Join Our Telegram channel to stay up to date on breaking news coverage

XRP Price Prediction – August 23

Ripple (XRP) is recovering above the $0.280 level and it is likely to continue higher towards the $0.300 resistance level.

XRP/USD Market

Key Levels:

Resistance levels: $0.33, $0.35, $0.37

Support levels: $0.24, $0.22, $0.20

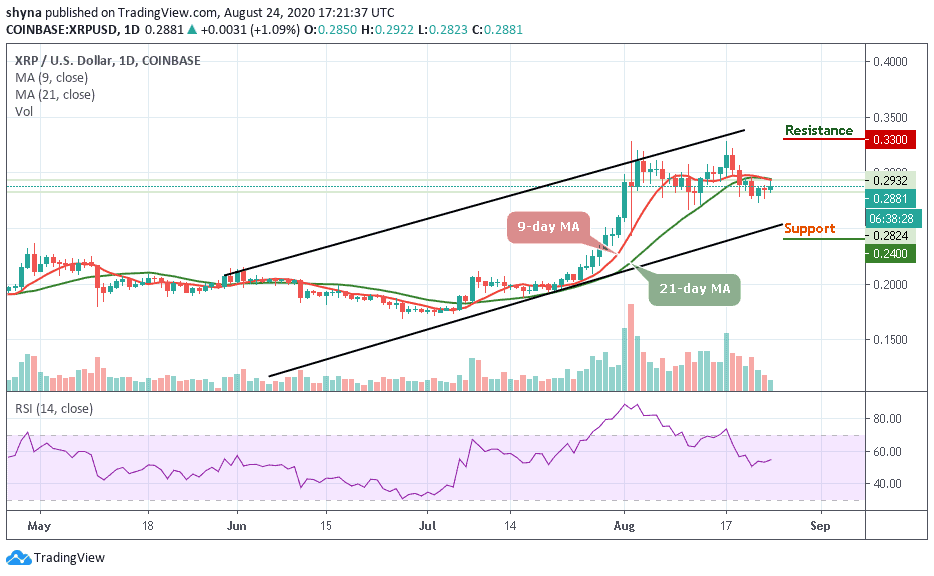

Early this week, XRP/USD managed to push above $0.30 as the coin penetrated a short-term falling price channel. The cryptocurrency reached as high as $0.328 before it started to head lower. Yesterday, XRP/USD fell from $0.321 as it dropped back into the previous short-term declining channel. This decline continued today as the coin penetrated back beneath $0.30 and reached the support at $0.284 below the 9-day and 21-day moving averages.

What to Expect from Ripple (XRP)

While the coin remains below the $0.300 psychological and technical resistance, it may remain bullish and the cryptocurrency could nearly double in the weeks ahead, which means it may soon near $0.50. However, the price seems to be following a rising channel with support near $0.282 on the daily chart.

Meanwhile, as the technical indicator RSI (14) faces the north, the nearest resistance is near the $0.290 level, above which the price might cross above the 9-day and 21-day moving averages to test the potential resistance levels at $0.33, $0.35, and $0.37. In other words, if the price fails to cross above the moving averages, it may likely see a sharp-drop towards the supports of $0.24, $0.22, and $0.20 respectively.

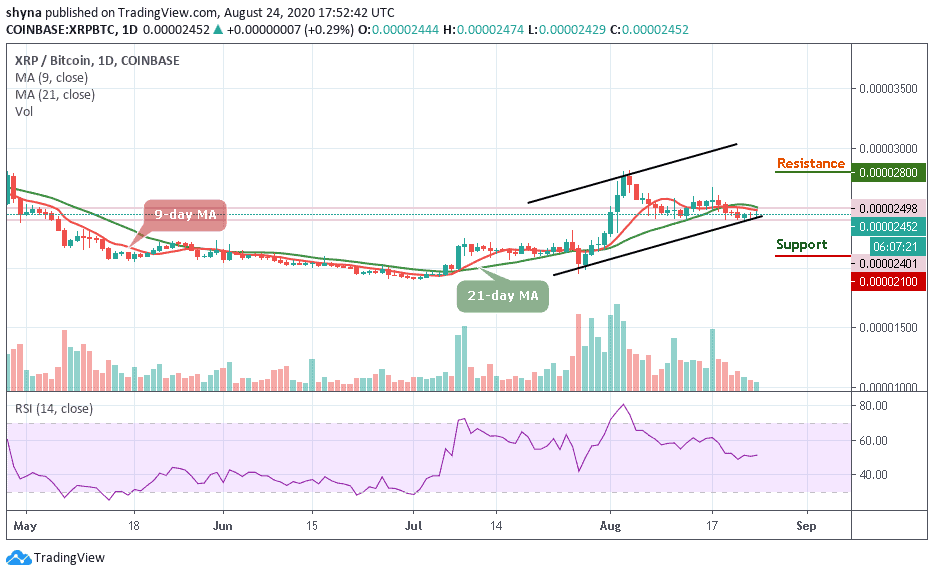

Against BTC, XRP is following a sideways movement while the price action remained within the channel. If the coin continues to move below the 9-day and 21-day moving averages, the XRP price variation may cross below the lower boundary of the channel. At the moment, the signal line of RSI (14) remains within the range-bound.

As the daily chart reveals, XRP/BTC is currently moving at 2452 SAT which is around the lower boundary of the channel. We may expect close support at the 2200 SAT before breaking to 2100 SAT and critically 2000 SAT levels. Should in case a bullish movement occurs and validates a break above the moving averages; traders can then confirm a bull-run for the market and the nearest resistance levels to reach lies at 2800 SAT and above.

Join Our Telegram channel to stay up to date on breaking news coverage