Join Our Telegram channel to stay up to date on breaking news coverage

This article examines cryptocurrencies that have demonstrated resilience and potential in volatile market conditions, making them viable options for investors looking for strategic opportunities in the digital asset market.

Given the current market outlook, investors seek smart investments for a potential market surge. Tokens like Render, Sei, and Aave show promising trends and are worth considering among the top cryptocurrencies to invest in now. Investors are showing heightened interest in these altcoins, anticipating a shift in market trends.

Top Cryptocurrencies to Invest in Now

Grayscale announced the launch of a new decentralized AI fund for native tokens, including Render (RNDR). This has triggered a surge within the AI sector, leading to significant gains for RNDR.

Simultaneously, the Sei Foundation has introduced a $50 million Japan Ecosystem Fund to bolster the gaming, social, and entertainment sectors. Additionally, the SHIBASHOOT presale has raised $600,000 so far.

1. Render (RNDR)

Render Network allows users to use unused GPU power to render motion graphics and visual effects. This method efficiently uses resources and supports the increasing demand for high-quality visual content across various industries.

Grayscale has recently launched a new decentralized AI fund that is available exclusively to accredited investors. This fund includes native tokens from Render, Bittensor, Filecoin, Livepeer, and Near. The fund’s strategy targets three main categories of decentralized AI assets.

It includes protocols developing AI services like chatbots and image generation, as well as solutions addressing centralized AI issues such as bot authenticity, deep fakes, and misinformation. Additionally, it focuses on protocols building AI infrastructure, including decentralized marketplaces for data storage, GPU computation, 3D rendering, and streaming services.

The intersection of 3D and AI is an exciting arena to a part of. We welcome being included in Grayscale’s Decentralized AI Fund! https://t.co/fYDqW4OIVz

— The Render Network (@rendernetwork) July 17, 2024

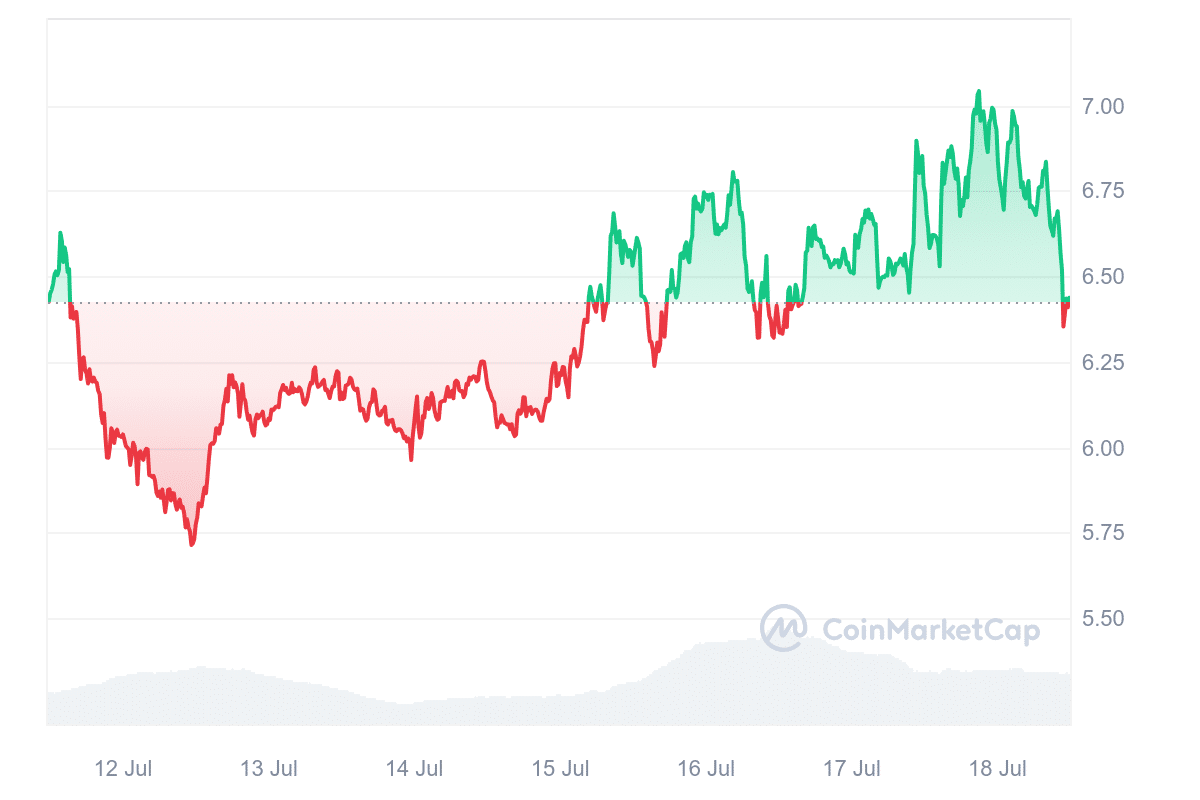

This news has triggered a surge within the AI sector, leading to significant gains for RNDR. The token traded at $6.58 at press time and saw a 2.39% decrease in the last 24 hours. However, it experienced a 2.64% surge in the past week, sparking optimism.

The token’s 14-day Relative Strength Index (RSI) at 42.66 indicates that it is currently neutral and may trade sideways. The growing attention and technical improvements in RNDR highlight the increasing importance of AI tokens in the larger cryptocurrency market. As the sector grows, these tokens will likely gain greater attention from investors and analysts.

2. Shiba Shootout (SHIBASHOOT)

Shiba Shootout uses a Wild West theme with blockchain technology in a play-to-earn mobile game. Players can engage in meme-making duels, poker tournaments, and virtual treasure hunts, earning SHIBASHOOT tokens as rewards.

Set in the fictional town of Shiba Gulch, players can participate in various activities to earn tokens. SHIBASHOOT is the in-game currency, offering numerous ways to earn and spend tokens.

The game features a competitive leaderboard system. Players gain experience points (XP) through gameplay, with top players earning bonus SHIBASHOOT tokens and exclusive rewards, encouraging continuous engagement.

Players can use the tokens for in-game transactions and special features. The game also allows the staking of SHIBASHOOT tokens, offering attractive annual percentage yields (APYs) to promote long-term holding. This staking provides passive income opportunities and helps secure the network.

Furthermore, the SHIBASHOOT presale has raised $600,000 so far. The presale aims to build a strong community by offering significant benefits to early adopters, including access to staking rewards and leaderboard bonuses.

Shiba Shootout has a total token supply of 9.4 billion. Allocations include presale, liquidity, marketing, and project development. Presale funds will support marketing efforts, provide liquidity for decentralized exchanges, and fund the platform’s ongoing development, ensuring sustained growth and value for the community.

3. Sei (SEI)

The Sei Foundation has recently introduced a $50 million Japan Ecosystem Fund. This fund aims to bolster the gaming, social, and entertainment sectors, offering significant support to early-stage startups and established teams. The goal is to help these entities scale their operations on the Sei Network.

The fund will primarily target Web3 gaming, social, and entertainment projects. Furthermore, Sei V2, touted as the most efficient blockchain in the Ethereum Virtual Machine (EVM) landscape, can potentially revolutionize consumer-facing blockchain applications. However, the fund remains open to projects outside these areas if they present exceptional utility for blockchain technology in Japan.

The Ecosystem Fund also aims to attract local talent and identify promising Japanese startups that can integrate into the Sei ecosystem. This aligns with the Sei Foundation’s broader goal of expanding the Sei network.

The impact of Sei v2 is undeniable ☄️

With consistently new ATHs in TVL and a surge of new deployments, the Sei ecosystem is gaining unstoppable momentum. pic.twitter.com/3mIbqV0xE0

— Sei 🔴💨 (@SeiNetwork) July 15, 2024

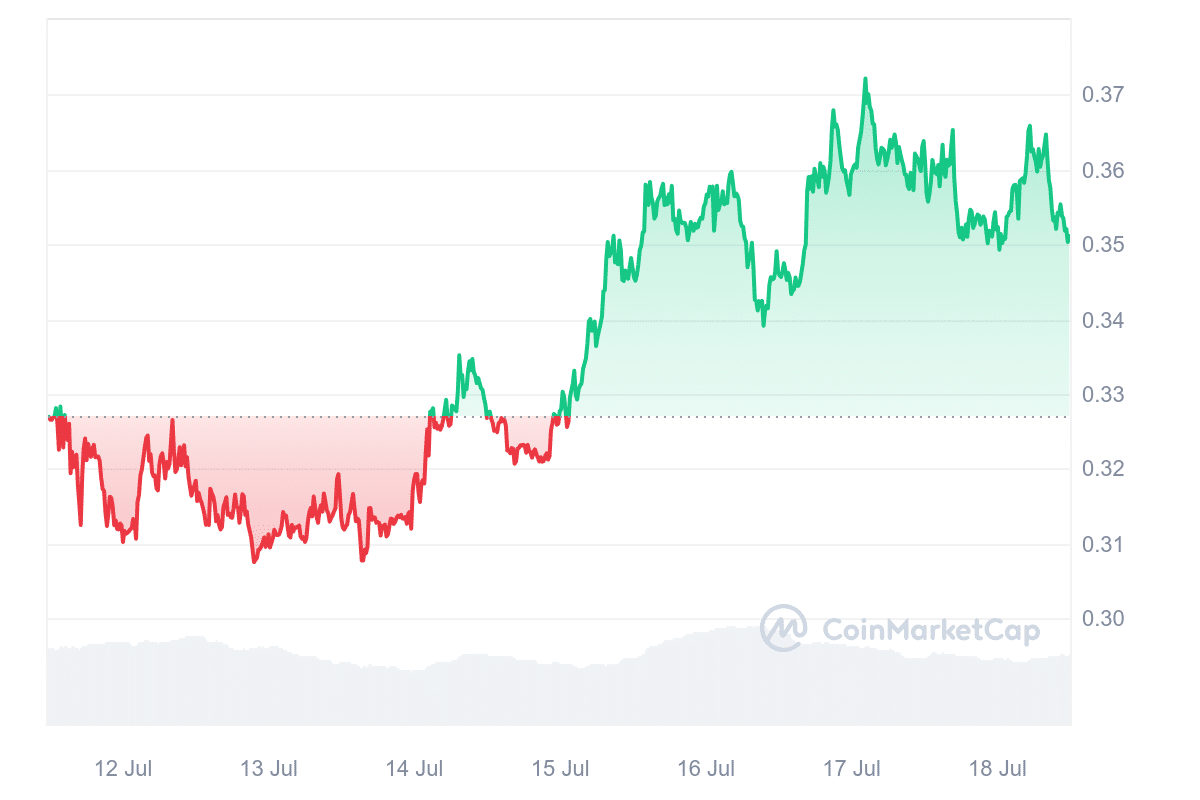

Despite a general downturn in the market, the Sei token has shown resilience, increasing by 8% over the past week. Analysis of its simple moving averages and Relative Strength Index (RSI) indicates that the token may have reached a bottom, with the potential to rise to $0.50. Sustaining this upward trend could allow the SEI token to surpass these levels.

Moreover, the SEI token experienced 18 green days in the last 30 days and maintains high liquidity relative to its market cap. These positive short-term signals make SEI one of the top cryptocurrencies to invest in now for potential gains.

4. Jupiter (JUP)

Jupiter allows users to swap tokens at optimal prices with low slippage and transaction fees. By aggregating liquidity from multiple exchanges and pools, Jupiter ensures users get the best possible rates for their trades.

Furthermore, the platform features advanced trading options like limit orders and dollar-cost averaging. Jupiter also offers a bridge aggregator that allows users to compare different routes for cross-chain transactions, enhancing the efficiency and cost-effectiveness of their trades.

The token powers the platform’s governance. Holders of JUP can participate in decision-making processes, influencing the platform’s future direction. This decentralized governance model aims to foster a community-driven approach to development.

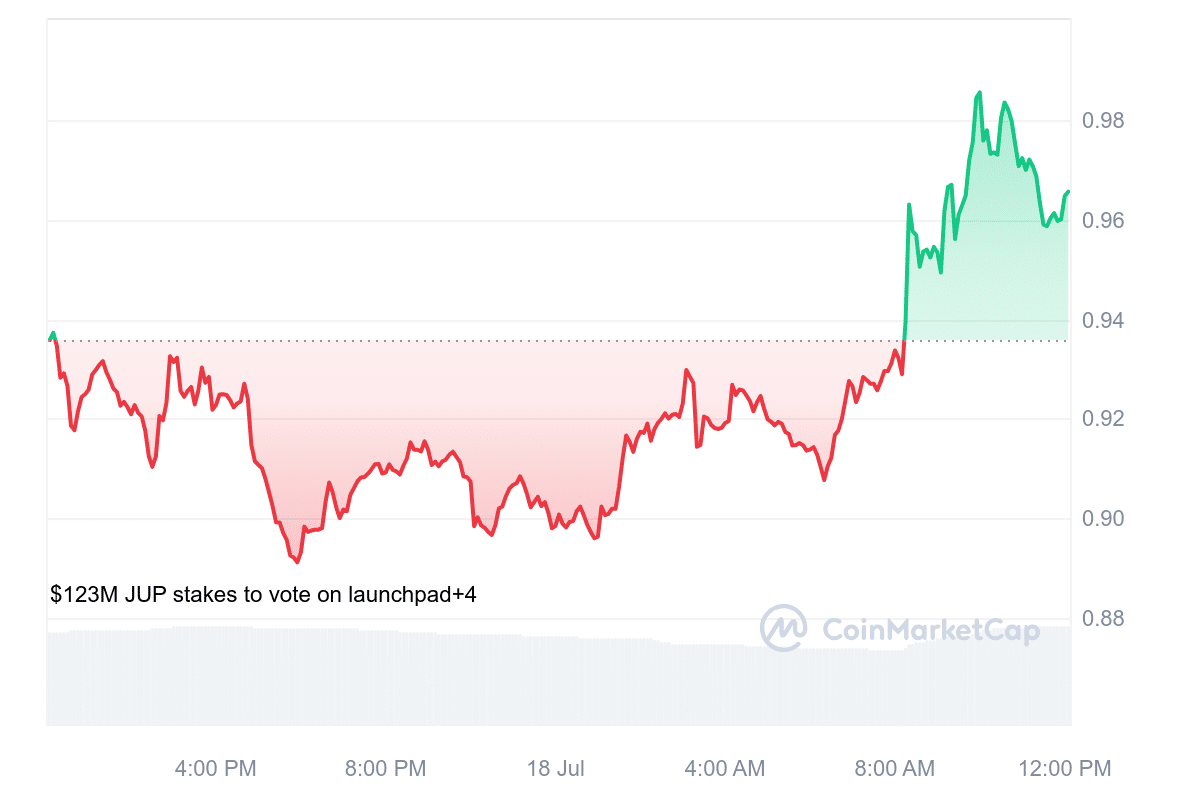

Moreover, the upcoming “Jupuary” relaunch is drawing attention to Jupiter. This relaunch will introduce a revamped governance structure with a new voting mechanism. Anticipation around these changes has boosted market sentiment, increasing trading volumes.

JUP is priced at $0.7763 at the time of writing, reflecting an intraday surge of 13.02%. The token trades significantly above its 200-day Simple Moving Average (SMA) by 28,912.41%. In the last 24 hours, Jupiter’s trading volume reached $152 million, marking a 6.52% increase.

This uptick in activity suggests growing interest and engagement with the token. Over the past 30 days, JUP has seen 17 green days, indicating frequent price gains. In addition, the JUP token is trading near its cycle high and has high liquidity relative to its market cap, suggesting an active market.

