Join Our Telegram channel to stay up to date on breaking news coverage

In the last 24 hours, approximately a quarter of cryptocurrencies have shown positive movement. Bonk is the top gainer today, marking a 35.12% increase. At the same time, Rollbit Coin experienced the most significant decline, showing an 8.71% loss within the same period.

Over the past year, Rollbit Coin has emerged as the strongest performer, showcasing an impressive gain of 7,272.00%. In 2022, Rollbit Coin was notably successful, registering a 7,557.00% gain since the year’s commencement.

Biggest Crypto Gainers Today – Top List

In contrast, Flare has faced substantial challenges in the past year, exhibiting a drastic decrease in value, marking a significant loss of -96.45%. Since the beginning of the year, Flare has consistently underperformed, facing a total loss of -97.60% of its value.

1. Bonk (BONK)

Bonk has consistently traded above its 200-day simple moving average, showcasing a positive trend. Over the last month, it recorded 22 green days out of 30, marking a 73% positive performance and high liquidity indicated by its market cap.

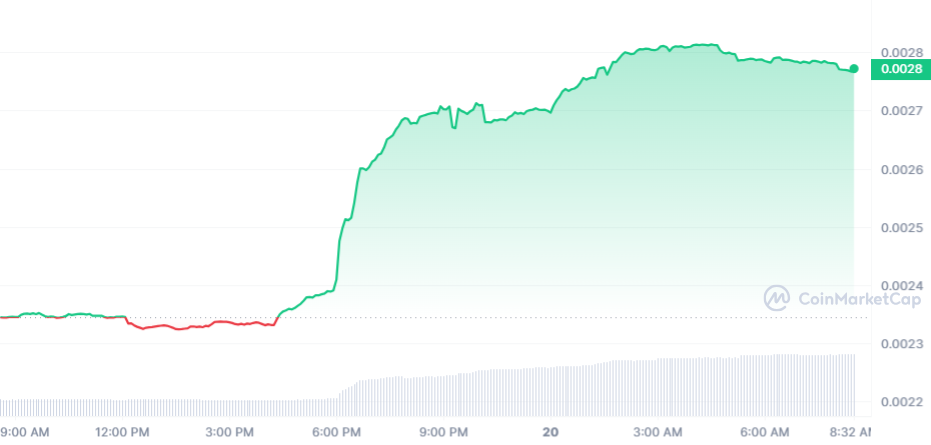

Presently valued at $0.054517, Bonk demonstrates a 24-hour trading volume of $72.00 million. Moreover, BONK has a market cap of $210.02 million, with a market dominance of 0.01%. Among the top crypto gainers today, it surged 36.19% in the last 24 hours.

GM

Love seeing all the excitement for BONK going into the holidays!

December will be here before we know it…Now it is time to take our iconic BONK shiba inu and show us your interpretation of holiday BONK dog!

Details in submission form 👇https://t.co/hPJOpYQdQy pic.twitter.com/dAxmutSwBw

— BONK!!! (@bonk_inu) November 17, 2023

Its peak occurred on Nov 20, 2023, hitting an all-time high of $0.054783. In contrast, its lowest point was observed on Oct 12, 2023, at $0.061753. Following this, subsequent cycles ranged from $0.054311 to $0.054504. Market sentiment indicates a bullish trajectory, with a Fear & Greed Index at 69, signaling ‘Greed.’

2. Synthetix (SNX)

Synthetix, a cryptocurrency, has experienced notable pricing and market performance shifts over the past year. Within a year, its price surged by 104%, showcasing a considerable growth trend. This increase positions it favorably against 78% of the top 100 crypto assets, signifying a competitive edge within the market.

Regarding technical analysis, the currency trades above its 200-day simple moving average, indicating a positive trend. Additionally, it has exhibited a positive performance in contrast to its token sale price, suggesting stability and potential reliability for investors.

Exciting news! Perps V3 is on the horizon, set to build upon the remarkable success of V2. Get ready for its upcoming launch on @BuildOnBase via the Andromeda Release.

V2 brought a paradigm shift to onchain perps, focusing on risk management and introducing now-standard features… pic.twitter.com/z2a7U9N4nv

— Synthetix ⚔️ (@synthetix_io) November 19, 2023

Furthermore, Synthetix is valued at $3.58, with a 24-hour trading volume of $389.54M. It also boasts a market cap of $411.66M, comprising a market dominance of 0.03%. Short-term trading patterns reveal a relatively positive trend, with 19 out of the last 30 days recording gains. This accounts for 63% of the observed period, placing it among the top crypto gainers today.

3. Skale (SKL)

Synthetix, a notable cryptocurrency, has seen considerable price shifts last year. It surged 104% in this period, outperforming 78% of the top 100 crypto assets. Currently valued at $3.60, with a trading volume of $394.30M and a market cap of $413.18M, it holds a 0.03% market dominance.

One strong indicator of Synthetix’s performance is its consistent trading above the 200-day moving average since its token sale. Over the last 30 days, it saw 19 positive trading days, marking a 63% positive trend. The current trading position is near its peak, reflecting high liquidity based on its market cap. This has placed SKL among the top crypto gainers today.

Experience the force of @SkaleNetwork in Web3 gaming!

With a 46% surge in daily active users to 126,457 and backed by hits like @32bit_Untitled & @Gamiflyco, SKALE's infrastructure is redefining blockchain gaming's future. pic.twitter.com/uxC4PKfTHC

— SKALE (@SkaleNetwork) November 17, 2023

Reviewing historical data, Synthetix reached its highest point on Feb 14, 2021, hitting $28.63, while its lowest was $0.032478 on Jan 5, 2019. Since its all-time high, it hit a low of $1.400150 and a high of $3.64 in the recent cycle.

Furthermore, sentiment analysis leans towards a bullish outlook for Synthetix. Thus coinciding with a Fear & Greed Index value of 69, suggesting a slight market inclination towards greed.

4. Telcoin (TEL)

Telcoin (TEL) has shown several notable indicators in its recent trading performance. It stands above its 200-day simple moving average, reflecting a sustained positive trend. Over the last 30 days, it has exhibited a positive trajectory, with 23 out of 30 days marked as green, constituting a 77% uptrend.

Trading near its cycle high, Telcoin is positioned at a significant point in its trading pattern. It is actively traded on KuCoin, a notable exchange platform. The sentiment around Telcoin’s price prediction is currently bullish, while the Fear & Greed Index registers 69. Thus indicating a sentiment of “Greed” in the market.

Regarding its supply dynamics, Telcoin has a circulating supply of 70.25 billion out of a maximum supply of 100 billion. The yearly supply inflation rate stands at 9.44%, with 6.06 billion TEL created last year. Telcoin ranks #72 in the Ethereum (ERC20) Tokens sector by market cap.

5. NEAR PROTOCOL (NEAR)

NEAR Protocol has undergone notable shifts in its pricing and performance over the past year. Its price has surged by 19% within the last year, showcasing a trajectory that outpaced 56% of the top 100 crypto assets. Currently valued at $2.08, the token’s 24-hour trading volume is $668.87 million, with a market cap of $2.08 billion. Thus representing a market dominance of 0.15%.

Several indicators suggest its recent performance trends. NEAR Protocol is trading above the 200-day simple moving average and has seen 22 green days in the last 30 days. This accounts for 73% of its recent trading activity, propelling it into top crypto gainers today.

Take a look back at the most iconic event of the Web3 calendar year – NEARCON23!

Forgot what's cooking?

From a NEAR Foundation x @0xPolygonLabs partnership to Data Availability, to fast finality with @eigenlayer, it's all there.https://t.co/2nIqnSU71i pic.twitter.com/XpAQH2hA7Q

— NEAR Protocol (@NEARProtocol) November 17, 2023

Furthermore, it’s trading close to its cycle high, reaching $2.11, while its all-time high stands at $20.42, achieved on Jan 16, 2022. Moreover, liquidity remains robust, supported by its high market cap and availability on Binance, a prominent crypto exchange.

6. Bitcoin Minetrix (BTCMTX)

Bitcoin Minetrix introduces a novel approach where users stake BTCMTX tokens to earn cloud mining credits. Thus aiming to decentralize control and ensure a secure mining experience for token holders.

Furthermore, the Bitcoin Minetrix staking pool has garnered substantial interest, with over 400,000 BTCMTX tokens currently staked. The project claims to offer an annual percentage yield (APY) of 103,225%.

Big news! 📢#BitcoinMinetrix proudly announces a colossal accomplishment, more than $4,000,000 raised! 🪙 pic.twitter.com/neW7VEgkjJ

— Bitcoinminetrix (@bitcoinminetrix) November 16, 2023

Despite its early developmental stage, Bitcoin Minetrix has seen considerable attention, positioning it among the top crypto gainers today. The ongoing BTCMTX presale has raised over $4,171,315 at $0.011 each out of a total supply of 4 billion tokens. During the presale phase, 70% (2.8 billion BTCMTX) of the token supply is available for acquisition using ETH or USDT.

7. Arweave (AR)

An impressive intraday surge has placed AR among the top crypto gainers today. Trading at $9.08, Arweave demonstrates a 24-hour trading volume of $208.69M, holding a market cap of $594.64M and a market dominance of 0.04%. This represents a 10.80% increase in the last 24 hours.

Furthermore, AR’s price surge has resulted in a positive performance compared to its token sale price. Over the last 30 days, Arweave has experienced 21 days of gains. This amounts to a 70% positive trend as the coin trades near its cycle high.

Some key facts about Arweave's tokenomics:

– $AR is used for block rewards and to upload data to Arweave.

– The maximum supply of $AR tokens is 66 million.

– The majority of token fees are in a sustainable endowment.A simple breakdown of Arweave's tokenomics below (NFA): 🧵👇 pic.twitter.com/zBqF5UOPpV

— Only Arweave (@onlyarweave) November 17, 2023

In terms of liquidity, the project exhibits high liquidity based on its market cap. It is actively traded on Binance, a prominent exchange platform. However, it’s important to note that the current sentiment for Arweave’s price prediction is bullish.

Similarly, the Fear & Greed Index sits at 69, indicating a state of greed within the market sentiment. Moreover, in the Layer 1 sector, Arweave holds the #39 ranking, emphasizing its position within this market segment.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage