Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin is back and so are altcoins. That’s the story of crypto this year.

Tezos is the only one among the top 10 (it is in No. 10 position with a market cap of $2.5 billion) that is trading at all-time highs. Yep, that’s right. Achieving that feat was helped, admittedly, by the fact that it didn’t launch (June 2018) until after the crypto boom had gone bust.

Nevertheless, its price history is remarkable, currently trading at an all-time high of $3.495

How Tezos came back from the lawsuits

Back in the day, it was one of the more successful initial coin offering, pulling in $232 million. However, that early success turned out to be the start of its troubles.

With so much money at stake, maybe it was inevitable that some of the biggest investors and major stakeholders would start to fall out with each other.

In the months following the ending of the ICO, it began to look like the Tezos smart contract platform might never launch as key figures argued among themselves.

Notably, Arthur and Kathleen Breitman – owners of Tezos’s intellectual property – found themselves at the centre of lawsuits from disgruntled investors who began to tire of the circus.

Tezos – a grown up Ethereum?

But Tezos survived the nonsense and lived to launch what is an innovative proof-of-stake consensus protocol with grown-up governance built in. Tezos is arguably what Ethereum should be… or hopes to be whenever its migrates to proof-of-stake finally comes to pass. So, if you are starting to think about diversifying from bitcoin to buy cryptocurrency further down the food chain, it might be worth paying attention to Tezos (XTZ).

Now let’s look at that price chart since XTZ started trading; it is truly something to behold.

From an initial coin offering price of $0.47 the price has touched a high of $3.95, with by far the greater part of that appreciation taking place this year, since mid-January.

What, then, has got buyers so excited and can this rocket keep flying, or is it running out of fuel?

Property developer picks Tezos

On 30 October 2019 a UK property developer – Alliance Investments – announced a development in which investors would be able to contribute through a security token offering (STO). The development is called River Plaza in the English city of Manchester where property prices in some districts are rising faster than in London. The 20-storey property will provide 180 luxury dwelling when it is complete.

The digitisation of real estate is one of the few areas in which crypto has started to make some inroads, although still at a small scale.

Alliance Investments said at the time of the announcement that it had teamed up with Overstock’s tZERO STO platform to sell its new development to property investors. In the small print of the deal was mention the Tezos Foundation – the rails for the STO is the Tezos blockchain.

That is a big win for Tezos, and there is more to come.

After all, it is all very well for Tezos supporters such as Cameron Winklevoss to proclaim that he’s a fan, with his ‘Love Tezos’ tweet last year, and to hail Tezos as the main challenger to Ethereum, but eventually a network has to start delivering – Tezos is delivering.

In January this year, Tezos showed that the UK property deal was not a flash in the pan.

Vertalo STO platform drops Ethereum for Tezos

Security token outfit Vertalo announced in January that it was dumping Ethereum and moving over to Tezos.

Vertalo chief executive Dave Hendricks says his firm will in fact continue to support Ethereum, but Tezos is now its default platform. He says Tezos allows for more languages and has faster transaction speeds than Ethereum.

“A real estate fund managed via a Tezos security token could simultaneously pay out a staking-based dividend next to an asset-secured dividend as is traditionally paid in investments like real estate investment trusts, an area that is a key focus for Vertalo and other security token platforms around the world,” Hendricks explains.

Although Tezos is indeed a challenger, it is worth pointing out that the vast majority of asset-digitising tokens are still running on the Ethereum network.

Ok, so there we have some fundamentals that tell us that this Tezos bull run is not just based on rumours and the tailwind of backing from the likes of the Winklevoss twins and billionaire Tim Draper.

What about buying into the Tezos story now?

Looking at its performance during the latest bitcoin retreat from $10,000, which saw the BTC price retrace violently, catching bulls off guard, it is highly significant that Tezos has stayed in the green while all around was/is bleeding – that’s got to be a sign of confidence among Tezos holders.

However, with a near 200% climb since mid-January, it is easy to fear how the price could pull back abruptly from the parabolic progress since then.

Tezos support levels and a break in a bullish channel – but price target $4.00

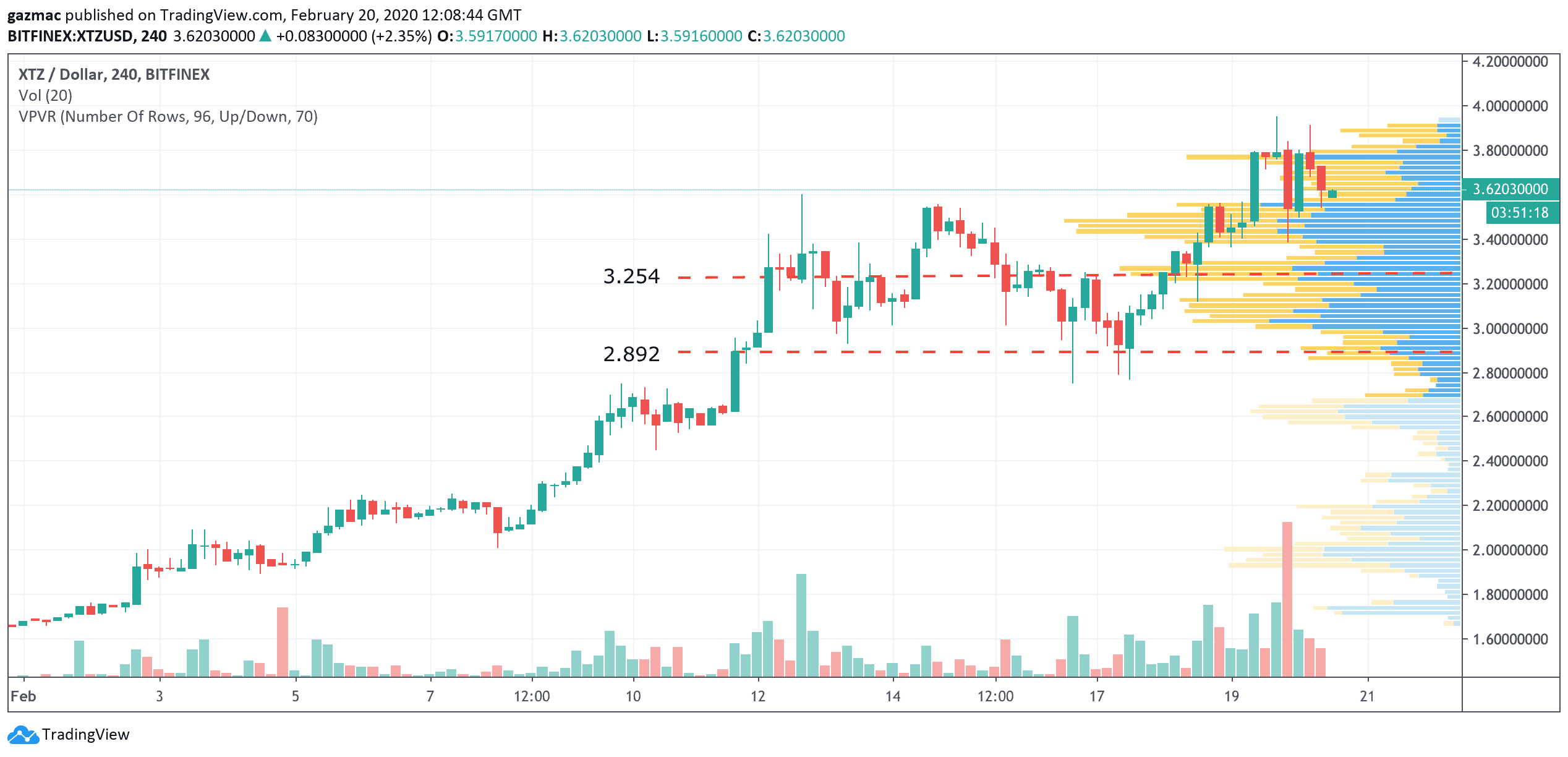

Priced at $3.620 at the time of writing, support can be found at $3.254 and $2.892.

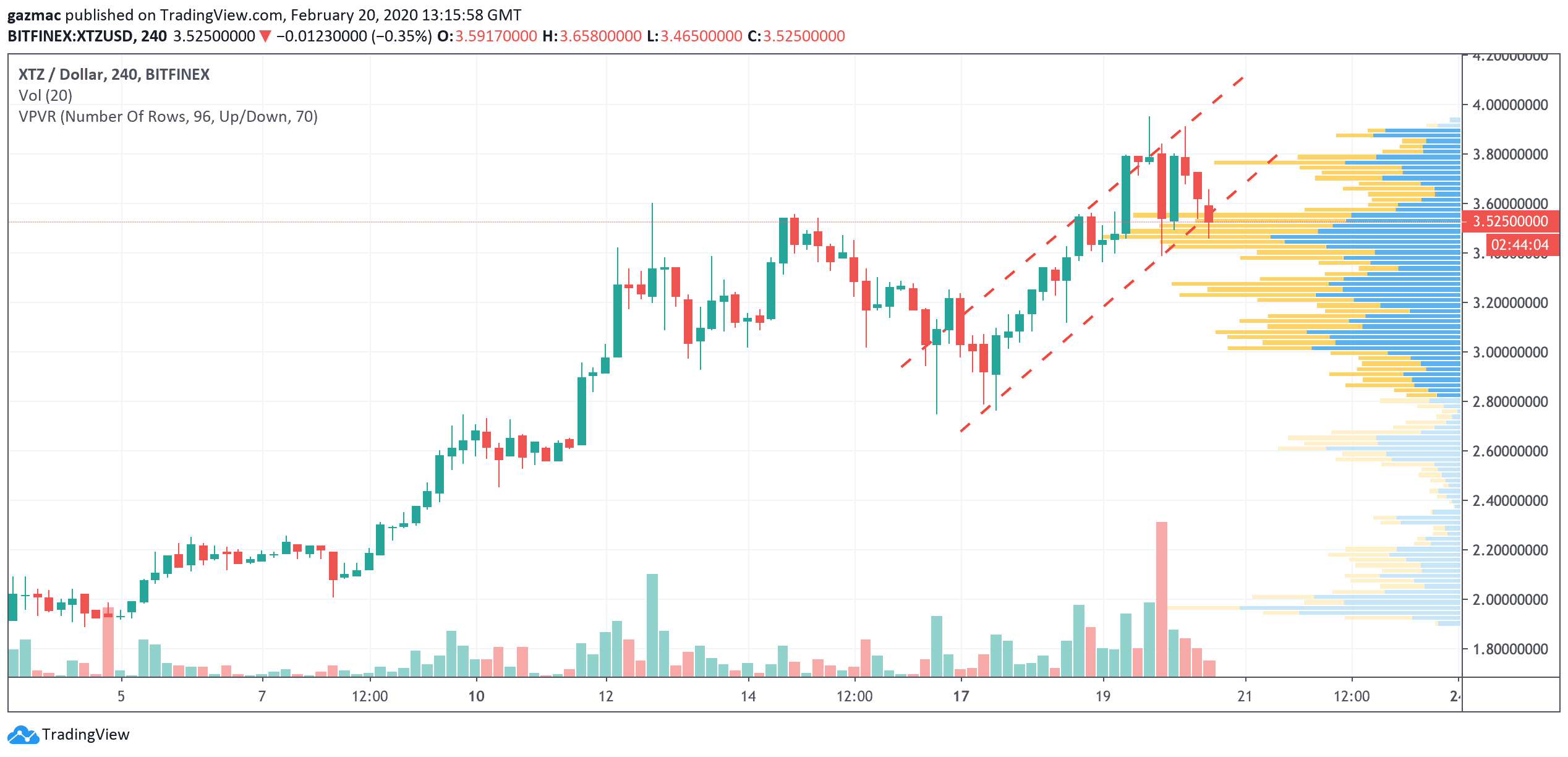

But bulls will be looking at the rising channel established over the past few days to watch for a violation. Indeed, the price had bounced higher every time it neared the lower band. That changed today as the chart below shows:

Whatever the short-term outlook, accumulating at these levels is sensible for those looking at homing in on Tezos as one of their altcoin portfolio holdings. Price Target $4.00.

However, this is still a market that is led by bitcoin.

If the top dog doesn’t grind back towards, and above, $10,000, it could lose support at $9,500. That would really let the bears out of the woods.

Not even Tezos would stay green in such a scenario.

Join Our Telegram channel to stay up to date on breaking news coverage