Join Our Telegram channel to stay up to date on breaking news coverage

The Graph price turned bullish with 10% gains over the last 24 hours to trade at $0.1138 as of 3:45 a.m. EST as investors reacted to the protocol’s update announced recently.

GRT received a boost from an Oct. 31 post on X in which The Graph team unveiled an update to its protocol that would enable its users to “upgrade seamlessly to The Graph Network.”

🌅The Graph Network delivers best in class performance, low query costs, reliable uptime, redundancy and fast syncing speeds.

Now it’s time for everyone to take advantage of the benefits of upgrading to the network!

This announcement unveils an updated plan for the sunrise of… pic.twitter.com/8iHduepTqZ

— The Graph (@graphprotocol) October 31, 2023

The three-phase plan comprises Sunray, which will enable support for all hosted service chains, introduce an easy upgrade flow, and offer a free query plan on The Graph Network, made possible by the upgrade Indexer.

The Sunbeam phase will involve the establishment of “a 60-day upgrade window to upgrade hosted service subgraphs, with dedicated upgrade support.”

The Sunrise phase will see the expiry of hosted “service endpoints … as all subgraphs upgrade” to the blockchain network.

The Graph Network is also looking forward to hosting the upcoming inaugural Datapalooza, a day focused on Web3 data innovations on Nov. 13, in Istanbul.

Datapalooza is only 13 days away!

📣 New speaker update: @andrej_dev from @chainlink!

Andrej will give a workshop on using Chainlink Functions to implement a DeFi strategy by connecting The Graph & Uniswap Router!

Stay tuned for info on additional speakers & presentations. https://t.co/HNFqcBtNF9 pic.twitter.com/jhIm6znaA3

— The Graph (@graphprotocol) November 1, 2023

Attendees are looking forward to a day full of “talks, panels, and workshops by developers, researchers, and experts” such as Andrej Rakic, a renowned Chainlink developer.

These developments coupled with the current positive sentiments in the cryptocurrency market have sparked investor interest in GRT with its trading volume spiking 44% to $90 million, according to data from CoinMarketCap.

As a result, The Graph token features among the top 100 digital currencies posting double-digit gains on Nov. 2.

Top 100 Cryptos Today – #MOONvember is really a thing! $BTC breaks 35K$NEAR pumped even more than $SOL$AAVE heading for $100$GRT double digits$ARB and $AVAX up 9%

Even $DOT on the run.

What a time to be alive! Stay well my friends. 🙏 pic.twitter.com/VHQCLO71n6— InvestAnswers (@invest_answers) November 1, 2023

The Graph Price Seeks 76% More Gains to $0.20

The GRT price had been sealed in a downtrend between Feb. 7 and Oct. 20. This price action was defined by a series of lower highs and lower lows leading to the appearance of a descending parallel channel on the daily timeframe.

During this period, The Graph’s price saw failed recovery attempts, drawbacks, fakeouts and bear traps. The downtrend was stopped by buyer congestion around $0.078.

Buyers bought GRT at a discount from this level resulting in a 53% spike that saw the price hit a high of $0.112 on Nov. 2. This rally saw the price reclaim key support levels including all the major moving averages while breaking out of the declining channel.

Bulls will now attempt to push the price above the $0.12 psychological level to confront resistance from the major barrier provided by the $0.15 psychological level. Overcoming this roadblock would clear the path for GRT to rise toward the $0.20 supply zone. This would result in a 76% climb from the current level.

GRT/USD Daily Chart

The position of the Stochastic RSI at 84 reinforced the bullishness of the GRT price. In addition, this trend-following oscillating indicator was positioned in the overbought territory, suggesting that the buyers were dominating the market.

The moving averages were also pointing upward, an indication that the market conditions still favored the upside. These chart overlay indicators also provided robust support for The Graph on the downside, which could absorb any selling pressure.

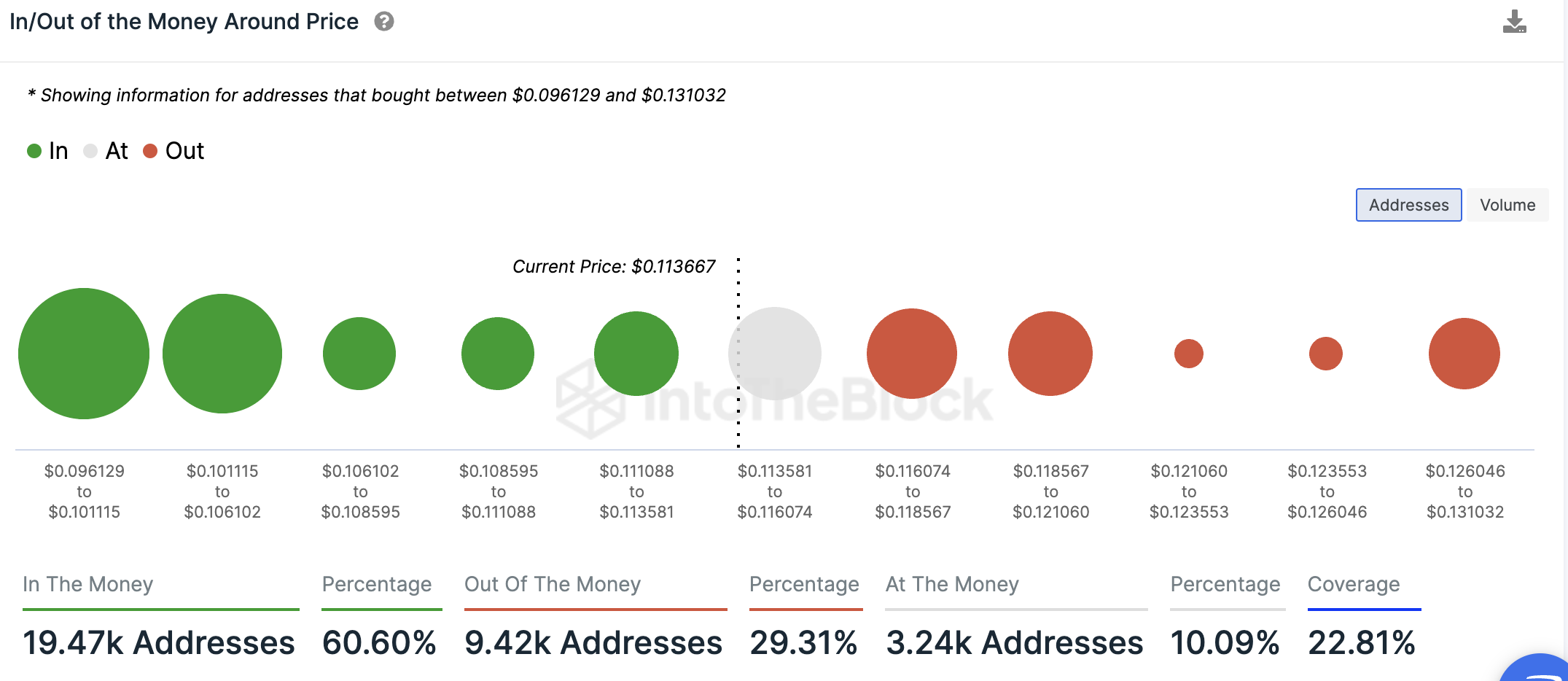

This was reinforced by on-chain data from IntoTheBlock, a market behaviour and blockchain analytics firm. Its In/Out of the Money Around Price (IOMAP) model showed that GRT enjoyed strong support compared to the resistance it faced on the upside.

The Graph IMMAP Chart

This suggested that the path with the least resistance was the upside.

On the downside, the Stochastic RSI painted extremely overbought conditions for GRT. This implied that the upward momentum could soon run out of steam as sellers book profits on the run-up to $0.12. The ensuing supply pressure could lead to a price correction.

Therefore, a daily candlestick close below the 200-day Exponential Moving Average (EMA) at $0.1033 could trigger massive see orders that could see GRT drop below the upper boundary of the falling channel.

This would take GRT back into the channel where it could continue trading for some time with the 100-day EMA, 50-day EMA, and the middle boundary of the channel at $0.095, $0.092, and $0.0785 respectively, providing support.

GRT Alternatives

Bitcoin Minetrix (BTCMTX) is a new crypto project that is causing a stir as its presale surges past the $3.1 million mark, reflecting the growing excitement surrounding the Stake-to-Mine ecosystem.

Bitcoin Minetrix presents an innovative solution to democratize the Bitcoin mining industry. It offers a genuine alternative to the prevalent mining scams that have plagued the sector in recent years while it races to become one of the best crypto presales to invest in for great gains in 2023.

Introducing #BitcoinMinetrix, the revolutionary cloud mining solution empowering individuals to engage in #Decentralised $BTC mining with ease. 💠

With the elimination of third-party cloud mining risks, users enjoy total control over their mining activities.#BitcoinMining pic.twitter.com/BV7BE7AfKs

— Bitcoinminetrix (@bitcoinminetrix) November 1, 2023

The project’s smart contracts have undergone a comprehensive audit by Coinsult, bolstering investor confidence with an added layer of security.

With the presale raise surpassing the $3 million mark in record time, early adopters are hailing Bitcoin Minetrix as a disruptive force in cloud mining, especially in anticipation of the upcoming Bitcoin block halving.

Exciting Announcement 🚀#BitcoinMinetrix has raised over $3,000,000! pic.twitter.com/Hs2063y9tJ

— Bitcoinminetrix (@bitcoinminetrix) November 1, 2023

Currently priced at $0.0114, BTCMTX is set to experience a price increase in four days. Respected analysts such as Jacob Bury are voicing bullish sentiments about the Stake-to-Mine solution, contributing to the project’s credibility.

Visit Bitcoin Minetrix here for more information on how to participate in the presale.

Related News

- Next Cryptocurrency to Explode Wednesday 1 November

- BTC Edges Higher But Bitcoin Minetrix Looks Set To Explode

- How to Buy Bitcoin

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage