Join Our Telegram channel to stay up to date on breaking news coverage

XRP has overcome several major obstacles since 2020 when the United States Securities and Exchange Commission filed a lawsuit against Ripple and its executives. The ongoing legal battle has caused uncertainty among investors and may continue to impact the price of XRP.

Even though XRP’s price tanked hugely after several US exchanges delisted it, the interest in the ongoing lawsuit has attracted global attention to it.

On its price moves, XRP has tried to retain its hold above $0.5, gained on March 28 after trading below it since January 2023. But when the price reached the significant resistance level of $0.5387 on April 19, 2023, it lost momentum and fell.

Many investors are now unsure when the momentum will change to place XRP above the $0.5 price mark again.

XRP Price Movement Since The Beginning Of 2023

According to CoinMarketCap data, on January 1, 2023, XRP was trading at $0.33. By January 21, the price increased 21.21% to $0.40 before falling back to $0.39 by the end of the month.

In February, the price of XRP fluctuated frequently between $0.38 and $0.40 and occasionally reached as high as $0.41 or as low as $0.370.

The coin started March with the same volatile nature but quickly rose to a high of $0.54 at the end of the month.

In April, XRP saw volatility, trading between $0.50 and $0.53 for most of the month. Notably, the price dropped slightly to $0.46 and was ranging.

As of May 5, XRP is down by -0.02%, with a slightly bearish sentiment in the XRP market. The 24-hour trading volume is also down by 27.77%, while the market cap is at $23.9 billion.

XRP Price Prediction With Technical Indicators

XRP is trading below the 50-Day & 200-Day Simple Moving Average (SMAs), indicating a short- and long-term downtrend. The Death Cross formed due to increased selling pressure contributed to the downtrend.

The Relative Strength Index (RSI)) is currently at 47.91, slightly below the neutral level of 50. However, this indicates that the market is in the neutral zone of indecision.

The Moving Average Convergence/Divergence (MACD) line has crossed above the signal line, indicating a bullish signal, suggesting that the momentum is shifting to the upside.

The MACD histogram also confirms the bullish sentiment as the histogram is above the zero line. The momentum might shift to the upside if the bulls maintain the pressure.

Ripple (XRP) Support And Resistance Levels

XRP’s price has struggled to break through the resistance level at $0.4875. But it has found support around the $0.4502 mark, indicating a consolidation phase and a potential bearish breakout if the bears build strong momentum.

Investors and traders may closely monitor XRP’s price action around the $0.4875 and $0.4502 levels, using them as key levels to watch for potential trading opportunities.

However, If XRP breaks above the $0.4875 resistance level, it could signal a bullish trend, and traders may look for long positions. On the other hand, if XRP breaks below the primary support level of $0.4502, it could signal a bearish trend reversal.

Factors Affecting XRP’s Price

The price of an asset is affected by several factors. Check some of them below.

- Market Sentiment: Positive news or developments in cryptocurrency can create a bullish sentiment and push the XRP price up. Negative news or developments can create a bearish sentiment and cause a decline. Market sentiment, defined as investors’ general mood or attitude towards the cryptocurrency market, can also impact XRP positively or negatively.

- Regulatory Developments: News of new regulations or crackdowns on XRP can lead to a decrease in demand and subsequent drops in price. For instance, the SEC case against XRP made many investors withdraw their investments in XRP, fearing a possible crash.

- Adoption and Use Cases: The demand and cost of XRP may rise if more companies and financial institutions use it for international trade. On the other hand, XRP’s price can fall if it fails to take off in the market or is supplanted by a rival.

- Macroeconomic Factors: Macroeconomic issues like unemployment, rising interest rates, inflation & economic growth frequently impact the price of crypto by influencing investor sentiment. For instance, the US Fed’s hardline inflation announcements have affected the cryptocurrency market.

- Demand And Supply: The law of demand and supply plays a significant role in determining the price of assets. Notably, when the supply of a token exceeds its demand, this causes a price drop, as sellers are forced to lower their prices.

But, when a token has a high demand, the price increases due to limited supply. Institutional traders use this dynamics of supply & demand to control the nature of the market.

Latest Trends On The Ripple Network

Some developmental activities on the Ripple network are worth noting as they represent ongoing activities in the ecosystem.

3 Japanese Banks Accepted Ripple-based MoneyTap

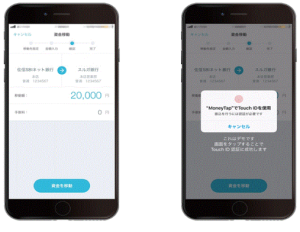

A ripple-based payment system, MoneyTap, is expanding in Japan as more regional banks (Yamaguchi, Momiji & Kitakyushu Bank) give customers access to the program.

The MoneyTap enable Japanese banks to provide peer-to-peer remittance services to their clients via mobile applications. The remittance service allows for online remittance through mobile phone and bank account numbers.

The app includes online identity verification and biometric authentication to provide high security for Yamaguchi, Momiji, and Kitakyushu clients. This expansion may attract more users to XRP, increasing its utility and demand.

Ripple (XRP) Alternatives

Below are some alternatives to XRP with massive bullish potentials.

AiDoge (AI)

AiDoge is an emerging project that has attracted the attention of cryptocurrency enthusiasts; currently in the presale stage, the project offers an enticing investment opportunity with tokens available at a low price.

Investors can purchase a higher quantity of tokens and potentially reap significant returns. The presale is divided into 20 stages, with each round increasing the token price.

The project’s goal is to raise funds for marketing and development, with 50% of AiDoge tokens available for purchase during this stage.

Ecoterra (ECOTERRA)

Ecoterra is a green effort that rewards users for recycling using a recycling app that will shortly go live. The software encourages users to participate in regular recycling activities by giving each item a value based on its environmental impact.

Ecoterra has a Carbon Offset Marketplace to trade carbon credits and offset carbon emissions. The platform is powered by the ECOTERRA utility token, which serves different purposes such as eco-activities, staking, and personal investment.

The presale for ECOTERRA tokens is ongoing, with a target of $3.15 million and just three days left to invest before the next presale round pushes the token’s price to $0.00775. The tokens will eventually list at $0.01, rewarding early investors.

Join Our Telegram channel to stay up to date on breaking news coverage