Join Our Telegram channel to stay up to date on breaking news coverage

XPTUSD Price Analysis – June 15

Increase in the Bears’ pressure may lead to a further decrease in the Platinum price in which the demand level of $776 – $714 could be the target. Should the Bulls defend the &776 level like before, the price may reverse.

XPT/USD Market

Key levels:

Supply levels: $833, $898, $962

Demand levels: $776, $714, $657

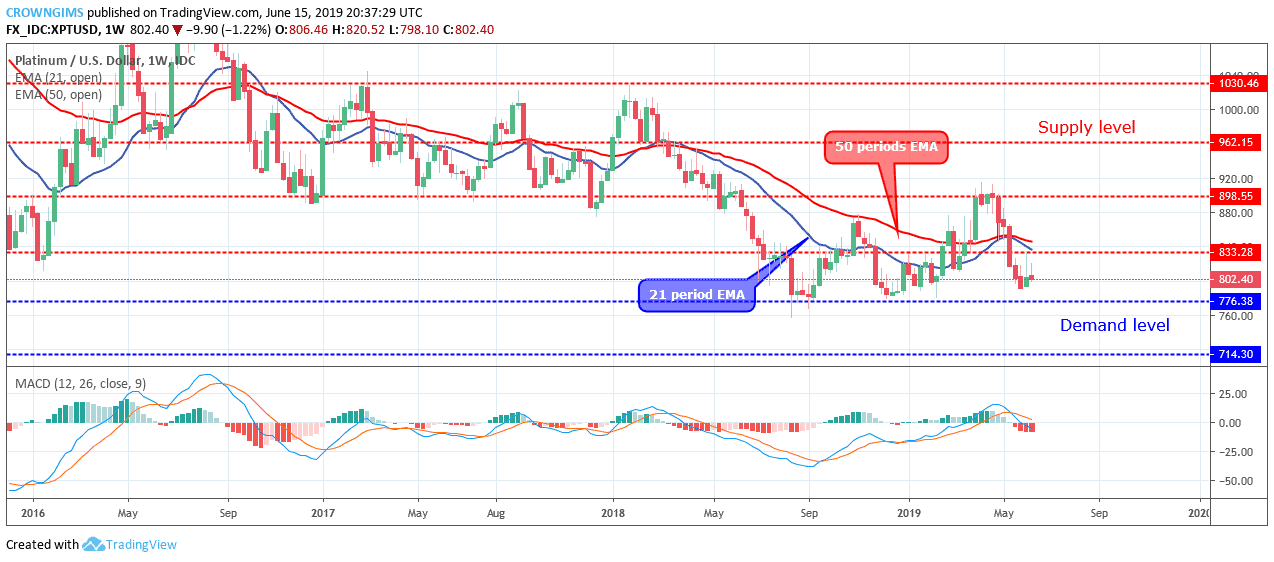

XPTUSD Long-term trend: Bearish

XPTUSD is bearish on the weekly chart. The Bearish momentum is gradually getting weak in the platinum market and that is why the platinum price could not reach the demand level of $776. The price started consolidating due to the Bulls’ momentum and the Bears’ momentums that are at equilibrium. There was no significant trending in the XPT market last week and the market closed with small bearish candle with an upper tail called an inverted hammer candle.

The 21 periods EMA is diverging away from 50 periods EMA and the platinum price is trading under the two EMAs as a symbol of a Bearish’ momentum. However, the Moving Average Convergence Divergence period 12 is below zero levels with the signal line pointing down to indicate sell signal. Increase in the Bears’ pressure may lead to a further decrease in the Platinum price in which the demand level of $776 – $714 could be the target. Should the Bulls defend the $776 level like before, the price may reverse.

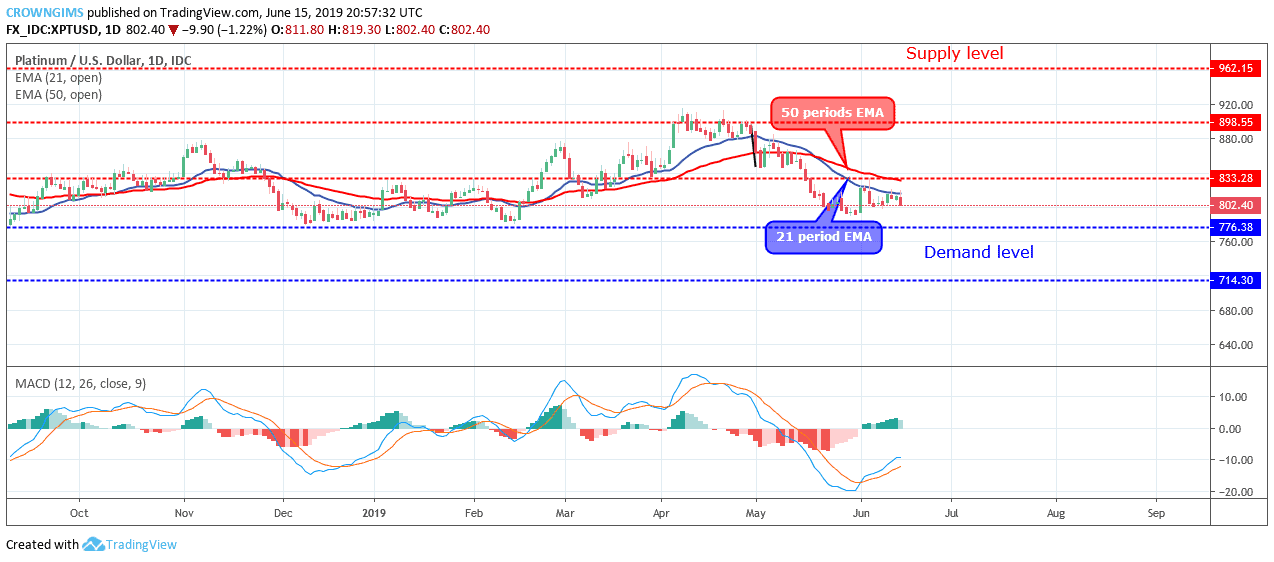

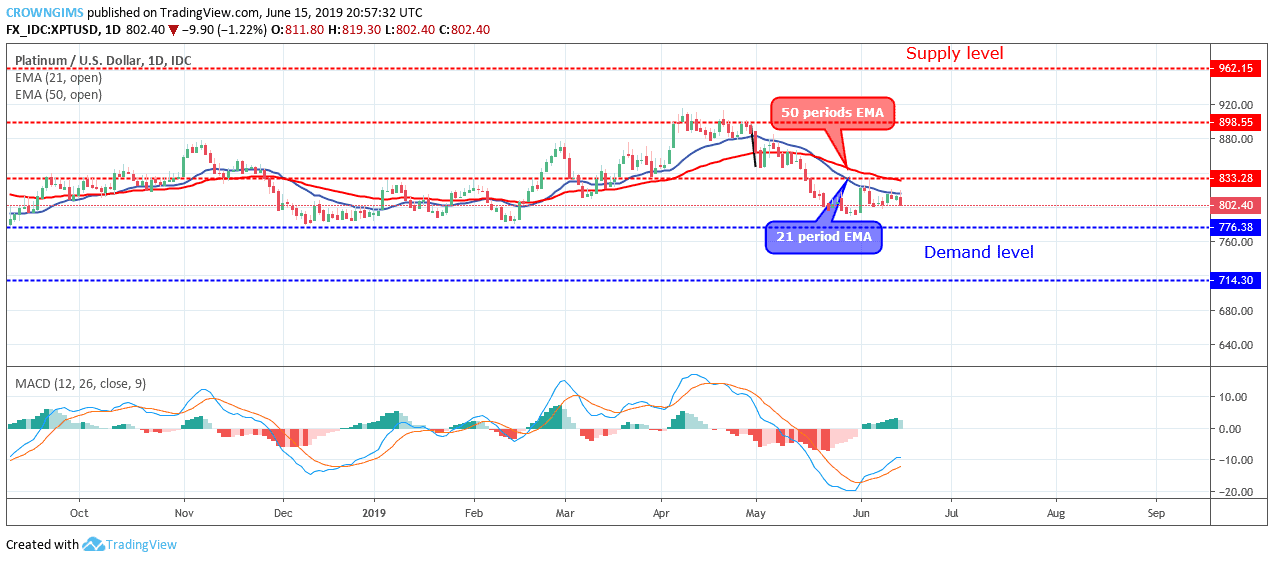

XPTUSD medium-term Trend: Bearish

XPTUSD is bearish in the medium-term outlook. The Bears maintain their pressure on the daily chart in the Platinum market. The bearish momentum became weak and the Bulls have no momentum to drive the market; this led to price consolidation below the $833 level.

The Platinum price is trading under the 21 period EMA and 50 periods EMA but at a direct close contact to each other which connotes low bearish momentum.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage