Join Our Telegram channel to stay up to date on breaking news coverage

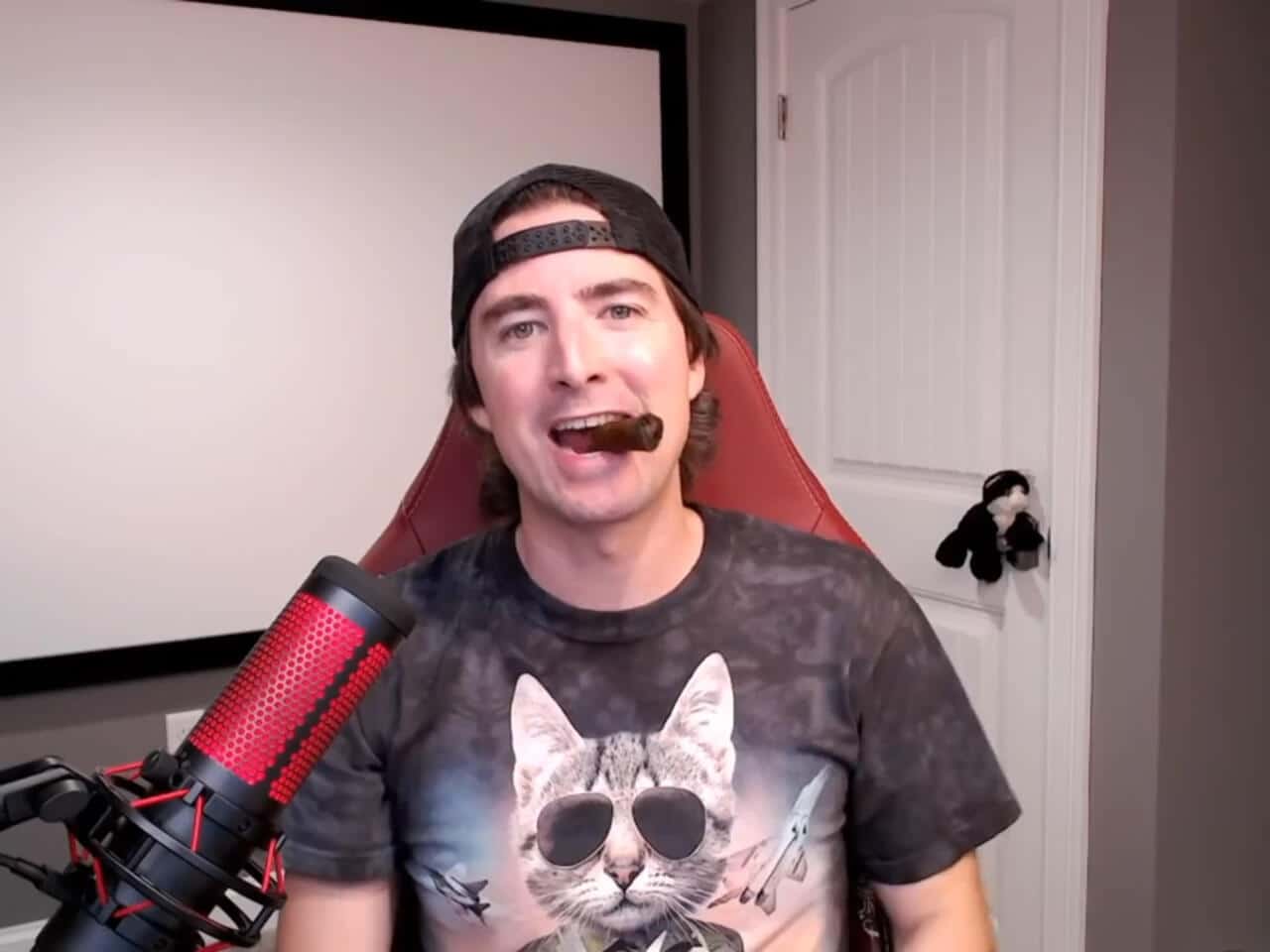

Influential stock trader Keith Gill, known as Roaring Kitty on social media platform X, has become the third largest individual investor in the pet store Chewy.

Gill holds 9,001,000 shares of the pet products company’s Class A common stock, or 6.6% stake, according to a June 24 13G filing with the US Securities and Exchange Commission (SEC). In the filing, he also clarified that he is not a cat.

The filing sent the crypto token CHEWY (CHWY) into orbit with a 497% pump in the last 24 hours. It traded at $0.0000000001105 as of 03:29 a.m. EST on trading volume that skyrocketed 1,151% to $21.3 million.

Keith Gill Makes First Known Investment Beyond GameStop

Gill entered the public spotlight back in 2021 after his role in the GameStop short-squeeze. He then went offline for nearly 3 years, but recently brought an end to his hiatus.

The SEC filing shows that he bought the shares at a closing price of $27.24 on June 28. This means that the stake is worth about $245 million. His position in Chewy is his first known investment beyond GameStop.

BREAKING: Keith Gill aka Roaring Kitty aka DeepFuckingValue of $GME GameStop fame files a SEC 13G for $CHWY, Chewy for 9,001,000 shares, or 6.6% of the company.

He identifies in the SEC filing as “not a cat”. pic.twitter.com/Fhm9WgDfiM

— unusual_whales (@unusual_whales) July 1, 2024

There is a link between GameStop and Chewy in the form of billionaire Ryan Cohen. In the past, Gill praised Cohen, who founded the online pet store and sold it in 2017. The billionaire is now the CEO of GameStop.

Institutional Chewy Stakeholders Fear A GameStop Repeat

Gill’s investment in Chewy has raised concerns among the company’s executives. The primary concern is that asset managers who have a stake in the company might flee their positions over fears that Gill’s involvement might trigger a rollercoaster ride for its shares, according to a Reuters report.

Gill’s disclosure caused the price of Chewy stocks (CHWY) to soar to an intraday high of $30 yesterday. However, the stock has since erased its gains and was down 6.6% at the close of trading on July 1.

CHWY’s recent price movement somewhat echoes that of GameStop’s stock price following Gill’s reappearance online earlier this year. In just the 24 hours after his return, GameStop stock surged from $17.46 to $48.75 per share on May 14.

Related Articles:

- Upcoming Crypto Presales: Unlock Early Investment Opportunities!

- Ethereum Co-Founder Vitalik Buterin Sees Net Worth Surge 54% This Year To More Than $851 Million, Arkham Says

- Top Cryptocurrencies to Buy Now July 1 – Jupiter, LayerZero, Theta Network

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage