Join Our Telegram channel to stay up to date on breaking news coverage

If you think FTX’s troubles were purely a family affair involving Sam Bankman-Fried (SBF) and his close kin, you’d be on the money. Recent reports have put the spotlight on Joe Bankman, Sam’s father, revealing he was more intertwined in the FTX operation than people initially believed.

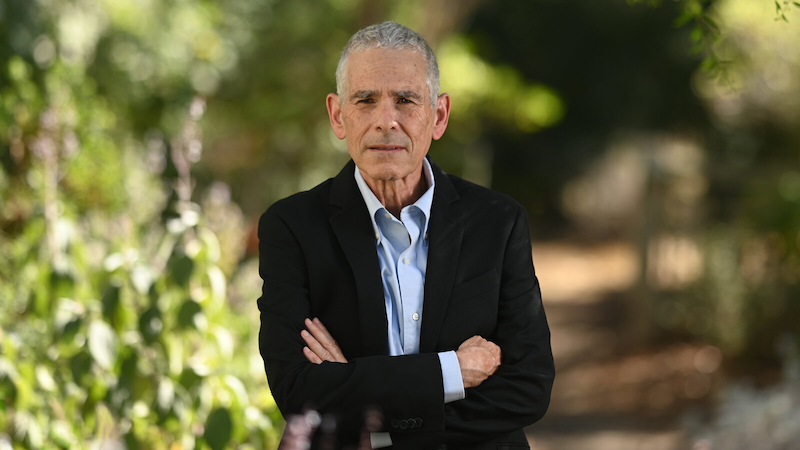

Joe Bankman isn’t just anyone; he’s a law professor at Stanford University. Insider reports indicate that he didn’t just play a minor advisory role; he was deeply involved in the operations of the FTX exchange. This involved both strategic consultations and even appearances in the public eye, such as when he shared screen time with Larry David in an FTX Super Bowl commercial. Dressed up like a founding father, complete with a powdered wig, he surely caught some attention.

Joe didn’t stop at dressing up for ads; he formally became part of the FTX team. Sources from Alameda, FTX’s sister hedge fund, have disclosed that Joe Bankman also had a hand in drafting some of FTX’s earliest legal documents. This adds another layer to his involvement: he wasn’t just a parent advising from the sideline; he was in the trenches with the team.

His hands-on approach was further confirmed by invoices from FTX’s legal team, which often listed Joe Bankman as an attendee during crucial meetings. Specifically, he contributed to the development of marketing strategies for FTT, FTX’s proprietary cryptocurrency. This token is crucial to the story because it was at the heart of FTX’s financial collapse.

Trouble started brewing when it was discovered that a substantial chunk of Alameda’s $14.6 billion in assets was tied up in FTT tokens. Once that came out, customers started pulling out their investments, creating a liquidity crisis for FTX. The financial strain was exacerbated by the company’s high expenditure, eventually leading to bankruptcy within just nine days.

Call Joe

As for the man at the helm, Sam Bankman-Fried, he had a habit of turning to his father for advice. Whenever legal issues cropped up, SBF often said he needed to “call Joe” before making any decisions. And it seems Joe was more than willing to help, even financially. Reports from Forbes indicate that Joe funded his son’s legal defense, thanks to a $10 million gift out of the company’s coffers. However, it wasn’t all roses; Joe also managed to waste at least a million of the company’s funds on poorly-judged crypto trades.

Joseph Bankman advised his son to hire Dan Friedberg — the poker company lawyer who helped cover up a cheating scandal — to be the company's in-house fixer and head of compliance. Not a coincidence that Friedberg worked with Tether's GC and Alameda "bought" $36b+ in Tether's. https://t.co/pE8VwpXEBb

— Jacob Silverman (@SilvermanJacob) August 13, 2023

Family Involvement and Profiting

It wasn’t just Joe; Gabe Bankman-Fried, another family member, was also entangled in FTX’s business affairs. Formerly involved in Democratic politics, Gabe led a nonprofit mainly financed by FTX, focused on ‘effective altruism.’ Despite his philanthropic efforts, Gabe had his quirks. He had written a memo suggesting the acquisition of Nauru, a tiny island nation, presumably as a “just in case” bunker for global catastrophes.

Fast forward to now, FTX holds assets totaling around $7 billion, including a staggering $1.16 billion in Solana (SOL) tokens and $560 million in Bitcoin. Recent rulings from a U.S. Bankruptcy Court judge have allowed FTX to sell and invest its crypto holdings to settle its debts. Entrepreneurs like Justin Sun, the Tron Network founder, are eyeing FTX’s assets to fuel growth in the crypto space.

Lastly, let’s not forget that the family did profit from FTX’s ventures. Legal documents reveal that in 2022, Joe Bankman and Barbara Fried raked in an impressive $26 million from cash and real estate investments alone. Joe also played a crucial role in FTX’s move from Hong Kong to the Bahamas. Both he and Barbara frequently visited the Bahamas HQ, enjoying a $16 million beachfront condo during their stays. While they claim this was just “temporary housing,” public records don’t associate the property with FTX in any way.

So, as the saga unfolds, it’s clear that Joe Bankman’s role in FTX was far from peripheral. From strategic decisions to legal complexities, he was there every step of the way. Whether for better or worse, that’s another story altogether.

Related News

- FTX Sues Sam Bankman-Fried, Others for $1B, Says He’s Using Misappropriated Funds to Pay for Defence

- FTX Former COO Constance Wang Joins Sino Global Capital’s Gaming Team – Bloomberg

- FTX Token Goes From Oblivion To $1.60 In A Month. Can The Once Top Crypto Gainer Come Back From The Dead?

- FTX Claims Portal Quickly Goes Dark But FTT Still Pumps

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage