Join Our Telegram channel to stay up to date on breaking news coverage

Today’s crypto market presents a mixed picture. The total market capitalization is $2.33 trillion, reflecting a slight -1.01% decrease over the past 24 hours. Bitcoin, priced at $63,000, saw a minor decline of -0.69%, bringing its market cap to $1.24 trillion and maintaining a dominance of 53.20%. This slight dip in Bitcoin’s price contributes to the overall neutral sentiment in the market, as indicated by the Fear & Greed Index reading 51.

In the past 24 hours, the total trading volume reached $324.31 billion, signalling robust market activity. However, only 23% of cryptocurrencies gained value, while 77% declined. Despite this short-term fluctuation, the global crypto market cap has experienced a remarkable 95.58% increase over the past year, underscoring the market’s long-term growth potential.

Biggest Crypto Gainers Today – Top List

Four crypto giants—MANTRA DAO, Metaplex, Helium, and Astar Network—are leading the market with notable increases. MANTRA DAO leads with an astounding annual price increase of 3,488% and a 24-hour surge of 6.17%. Metaplex follows with a robust 24-hour increase of 24% and an annual rise of 385%. Helium shows steady growth, with a 163% annual increase and a 5% daily rise. Astar Network rounds out the list with a 66% annual gain and a 3.71% 24-hour increase. These top gainers showcase significant technological advancements and offer compelling opportunities for profitable investments.

1. MANTRA DAO (OM)

MANTRA Chain is pioneering regulatory compliance in the Cosmos ecosystem. It offers a secure, high-performance platform for real-world and tokenized assets built on the robust Cosmos SDK. MANTRA Chain empowers Web3 builders with efficient asset tokenization and compliance, facilitating transparent ownership transfers of real-world assets. The OM token, integral to the platform, facilitates seamless cross-chain transactions and rewards participants.

Last month, MANTRA launched the much-anticipated USDY vault. This initiative offers users access to yields supported by short-term US Treasuries within DeFi. The USDY vault provides an APY of 5.3%. Additionally, participants can earn $ONDO and mainnet $OM rewards. This launch represents a significant advancement in MANTRA’s RWA tokenization efforts. Also, it bridges traditional finance with DeFi, providing new investment avenues.

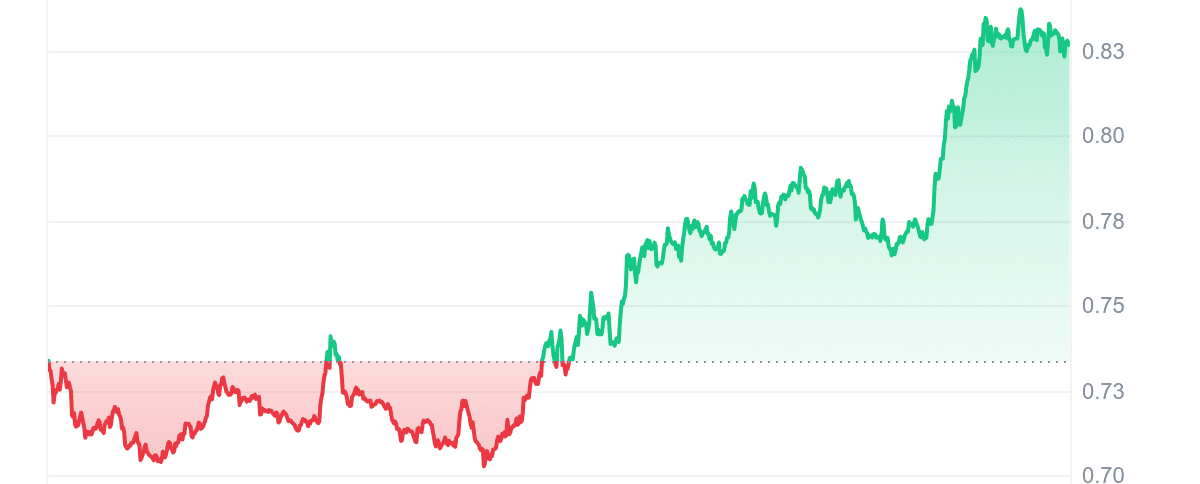

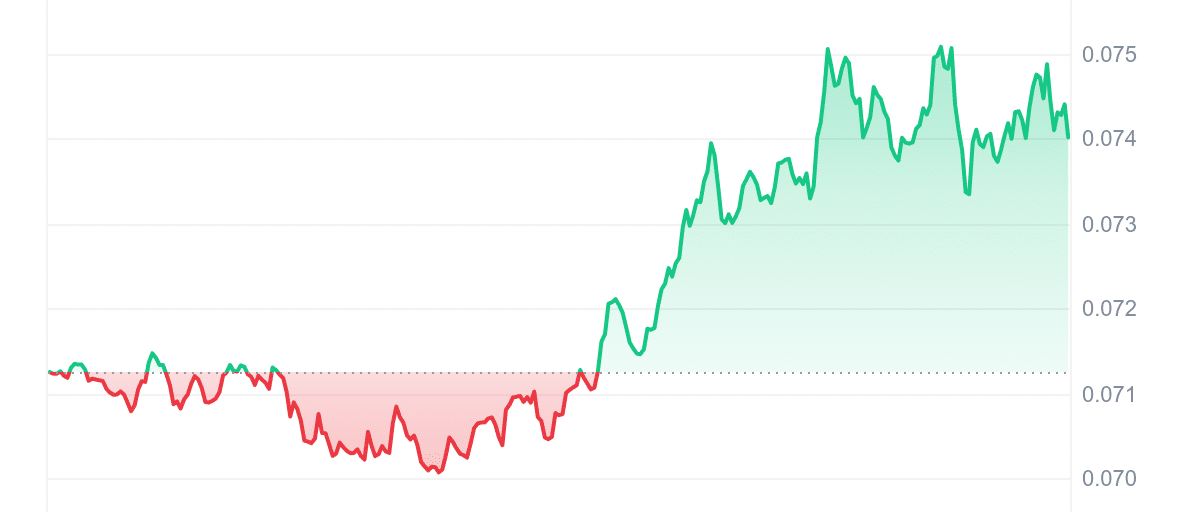

OM is the highest gainer among the analyzed tokens, with a staggering annual price increase of 3,488%. This astronomical growth far outpaces the other tokens, highlighting its exceptional performance. With a 24-hour surge of 6.17% and high liquidity (0.1565 volume-to-market-cap ratio), OM shows robust market interest and trading activity.

🔥 The leaderboard for #MANTRA’s Hongbai Incentivized Testnet is officially LIVE!

Start completing onchain quests to climb higher on the leaderboard, maximizing your chances of receiving a share of the $OM 🪂.

👀 Follow our socials for further announcements as we delve deeper… pic.twitter.com/00ltB1B2EM

— MANTRA – Tokenizing RWAs (@MANTRA_Chain) June 26, 2024

Despite having fewer positive trading days (33%) than Metaplex and Helium, OM’s significant long-term gains and incredible rise above its 200-day SMA (3,373.67%) make it a standout. Its neutral RSI of 30.75 suggests potential stability, setting it apart from Helium, which is currently overbought. Additionally, OM outperformed 95% of the top 100 crypto assets over the past year, underscoring its market dominance.

2. Metaplex (MPLX)

Metaplex pioneers digital asset management on Solana, offering a decentralized protocol for creating, trading, and utilizing non-fungible tokens (NFTs) with unparalleled efficiency. It introduces essential components like the Digital Asset Standard and Metaplex Program Library (MPL), empowering developers to mint, trade, and innovate in a dynamic blockchain ecosystem.

At its core, Metaplex features smart contracts designed for seamless NFT lifecycle management. From the Token Metadata contract defining asset details to the Token Vault enabling fractional ownership, each contract ensures transparency and security.

Additionally, MPLX, the utility and governance token, enhances community governance through the Metaplex DAO, fostering collaboration and innovation within the Solana ecosystem. Consequently, Metaplex’s secure infrastructure and commitment to interoperability redefine digital asset management, setting new standards for decentralized applications and global NFT marketplaces.

The next step in the evolution of the Metaplex DAO has begun!

50% of the Metaplex Protocol’s May fees (4,490 SOL) and an initial small portion of the historical fees (5,510 SOL) were used to purchase $MPLX in June.

In total 3.8 million $MPLX was contributed to the Metaplex DAO! pic.twitter.com/7umWebLA54

— Metaplex 🦾 (@metaplex) July 1, 2024

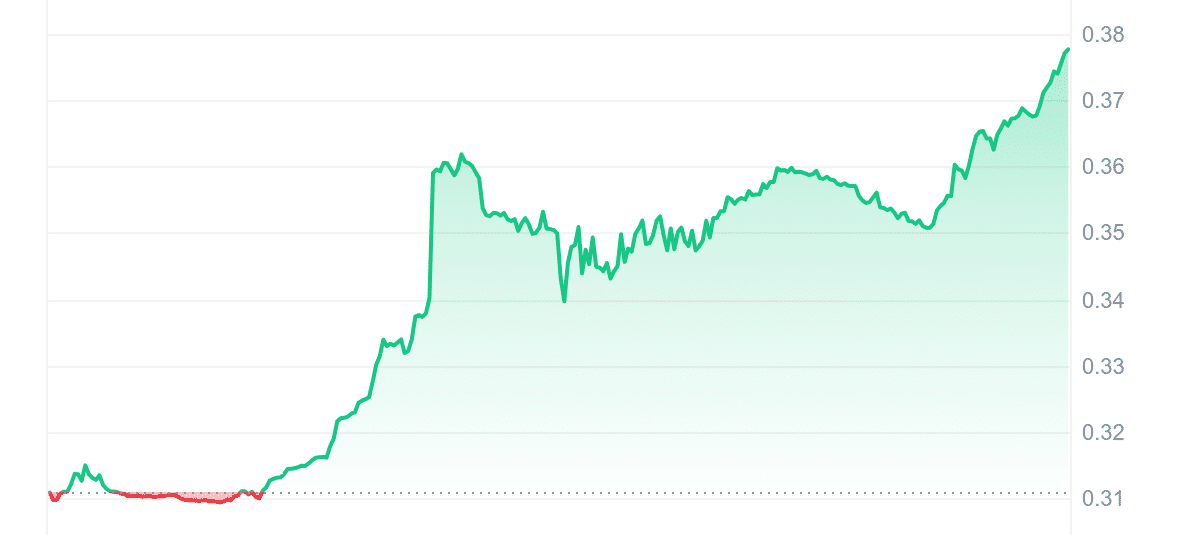

Metaplex boasts an impressive 24-hour increase of 24%, the highest among the tokens, indicating strong short-term momentum. Its annual price increase of 385% is also noteworthy, though it falls behind MANTRA DAO’s phenomenal growth. With medium liquidity (0.0126 volume to market cap ratio) and a neutral RSI of 59.65, MPLX shows balanced trading conditions.

It had 47% green days in the past month, outperforming OM and Helium in terms of positive daily performance. Trading 432.45% above its 200-day SMA, Metaplex demonstrates substantial long-term strength, although not as pronounced as OM’s rise. Furthermore, MPLX outperformed 81% of the top 100 crypto assets over the past year, highlighting its competitive edge.

3. Mega Dice (DICE)

The $DICE token is rapidly positioning itself as the premier GameFi asset, with its current price at $0.0825. Designed to revolutionize the gaming finance sector, $DICE offers remarkable utilities and rewards. Tokens can be staked to earn impressive annual percentage yields (APYs) with up to 50% weekly cashbacks and 10% rakebacks. Additionally, its $2.25 million presale airdrop, divided into three seasons, rewards $DICE users with $750,000 per season.

Haven’t bought $DICE yet? Follow the link below to buy in a few easy steps – not convinced, view our reasons below ⤵️

BUY $DICE HERE: https://t.co/E5WFsXQhfQ

Current Price: 1 $DICE = $0.0825 🚀

Here’s why $DICE is set to become the leading GameFi token, outpacing all… pic.twitter.com/wI2jy30ntr

— Mega Dice Casino (@megadice) June 28, 2024

$DICE holders benefit from exclusive promotions and can leverage their tokens for futures trading on Mega Dice, all powered by the Solana (SOL) network. Its total supply is 420 million tokens, with no team allocations, ensuring fair distribution. A dedicated liquidity pool enhances volume on decentralized and centralized exchanges, while strategic buybacks and burns support and sustain token value.

Haven’t bought $DICE yet? Follow the link below to buy in a few easy steps – not convinced, view our reasons below ⤵️

BUY $DICE HERE: https://t.co/E5WFsXQhfQ

Current Price: 1 $DICE = $0.0825 🚀

Here’s why $DICE is set to become the leading GameFi token, outpacing all… pic.twitter.com/wI2jy30ntr

— Mega Dice Casino (@megadice) June 28, 2024

Strategic marketing and partnerships propel $DICE forward, featuring collaborations with hundreds of top Key Opinion Leaders (KOLs) and plans for major exchange listings. The $DICE community is thriving, boasting 12,000 members on Telegram and 29,000 followers on Twitter, all supported by dedicated 24/7 moderators. With $1.4 million already raised, $DICE eagerly anticipates its next price surge as it approaches the $2 million milestone.

4. Helium (HNT)

Helium is a blockchain-based network for IoT devices that uses nodes called Hotspots to connect wireless devices. The native token, HNT, powers the network and rewards Hotspot operators for transferring data. Helium aims to provide a decentralized, efficient solution as the need for IoT grows.

The network relies on LoRaWAN, a protocol that enables device communication and ensures data transfer across nodes. Helium, dubbed “The People’s Network,” addresses privacy concerns in IoT by leveraging blockchain technology and decentralization.

Users host Hotspots and manage nodes, earning rewards through the Proof of Coverage consensus mechanism. Based on the HoneyBadger Byzantine Fault Tolerance protocol, this mechanism validates Hotspot locations and ensures network stability. The network’s decentralized architecture provides 200 times greater coverage than WiFi for IoT devices. It also uses a non-exchangeable token, Data Credits, for transaction fees, enhancing security and utility.

Two years ago, Helium introduced the Network of Networks—a platform designed to launch complementary, distinctive, decentralized networks.

Today, @HeliumFndn announced to expand its mission beyond wireless technology to include decentralized physical infrastructure networks… pic.twitter.com/5YSOWKCDE8— Helium🎈 (@helium) July 1, 2024

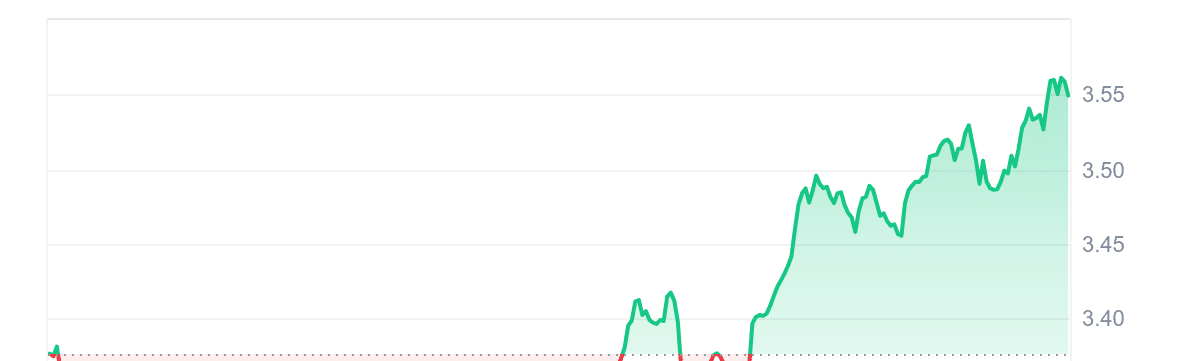

Helium has increased solidly by 5% over the last 24 hours and has grown annually by 163%, positioning it as a strong contender but behind MANTRA DAO and Metaplex. Its medium liquidity (0.0119 volume-to-market-cap ratio) supports healthy trading, though not as robustly as OM or Astar.

HNT’s RSI of 74.77 indicates it is currently overbought, contrasting with the neutral RSIs of the other tokens. With 40% green days and trading 58.27% above its 200-day SMA, Helium maintains a steady upward trajectory. Furthermore, it outpaced 75% of the top 100 crypto assets over the past year, indicating its strong performance relative to the market.

5. Astar Network (ASTR)

Astar Network helps developers build decentralized applications (dApps) and layer two solutions. It offers web 3.0 infrastructure, financial incentives, incubation programs, and technical support. Astar supports EVM and WASM smart contracts, connecting Polkadot with layer one blockchains like Ethereum and Cosmos.

As a Polkadot Parachain, it supports DeFi, NFTs, and DAOs, enabling developers to focus on application development. Backed by Binance Labs and Coinbase Ventures, Astar operates on Substrate and Optimistic Virtual Machine (OVM) layers.

Astar aims to be a full-scale multi-chain smart contract platform. Built on Parity Substrate, it offers upgradeable blockchains and customizable block execution. Unique features include operator trading, Multi-Lockdrop for token distribution, and a dApp rewards system that incentivizes developers. With a nominated Proof-of-Stake consensus, Astar benefits from Polkadot’s scalability and security, ensuring a robust and efficient network.

✨ It’s finally here!

We're thrilled to announce the Official Launch of @SonovaNFT, a premier NFT marketplace tailored for collectors and professional traders.

▶️ Follow the new collections being launched this month: https://t.co/TIsmIJDROn pic.twitter.com/NIZULSWw0I

— Astar Network (@AstarNetwork) July 1, 2024

Astar’s performance is more modest compared to its peers, with a 24-hour increase of 3.71% and an annual rise of 66%. Its high liquidity (0.1524 volume to market cap ratio) ensures strong trading activity comparable to OM. With a neutral RSI of 57.91 and 40% green days, Astar mirrors the stability seen in Metaplex and Helium but lacks their dramatic gains. Trading 29.29% above its 200-day SMA, Astar shows steady growth, though it does not match the exceptional increases of MANTRA DAO or Metaplex. However, Astar outperformed 49% of the top 100 crypto assets over the past year, which is lower than the others.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage