablecoin markets that monitor the price of US dollars as well as stablecoins that track the price of Bitcoin. Curve’s purpose is to enable stablecoins to be traded with cheap fees and minimum price movement because of the range of alternatives available on the market, each with its amount of risk. Curve is a popular Defi platform since it prioritizes consistency over volatility. Curve is a well-known Automated Market Maker technology that allows users to trade tokens efficiently while keeping cheap fees and little slippage by allowing liquidity pools made up of assets that behave similarly. Liquidity providers that provide tokens to the pools benefit from this method since their costs are reduced. Curve motivates them to participate by integrating with third-party DeFi technologies and rewarding them with CRV tokens and interest. Curve is a platform that looks a lot like Balancer and Uniswap, but it differs in that it only accepts liquidity pools made up of assets that behave similarly, such as stablecoins or wrapped versions of assets like tBTC. Curve can provide the lowest costs, employ more efficient algorithms, and avoid the loss of any decentralized exchange on Ethereum thanks to this strategy. Curve was founded in 2020 to produce a low-fee AMM exchange while also providing liquidity providers with an efficient fiat savings account. Curve enables investors to avoid more volatile crypto assets while still earning high-interest rates via lending procedures by concentrating on stablecoins. The Curve model is more conservative than other AMM platforms in that it minimizes volatility and speculation in favor of stability. Curve does not attempt to maintain the values of various assets in proportion to one another. Curve may now concentrate liquidity towards the optimal price for similarly valued assets, ensuring that liquidity is available when it is most required. As a result, Curve may achieve a considerably greater liquidity utilization with such assets than would otherwise be achievable. You may earn fees on an AMM exchange like Uniswap anytime a deal is made. Trading costs on Curve are cheaper than on Uniswap, but interoperable tokens may be used to gain incentives outside of Curve. The Curve protocol began its road toward decentralized governance in August 2020, when it launched a decentralized autonomous organization to handle protocol modifications. The majority of DAOs are governed by governance tokens, which provide token holders voting rights. The CRV token is in charge of the Curve DAO in this situation. The CRV token may be purchased or earned via agricultural yields. When you put assets into a liquidity pool, you are rewarded with tokens. You earn the CRV token in addition to fees and interest by contributing DAI to an authorized Curve liquidity pool. Yield farming the CRV token improves the incentives to become a Curve liquidity provider since you earn not only a monetary asset but also ownership of a powerful DeFi system. Anyone with a certain amount of locked CRV tokens may submit an upgrade to the Curve protocol. Fees can be changed, fees can be moved, new liquidity pools can be created, and yield farming awards may be adjusted. By locking up CRV tokens, holders vote on whether to approve or reject a proposal. The more voting power the CRV token has, the longer it is locked up. It is impossible to sell CRV tokens without the assistance of a broker. The majority of investors choose to sell CRV via a broker, sometimes referred to as an exchange. Aside from selling and purchasing cryptocurrencies, you may do other things on an exchange. In terms of selling, we’ve included a few exchanges in this article where you may safely swap your CRV tokens. Also, keep in mind that these exchanges have been thoroughly evaluated by industry professionals and are regarded as trustworthy by experienced investors and dealers. These brokers provide a variety of services. Users may swap their CRV tokens for USDT or any other cryptocurrency or fiat pair offered on their platforms. Most traders choose to swap their CRV tokens for Tether since the stablecoin’s price has little or no fluctuation. The aforementioned brokers are some of the most well-known cryptocurrency brokers in the world. Apart from adhering to current rules in the countries where they operate markets, they also boast a slew of unique features aimed at making trading more fun for their customers. When looking for a broker, there are a few things to look for, and the lack of them might be a warning indicator. Brokers and exchanges, for their part, strive to meet their consumers’ expectations, beginning with an easy-to-use trading interface. Traders do, however, have preferences when it comes to trading through a broker vs trading on an exchange. Numerous trading pairings, security, and dependable customer assistance are only a few of these choices. These exchanges were chosen based on their repute among other exchanges. The CRV coin, in particular, has a lot of liquidity on its platforms. Traders value liquidity since they can’t readily trade the CRV token if it’s not available. Due to the large trading volume on these platforms, traders also participate in futures trading in addition to buying and selling CRV. It’s just as simple to sell a CRV as it is to acquire one. Because of its DeFi protocol, CRV is in great demand. As traders look forward to borrowing other tokens to execute deals, the lending protocol has led to the DeFi industry’s massive development. The fact that CRV is a decentralized protocol has piqued traders’ curiosity. Interest rates in the mainstream sector are often high, and the inconveniences that come with a centralized system might be a turn-off when trying to