Join Our Telegram channel to stay up to date on breaking news coverage

Americans may not be overly enthusiastic about cryptocurrencies like Bitcoin, but there are some notable brands in North America that are embracing the digital assets industry.

Brands Embrace Digital Assets While Americans Remain Unenthusiastic

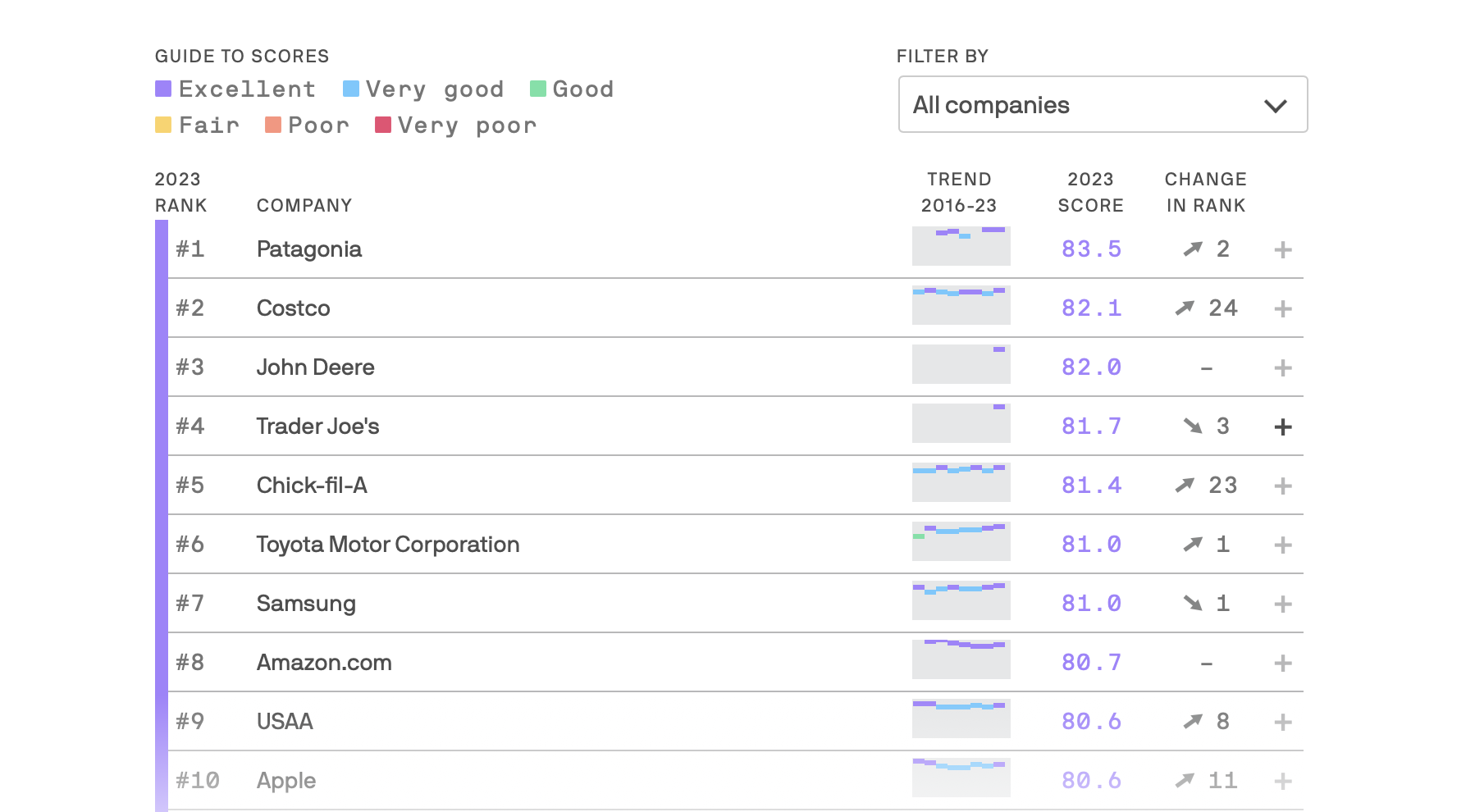

The Axios Harris Poll 100, a reputation ranking survey conducted by Axios and Harris Poll, provides insights into the public perception of various brands in the United States. While crypto-native brands like FTX and Bitcoin fared poorly in the poll, other popular American brands have shown openness towards Web3 and crypto.

Patagonia, an outdoor gear maker, emerged as the top brand in the survey, while the Trump Organization found itself at the bottom of the list. Decrypt, a reputable news source, analyzed the 2023 poll results to determine where leading American brands stand on crypto and Web3.

FTX barely edged out the Trump Organization to secure the 99th spot, with Bitcoin following closely at #93. Despite these rankings, it is surprising to note that many of the top-rated brands are displaying receptiveness to the digital assets industry.

One unexpected brand that has shown interest in crypto-related endeavors is Chick-Fil-A, a major fast-food chain ranked at number 5 on the list. The company has filed several trademark applications indicating its intention to enter the NFT and metaverse space.

Another brand on the list, the Toyota Motor Corporation, holds the #6 spot. The automobile giant recognized blockchain as a fundamental technology and established the Toyota Blockchain Lab in 2019.

The automotive industry, as a whole, has also taken notice of the potential in Web3, NFTs, blockchain, and digital wallets. A report published earlier this year by Yahoo! Finance highlighted the interest of renowned car manufacturers such as BMW, Mercedes Benz, Porsche, Subaru, and Jaguar in entering the crypto space.

Kellogg Company, known for its popular snacks Pop Tarts, ranked at #26 on the Axios Harris Poll. This food giant has ventured into Web3 gaming by exploring opportunities in the space.

Pfizer, a pharmaceutical powerhouse, sits at the middle of the ranking at #50 and is actively involved in crypto-related activities. Pfizer Ventures, the company’s investment arm, has shown interest in decentralized science through a recent funding round for VitaDAO. Additionally, Pfizer joined a working group in 2019 to research blockchain for supply chain management.

In the tech sector, Sony and Samsung have made notable moves in the crypto realm. Sony, just outside the top 10 at #12, applied for an NFT-related patent this year, signaling its interest in further Web3 ventures for its PlayStation brand. Samsung, a top 10 brand, announced a Smart TV patent that would enable users to purchase NFTs from the comfort of their homes.

While many brands on the list have not publicly expressed interest in cryptocurrency, blockchain, or Web3, there are several that have been involved in these areas for some time. The future will reveal whether more brands will join this growing trend.

Despite the negative sentiment towards cryptocurrencies expressed by some Americans, a number of leading American brands have demonstrated openness to the digital assets industry.

From fast-food chains to automobile manufacturers and pharmaceutical giants, these brands are exploring the potential of crypto and its associated technologies. It will be interesting to see how the landscape evolves and whether more brands will join this movement in the future.

Comprehensive Blockchain Analytics to Boost Crypto Adoption Among Institutions

The increasing exploration of digital assets by institutions has created a higher demand for on-chain analytics platforms. These tools are employed by compliance experts, investigators, and regulators to gain a better understanding of patterns and entities involved in cryptocurrency transactions.

Cointelegraph recently interviewed Tom Robinson, the co-founder and chief scientist at analytics firm Elliptic, and Eray Akartuna, a senior cryptocurrency threat analyst at the same company, to delve into the role of on-chain analytics in broader cryptocurrency adoption.

When asked about typical use cases for institutional clients, Tom Robinson highlighted anti-money laundering (AML) and sanctions compliance for crypto exchanges and businesses handling crypto assets.

Elliptic’s transaction and wallet screening tools assist businesses in staying compliant with regulations and reducing fraud. The Discovery product also enables due diligence on crypto businesses by providing risk profiles based on blockchain transaction analysis.

Regarding the difference between AML in crypto and mainstream AML in traditional banks, Robinson emphasized that most crypto transactions are visible on the blockchain, making it easier to trace funds and identify criminal activity using blockchain analytics tools.

The discussion then turned to the role of artificial intelligence (AI) and machine learning in on-chain analytics, particularly in fraud prevention and AML. Eray Akartuna confirmed that machine learning is already being utilized in their blockchain analytics products. However, he stressed the importance of thorough testing to ensure the accuracy of these techniques.

Machine learning can help identify patterns in blockchain transactions and distinguish different patterns on different blockchains. Heuristics play a crucial role in identifying illicit activities and actors on the blockchain.

Elliptic’s risk score, derived from analyzing incoming and outgoing transactions to clusters of wallets, assists in predictive analysis. This score helps identify risky wallets associated with exchanges, terrorist groups, or dark web markets, aiding banks and exchanges in making informed decisions regarding business relationships.

The interview also shed light on the complex problems Elliptic tackles. Robinson highlighted the ability to identify proceeds of crime in crypto, even after they have been laundered cross-asset and cross-chain.

Criminals now exploit decentralized exchanges and cross-chain bridges to move their funds, making it crucial to develop tools that trace crypto funds automatically across different assets and blockchains.

In terms of adoption by banks, Akartuna mentioned that while it is a slow but steady process, compliance remains a top priority. Banks see blockchain analytics as an essential component to address regulatory concerns.

The decentralized finance (DeFi) space presents a key use case for institutions looking to invest clients’ funds. They need to ensure the credibility and risk profile of liquidity pools. Challenger banks, such as Revolut, also require compliance and AML capabilities before offering cryptocurrency services to customers.

Elliptic maintains an ongoing dialogue with regulators globally and provides them with a deep understanding of their blockchain analytics solutions. This helps regulators gain confidence in the compliance programs of exchanges and banks that utilize these tools.

Related Articles

- Best Altcoins

- Best Beginner Cryptos

- Thriving Crypto Adoption Amid Economic Hardships – Insights into Troubled Economies

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage