Join Our Telegram channel to stay up to date on breaking news coverage

XRP Price Analysis – June 15

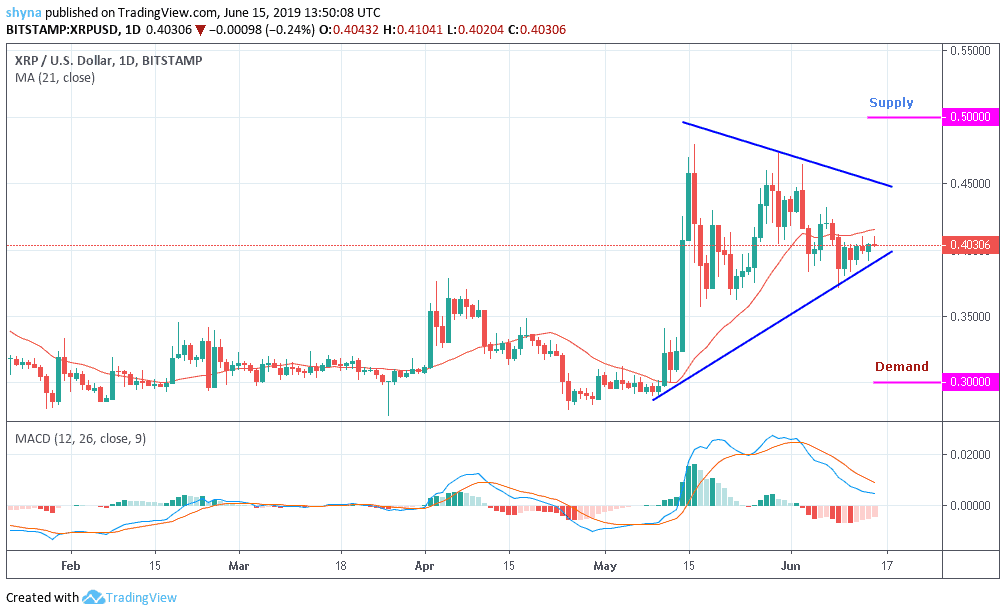

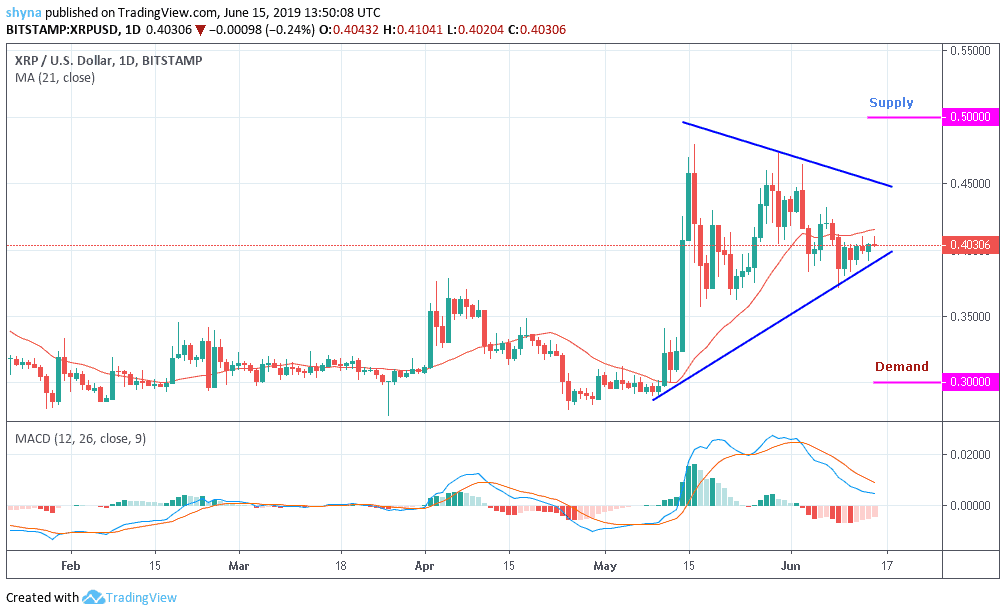

Ripple’s XRP price late in the session on Friday was nursing losses of over 1.5%. XRP/USD has once again fallen by the psychological $0.4000 territory, a known area of supply, which has proven to be of difficulty to break.

XRP/USD Market

Key Levels:

Supply levels: $0.5, $0.6, $0.7

Demand levels: $0.3, $0.2, $0.1

Ripple up and down action around $0.4 is becoming mundane especially for the bulls who would like to see the third largest cryptocurrency trading above $0.5 supply level before the end of June. The incredible performance of Bitcoin in the last couple of days has been largely ignored by XRP.

Meanwhile, XRP/USD pushed against the supply at $0.5 following the correction from $0.3909. Ripple has been forming a higher low pattern since the beginning of the week where the trend line has been key to the upward sloping trend while the price is still moving below the 21-day moving average. The market may likely move towards the demand levels at $0.3, $0.2 and $0.1 as MACD indicator giving some bearish signals.

XRP/BTC Market

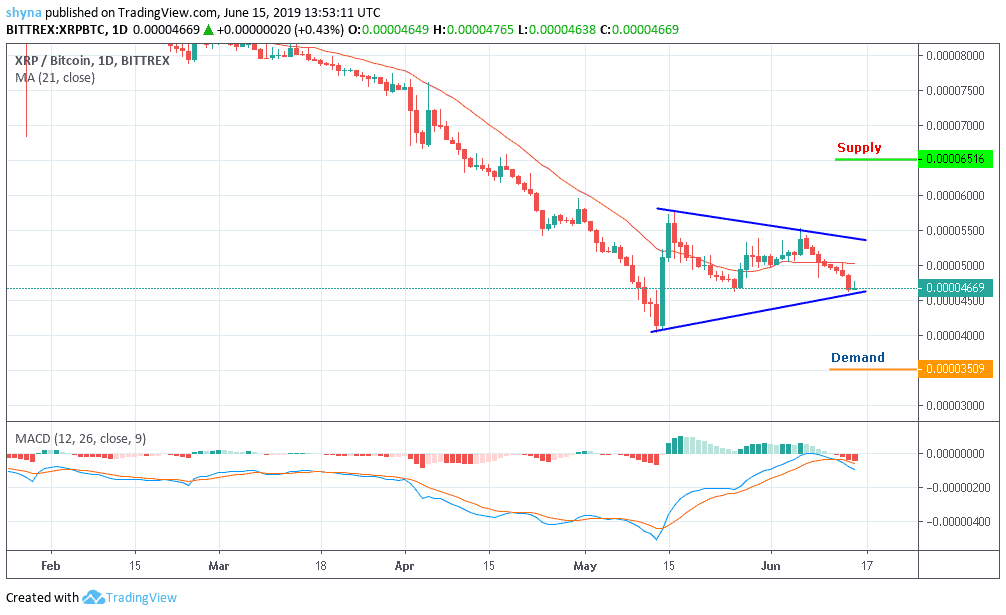

Against Bitcoin, it can be seen that XRP has been struggling to hold grounds above 0.000050BTC as it currently trades at around 0.000047BTC. Mere looking at it from above, the nearest level of supply lies at 0.00055BTC. Above this, higher supply is located at 0.00060BTC. And if the buyers push XRP/BTC above 0.000060BTC, the higher supply level will be located at 0.000065BTC, 0.000070BTC and 0.000075BTC.

The market price has crossed down the 21-day red line of MA and the daily MACD has started giving bearish signals, if the downtrend movement continues and cross down the lower channel of symmetric triangle, this can lead to more additional drops in the level of demand close to 0.0000035BTC; where sellers are expected to dominate before a reversal comes in.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage