Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin surged to a record high of $75,372, driven by the excitement of Donald Trump’s presidential win, sparking a broader crypto rally. With 98% of cryptocurrencies in the green, the market sentiment is buzzing with “greed.” As investors flock to the crypto market, Uniswap, SuperVerse, Jito, and Aerodrome Finance show impressive gains and offer prime opportunities for savvy traders. This bullish momentum signals a promising outlook for the crypto space, making now the perfect time to explore the top gainers.

Biggest Crypto Gainers Today – Top List

Uniswap led the way with a 17.79% surge, reaching $8.10, driven by strong DeFi market interest. Meanwhile, SuperVerse followed closely, jumping 17.56% to $1.29, boosted by its Web3 gaming connections. In addition, Jito saw a 16.38% rise, reaching $2.21, fueled by the success of its restaking launch. Finally, Aerodrome Finance gained 14.62%, climbing to $1.23, continuing its impressive growth with a 5,000% increase over the past year. These remarkable gains collectively call for a deeper analysis to see their enticing opportunities for investors.

1. Uniswap (UNI)

Stealing the spotlight today, Uniswap is soaring as the first top crypto gainer on the list, standing out among others. Right now, UNI is priced at $8.10, marking a notable 17.79% surge in the last 24 hours. This impressive rise shows Uniswap’s growing influence in decentralized finance (DeFi) and hints at the market’s strong interest in this decentralized trading protocol.

As an automated market maker (AMM), Uniswap aims to keep trading fast, open, and efficient, making it accessible to anyone holding tokens. Built as a decentralized protocol, it operates on the Ethereum blockchain, with UNI structured as an ERC-20 token. Yet, like many Ethereum-based assets, Uniswap occasionally faces congestion on the network, sometimes driving up gas transaction fees. Nevertheless, UNI has maintained high liquidity, demonstrated by its 0.0882 volume-to-market cap ratio, a reassuring sign for traders and investors alike.

Bridging volume has already crossed $13M in the last ten days

Pushing the cross-chain future forward, one step at a time 🦄 pic.twitter.com/MjRZM5Mu47

— Uniswap Labs 🦄 (@Uniswap) November 3, 2024

In fact, the 14-day Relative Strength Index (RSI) for UNI is currently at 34.94, indicating a neutral position and suggesting potential sideways movement in the short term. Over the last 30 days, UNI has seen green days 53% of the time, which shows a steady level of investor confidence and engagement with this token.

But the long-term outlook is even more promising. Uniswap is trading a solid 52.62% above its 200-day simple moving average of $5.28, and over the past year, UNI’s value has climbed by 60%. Plus, it has outpaced 52% of the top 100 crypto assets by market cap, demonstrating its resilience and appeal in the competitive crypto market.

2. SuperVerse (SUPER)

SuperVerse is the second top gainer today, taking a leap in price and popularity. Known for uniting the web3 gaming world, SuperVerse connects millions of players to the best crypto games through its SUPER token. This unique network lets top gaming projects seamlessly share users and liquidity, helping reduce industry fragmentation and boosting mainstream potential.

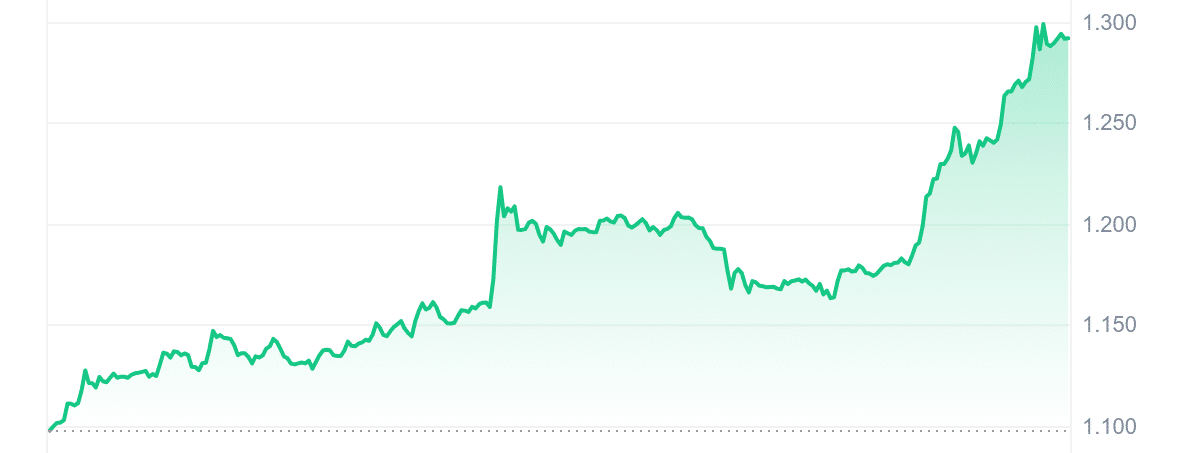

Today, the SUPER token price has surged by 17.56% in the last 24 hours, reaching $1.29. With high liquidity—its volume-to-market cap ratio stands at 0.1390—SuperVerse is well-positioned to handle trading demand. Its 14-day RSI rests at 69.92, suggesting the token remains stable and may trade sideways in the short term.

In the past 30 days, SuperVerse has seen 14 green days, marking 47% of the time as positive. This period also brought a 7% volatility rate, demonstrating a reasonably steady price pattern. And long-term performance tells an even more remarkable story. Currently, SuperVerse trades 629.99% above its 200-day SMA, with a stunning 1,281% price increase over the past year. Impressively, it has outperformed 90% of the top 100 crypto assets in that time, showing its growing market strength.

DING DING DING! 🥋

SuperVerse is stepping into the ring with @KarateCombat – crypto’s first sport and the ultimate full-contact striking league! 💪

Saiyans, put your boxing gloves on! 🥊

1/5 pic.twitter.com/cTfEsFLtYY

— SuperVerse (@SuperVerse) October 31, 2024

SuperVerse’s foundation lies in its commitment to secure, cost-effective gaming transactions. With the added governance power through its DAO, token holders actively shape the ecosystem. By integrating NFTs, gaming rewards, and a robust DAO structure, SuperVerse combines community and technology. As it builds on transparency and user engagement, it appeals to gamers and crypto investors.

3. Flockerz (FLOCK)

Flockerz is stirring excitement with its over $1.2 million funding milestone. This Vote 2 Earn meme coin has quickly gained traction, and investors are rushing to secure their stake before the next presale stage pushes the price up.

It shines with its strong focus on fostering community engagement and collaboration. Through its Vote 2 Earn model, investors can earn $FLOCK by voting on critical project decisions, essentially taking the reins. This decentralized governance system, dubbed FlockTopia DAO, allows token holders to drive the project’s future and earn rewards, putting power firmly in the community’s hands.

The project also offers lucrative staking rewards. Investors can stake their $FLOCK tokens with an impressive APY of 1,313%, one of the highest rates in the industry. This approach indicates the project’s dedication to rewarding its community members for their support. Also, experts and popular analysts have called Flockerz the next big meme coin to watch, setting expectations for significant returns.

No matter where the wheel lands you're always winning with the flock!

Ready to take a spin? 🐦🎡 pic.twitter.com/YY5Gt7dBa0

— Flockerz (@FlockerzToken) November 4, 2024

This early presale success and strong community backing position Flockerz as a meme coin with staying power. Its utility-focused features and rewards for participation create a unique, dynamic ecosystem that’s well-suited to thrive. Flockerz is a solid choice in the meme coin market for investors looking to dive into a promising new project.

4. Jito (JTO)

Next is Jito, capturing attention with an impressive 16.38% price surge. Trading at $2.21, JTO has captured attention within the Solana ecosystem. This gain follows significant news: Jito, the most extensive DeFi protocol on Solana, entered the restaking market. The launch exceeded expectations, with deposits surpassing the 147,000 SOL limit in mere hours. This equaled roughly $25 million, showing remarkable investor enthusiasm.

Restaking introduces more opportunities for users. It allows them to earn additional rewards by staking their liquid staking tokens. Jito’s move sparked a notable increase in total value locked (TVL). Currently, about 14.1 million SOL sits within Jito, making up 39% of Solana’s $6.3 billion in locked assets.

Jito’s role as a liquid staking protocol, combined with its MEV product suite, enhances its appeal. Users exchange SOL for JitoSOL, maintaining liquidity while earning yield. This setup also brings MEV extraction profits to holders. MEV, or maximum extractable value, refers to profits from transaction ordering, a crucial factor for traders.

🚀 InfStones is thrilled to support @jito_sol Restaking on @solana! 🚀

Restaking boosts network security & liquidity, letting users earn more with assets in DeFi. Dive into Jito’s Vaults, NCNs, and VRTs, redefining staking on Solana.

🔗 Learn more: https://t.co/XWogRNuJcs pic.twitter.com/5l0MXfWeGI

— InfStones Global (@InfStones) November 1, 2024

Security remains essential for Jito. The platform implements strict measures, including an open-source validator client, ensuring transparency and fairness in MEV extraction. Jito token holders are pivotal in governance, making fees and treasury management decisions.

JTO’s liquidity is another highlight. With a 0.5595 volume-to-market cap ratio, it’s highly liquid. It has seen 13 green days in the past 30 days, or 43%, indicating steady performance. Despite its rapid growth, volatility stays low, at 8%. Jito’s position in the Solana ecosystem strengthens as the restaking market expands.

5. Aerodrome Finance (AERO)

Rounding off our list is Aerodrome Finance, a true gem in decentralized finance. This gainer, AERO, operates as a next-generation automated market maker on the Base network. It is the primary liquidity hub, combining an effective liquidity incentive engine, vote-lock governance, and a user-friendly design.

What truly sets AERO apart, however, is its vote-lock governance model. For instance, users can lock their tokens for voting power, giving them a significant say in platform decisions. This approach fosters long-term commitment and aligns users’ interests with the protocol’s success. As a result, this model boosts security and reduces governance attack risks, building trust within the community.

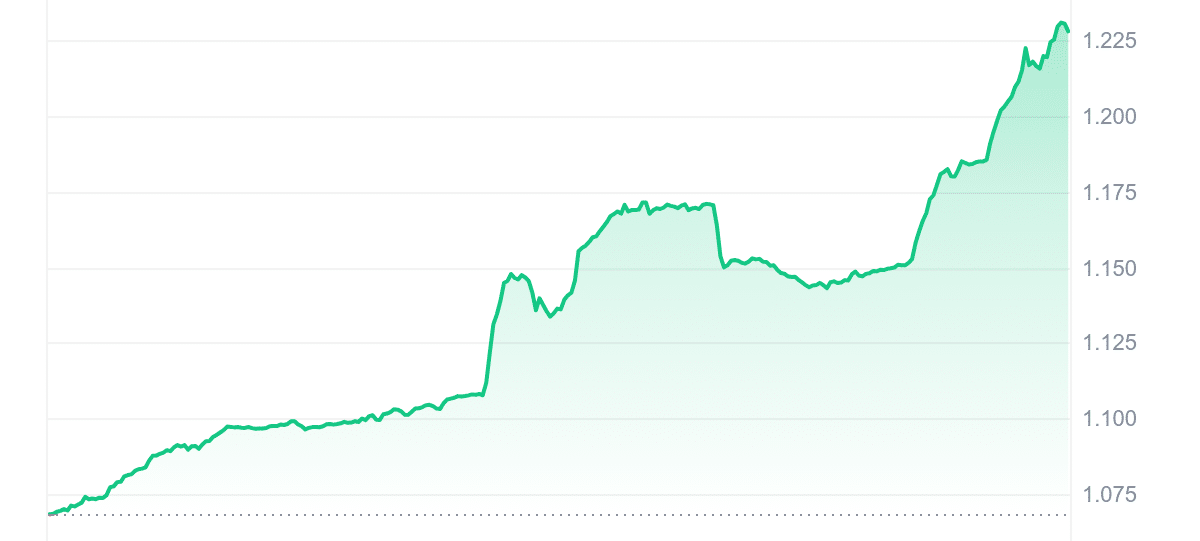

Now, let’s talk about its recent price surge. AERO has jumped 14.62% in the last 24 hours, reaching $1.225829. Interestingly, this isn’t just a one-time event. Over the past year, AERO has seen an impressive 5,087% price increase. Even more striking, it has bested 94% of the top 100 crypto assets, highlighting its strength as an investment.

Aerodrome Dominating UniV3 Volume for ETH Trading Onchain ✈️

Over the past week, the WETH-USDC pool on Aerodrome generated 6.5X more volume than the comparable UniV3 pool.

Last week this pool also generated over $1m in swap fees. veAERO voters share 100% of these Total Rewards. pic.twitter.com/ytrqUgn4rq

— Aerodrome (@AerodromeFi) November 5, 2024

When it comes to liquidity, AERO holds its ground. With a volume-to-market cap ratio of 0.0339, it showcases high liquidity, ensuring stability for active traders. Additionally, it’s had 14 green days in the last 30 days, representing 47% of that period. This points to a steady momentum, even amid market fluctuations.

Despite its notable growth, AERO keeps volatility in check. In fact, its 30-day volatility is just 8%, showing controlled price movements. This stability appeals to investors who prefer minimized risk. Altogether, Aerodrome Finance closes today’s list as a compelling option in the crypto market.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage