Join Our Telegram channel to stay up to date on breaking news coverage

- What – Since Silicon Valley Bank filed for insolvency, business customers of Silicon Valley Bank found themselves in a precarious situation as things escalated rapidly and started moving to Bitcoin.

- Why – Even big tech companies with millions and billions of dollars in their accounts are now concerned about the safety of their deposits.

- What Next – This has triggered a rush among businesses to diversify or move to larger, more secure banks.

Meanwhile, the price of Bitcoin has surged from $20,000 to $28,000 in just two weeks as companies look for alternative investment options.

The current scenario has created a sense of unease and uncertainty among businesses, with many feeling vulnerable about their finances in ways they have not experienced before.

In this new macro climate, American Billionaire Tim Draper has published a list of business recommendations. He suggests that companies allocate some cash to Bitcoin to cover payroll expenses.

Tim Draper promotes Bitcoin as a hedge against bank failures.

Tim Draper urges business founders to include Bitcoin as part of their cash diversification strategy. Draper, who gained fame for winning bidding of 30,000 BTCs from the U.S. Marshals in 2014 and his predictions on bitcoin prices, recently shared a Twitter document outlining several factors businesses should consider during bank failures.

“Since boards and management are responsible for making payroll, even in times of crisis, it is important to build out contingency plans for bank failures that could happen more and more often if governments continue to print money and whipsaw interest rates to counteract inflation caused by the over-printing of money.”

Per Tim Draper, the collapse of Silicon Valley Bank (SVB) underscores the significance of having a solid contingency plan during unpredictable circumstances.

Numerous reports suggest that several tech startups, which relied on Silicon Valley Bank, faced a period of ambiguity when the bank failed and did not have sufficient funds to pay their employees. However, the government watchdog FDIC (Federal Deposit Insurance Corporation) intervened and protected customers’ deposits in a more Federal Reserve-approved systematic way to minimize the risk, thus preventing a major financial crisis.

Recommendations for Diversifying Banking Options

As per Draper’s cash management plan, created in collaboration with individuals from Wharton School, preempting dealing with banking risk is crucial. Draper suggests that businesses should not depend on a single institution to manage their cash and recommends keeping at least six months’ worth of short-term cash in two banks. One of the banks should be local, and the other one should be of global level.

Furthermore, Draper advises maintaining a minimum of two payrolls in Bitcoin or other cryptos and holding excess funds in easily convertible assets for emergency situations. Draper supports these measures, stating they safeguard businesses during uncertain times. In his own words:

“For the first time in many years, governments are taking over banks, and governments themselves are at risk of becoming insolvent. Bitcoin is a hedge against a ‘domino’ run on the banks and on poor over-controlling governance.”

Will Cryptocurrency Become the New Cash Management Norm for Businesses?

The reasoning behind the recommendation to invest in cryptocurrencies is to ensure that businesses have enough funds to cover at least two payroll cycles in case they cannot access their money from a bank.

This is particularly important for tech firms located in Silicon Valley, where CEOs and other company officials can be held personally accountable for unpaid employee wages under California law.

Payroll expenses can be substantial, requiring access to liquid funds. For instance, in 2022, Google had more than 190,000 workers, with an average salary of $133,000 per year, as per data. Assuming these figures remain unchanged, two weeks’ worth of payroll would amount to $971 million, while two months’ worth would cost $4.12 billion.

Employees of various businesses typically receive bi-weekly paychecks, which translates to a minimum of $1.9 billion per payroll cycle. Remember that this is just one major tech company, and there are numerous others in Silicon Valley.

If companies take Tim Draper’s advice, the amount of money flowing into cryptocurrencies such as Bitcoin would be substantial.

Read more:

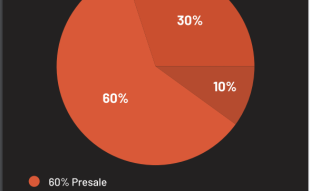

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage