Join Our Telegram channel to stay up to date on breaking news coverage

Crypto analyst Michael Van de Poppe has recently discussed the altcoin market’s potential for a significant breakout. The analyst highlighted a developing bullish pattern represented by a “higher low” formation. This pattern could signal a trend reversal in the altcoin market.

He further suggested that the market structure indicates a possible upward shift when viewed on a larger time frame. He projects that this turnaround might become evident by September. As such, traders are seeking the top altcoins to consider for investment, anticipating the bullish trend.

Top Crypto to Invest in Right Now

Uniswap is the second-largest protocol on the Polygon network, with a TVL of $226 million. Meanwhile, Helium recorded an intraday price increase of 1.62%, bringing its value to $7.15. Additionally, SUN’s recent performance indicates rising market interest and optimism for decentralized finance applications. These developments place each asset among the top crypto to invest in right now.

1. Uniswap (UNI)

Uniswap is a decentralized trading protocol recognized for enabling automated trading of decentralized finance tokens. It maintains an open platform for anyone holding tokens, aiming to enhance trading efficiency compared to traditional exchanges.

By addressing liquidity issues through automation, Uniswap effectively avoids challenges that previously hindered decentralized exchanges. Currently, Uniswap is the second-largest protocol on the Polygon network by Total Value Locked (TVL), holding $226 million.

Furthermore, the token has experienced a notable increase in TVL, rising by 39.2% over the last month. Its market capitalization is $3.5 billion, reflecting solid market confidence and broad adoption.

We believe everyone should have access to an onchain identity

That’s why we built uni.eth usernames directly into the mobile app

Completely gasless and free to claim 🫡 pic.twitter.com/3psAr1dhGt

— Uniswap Labs 🦄 (@Uniswap) August 25, 2024

Regarding performance, the UNI token’s price has surged by 1.43% in the last 24 hours, trading above its 200-day simple moving average. It has also recorded 15 green days within the past 30 days. Similarly, UNI boasts robust liquidity relative to its market capitalization.

The 14-day RSI is at 34.94, suggesting a neutral stance, with the cryptocurrency likely to trade sideways soon. Moreover, Coincodex analysis predicts that the UNI token will reach as high as $ 28.06 next year.

2. Sun (SUN)

SUN is a token developed as a social experiment to enhance the TRON DeFi ecosystem. Positioned as the Bitcoin equivalent on the TRON network, SUN adopts a unique approach by forgoing traditional funding methods.

The token’s genesis mining started in early September 2020, two weeks before its official launch. During this phase, participants could stake TRX or other TRC-20 tokens to earn rewards and governance rights associated with SUN. The project’s security model mirrors many proof-of-stake (PoS) tokens, relying on community consensus and financial incentives to secure the network.

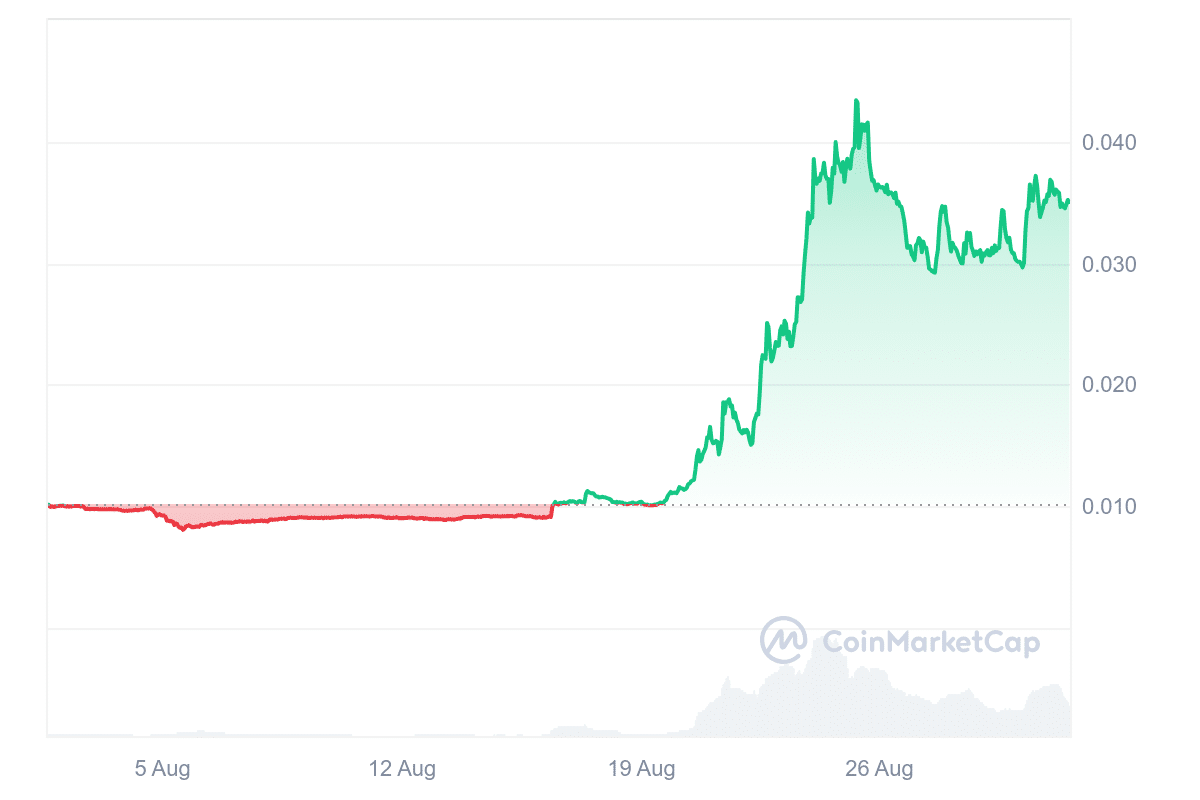

At press time, SUN’s price experienced a decline of 5.17% within the last 24 hours, with a trading volume of $183 million. Despite this drop, the token has shown a significant surge of over 240% in the past month. This upward movement began after TRON founder Justin Sun announced the SunPump launch on August 13, which propelled SUN’s price to a peak of $0.043.

Additionally, the SUN Relative Strength Index (RSI) has notably increased, suggesting continued upward momentum in the price chart. Also, the market sentiment around the token appears positive, further strengthening investors’ optimism.

If SUN can maintain its price above the current support level of $0.02345, it could potentially break through the upper resistance level of $0.0340. However, if the trend reverses, the token might test a lower support level at $0.0180.

SUN’s recent performance reflects growing market interest and enthusiasm for DeFi applications. With its evolving focus and new use cases, SUN may be well-positioned for further development and growth, making it the top crypto to invest in right now.

3. Shiba Shootout (SHIBASHOOT)

Shiba Shootout has attracted considerable attention since its debut in the meme coin market. This project features a Wild West-inspired theme, with characters like Marshal Shiba and the Shiba Sharpshooters at its core.

🚀 Claim your free $SHIBASHOOT tokens now! Sign up and start stacking those coins today! 🐕💥

Jump in the fun! 🚀 https://t.co/Fxf9PWP0gz pic.twitter.com/34SoD95X6D

— shibashootout (@shibashootout) August 31, 2024

In the fictional Shiba Gulch, Marshal Shiba leads the community in meme battles, light-hearted banter, and meme competitions, creating a lively digital environment. Moreover, the project recently surpassed $1 million in its presale phase, drawing significant interest from market participants.

The rapid pace of the presale suggests that it could sell out soon. Shiba Shootout’s unique vision of a crypto-themed Wild West resonates well with its audience. Similar to Floki Inu, it extends the meme coin niche by incorporating play-to-earn features. The platform features its play-to-earn game, which is already available on Android and iOS platforms.

The project also includes a staking program called Cactus Staking, which offers passive income with higher-than-average returns. Currently priced at $0.02 in the ongoing presale, SHIBASHOOT presents itself as an affordable cryptocurrency with various utility features.

4. Helium (HNT)

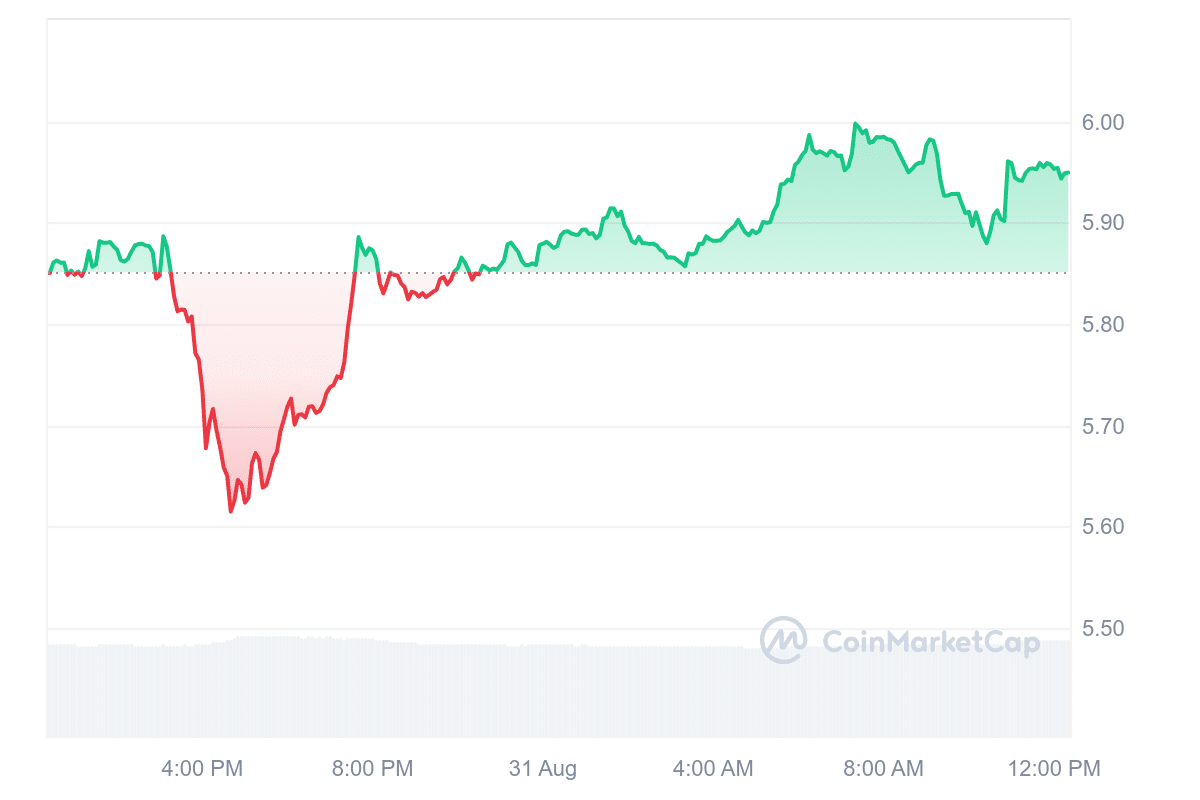

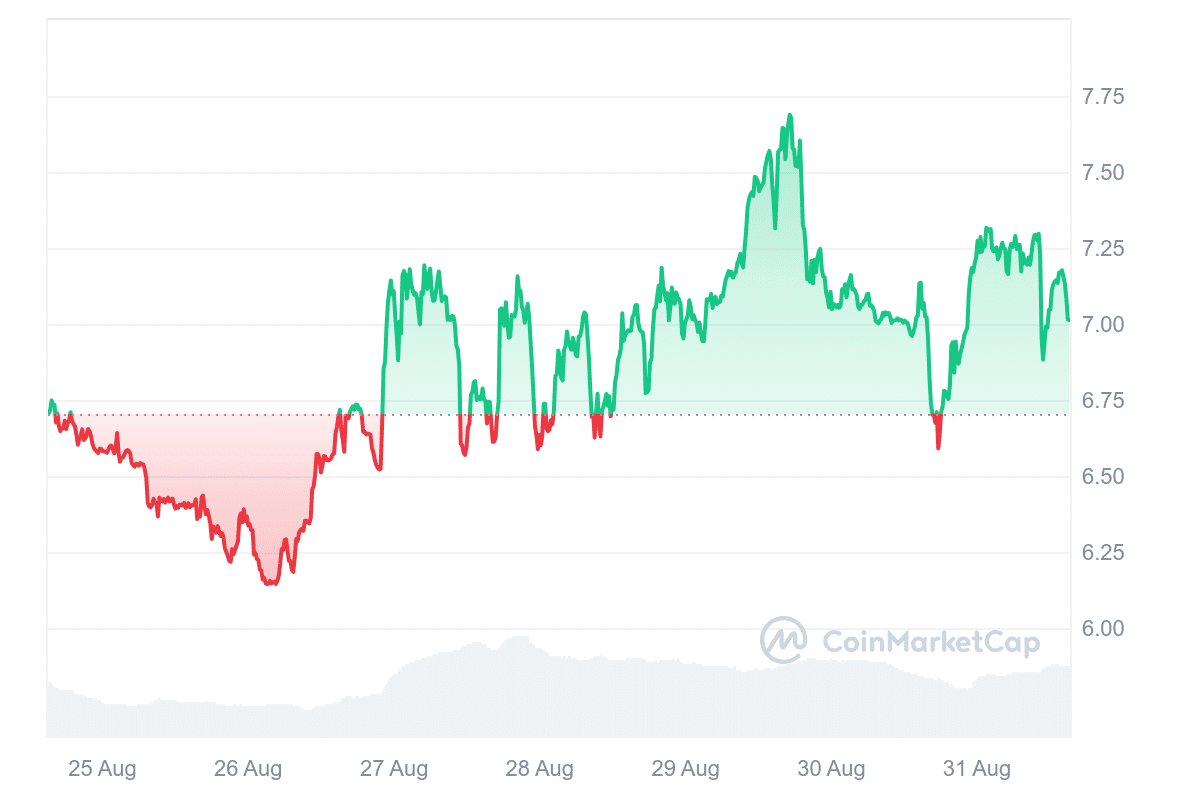

Helium has recently experienced an intraday 1.62% price increase, currently valued at $7.15. It further boosts a market cap to over $1.1 billion. This uptick places Helium among the top gainers in the market. Daily trading volume has also increased alongside the price rise, reflecting growing interest in the asset.

Furthermore, Helium’s decentralized network model continues to attract attention, particularly from major U.S. carriers. The network offers a new approach to expanding wireless coverage through a decentralized network of mobile nodes, contrasting with the traditional method of building additional cell towers. This innovation has led to discussions about Helium’s potential impact on wireless infrastructure.

Notably, two major U.S. carriers are reportedly testing the offloading of their traffic to Helium’s MOBILE network. Carrier 1 has around 185,000 customers, while Carrier 2 has over 122,000 users involved in the trial. If successful, this partnership could benefit both carriers and Helium, as the carriers might reduce costs and improve coverage, while Helium could see increased traffic and revenue for hotspot providers.

The monthly Helium Network Community Call is happening this week, on Wednesday, August 28th, 2024, at 16:00 UTC in the Helium Discord.

Join the event here: https://t.co/8Xltmtpqa2.

This call is an incredible opportunity for developers, Hotspot owners, and all members of the… pic.twitter.com/SqGjfdnNYS

— Helium🎈 (@helium) August 26, 2024

The recent price increase coincides with the just concluded community call on August 28, where developers, hotspot owners, and community members discussed updates and governance within the Helium ecosystem.

Market sentiment for Helium remains positive, with the Relative Strength Index (RSI) at 58.82, indicating the potential for further price growth before reaching an overvalued state. Additionally, Helium is trading significantly above its 200-day Simple Moving Average (SMA) of $2.25, suggesting there may be room for further gains before a potential price reversal.

5. ORDI (ORDI)

ORDI has garnered attention from DeFi investors due to its innovative approach. The Ordinals protocol, which allows data to be embedded directly in Bitcoin’s smallest unit, the Satoshi, is a notable development. This feature enables the creation of Bitcoin-backed NFTs without relying on sidechains, allowing developers to create ordinals representing ownership of both on-chain and off-chain assets.

Additionally, the protocol facilitates the creation of rare and exotic collectible pieces, known as ordinals. Since ordinals are essentially Satoshis, they are easily accessible to any Bitcoin user, which broadens the protocol’s appeal.

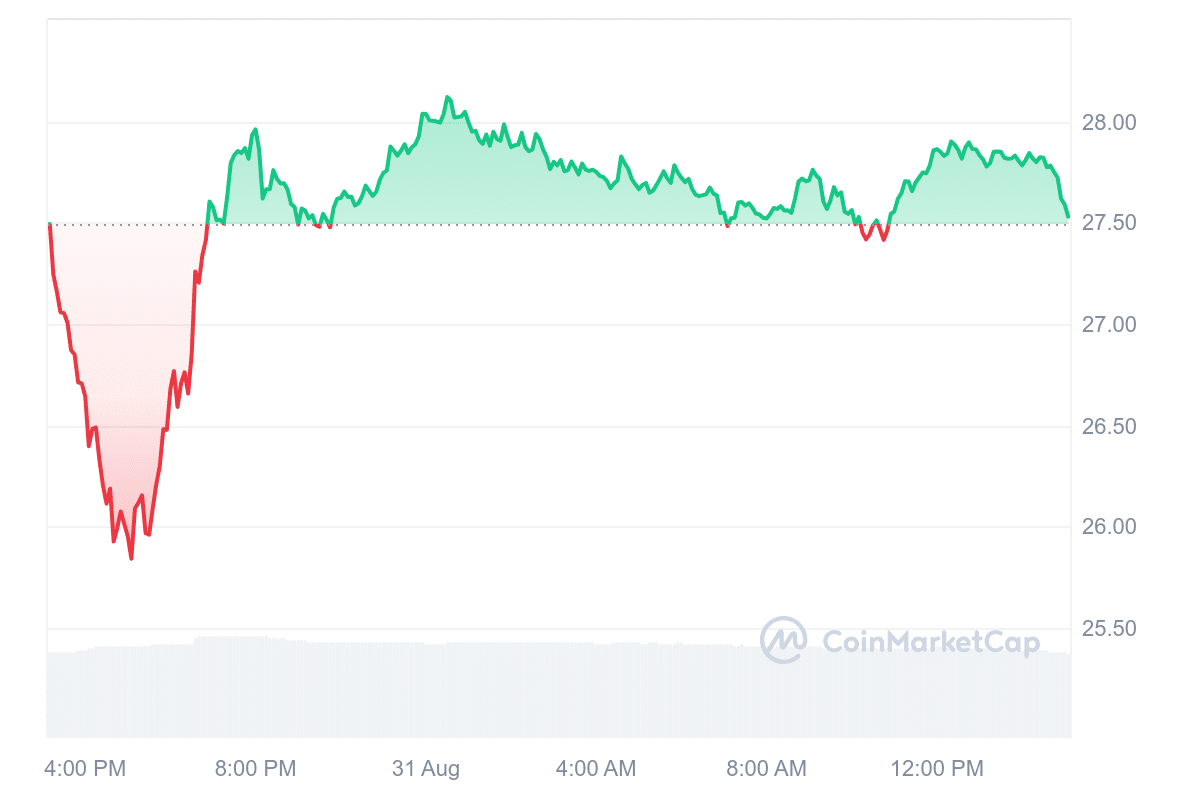

Recently, ORDI’s price performance has been significant, with a 28% gain over the past week. This surge has helped ORDI recover much of the losses experienced earlier in the month, with the broader market’s optimism playing an important role.

Currently trading at $27.60, ORDI has seen a modest intraday increase of 0.36%. The volume-to-market cap ratio of 20.94% indicates significant volatility in this cryptocurrency.

Technical indicators showcase that the token trades above the 200-day simple moving average, suggesting it has strong liquidity relative to its market cap. The 14-day Relative Strength Index (RSI) is 59.59, indicating a neutral position, which could imply sideways trading in the near term.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage