Join Our Telegram channel to stay up to date on breaking news coverage

This week, key economic events in the U.S are set to capture the attention of crypto investors. The shift in market sentiment is a result of President Donald Trump’s recent executive order to establish a crypto strategic reserve. With crucial data releases—including Manufacturing PMI, tariff updates, and employment reports—the broader crypto market, including Bitcoin, remains sensitive to economic signals.

Adding to the momentum, tokens across various asset classes are also rallying, with a notable surge in cost-effective options. Investors are actively seeking opportunities as anticipation builds for the White House Crypto Summit on March 7, which could outline the future of U.S. digital asset policies. Notably, many are looking into the Best Altcoins to Buy Now, hoping to capitalize on emerging trends and potential market shifts.

5 Best Altcoins to Buy Now

Wormhole has been gaining momentum as a leading multichain interoperability protocol, drawing increased attention in crypto. In February, key metrics from Maker’s Sky ecosystem reflected significant developments, showcasing growth in certain sectors and strategic adjustments across the protocol. Polygon has also made strides in the payments sector, facilitating transactions with USDC and USDT.

Meanwhile, the Meme Index ($MEMEX) has secured nearly $4 million during its ongoing presale. Despite experiencing a short-term dip, TRX has surged by 66% over the past year, outperforming 84% of the top 100 cryptocurrencies. In the broader market, Bitcoin-proxy stock MicroStrategy retreated following an early rally, mirroring the pullback across the cryptocurrency landscape.

1. Wormhole (W)

Wormhole has been gaining traction as a multichain interoperability protocol, attracting interest from institutional-grade assets and stablecoin issuers. Several well-known entities have chosen Wormhole to support their transition to multichain frameworks, highlighting its growing role in tokenization.

Notable partnerships include BlackRock’s BUIDL fund, which, with $11.6 trillion in assets under management, has integrated with Wormhole through Securitize to enable multichain fund tokenization. Similarly, Apollo Global Management’s ACRED fund, backed by $730 billion in assets, adopted Wormhole for diversified credit securitization.

institutional-grade assets are choosing Wormhole to go multichain.

✅ BlackRock BUIDL ($11.6 trillion AUM) goes live with Wormhole via @Securitize for institutional-grade, multichain fund tokenization ($BUIDL).

✅ Apollo Global ACRED ($730B AUM) selects Wormhole via Securitize… pic.twitter.com/Ri54rtLnUe

— Wormhole (@wormhole) March 3, 2025

These collaborations suggest a steady increase in the adoption of multichain solutions for real-world assets (RWAs), institutional funds, and prominent stablecoins, with Wormhole playing a key role in this transition.

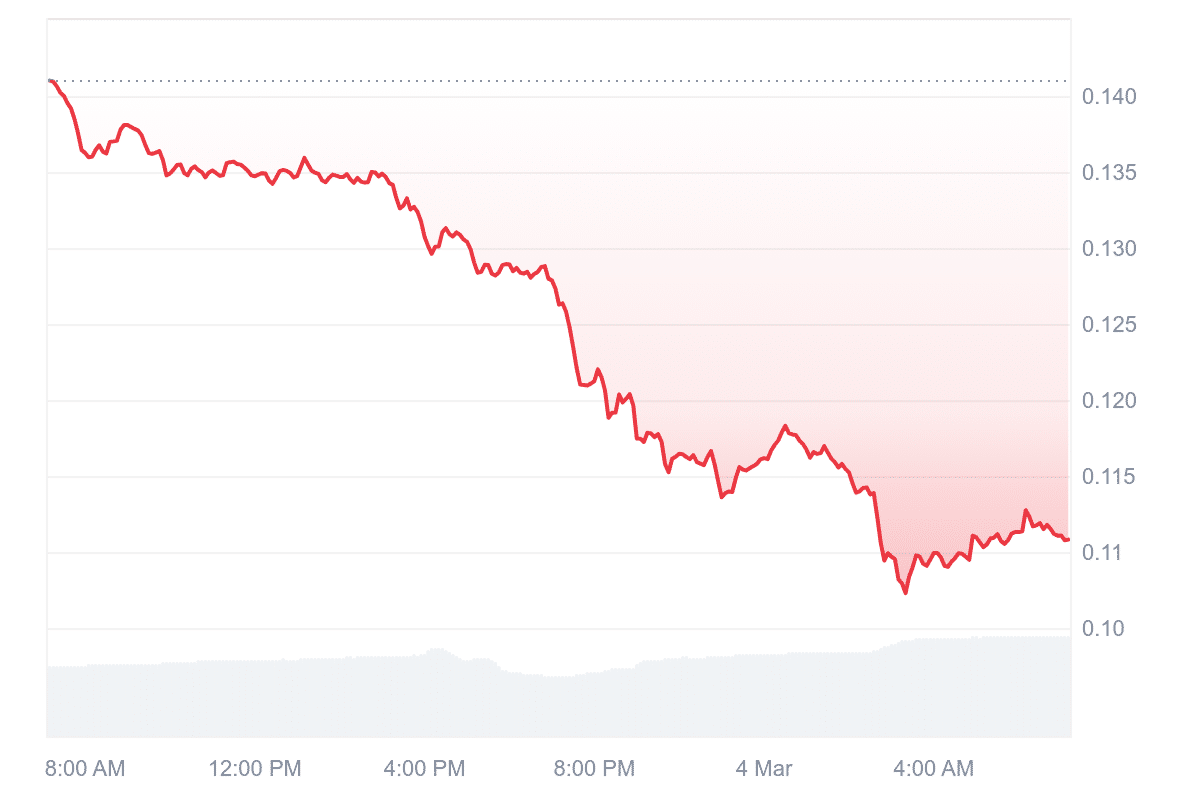

Regarding its market performance, the current price of Wormhole’s token (W) is approximately $0.1114, reflecting a 19.44% decline over the past 24 hours. Looking ahead, projections for April 2025 indicate a potential price range between $0.3624 and $0.5539, with an average forecast of $0.4667. If these predictions hold, this could imply a return on investment (ROI) of roughly 397.74%.

2. Maker (MKR)

In February, key metrics for the Maker’s Sky ecosystem showed notable shifts, highlighting growth in certain areas and adjustments across the protocol. The total supply surpassed 9 billion, reflecting steady expansion. A significant milestone was USDS flipping DAI, signaling a shift in stablecoin positioning within the ecosystem. The Sky Savings Rate was also adjusted, likely in response to evolving market conditions. Multichain adoption also saw an uptick, indicating a broader network reach.

USDS in Sky Token Rewards experienced considerable growth, rising from 236 million to 461 million. These rewards earn an 8.12% APY in SKY tokens, reinforcing participation incentives.

9 billion supply surpassed. USDS flipped DAI. Sky Savings Rate adjusted. Multichain adoption accelerated.

A thread on February’s key protocol metrics. pic.twitter.com/x10GDxPleT

— Sky (@SkyEcosystem) March 3, 2025

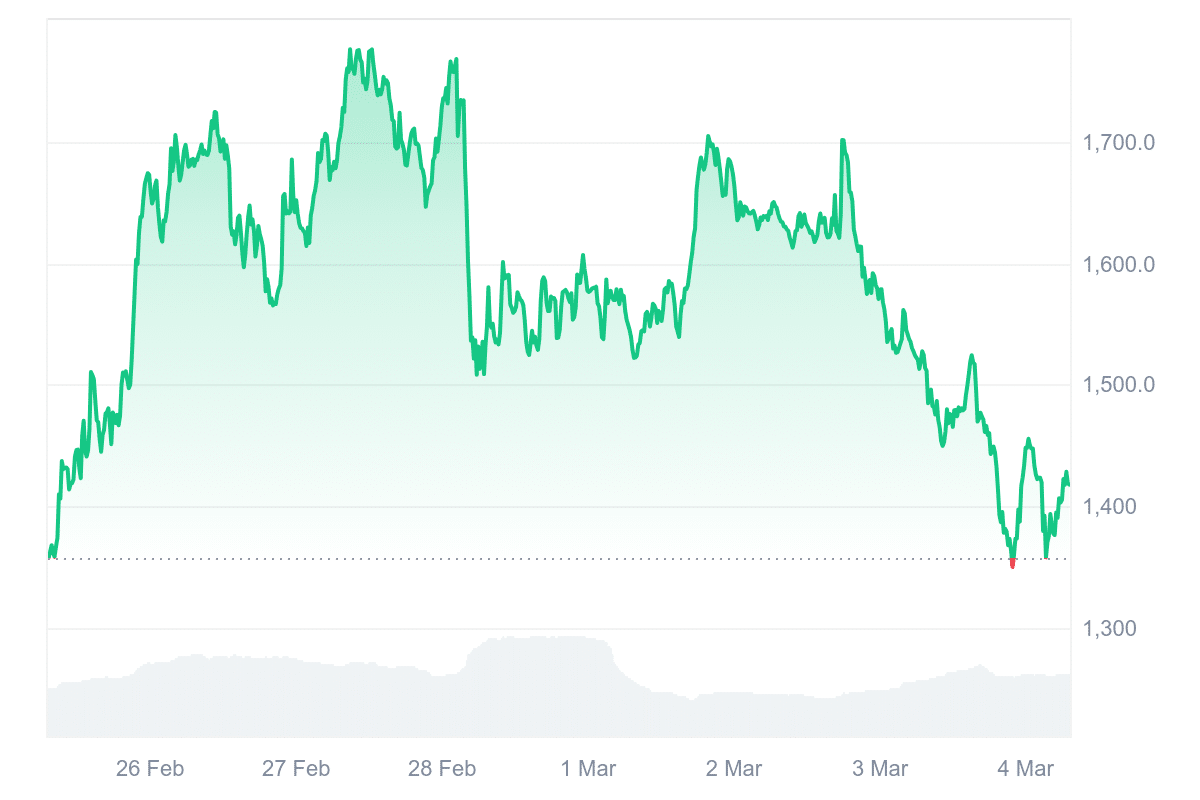

Regarding Maker (MKR), the token is trading at approximately $1,417.92, 19.26% below its 200-day simple moving average (SMA) of $1,738.24. This marks a 78% decrease from its all-time high. Over the past 30 days, MKR recorded 15 green days, meaning the daily close price exceeded the daily open price half the time.

3. Polygon (MATIC)

Polygon has shown notable activity in the payments space, supporting transactions with USDC and USDT. According to recent data, Polygon ranks as the third-largest blockchain in active on-chain addresses for USDC, highlighting its growing role in stablecoin transactions.

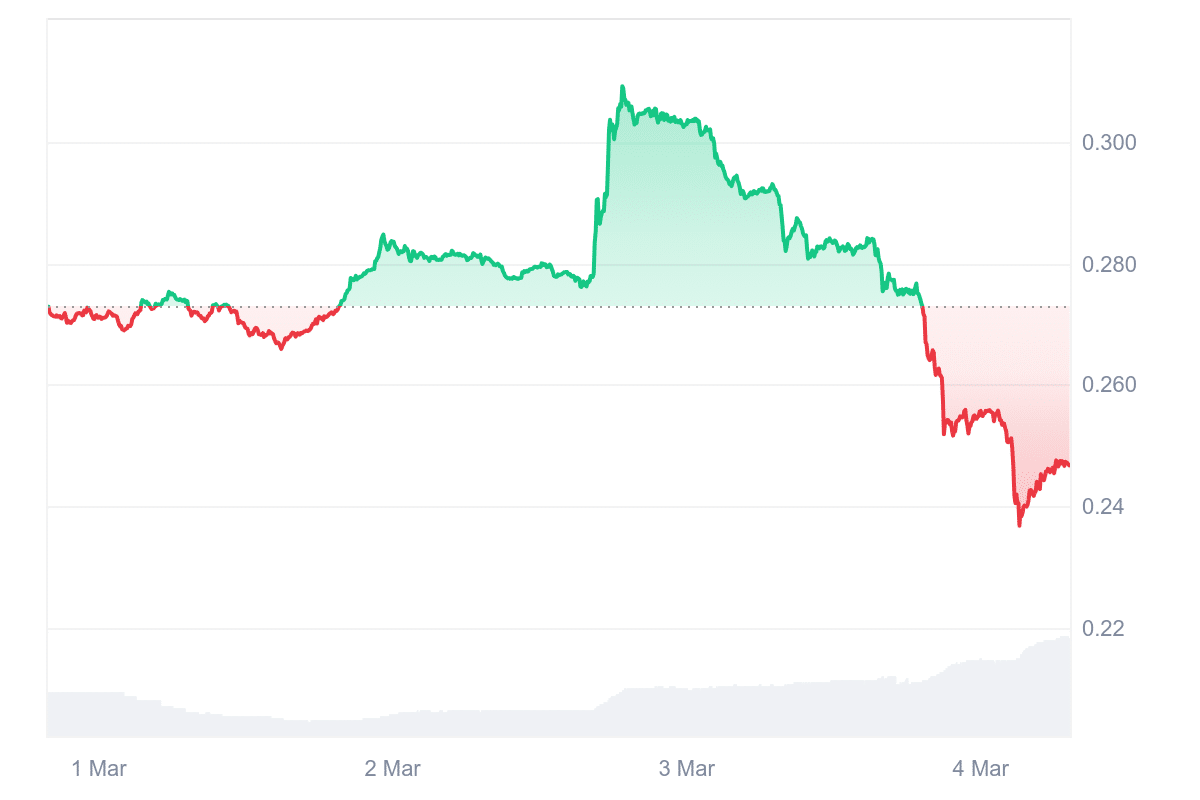

Currently, the price of MATIC stands at $0.246218, reflecting a 13.13% decline over the past 24 hours. Despite this short-term drop, the token’s performance remains positive compared to its initial sale price.

Payments on Polygon with USDC & USDT 📈 https://t.co/SxeuXkONBW

— Polygon (※,※) (@0xPolygon) March 3, 2025

Polygon’s 24-hour trading volume, relative to its market capitalization, shows a ratio of 0.1030 — a liquidity indicator. The network’s yearly inflation rate is also negative at 75.44%, suggesting a reduced circulating supply over time. This reduction could trigger a potential long-term rally.

4. Meme Index ($MEMEX)

Meme Index ($MEMEX) has raised close to $4 million in its ongoing presale. The project offers a structured way to invest in meme coins by spreading investment risk. Unlike purchasing individual meme coins, the Meme Index pools investments into four distinct funds, each catering to different risk levels. This approach reduces the need for constant portfolio monitoring and lessens the impact of choosing underperforming coins.

The key issue with meme coin investments is their unpredictability. Some coins may surge in value, while others can quickly lose momentum. Investing in a single coin risks significant losses if that coin underperforms. Meme Index addresses this by distributing funds across multiple options, balancing risk and potential reward.

Meme Index provides four investment funds: the ‘Meme Titan Index’ focuses on relatively stable assets, while the ‘Meme Frenzy Index’ targets high-risk, high-reward opportunities. Investors can choose a fund that aligns with their risk tolerance, offering flexibility in their strategy.

🚀 Track the Meme Index Pre-Sale Like a Pro with Best Wallet! 🚀

💰 Seamless Buying & Claiming – No hassle, just results

🔔 Instant Notifications – Stay updated in real-time

📊 Always Be One Step Ahead – Never miss a move

Lock in your spot before it’s too late! ⏳👇

— Meme Index (@memecoin_index) March 3, 2025

Participation is limited to holders of Meme Index tokens. Purchasing these tokens, especially during the presale period, grants access to the funds. At the current presale price of $0.0166883, investors may also benefit from a high staking Annual Percentage Yield (APY) of 583%. Additionally, token holders receive voting and governance rights, allowing them to influence future project developments. With the presale set to end in 28 days, early investors can secure MEME tokens at a reduced rate and potentially benefit from the staking rewards.

5. TRON (TRX)

The TRON DAO officially launched the TRON Builders League (TBL). This $10 million incubator program aims to support the growth of the TRON ecosystem by providing resources for developers and innovators.

TBL offers several key benefits for participants, including financial support for project development, direct mentorship from TRON experts, and access to investors and significant contributors within the ecosystem. The program is structured into focused tracks, each addressing different aspects of blockchain technology and innovation, such as infrastructure and security, payments and DeFi, gaming and interactive media, AI and automation, cross-chain and interoperability, DePIN and real-world assets, consumer and social apps, and memes with utility.

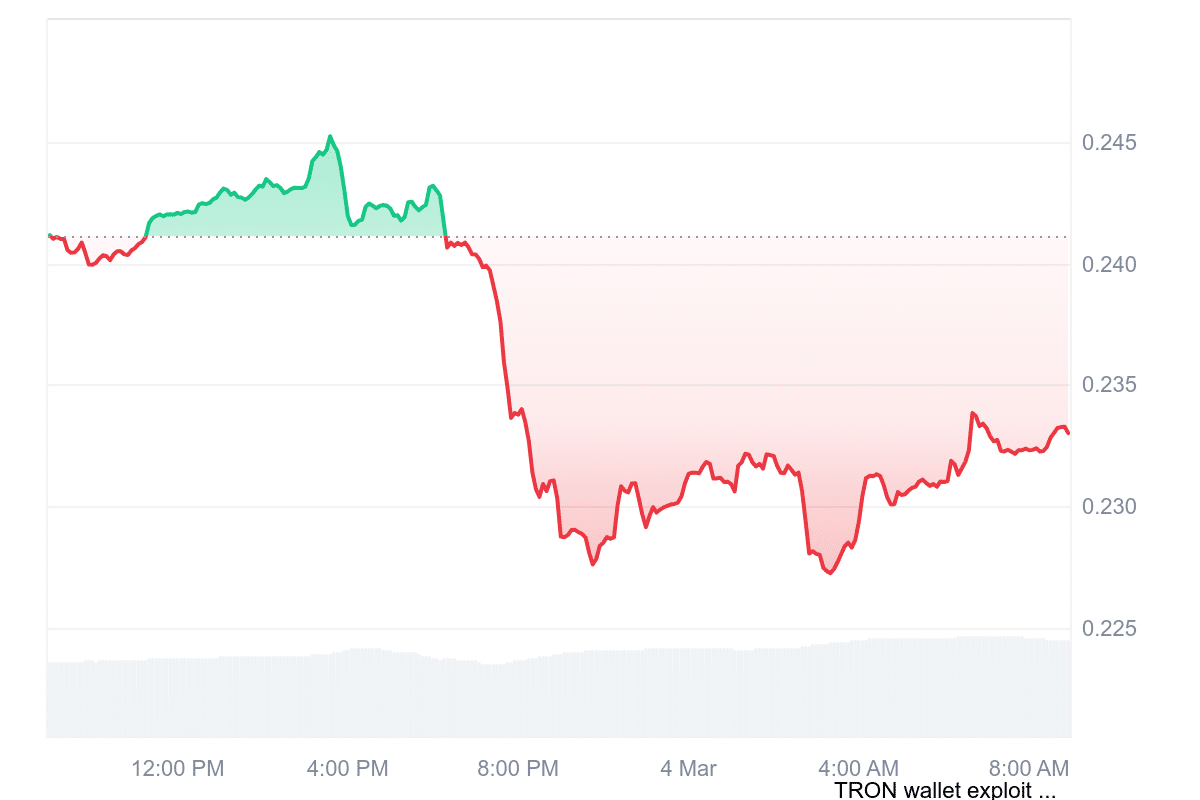

TRON’s current price is $0.232933 from a market perspective, reflecting a 2.64% decline over the past 24 hours. Despite this short-term dip, TRX has shown a 66% increase over the past year, surpassing 84% of the top 100 cryptocurrencies. It has also outperformed both Bitcoin and Ethereum within the same timeframe.

Technical indicators highlight that TRON is trading above its 200-day simple moving average (SMA), currently 11.85% higher than the $0.208129 mark. The token’s market performance over the last month shows 16 positive trading days out of 30, suggesting relatively stable liquidity.

Looking ahead, projections for April 2025 estimate that TRX prices could range between $0.286011 and $0.358943, with an average forecast of $0.316892. If these predictions hold, this could imply a return on investment (ROI) of 54.14% compared to the current price.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage