Join Our Telegram channel to stay up to date on breaking news coverage

Last week saw the first significant increase in weekly unemployment claims in the US in a while.

Jobless claims certainly saw an unprecedented surge during the pandemic and the subsequent shutdowns that led to a government-mandated recession. However, given the more typical recession currently ongoing, jobless claims usually peak in the 350,000–400,000 range and continuing claims tend to rise.

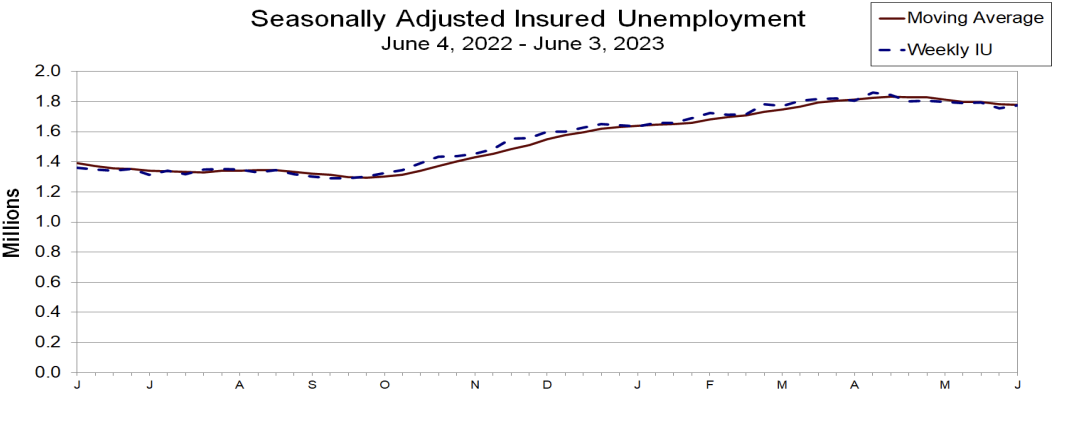

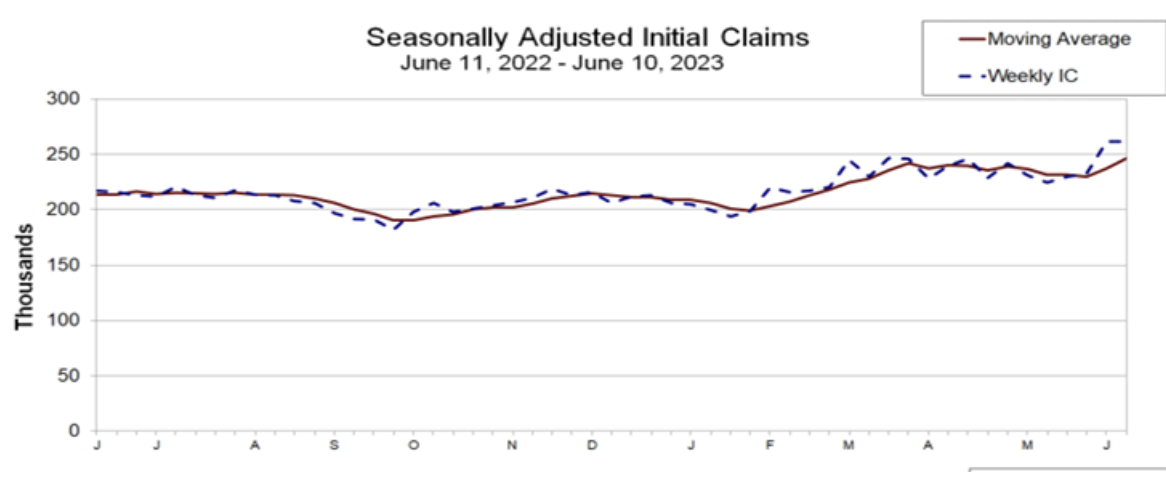

As of last week, initial jobless claims increased to 261,000 last week from 233,000 the week before, while continuing claims decreased to 1.757 million from 1.794 million.

The release of unemployment macroeconomic data by the United States Department of Labor (DOL) in April suggested higher-than-anticipated unemployment claims. There was a sharp decline in US stocks immediately after, due to worries about the possibility of a looming recession. There was also a slight decline in the price of cryptocurrencies, with Bitcoin’s price temporarily reaching $27,922.

While BTC has quickly recovered and is already trading over the $28,000 barrier, Ethereum was able to retain bullish momentum in anticipation of its imminent Shapella upgrade.

What Does the Latest Data Suggest?

According to the latest report by the DOL, “In the week ending June 10, the advance figure for seasonally adjusted initial claims was 262,000… The 4-week moving average was 246,750, an increase of 9,250 from the previous week’s revised average. This is the highest level for this average since November 20, 2021, when it was 249,250.”

The Labor Department also announced a sharp drop in weekly unemployment claims, reversing the previous week’s spike. This means that fewer Americans than anticipated filed new claims for unemployment benefits, with Massachusetts seeing the largest drop in applications.

There were reportedly 1.6 job opportunities for every unemployed person in March, considerably above the 1.0–1.2 range that is consistent with a jobs market. Despite such signs of cooling, however, the labor market has remained tight.

“The labor market is not deteriorating like we had thought as jobless claims were pumped up to recession levels by fraudulent applications for unemployment benefits,” Christopher Rupkey, Chief Economist at FWDBONDS in New York told Reuters.

During recessions, interest rates often fall as bond prices rise, loan demand slows, and monetary policy is loosened by the Federal Reserve. The central bank has been tightening its monetary policy quickly since the 1980s, regularly examining the job market for indications of stress.

It has been common practice for the Federal Reserve to lower short-term rates and facilitate lending access for municipal and corporate borrowers throughout recent recessions. However, for the first time since March 2022, the central bank is anticipated to keep interest rates unchanged.

Bitcoin’s Status Amid Recent Developments

The largest cryptocurrency in the world, Bitcoin, is also back on the road to recovery. According to Coinmarketcap, BTC has risen by almost 8% over the last 24 hours and is trading at 28,939.07 at the time of writing.

Bitcoin 7-day growth

When the U.S. Securities and Exchange Commission, SEC, sued one of the top cryptocurrency exchanges, Binance, and its founder and CEO, Changpeng Zhao (CZ), Bitcoin had already dropped below $26,000 and was trading at a three-month low in May.

It is finally in the green now, with the dollar’s decline, a slowdown in inflation readings, a pause in rate increases in the United States, the confidence generated by BlackRock’s ETF filing, and the movement of funds into safe havens contributing to its recovery during the past two weeks.

Bitcoin has increased by 80% this year compared to last. It wouldn’t be wrong to suggest that the recent financial crisis in the United States has increased interest in cryptocurrencies. After all, they are seen as a potential replacement for the traditional banking system.

Although Bitcoin is still approximately 50% below its all-time high, which was $69,000 in November 2021, the path to recovery is still long. This makes it important for investors to seize the opportunity to diversify their portfolios and invest in other promising cryptocurrencies, like DLANCE.

What Does This Mean for Crypto Investments: Right Opportunity to Diversify

Bitcoin is frequently used as a barometer to assess the state of the entire cryptocurrency market. When Bitcoin does well, many other cryptocurrencies tend to do the same for the simple reason that market confidence is high.

That’s excellent news for all cryptos, but it’s even better for projects that are catching the eye of crypto experts due to their promising outlook. With Bitcoin showing impressive growth in its price movements recently, this is the perfect opportunity for investors to diversify.

The blockchain-based freelancing and recruitment platform DeeLance (DLANCE) is one such crypto initiative worth considering.

Investing in DeeLance

DeeLance is a brand-new web3 recruitment platform that aims to revolutionize the freelancing sector by giving the competition an inferior Web3 platform. The new web3 startup aims to transform remote work by bringing together businesses and freelancers in a metaverse powered by Bitcoin and NFTs.

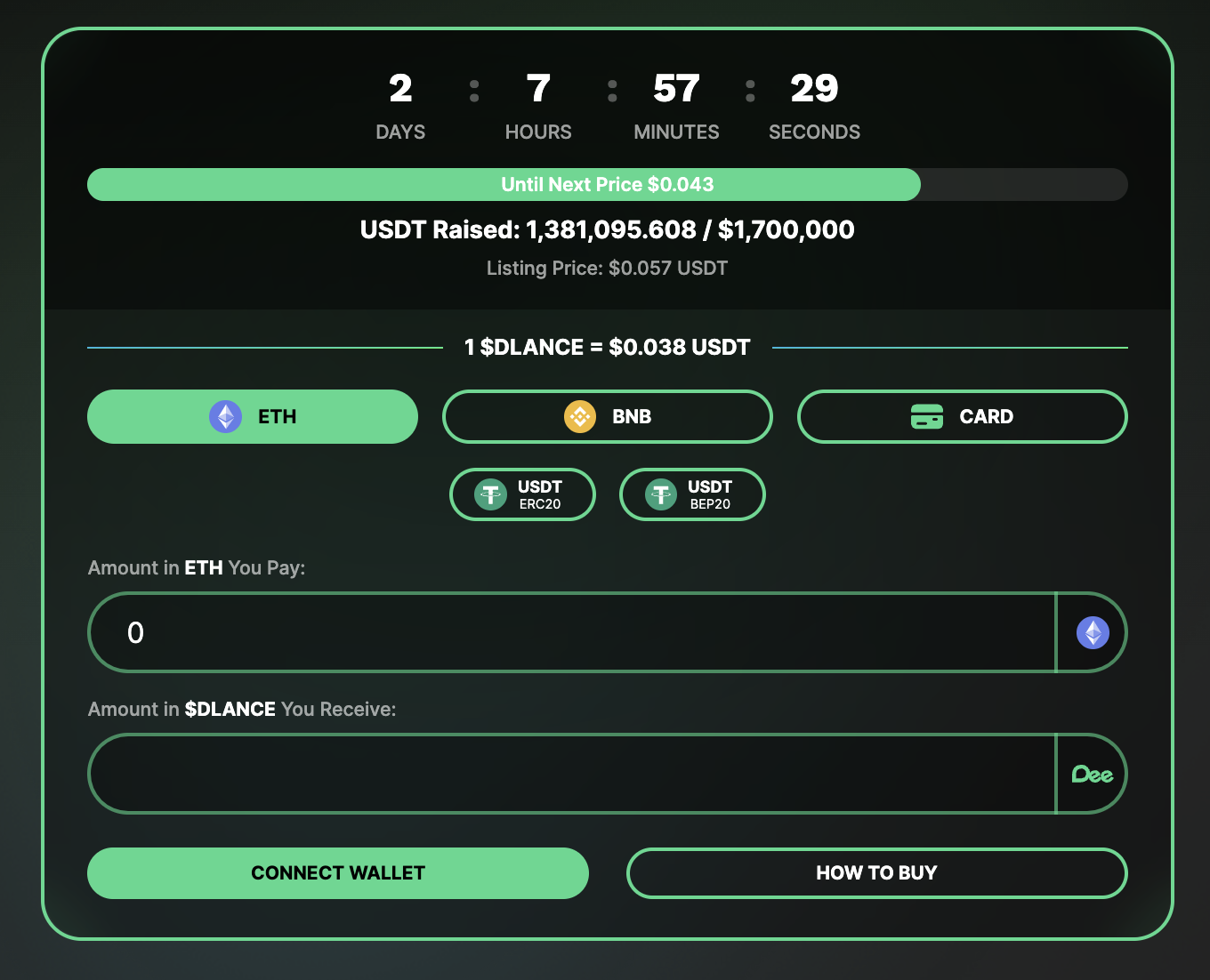

The blockchain-based venture has so far been able to raise more than $1.3 million. This astounding number shows how much the community and investors believe in and care about this project, realizing that it has the power to revolutionize how we work and exchange services online.

The DeeLance platform’s native token, DLANCE, complies with the ERC-20 standard and has a one billion token supply in total. On the DeeLance website, a fraction of these tokens is now being sold during the first round of the presale.

During this initial stage, DLANCE tokens are available for purchase at the most competitive price for investors, employers, and freelancers. Currently, 60 million tokens are offered for $0.025 USDT. The second and third stages will offer 73 and 83 million tokens, respectively, at $0.027 and $0.030 per token. The main objective of the presale is to raise $6 million before the centralized exchange offering.

DLANCE tokens can be purchased on the official website using Ethereum (ETH), BNB, or a credit card.

Related News

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage