Join Our Telegram channel to stay up to date on breaking news coverage

As Sunday unfolds in the crypto market, Bitcoin hovers at $56,908 after a slight 1.14% decline, maintaining its dominance at 53.44% with a market cap of $1.12 trillion. Trading activity remains robust, with a total volume of $288.28 billion in the past day, yet sentiment is cautious, with a Fear & Greed Index reading of 29.

Notably, the market shows a stark contrast: while some cryptocurrencies celebrate gains, a significant 77% face losses. Ribbon Finance (RBN) stands out as the top performer, surging impressively by 22.71% in just 24 hours. In contrast, AIOZ Network struggled, experiencing a notable downturn of -11.79% in its token price. As market dynamics progress, investors keen on the day’s shakers should focus on today’s top gainers.

Biggest Crypto Gainers Today – Top List

Within today’s top gainers lies a spectrum of investment opportunities. Golem leads with an impressive 16.00% surge, leveraging blockchain technology to democratize access to computational power for AI, CGI rendering, and more. Following closely, SSV Network showcases a 9.15% increase, pioneering decentralized Ethereum staking by splitting validator operations across multiple nodes.

Centrifuge follows with an 8.79% rise, integrating real-world assets into DeFi to lower capital costs for SMEs. Lastly, Optimism secures a 7.82% gain, bolstering Ethereum scalability with its layer-two solution. These projects increase token values and advance decentralized technology, improving security, efficiency, and accessibility in crypto—continue reading for more insights.

1. Golem (GLM)

Golem has taken the lead with an impressive 16.00% surge in the last 24 hours. As a pioneering blockchain-based software, Golem allows users to buy and sell computational power for high-demand tasks like artificial intelligence, CGI rendering, and cryptocurrency mining. This decentralized system offers a P2P market for computing resources, connecting those with excess computational power to those in need, all facilitated by the GLM token.

The Golem Network processes and validates requests, ensuring efficient and almost instant completion of tasks. This revolutionary approach decentralizes and makes cloud computing more cost-effective and user-controlled.

What sets Golem apart is its unique approach to task management and decentralization. By splitting tasks into smaller portions, Golem speeds up processing and reduces costs compared to traditional cloud services. This system ensures that providers get paid directly, incentivizing the sale of computational power.

🚀 We’re thrilled to announce that golem-js 3.0 is now live!

This release brings major updates, new features, and significant improvements. Check out our blog post for all the details and upgrade instructions:

📖 https://t.co/hxEbtugNni#JS #GolemNetwork $GLM pic.twitter.com/xj5oEYvyWX

— Golem Network (@golemproject) July 2, 2024

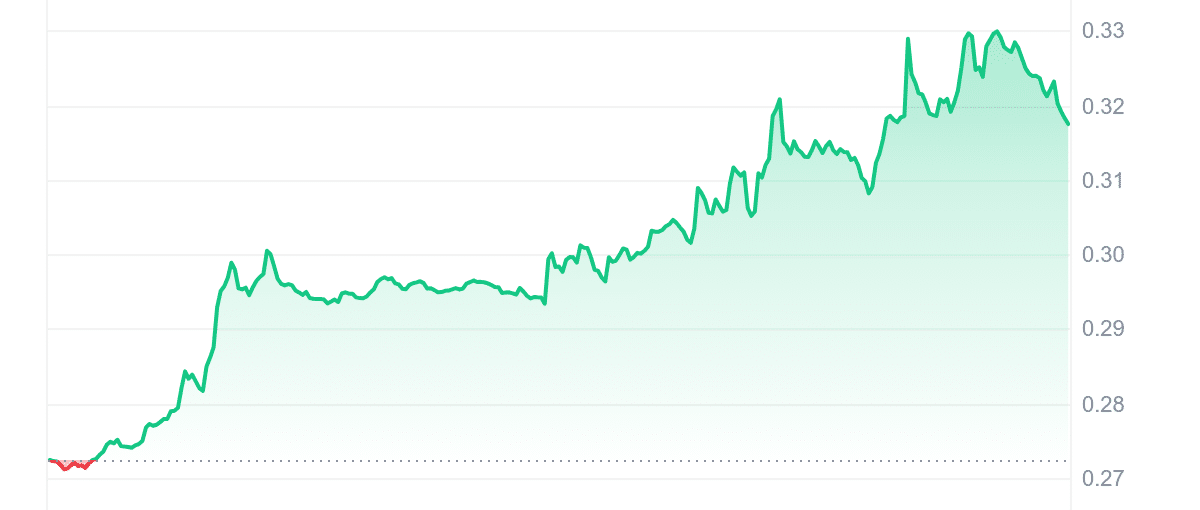

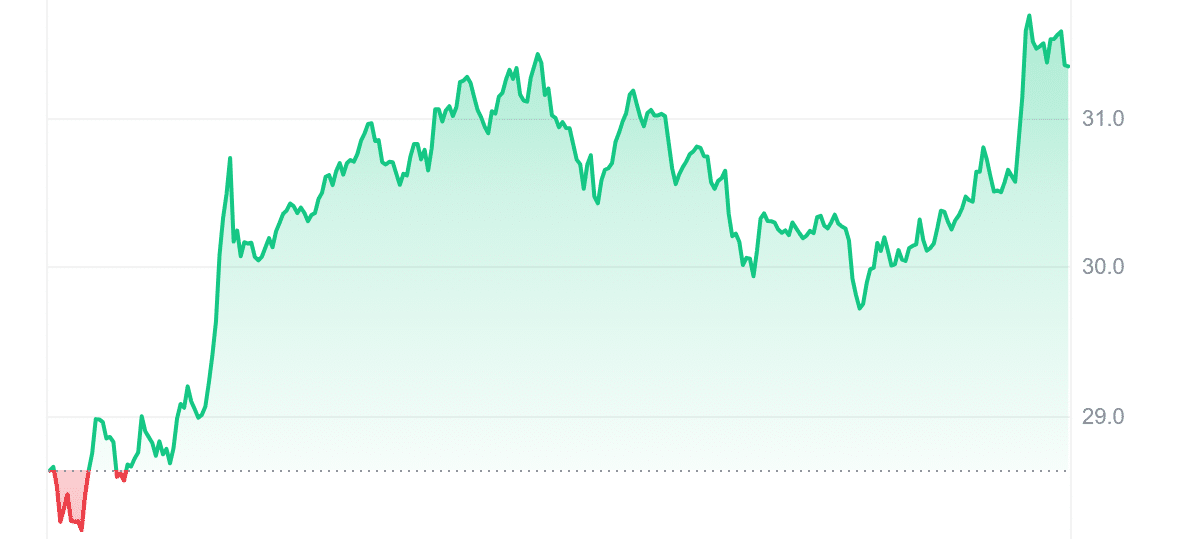

The substantial 16.00% increase in GLM price is supported by a robust volume-to-market cap ratio of 0.3861, indicating healthy liquidity. While the 14-day RSI of 60.10 suggests that Golem is trading neutrally, its impressive performance above the 200-day SMA by 46.54% reflects strong bullish momentum. Despite having only ten green days in the past month, the price has exhibited low volatility, making it a relatively stable asset. Over the past year, Golem has increased by 73%, outperforming 60% of the top 100 crypto assets, demonstrating its competitive edge in the market.

2. SSV Network (SSV)

Trailing Golem, SSV Network has seen a 9.15% increase in the last 24 hours, thanks to its unique decentralized staking infrastructure. Unlike traditional methods, SSV Network reshapes Ethereum staking by splitting validator keys among multiple non-trusting nodes. By decentralizing validator operations, SSV Network sets a new standard for reliability in Ethereum staking, making it a compelling choice for crypto investors.

SSV Network represents a major leap from existing staking schemes, providing ‘active to active’ redundancy and infrastructure flexibility. Validators can store keys offline and adjust their multi-operator setups without risking slashing. This level of customization and security is unmatched, positioning SSV Network as a leader in decentralized staking.

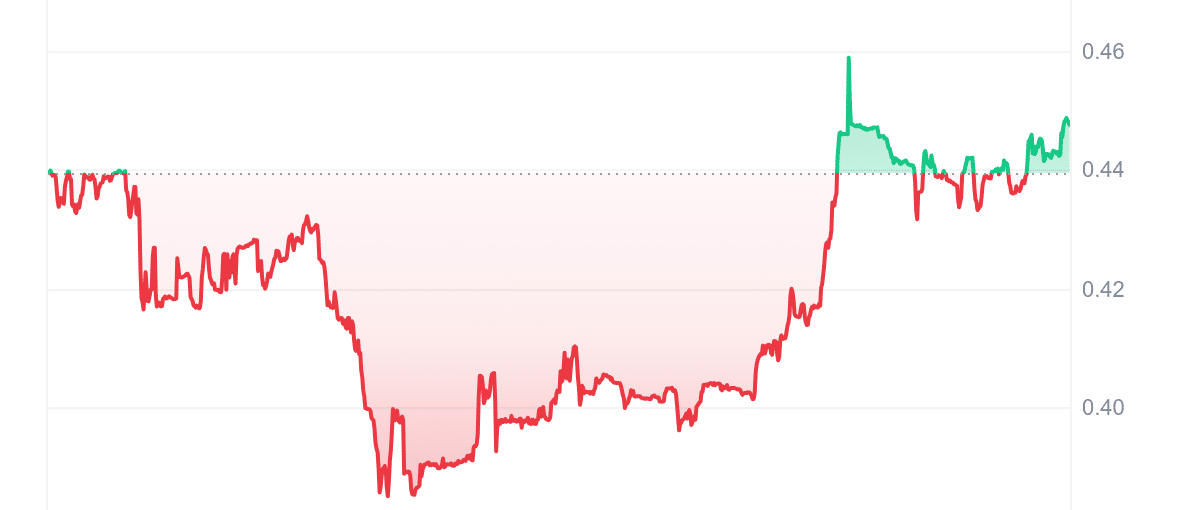

SSV’s price metrics paint a compelling picture of its market presence. With a volume-to-market cap ratio of 0.2366, it boasts substantial liquidity, though it does not match Golem’s impressive figures. The 14-day RSI sits at 58.75, indicating a neutral trading stance in line with its peers. Notably, SSV Network’s price is 65.14% above its 200-day SMA, highlighting a robust upward trajectory.

Stader Labs has joined hands with @ssv_network to keep Ethereum decentralized. 🎉$ETHx permissioned node operators will now be powered by SSV.

We are really excited about this integration that furthers our commitment towards the Ethereum community. 🤝 pic.twitter.com/0lR6mEkEhg

— Stader Ethereum (@staderlabs_eth) July 4, 2024

The network has enjoyed 13 green days in the last 30, a higher frequency of positive trading days than other gainers. This, coupled with its low 30-day volatility and a remarkable 76% annual increase, positions SSV Network as a formidable contender. It outperforms 60% of the top 100 crypto assets, demonstrating its resilience and growth potential.

3. Base Dawgz (DAWGZ)

Base Dawgz is storming the crypto scene as a captivating new meme coin with a dog-themed twist. This unique cryptocurrency isn’t just about fun and games; it’s offering investors a golden opportunity to earn passive income through its innovative staking rewards. The staking program allocates 20% of the total supply (1.69 billion DAWGZ) for hourly rewards over a year.

Early investors are already seeing the benefits, with the presale raising over $2.3 million and tokens currently priced at just $0.00581 each. But hurry; this price won’t last as the presale stages progress, making early investment a savvy move.

But that’s not all! Base Dawgz is more than just staking rewards. The project has rolled out a Share-to-Earn system that’s taking the crypto community by storm. Create and share hilarious memes on social media to rack up points, which can be exchanged for even more DAWGZ tokens post-presale.

What truly sets Base Dawgz apart is its impressive multi-chain flexibility. Thanks to advanced protocols like Wormhole and Portal Bridge, it operates across multiple platforms, including Ethereum, Solana, Base, Avalanche, and Binance Smart Chain. This multi-chain approach opens up a world of possibilities, offering more exchanges, liquidity, and DeFi opportunities. Such a dynamic and engaging project makes Base Dawgz an investment opportunity that is not to be missed.

4. Centrifuge (CFG)

Centrifuge has captured attention with an 8.79% rise, reflecting its role in bringing real-world assets into the DeFi ecosystem. This protocol aims to lower capital costs for small and mid-sized enterprises (SMEs) while providing investors stable income. By tokenizing real assets and using them as collateral in DeFi, Centrifuge is creating a new financial ecosystem that connects traditional finance with the benefits of blockchain technology.

Centrifuge’s security is robust, leveraging Polkadot’s Nominated Proof-of-Stake (NPoS) mechanism. Transaction fees are paid in CFG tokens, and transaction aggregators on Polkadot receive a share for processing and storing data. This setup encourages fair operation and enhances censorship resistance, ensuring the network remains secure and efficient. Using Polkadot’s relay chain for additional security measures further solidifies Centrifuge’s position as a reliable platform.

A new version of the Centrifuge app was just released!

Our CTO @offerijns wrote a thread outlining new features.

Give it a read ↓ https://t.co/PD9FyozFZJ

— Centrifuge (@centrifuge) July 4, 2024

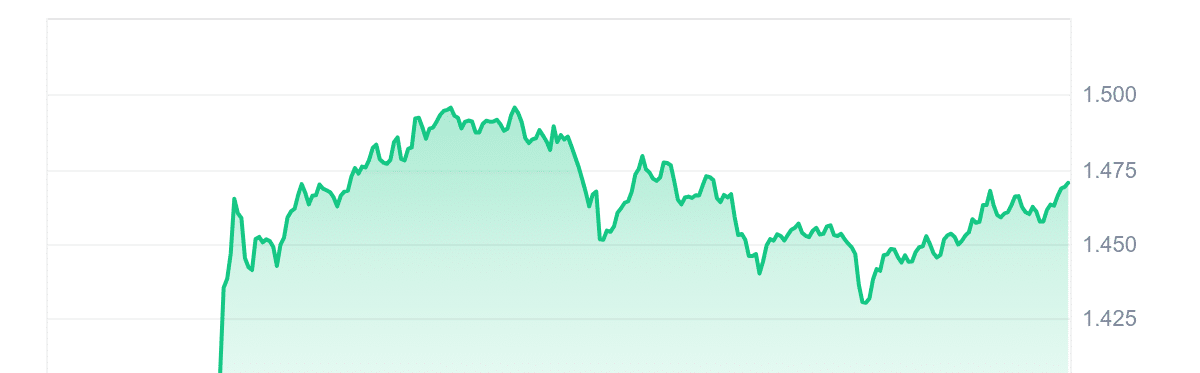

Despite its low volume-to-market cap ratio of 0.0034, indicating limited liquidity, Centrifuge has maintained resilience, trading 15.32% above its 200-day SMA. The 14-day RSI stands at 55.18, signaling neutral trading conditions. Over the past year, it has shown a respectable 42% increase, though less impressive than Golem and SSV Network. With nine green days in the last 30, Centrifuge demonstrates consistent performance similar to Optimism. It boasts lower volatility and steady growth, outpacing 46% of the top 100 crypto assets, highlighting its stable position in the market.

5. Optimism (OP)

Optimism rounds out this group of top gainers with a 7.82% increase in the last 24 hours. As a layer-two blockchain on Ethereum, Optimism utilizes optimistic rollups to record transactions trustlessly on its network, ultimately securing them on Ethereum. This innovative solution leverages the security of Ethereum while significantly enhancing transaction speed and reducing costs. With over $500 million in Total Value Locked (TVL) and hosting prominent protocols like Synthetix and Uniswap, Optimism is a cornerstone of Ethereum’s scalability strategy.

Optimism’s design is guided by four core tenets: simplicity, pragmatism, sustainability, and, fittingly, optimism. It employs proven Ethereum code and infrastructure, ensuring a seamless integration with the Ethereum mainnet. Transactions on Optimism are processed without a mempool, leading to immediate acceptance or rejection, thus providing a smooth user experience. The network’s security is fortified by Ethereum’s consensus mechanism, with transactions being challengeable for seven days before becoming final, ensuring robustness and reliability.

Alt-DA Mode on the OP Stack with @CelestiaOrg, @eigen_da and @AvailProject provides chain operators the freedom to choose whichever DA layer they believe has the best tradeoffs of security, decentralization, and cost. pic.twitter.com/HQ0IkPnwTD

— Optimism (@EthCC July 8 to July 13) (@Optimism) June 28, 2024

OP liquidity is the strongest among the four gainers, with a volume-to-market cap ratio of 1.0838, suggesting a highly active trading environment. The 14-day RSI of 56.88 indicates neutral market sentiment, while its current trading position is 7.92% below the 200-day SMA, highlighting a potential buying opportunity. Despite having the same green days as Golem last month, Optimism’s 22% annual increase lags behind the others. Nonetheless, it has outperformed 40% of the top 100 crypto assets, maintaining a competitive stance in the market.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage