Join Our Telegram channel to stay up to date on breaking news coverage

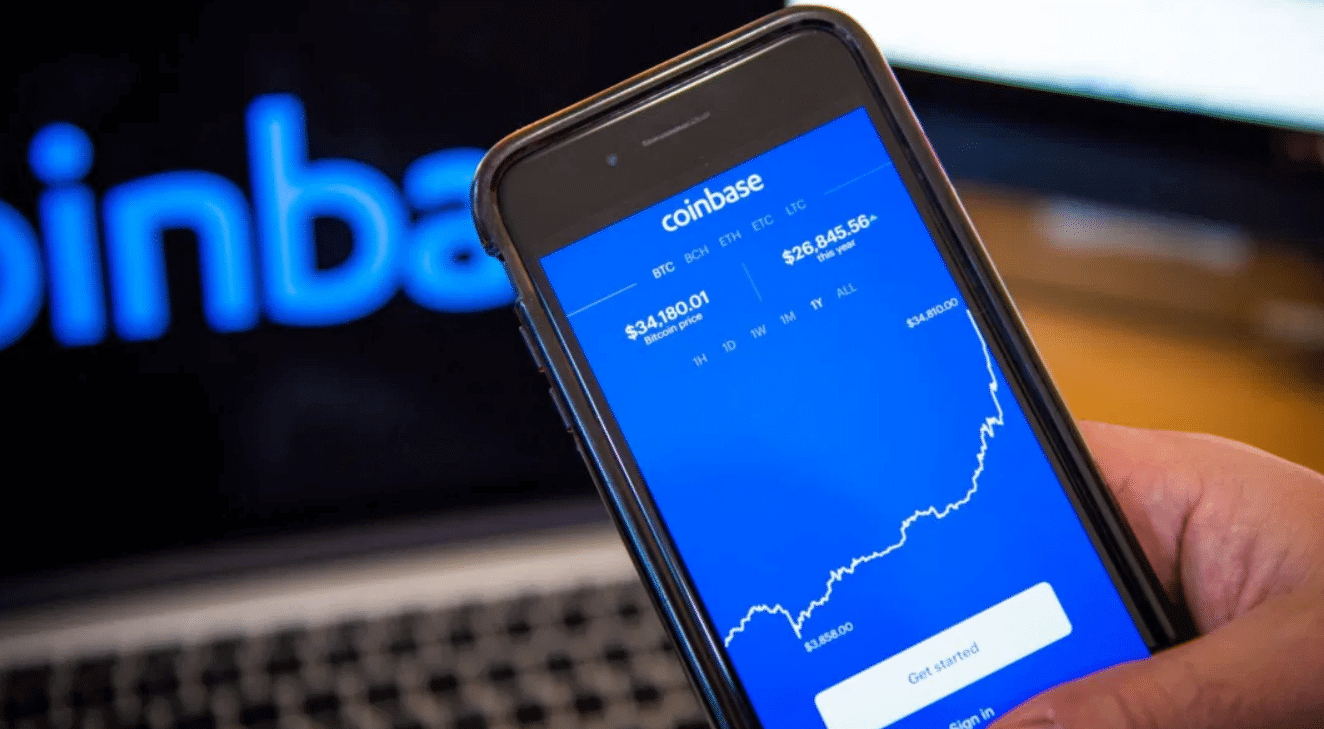

XP has announced that it has partnered with Nasdaq to launch the XTAGE cryptocurrency exchange. XTAGE will support the buying and selling of cryptocurrencies and support other investment products based on crypto technology.

XP partners with Nasdaq to launch a crypto exchange

XP is Brazil’s largest investment brokerage platform, with over 3.5 million clients and $168 billion in assets under custody. The company has announced that XTAGE’s planned launch will be in Q2 2022.

Lucas Rabechini, the director of financial products at XP, said that “the creation of XTAGE represents an important milestone in advancing the digital asset market and our ability to offer investors greater access to the digital asset ecosystem. Through the technology partnership with Nasdaq, we are confident that XP will operate on an innovative and robust infrastructure.”

Your capital is at risk.

This is not the first partnership between Nasdaq and a company based in Brazil. In 2019, the company announced a partnership with Hashdex to release the world’s first Bitcoin spot exchange-traded fund.

Nasdaq’s executive vice president and head of market technology infrastructure, Roland Chai, said that the partnership would create new opportunities for investors and companies in the country. In 2018, XP opened another cryptocurrency exchange dubbed XDEX. However, the exchange was closed in March 2020.

Crypto adoption in Brazil

Brazil is slowly becoming a major hub for cryptocurrency transactions. Nubank, a leading digital bank in the country, announced a partnership with Paxos to enable its customers to buy, sell and hold cryptocurrencies.

The bank also announced new plans to increase its exposure to the cryptocurrency market. Its parent company, Nu Holdings, announced it would allocate around 1% of its balance sheet to Bitcoin. Warren Buffet, through Berkshire Hathaway, is an investor in Nu Holdings.

BTG Pactual, another leading bank in Brazil, announced it would offer Bitcoin investment services to its customers. The bank is also making plans to launch its own cryptocurrency exchange, according to its president, Roberto Sallouti. This exchange will be opened in around two months.

“We will have our cryptocurrency trading platform in up to two months […] BTG’s proposal is to have a complete investment platform for our clients,” Sallouti said. The rate at which Brazilian institutions are embracing crypto offerings follows increased demand from the market. Latin America is currently one of the largest cryptocurrency economies.

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage