Join Our Telegram channel to stay up to date on breaking news coverage

Crypto lending has become the latest trend in the digital currency sector. In a recent report published on Tuesday, lending firm Genesis said that it witnessed record volumes in 2020, thanks to interest in DeFi.

DeFi market responsible for the rise

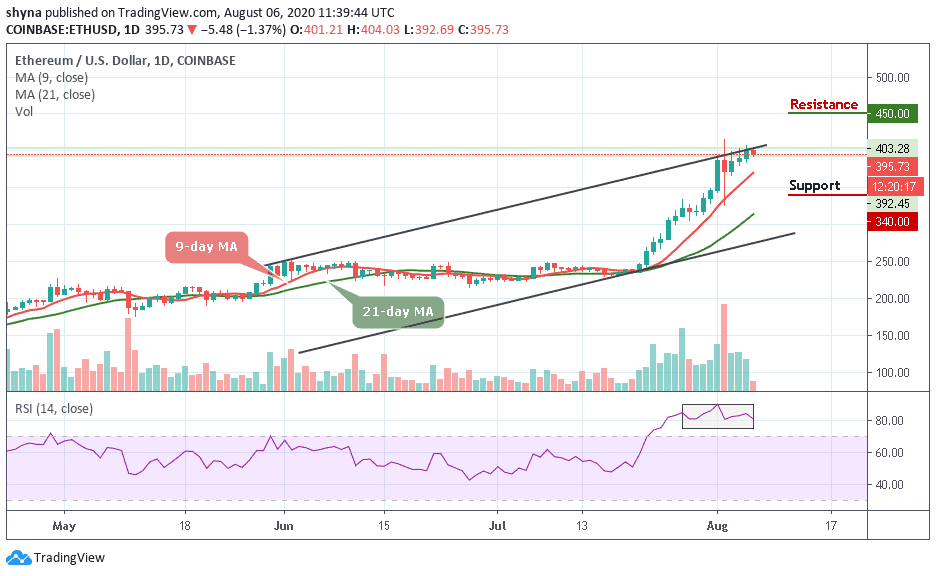

According to Genesis, this rise in trading volume could be because of the increase in the DeFi market which has surged. Another important reason behind the rise is the increasing institutional demand for cryptocurrencies. The firm’s lending business added $2.2 billion in originations during the second quarter of 2020. This will mark the largest quarter ever for the firm as it marked a 324% increase in originations on a year-on-year basis. The firm’s active loans outstanding have also increased by 118% on a quarter-on-quarter basis.

Michael Moro, the CEO of Genesis said in an interview that their business was growing at a sound pace. He said that the growth it experienced is a “function of many things,” as long as they are within the firm’s risk framework. The digital currency market is still high-risk with several fraudulent actors and a lack of proper regulation. The volatility of this sector also interferes with its ability to work as a global hedge.

New yield opportunities in DeFi

Genesis suggests that traders are looking for new yield opportunities, which are available in the DeFi markets. Here, yields can be as high as 1000%. Moro noted that one of the major themes during the second quarter was the demand for yield on digital assets. This search for yield meant that the quarter depended heavily on this one factor.

Moro understands that this growth may not be sustainable. He said that unless the price of cryptocurrencies goes up significantly, they cannot expect anything close to a 120% quarter-on-quarter growth in the upcoming months.

In the second quarter, Genesis traded crypto worth $5.2 billion. The derivatives desk of the company, which was launched recently, recorded a volume of $400 million in June. Since the launch of their business, Genesis has originated $8 billion in crypto loans in Bitcoin, Ethereum, and a few other digital coins.

Join Our Telegram channel to stay up to date on breaking news coverage