Join Our Telegram channel to stay up to date on breaking news coverage

While all of us were eagerly waiting for September to arrive, there’s one aspect of it that can be particularly unexciting for Bitcoin Investors. Over the last five years, Bitcoin- the most preferred investment asset for crypto investors, has had losses in the month of September.

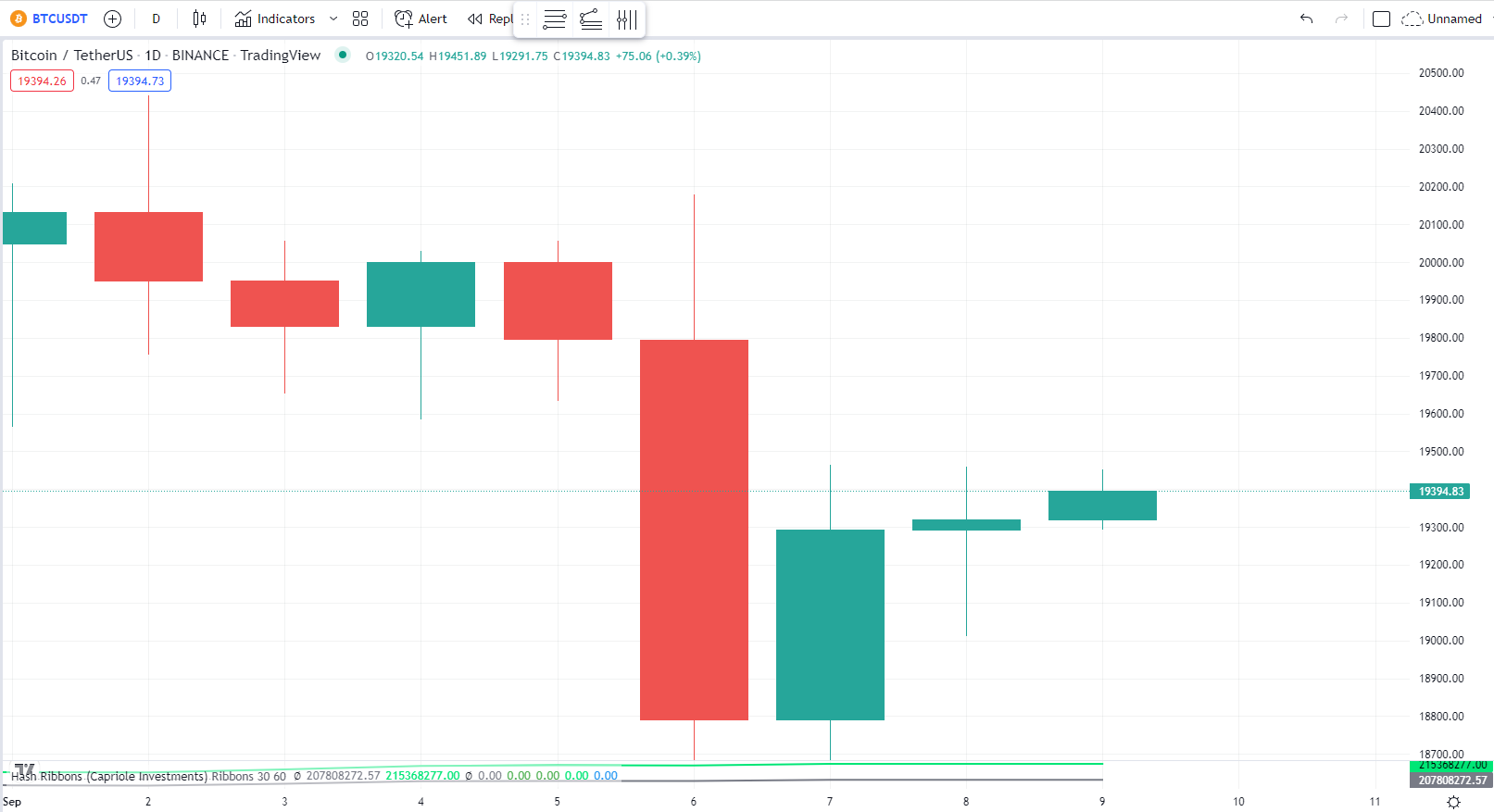

Bitcoin has dropped roughly by 8% each month of September over the past five years. Although there have been instances where it showed a positive trend.

This year, Bitcoin hasn’t exactly radiated much optimism, falling by more than 60% this year. Ethereum, too, has shown a similar trend. The entire crypto market has had a downfall, and given that September isn’t going to be particularly exciting, investors believe that it might be time to sell. While on the other hand, many also believe that it can only get better from there.

Why Does Bitcoin Underperform in September

In the month of August, Bitcoin came pretty close to touching the $25k level and got investors excited for a while, however, as of now, it’s been hovering below $20k. This month is expected to raise a negative sentiment as well.

Cryptocurrencies aren’t the only market affected by September. The S&P 500 index has consistently declined this month, dropping by 1.1% on average, historically speaking. The crypto market runs parallel to these prices and both these markets could witness a drop in this month.

Along with the performance of stock markets, there are other reasons that contribute to the impact. One noteworthy event among these is when investors sell their holdings to lock their profits or other tax-related purposes in September, as the year closes.

Additionally, the new school year begins in September and parents are likely to liquidate their assets to pay for the expenses. This too, adds to the effect.

And finally, as believed by many who understand market psychology, the crypto effect in September could be a self-fulfilling prophecy. Because people believe the market will fall, they liquidate their assets to avoid sudden losses, and in the process, create the very fall they anticipated would happen.

Where Do We Go From Here

The occurrence of the “September Effect” has multiple theories, however, it’s tough to pinpoint the true cause. But for an average investor, there isn’t a need to understand the phenomena in detail, as long as they are aware that it occurs.

Interestingly, a few times, the crypto market has actually increased through September. And this year, experts believe that the phenomenon won’t be as much a consequence of the above-mentioned reasons, but matters concerning the rate hikes of the Federal Reserve.

As interest rates increased, investors reduced their risk appetite and ventured towards less risky assets. Their crypto holdings have thus suffered. Along with that, investors are awaiting the Merge of the Ethereum blockchain and its expected to impact the prices, eventually pushing them higher.

Yes, the month of September hasn’t been the best for crypto but this shouldn’t abstain you from investing. Alternatively, you can use the understanding of this effect to better your investment strategies and in the end, gain better returns.

Read More

Join Our Telegram channel to stay up to date on breaking news coverage