get a cheap rate. There is also a facility for so-called “flash loans” on CRV. This allows traders to get loans without having to put up any kind of security. However, whatever transaction the trader uses such a loan for must be finished in a short amount of time, which is typically 10 seconds since transactions on the Ethereum blockchain are added to the block within that time frame. Otherwise, the transaction will be voided, and it will be treated as if no loan had ever been taken out. We’ll use eToro, a popular cryptocurrency broker, to sell CRV. eToro has been mentioned in all of our bitcoin buying and selling recommendations. Millions of people utilize the eToro site, which provides a large selection of cryptocurrencies and trading pairings. The cryptocurrency exchange is situated in the United States and has only limited jurisdiction. As a result, if you’re in Africa or portions of the Middle East, you won’t be able to use the site. eToro features a user-friendly trading platform that makes it easy for traders to sell CRV and other cryptocurrencies. Even if you’re a complete novice, you may use the site to sell your CRV assets. If you want to sell your CRV on eToro, you must complete the five procedures listed below. You may sell CRV on the platform if the procedures below are done correctly. You can’t sell a CRV unless you own it or have it in your possession. Purchasing the DeFi token is the first step in the process of selling it. Users may purchase CRV on eToro, or they can buy it from another broker and sell it on eToro. CRV may only be purchased by verified users on eToro. As a result, after you’ve created an account, you’ll have to go through a verification procedure. eToro allows you to deposit dollars into your account once you’ve validated your account and the information you provided. The stablecoin USDT is preferred by many traders. You may deposit dollars into your eToro account using a variety of methods. You may transfer currency to your eToro account using your credit/debit card, local bank account, or third-party payment services like Skrill, PayPal, or Neteller if you choose. Buy CRV You may either purchase CRV directly in the fiat currency deposited or buy USDT first and then buy CRV after the funds have reflected in your account. Alternatively, you may utilize the platform’s demo account. Every user at eToro is given a sample account to evaluate the site and determine whether it fulfills their needs. Everyone who invests in a crypto asset hopes to earn. It’s important to know when and where to acquire an item, but it’s equally important to know when and where to sell it. No trader or investor purchases cryptocurrency with the expectation of losing money. Even investors who acquire crypto assets to hold them for the long term are aware when they are in profit and may sell. Cryptocurrencies are very volatile investments, with values that may plummet at any time. Having a sell objective is usually a good idea. You are more likely to lose money in the negative direction of the market if you do not do so. CRV Chart To assist traders in making informed trading choices, eToro has given trading charts for all crypto assets, including CRV. Candlesticks and patterns are used in these charts to analyze previous and current price movements across various periods. You can also use these charts to figure out when it’s a good time to purchase CRV or other cryptocurrencies. When you click on CRV on the cryptocurrency interface, you’ll be sent to a page where you may purchase or sell CRV. Because eToro provides a variety of crypto assets and trading pairings, you may have additional assets in your account than CRV. The asset, CRV, is the subject of this tutorial. Knowing the overall worth of your portfolio will enable you to assess if the quantity of CRV you desire to sell is sufficient. The least amount that may be withdrawn from eToro is $30. So, before you sell, you should have at least that much CRV. CRV Overview Click the top left corner of your dashboard to see the value of CRV in your portfolio. You can view all of your crypto assets and their values by clicking on the icon. Apart from CRV, you may click on any other asset you want to sell. Before you may sell the item, you must have the necessary withdrawable amount. You may hold an open position on the CRV coin while trading on eToro. If you don’t have a sufficient quantity of the token in your wallet that isn’t part of the open position, you may not be able to sell. If you keep your tokens instead of selling them, you risk losing whatever profits you’ve earned on the crypto asset. The comparable balance in your portfolio is shown after converting your tokens to cash or stablecoin. It may be decreased in certain cases owing to a phenomenon known as slippage. When an asset settles for a price that differs from the original price objective, this is known as slippage. This might happen in a favorable or bad way. CRV Trade If you wish to cancel an active position on CRV via your eToro account, go to the portfolio icon and see all of your assets. There, you may choose CRV, which will lead you to the trading area. You may select whether to sell your whole CRV or only a piece of it in this area. You may, on the other hand, utilize the search icon to hunt for a certain CRV combination and still end up in the trading area. The equal value of the conversion is now available for withdrawal. You may use your local bank account or credit card to withdraw the funds. Withdrawing money from eToro is a straightforward procedure as long as you’ve completed the necessary verification steps. There are times when withdrawal issues may develop, but they are unlikely to occur if you already have a plan in place. It’s also possible that a user is logging in from a nation where the platform isn’t available. Incomplete verification, issues while initiating withdrawals, and missing withdrawal channels are examples of other scenarios. eToro is committed to making withdrawals as simple as possible on its platform. Every cryptocurrency offered on eToro’s platform may be liquidated, according to the company. You may transfer your CRV to fiat currency at any moment. While some other exchanges set a larger minimum withdrawable amount, eToro set it low. This demonstrates that eToro is user-friendly not just in terms of the user interface, but also in terms of the costs charged for each transaction made on the exchange. In the United States, there are presently no taxes on cryptocurrencies. The proposed infrastructure bill, on the other hand, proposes to tax capital gains inside the nation, with different tax rates for short and long-term gains. When it comes to taxes on short and long-term profits, the short term refers to earnings achieved inside a year, and the long term refers to gains gained beyond a year. These taxes apply to a variety of crypto-related activities such as DeFi yields, airdrops, mining, and transaction fees, among others. It may be difficult to hold its owners accountable for their tax commitments. The use of cryptocurrency for criminal purposes has long been a source of worry for US officials. As a result, they are attempting to adopt rules that would protect them from such activities. One will be provided under the infrastructure bill. There are around 100 exchanges across the world, each with its authority. Some provide services that are available worldwide with minimal exclusions, while others are exclusive to a nation or area. Crypto exchanges are often used to make cryptocurrencies available to investors and enthusiasts. Despite having a single goal, these platforms may provide a variety of services. This implies that, in addition to buying and selling cryptocurrency, you may make use of additional features like staking, lending, and automated trading, depending on your needs. Some crypto exchanges have managed to stand out and connect with millions of individuals all around the world. The top crypto exchanges are identified using specific metrics. Security, a user-friendly interface, quick customer service, a tutorial on how to use the exchange, and a growing community are among the standards. Only a few exchanges have been able to satisfy these standards to provide the best possible service to their subscribers. We’ve compiled a list of renowned and trustworthy cryptocurrency exchanges below. Because CRV is a digital asset, it must be stored properly and securely. Digital wallets are where cryptocurrencies like CRV are kept. Cryptocurrency owners may store their digital assets in a variety of ways. Some keep their money in digital wallets, while others put it in hardware wallets, often known as cold wallets. Each of these wallet kinds has its own set of advantages and disadvantages. You may keep your CRV in any wallet of your choosing, according to your preferences, as long as you take cautious steps to preserve your assets. We’ve gathered a list of the top crypto wallets for storing your CRV tokens in another post. When it comes to investing, numerous approaches are often used. Some people prefer the short-term approach, where they just have to wait a day to a week before selling. Others may purchase CRV to hold it for some time, returning in a few weeks or months to see whether they have profited from their purchases. Long-term investing entails holding for many years before selling. In other words, you only sell once the token’s price has reached your aim. As an investor, you may also benefit from industry professionals’ market insights. However, don’t depend exclusively on it or blindly adopt their viewpoints without doing a thorough investigation. These experts are human, and as such, they are prone to error. On eToro, you may also have access to expert updates. The price of the CRV has risen steadily in recent months, especially after DeFi became popular this year. The asset’s price is not steady since the market is variable. When the market swings, it indicates that prices will rise at times and then fall as a result of a gloomy report or when investors begin to sell out. The price changes are usually visible on the chart in the form of candlesticks and other patterns. The CRV token is certain to perform well due to its usefulness. Being a protocol native token, it has a distinct advantage over other DeFi coins. Because of its value in decentralized finance, CRV has a bright future. As a result, it’s a crypto asset to keep an eye on. Before you sell your CRV, keep the following points in mind. You must close positions before selling CRV on eToro and other brokers’ platforms. You may exchange the asset for USDT or your home country’s fiat currency, then withdraw the funds to your local bank account. A wallet, whether hardware or software, may store CRV. It is secure to the degree that the owner is conscientious about security. If you want to acquire a cryptocurrency, you should do it with knowledge rather than guesswork. Invest what you can afford to lose, as the saying goes. This article might serve as a reference tool for making CRV investments. Read more: On this Page:

Step 1: Buy CRV

Step 2: Always Know When To Sell

Step 3: Know The Total Value Of Your Portfolio

Step 4: Close All Active Positions

Step 5: Withdrawal Requirements And Exchange Rates

Crypto Taxation In The US

Best Crypto Exchanges

Storing CRV In The Best Wallets

When Is The Best Time To Sell My CRV?

Price Of CRV

Should I Sell CRV?

Summary