5. Aave (AAVE)

Aave consistently attracts investor interest due to its substantial market capitalization and strong endorsements. It offers significant liquidity and shows potential for long-term growth. The platform’s community-driven governance and quick adaptation to market demands enhance its utility.

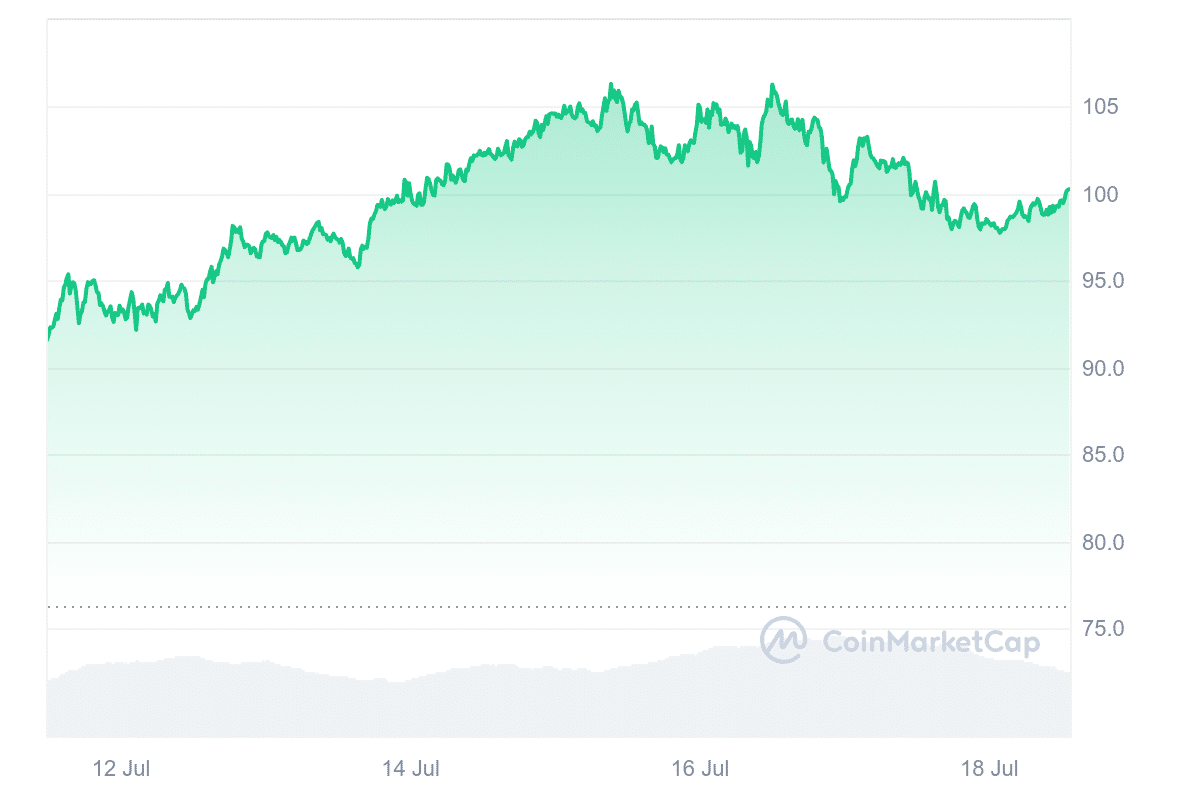

At press time, AAVE’s price is $100.03, reflecting a 0.89% increase in the past 24 hours. Over the last week, the token saw a significant surge of 9.43%. Moreover, it is trading 27.64% above its 200-day Simple Moving Average (SMA) of $78.04.

The 14-day Relative Strength Index (RSI) is 60.18, indicating a neutral market position. Current market sentiment towards Aave remains bullish, with the token experiencing 17 green days in the past 30 days. The high liquidity of Aave is further supported by its market cap, reinforcing its stability and appeal in the DeFi space.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage