Join Our Telegram channel to stay up to date on breaking news coverage

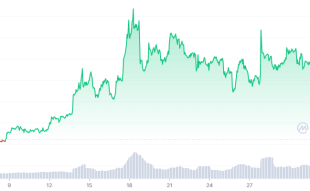

Synthetix (SNX) price displayed massive volatility during the second half of January as bears and bulls engaged in a stiff battle to rule the market. Accordingly, the price consolidated between $2.010 and $2.752, with both parties giving their best. Nevertheless, with every massive gain the bulls recorded, bears countered it with an equal and opposite force, thereby stagnating the price within that range.

Barely a week into the second month, however, the narrative seems to be changing after bulls recorded an epic run on February 1, raising the price 16% in the day from $2.19 to a high of $2.72, and while bears have attempted a correction, the efforts did not pan out as bulls came in their numbers to defend their position.

SNX is among the tokens that were gravely affected by the FTX collapse when Sam Bankman-Fried’s crypto empire came crumbling down. Between November 8 and November 13, the token dipped almost 50% to a low of $1.55.

At the time of writing, the SNX price was trading at $2.71, up 6% on the last day, with a 24-hour trading volume of $99.9 million, notably more than 90% higher than on the last day. The token recorded a live market cap of $676.7 million, putting the SNX token at #74 on CoinMarketCap’s wall listing crypto assets by market cap size.

SNX Token Soars After Synthetix Back Threshold As A TBTC Minter

In a February 1 announcement, Synthetix declared its decision to become a tBTC v2 Minter officially and that it would be supporting the launch of Threshold Network’s tBTC v2, the industry’s only decentralized and scalable Bitcoin-to-Ethereum bridge.

Synthetix is excited to announce that it's supporting @TheTNetwork's launch as a $tBTC minter!

Learn more about how SNX (& other DeFi OGs) are supporting decentralized BTC on Ethereum: https://t.co/SG1ybkqO8U

— Synthetix ⚔️ (@synthetix_io) January 31, 2023

From the report, tBTC is going live with a security model christened ‘optimistic minting,’ which comprises two essential functions: Minters and Guardians. Minters are a permissioned group of actors serving to keep track of the chain and minting tBTC once every valid deposit is complete. While monitoring, authorized Guardians can review minting requests, eliminate any possible malicious mints, and get rid of errant minters.

Notably, this will be tBTC v2’s first mainnet release and marks the beginning of tBTC v2’s path to fully permissionless minting.

We are officially live! 🎉

Introducing tBTC v2’s first mainnet release.

Be the first to earn with your #Bitcoin on #DeFi with the industry’s only decentralized and scalable BTC-to-ETH bridge.

Mint tBTC now👇https://t.co/RFwL0n8X5Q pic.twitter.com/Xuib68GwfY

— Threshold Network ✜ (@TheTNetwork) January 31, 2023

Ultimately, therefore, Synthetix will play a crucial role in the tBTC protocol as a Minter, with the network saying:

It is amazing to support the rollout and operation of a crucial piece of truly decentralized infrastructure that will make it possible for BTC to be deployed across DeFi.

Following the announcement, SNX price broke out, recording a striking $1.24 million in trading volume on the day, nearly the same as the $1.58 million all-time high in daily active users recorded on January 20 after the Synthetix Treasury Council debuted its incentive program for CurveFinance synth pools through the StakeDAOHQ vote market on Ethereum mainnet.

As of February 5, SNX price was looking to a new target as bulls gave their best to deliver the expected gains.

SNX Bulls Target 25.66% Increase To $3.43

At the time of writing, SNX bulls were looking to record more gains, with the token trading at $2.71. The token has spent the year trying to recover the losses incurred when the FTX implosion occurred.

The price was standing at the $2.5 level for support giving bulls the base they needed to hit their targets. Upward, the SNX token was confronting the first resistance at $2.8, which was obstructing its rally north. This meant that a daily candle stick close above this level could open the doors for investors to make more profits.

Accordingly, an increase in buying pressure from the current level would mean more price gains for the token, with the first target being the 107% Fibonacci retracement at $2.99. Such a move would undoubtedly excite investors and reinvigorate their ambition to target the 138% Fibonacci retracement at $3.43. Such a move would mean a 25.71% increase from the current level.

SNX/USD Daily Chart

The positive outlook for SNX price was supported by several key metrics. To begin with, a golden cross was formed when the 50-day Simple Moving Average (SMA) crossed above the 100-day SMA. Such a move often hints at the beginning of an uptrend.

In addition, there was a pending buy signal which would be sent out once the Relative Strength Index (RSI) crossed above the signal line (line in yellow), the same case for the Moving Average Convergence Divergence (MACD) (line on blue) that was just about to cross above the signal line (orange line).

The 200-day SMA at $2.4 also provided support for SNX price, passing as the first area where buyers could pause to regroup and hopefully come back into the market. However, given the high-risk nature characteristic of the crypto market, things could go in the opposite direction if sellers recovered the SNX market.

With sellers taking charge, the first realistic level for the price to regress would be the 78.6% Fibonacci retracement at $2.58. If bears’ selling appetite grows below this level, the price could dip further to retest the 50% Fibonacci retracement at $2.176 or further down to revisit the 23.6% Fibonacci retracement at $1.8. In extreme cases where only sellers dominate the market, the SNX price could retest the $1.46 support floor.

SNX Alternatives

Well, if you are not looking to invest in Synthetix (SNX), consider this exciting new crypto-gaming project dubbed Meta Masters Guild. It is currently holding a presale for its native token MEMAG, which has now raised more than $2.83 million with just a few weeks since it went live with the fundraising and advertising.

The MEMAG token holds a lot of promise, as indicated by industry analysts, who say it can record massive gains as the year continues to unfold.

Don’t let this opportunity pass you!

Read More:

- These Crypto Coins are Expected to Pump 55x by 2024

- Another SBF Company Goes Under – Are You Affected?

- How to Buy Bitcoin

Join Our Telegram channel to stay up to date on breaking news coverage