Join Our Telegram channel to stay up to date on breaking news coverage

Over the past few months, Ripple (XRP) has oscillated between $0.45 and the psychological $0.5 level. In the current market climate, fear, uncertainty, and doubt (FUD) are causing liquidity to tighten.

XRP’s consolidation and decline may also be attributed to the unpredictability surrounding Ripple’s lawsuit against the SEC. XRP’s value has declined by 3.78% within the last seven days. Despite this, the token ranked as the sixth most valuable asset based on market cap and held on to $0.48.

Indicators Boost XRP

The XRP/USD 4-hour chart shows bulls pushing XRP upward to $0.46 on September 11. XRP has experienced a massive boost since hitting the $0.48 ceiling, even though it is still within reach of the bears.

As a result, the Relative Strength Index (RSI) has also departed the 18.11 point it was on September 11. RSI was 44.93 when writing this article. Indications of increased buying pressure are evident from the increase.

The RSI could rise to 50.00 and move above that psychological level, allowing XRP to reach $0.50. To accomplish that, bulls must ensure that bears are not neutralized by their presence in the market.

Bollinger Bands (BB) is another positive outlook XRP enthusiasts can consider. In the early days of the band’s contracting, XRP’s volatility was very low. As of the writing of this article, the BB indicated a high level of volatility.

Price fluctuations could be significant, either upwards or downwards. It shouldn’t be written off if XRP’s buyers consistently outweigh its sellers, leading to a push toward $0.60.

Traders Set a lower-than-$0.60 Target

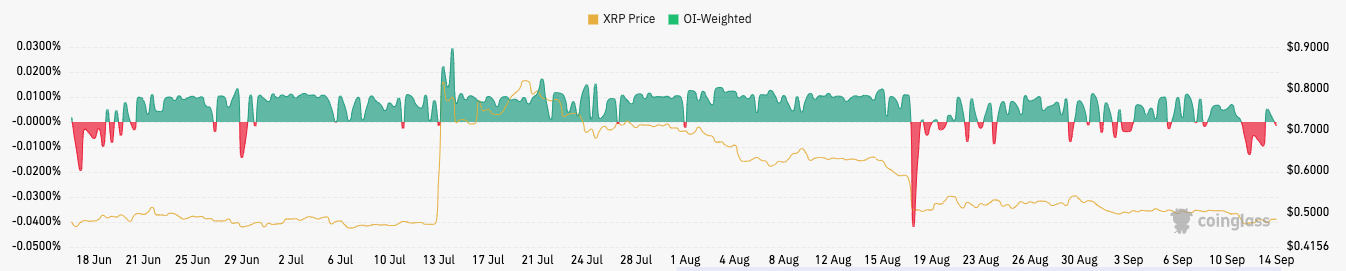

The funding rate indicated that traders’ sentiments had changed towards the token. A positive funding rate has been observed for XRP, according to Coinglass. As a context, funding rates refer to payments made between long and short positions to maintain the open position.

It suggests traders are bearish on the price action when there is a negative funding rate. The opposite is true: a positive funding rate means traders are bullish on the price. Data from Coinglass, however, shows traders’ next target price for XRP to be well below $0.60

As a result, the next direction of XRP could well be determined by market sentiment and buying and selling pressure. Traders must remain mindful of external factors, such as Ripple’s SEC case developments. The price of XRP may rise above $0.50 in the near future.

Promising Alternative to XRP

A token on the BNB Smart Chain, Bitcoin BSC (BTCBSC), aims to give investors the opportunity that Bitcoin provided in April 2011, when 1 BTC was under a dollar. BTC circulated at that time in slightly more than 6 million numbers. $BTCBSC tokens are available for $0.99 in the presale from the Bitcoin BSC team.

A presale for the $BTCBSC cryptocurrency has already raised $1.73 million. There are already high price targets predicted for the token by analysts.

The future looks bright, considering the advantages of the Binance Smart Chain and Bitcoin’s popularity.

For more information on how to participate in the ongoing presale, please visit Bitcoin BSC here.

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage