Join Our Telegram channel to stay up to date on breaking news coverage

In an era of political stagnation in the United States, while other regions are actively developing crypto frameworks, it is crucial to examine the growing demand for crypto assets on the ground.

Cryptocurrency Demand Surges in Troubled Economies

The demand for these assets is particularly significant as numerous large countries grapple with surging inflation, unstable currencies, autocratic control over financial access, and an increasing awareness of cryptocurrencies among their populations.

The lack of trust in centralized institutions further amplifies the need for alternative financial systems. One such country is Pakistan, the world’s fifth most populous nation with over 239 million people.

Recent reports suggest that the Pakistani government has firmly stated that cryptocurrencies will never be legalized in the country to avoid penalties imposed by the Financial Action Task Force (FATF).

At first glance, this decision may appear to be an overreaction to FATF’s stance on crypto, especially considering the organization’s recent call for regulation rather than an outright ban in their letter titled “An end to the lawless crypto space.”

However, it is important to consider the complicated relationship between Pakistan and the FATF. Just last October, Pakistan was removed from the FATF’s “grey list,” which designates countries with deficiencies in their anti-money laundering (AML) controls, potentially limiting their participation in global finance.

In addition to that, ongoing discussions with the International Monetary Fund (IMF) regarding a bailout package further complicates matters.

The IMF has expressed unease with crypto markets in the past, and there were reports of applying crypto-suppression conditions during negotiations with Argentina. These factors likely contribute to Pakistan’s reluctance to embrace cryptocurrencies fully.

Regardless of the government’s position, there is a thriving crypto adoption in Pakistan. It has been reported that people are actively converting their salaries into stablecoins as a safeguard against the devaluation of their currency.

The Pakistani rupee has experienced a significant decline of more than 20% against the U.S. dollar year-to-date and over 30% in the past year. In contrast, Bitcoin (BTC) has seen a remarkable increase of 103% in rupee terms in 2023 (compared to 63% in U.S. dollar terms).

Notably, a 2022 report by forensics company Chainalysis ranked Pakistan sixth globally in terms of crypto adoption, underscoring the growing interest in cryptocurrencies within the country.

Moving to another troubled economy, Nigeria, the sixth most populous country in the world with over 218 million people, is expected to devalue its currency following the inauguration of the new president. The devaluation aims to alleviate trade imbalances and address dollar shortages.

Nigeria ranks eleventh in global crypto adoption, signaling the country’s growing interest in cryptocurrencies. Google Trends data also reveals that Nigeria leads in terms of searches for the term “crypto” and ranks second for the term “bitcoin” over the past 90 days.

This demonstrates the Nigerian population’s increasing curiosity and engagement with cryptocurrencies as they seek financial stability and alternative investment opportunities.

Similarly, Turkey, with over 85 million inhabitants and ranked as the 18th most populous country globally, faces significant economic challenges. The country’s currency recently hit a record low as markets brace for the expected re-election of President Erdogan.

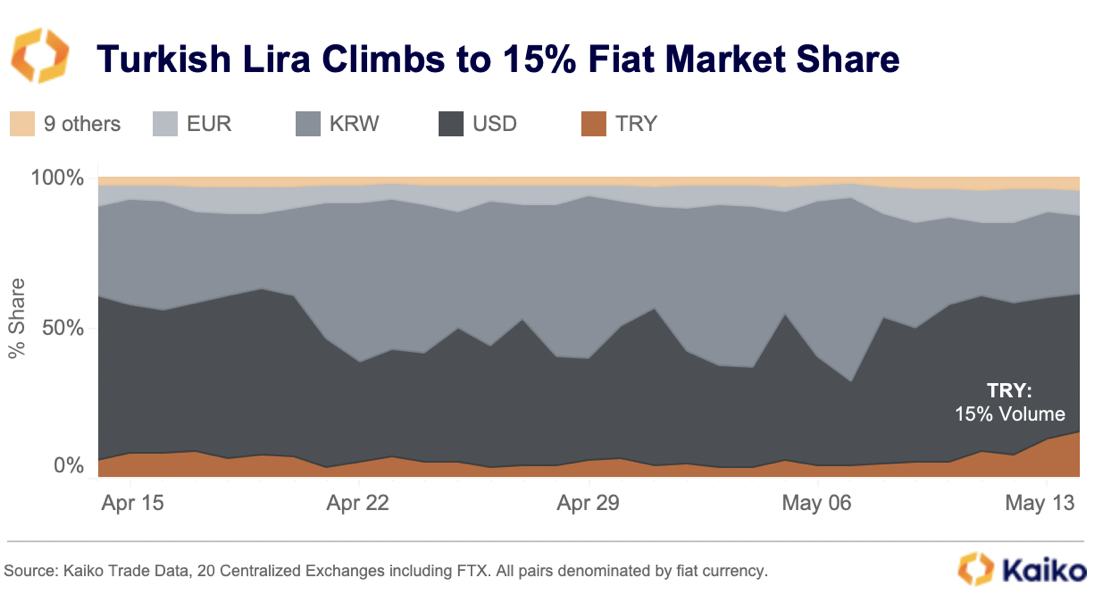

Crypto activity denominated in Turkish lira has surged, surpassing euro-based activity, as illustrated by a chart from crypto market data firm Kaiko.

Turkey’s position as the twelfth country in Chainalysis’ 2022 crypto adoption ranking indicates the growing interest in cryptocurrencies as a means to hedge against currency volatility and diversify investments in a financially uncertain environment.

Uncovering Crypto’s Global Appeal – Japan’s Pioneering Role and Surprising Adoption Patterns

While countries facing economic hardships show significant crypto demand, even nations like Japan, the world’s eleventh most populous country with over 124 million people and the third richest in terms of nominal GDP, demonstrate unexpected adoption trends.

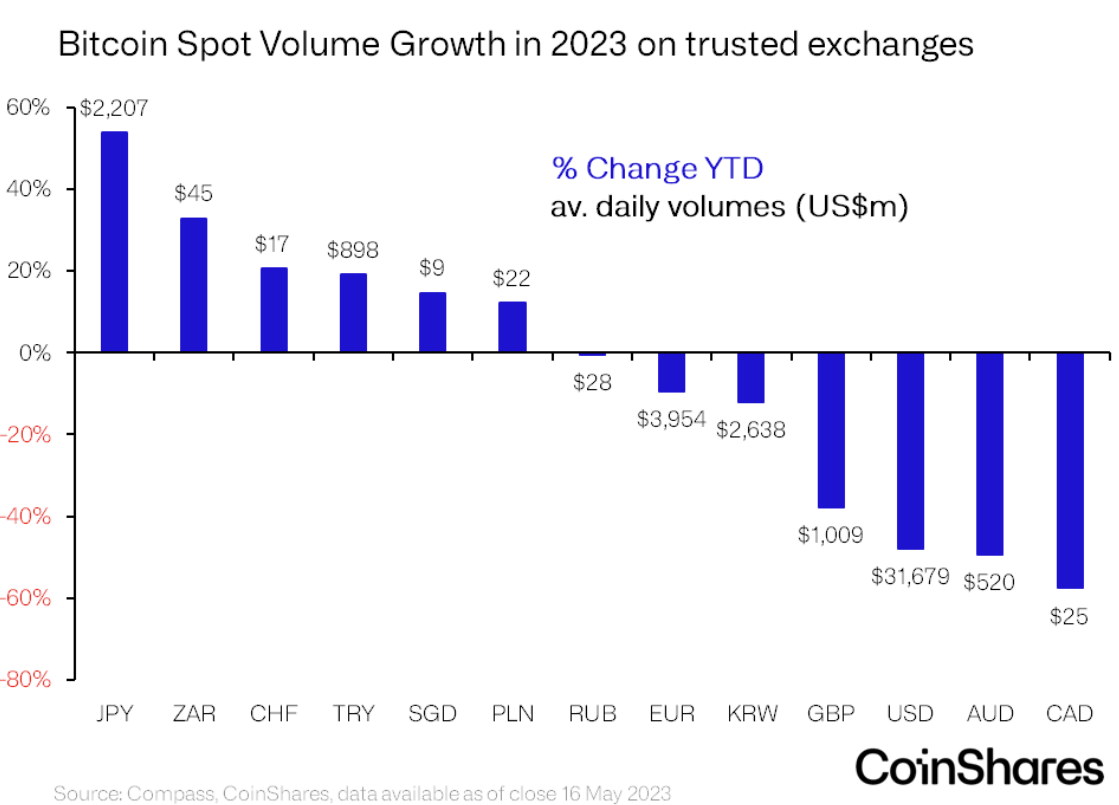

Japan, known for its low inflation and relatively stable currency, has emerged as a prominent player in the crypto space. According to James Butterfill, head of research at CoinShares, Japan leads in growth of spot volumes on crypto exchanges. It has the second-highest average daily volume (after the U.S.) and has experienced approximately 55% growth year-to-date.

Interesting to see Bitcoin spot volume growth rising in emerging markets and Japan, but falling in most developed markets. pic.twitter.com/VnbODnKWG4

— James Butterfill (@jbutterfill) May 17, 2023

The reason behind Japan’s increased crypto activity remains uncertain. It could be driven by speculative trading, considering the country’s low inflation and stable currency. However, it is also plausible that investors in Japan are anticipating higher inflation and currency instability, prompting them to seek cryptocurrencies as a hedge. Nonetheless, the potential for rate hikes to counter inflation might strengthen the yen, raising questions about the role of Bitcoin as a hedge in Japan.

Beyond the countries discussed, there are numerous examples of citizens worldwide turning to cryptocurrencies to protect themselves against local currency volatility and debasement. Countries like Ukraine, Argentina, and Lebanon stand out as prominent examples.

While these individuals face challenges related to the lack of reliable onramps and custody solutions, they remain relatively unconcerned about the regulatory hostility seen in the United States.

These instances emphasize that while the United States possesses the largest financial market globally, the purpose of cryptocurrencies extends far beyond mere speculation. Developing economies, accustomed to regulators limiting financial freedom, find the decentralized nature of cryptocurrencies easier to comprehend and appreciate compared to individuals living in more open regimes.

The growing demand for cryptocurrencies across diverse economic landscapes underscores the need for a broader understanding of their significance and potential impact on traditional financial systems.

Read more:

- Forrester VP Issues Predictions on “Revolutionary” Blockchain Adoption

- Bitcoin Adoption Grows After Acceptance by Major Real Estate Firms

Join Our Telegram channel to stay up to date on breaking news coverage