Join Our Telegram channel to stay up to date on breaking news coverage

The US Securities and Exchange Commission (SEC) approved eight spot Ethereum ETFs (exchange-traded funds) in another landmark regulatory breakthrough for the crypto industry.

The securities watchdog approved so-called 19b-4 forms for ETF applications filed by Ark, Bitwise, BlackRock, Fidelity, Franklin Templeton, Grayscale, VanEck, and Invesco Galaxy late today after a last minute rush to get them over the line. But the funds will not be able to trade until the SEC approves S-1 filings from the applicants.

“If they work extremely hard it can be done within a couple weeks but there are plenty of examples of this process taking 3+ months historically,” said Bloomberg Intelligence ETF analyst James Seyffart in a post on X. “Obviously this situation is nothing like anything that’s happened historically IMO.”

Still, an order from the SEC approves the ETH ETFs ”on an accelerated basis.”

BOOM!! APPROVED! There it is. The SEC just approved spot #Ethereum ETFs. What a turn of events. It's really happening.

h/t @PhoenixTrades_ pic.twitter.com/KQ39mDyCbT

— James Seyffart (@JSeyff) May 23, 2024

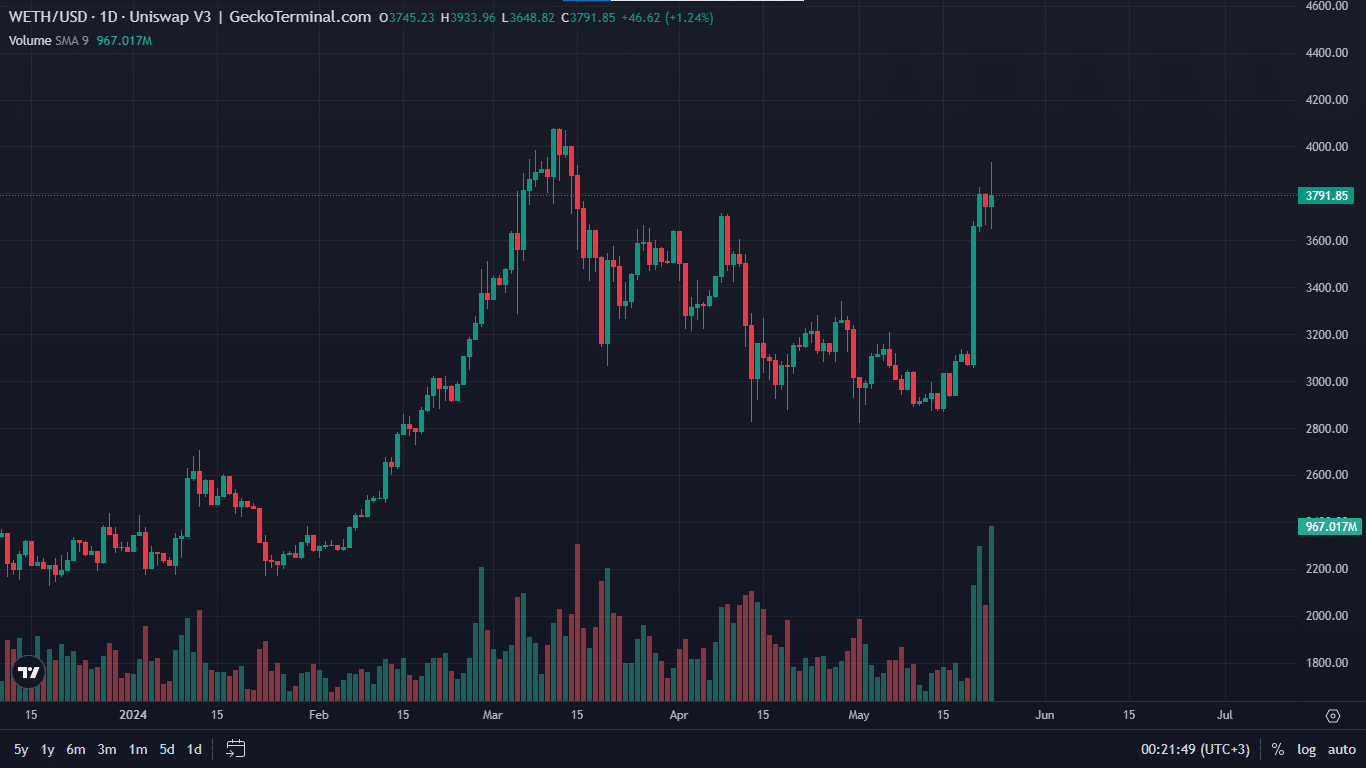

Ethereum’s response was muted, with its price climbing 1.8% in the past 24 hours to trade at $3,836 as of 6.02 p.m. EST, indicating that markets had already priced in the approvals.

The decision comes a little over four months after the landmark approval of multiple Bitcoin spot ETFs in January, and despite the fact that until early this week most analysts had believed such a decision was highly unlikely.

Were ETH ETF Approvals A Political Imperative?

There is speculation that the turnaround may have been prompted by political dynamics as the presidential election looms.

After Republican candidate Donald Trump accepted campaign donations in crypto, there was speculation by analysts that the Democrats may need to change their anti-crypto stance, too, Galaxy Digital CEO Mike Novogratz told CNBC’s Squawk Box in an interview earlier this week.

It seems “someone at the Biden White House made a call and said, guys, we can’t be the party against crypto anymore,“ he said

Last Minute Scramble

Today’s announcement came only hours after the SEC initiated talks with Ethereum ETF issuers for final adjustments to their S-1 forms, causing markets to speculate that approval was a done deal. Ahead of the announcement, SEC chair Gary Gensler had told investors to “stay tuned.”

In the late afternoon the SEC asked for a six-hour extension to the deadline as it rushed to complete the approval process.

JUST IN: The SEC initiates talks with Ethereum ETF issuers for final adjustments to the S-1 form.

Looks like the $ETH ETF is a done deal. 🚀

— Lark Davis (@TheCryptoLark) May 23, 2024

Ethereum ETFS Fast-Tracked By SEC

The SEC began fast-tracking the approvals process early this week, when it asked applicants to update their filings. That prompted analysts Eric Balchunas and James Seyffart at Bloomberg Intelligence to up the odds of approval to 75%, from ”slim to none” previously.

In anticipation of an imminent approval, investors purchased more than 100,000 ETH in spot markets on May 22, the highest for a day since last September, according to on-chain analytics firm CryptoQuant

Early ETH holders buy over 100K ETH yesterday

Julio Moreno, Head of Research at CryptoQuant, reported on X that "Permanent Holders" of Ethereum bought a massive amount of ETH yesterday amid the increasing speculation of spot ETH ETF approval. They purchased over 100,000 ETH, the…

— CoinNess Global (@CoinnessGL) May 21, 2024

A bipartisan group of House lawmakers, including Majority Whip Tom Emmer and NJ Democrat Josh Gottheimer, had sent a letter to the SEC chair yesterday, May 22, urging the SEC “to approve spot Ether ETFs and ‘`other’ digital assets.”

The letter said that the investment products would offer investors access to crypto in a regulated, transparent, and safe format.

We urge SEC Chair @GaryGensler to approve the pending Ether ETP applications. @GOPMajorityWhip @RepJoshG @USRepMikeFlood @WileyNickel

Check out our letter to @GaryGensler below: pic.twitter.com/uv8Sp8lqUx

— French Hill (@RepFrenchHill) May 23, 2024

Singapore-based QCP Capital said earlier that approval of ETH ETFs could trigger a 60% increase in the price of Ethereum.

The Ethereum price has soared by almost 45% in the past two weeks, mirroring the surge seen in the Bitcoin price in the run up to the approval of spot Bitcoin ETFs in January.

GeckoTerminal: ETH/USD 1-day chart

Also Read:

- Meme Coins Explode On Ethereum ETF Optimism As Pepe Hits ATH

- Ethereum Price Prediction: ETH Climbs 2% As 5 ETF Bidders Amend Their Filings And This Green AI Crypto Presale Races Towards $4 Million

- Ethereum Name Service, Ethena, And ETH Meme Coins PEPE And FLOKI Among Big Winners As ETH ETF Odds Improve

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage