Join Our Telegram channel to stay up to date on breaking news coverage

On June 15, the total market capitalization of cryptocurrencies dropped to $1.02 trillion, reaching its lowest point in three months. This decline in value has been influenced by uncertainties surrounding regulations in the cryptocurrency industry.

While the derivatives market has shown resilience and experienced some price gains at the end of the week, particularly in Bitcoin (BTC) and Binance Coin (BNB), it might be unwise to view this as a cause for celebration.

Declining Market Capitalization Amidst Regulatory Uncertainties

Regulatory conditions for cryptocurrencies have been deteriorating in recent weeks, contributing to the bearish trend. In the previous week, Bitcoin and BNB saw modest gains of 2.5%, while XRP and Ether experienced declines of 5.2% and 0.7% respectively.

The 10-week pattern in the crypto market has repeatedly tested the support level, indicating that it will be challenging for the bullish trend to break through while regulatory conditions continue to worsen worldwide.

To illustrate the impact of regulatory developments, Bakkt, a derivatives exchange based in New York, has decided to delist Solana, Polygon, and Cardano due to recent regulatory changes in the United States. This decision follows lawsuits brought by the Securities and Exchange Commission against Binance and Coinbase.

More recently, on June 16, Binance, a major crypto exchange, became the subject of a preliminary investigation in France for operating without a license and providing services to French customers unlawfully.

Furthermore, regulators have discovered that Binance, the cryptocurrency exchange, had insufficient Know Your Customer (KYC) procedures in place. This indicates that the exchange did not adequately verify the identities of its customers, as required by regulations.

In addition, Binance made an announcement on the same day that it would be exiting the Netherlands because it failed to obtain a virtual asset service provider license necessary to operate in the country.

Despite the challenging regulatory environment, two derivatives metrics suggest that the bullish sentiment has not completely faded. However, breaking the bearish price trend will likely prove to be difficult for the bulls.

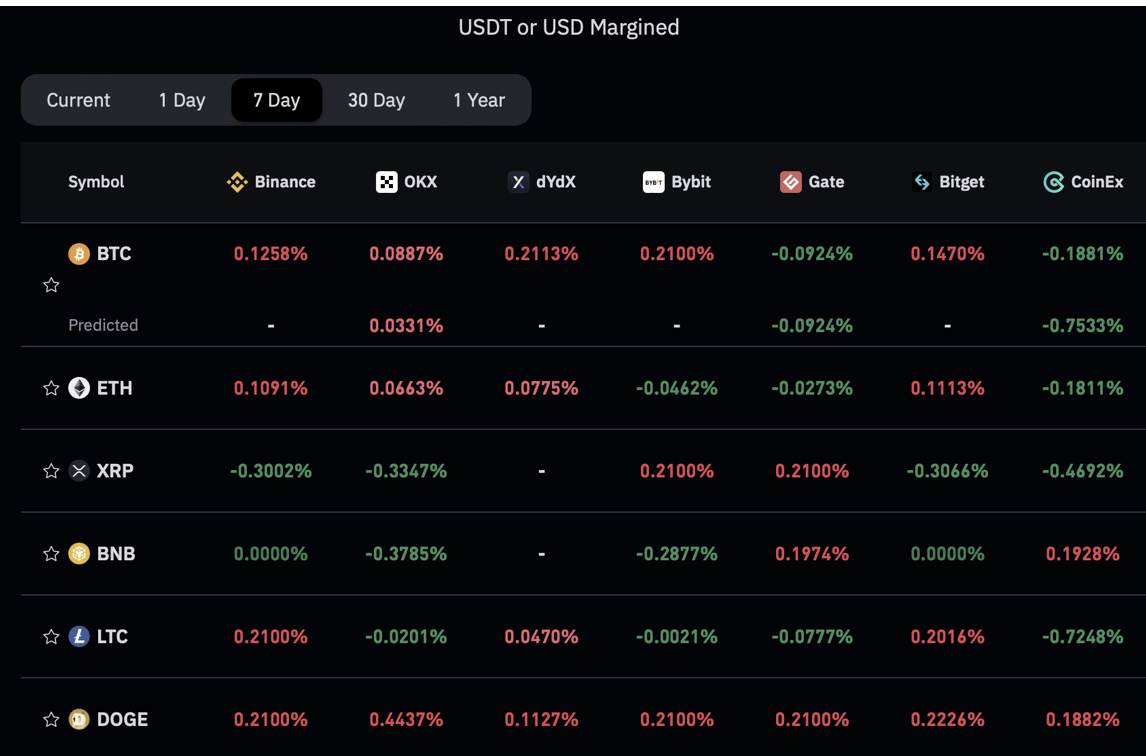

Derivatives such as perpetual contracts reveal the demand for leverage in Bitcoin (BTC) and Ether (ETH). A positive funding rate indicates that buyers require more leverage, while a negative rate suggests that sellers need additional leverage.

Currently, the seven-day funding rate for BTC and ETH is neutral, indicating balanced demand between leveraged buyers and sellers. BNB is an exception, with traders paying up to 1% per week for short bets, likely due to regulatory concerns surrounding Binance.

The premium of Tether (USDT), a stablecoin, is an indicator of demand from Chinese crypto retail traders. When the premium exceeds 100%, it signifies excessive buying demand, and during bearish markets, Tether’s market offer increases, leading to a discount of 2% or more.

The Tether premium in Asian markets fell to 99.2% after remaining stable since June 6, indicating some discomfort, possibly triggered by reports of Tether reserves’ exposure to Chinese debt markets.

While derivatives metrics have shown resilience in the face of regulatory activities targeting crypto exchanges, bears have yet to prove their strength in pushing the market capitalization of cryptocurrencies below the $1 trillion mark. Any gains above $1.12 trillion in capitalization, representing a 10% increase from the recent low, are likely to be short-lived in the coming months.

Currently, bullish investors are relying on the potential approval of a Bitcoin exchange-traded fund (ETF) and/or a Federal Reserve rate cut as catalysts for a potential bull market. However, with the Bitcoin halving event still more than 300 days away, the outlook remains uncertain.

Will Legal Actions and Fed Policy Pause Prolong Crypto’s Bearish Trend?

The cryptocurrency markets have witnessed a bearish turn in mid-June, as various macro factors have come into play. Bitcoin’s price dipped below $25,000, reaching its lowest level since March, following legal actions taken by the Security and Exchange Commission (SEC) against prominent exchanges like Binance and Coinbase. Additionally, the Federal Reserve’s decision to pause its rate hike policy has added to market uncertainty, leaving traders unsure of the potential implications.

The recent SEC crackdown has been a significant driver of the prevailing bearish sentiment, leading to increased regulatory scrutiny within the industry. Furthermore, lower-than-expected inflation rates in the United States momentarily boosted the U.S. dollar, creating further market dynamics.

However, Bitcoin experienced a rebound as it surpassed the $25,000 mark once again, with traders seizing the opportunity to buy during the price dip. This buying activity was likely influenced by oversold conditions, as indicated by the relative strength index (RSI) falling below 30.00.

Analyzing the BTC/USD daily chart, the RSI has broken through a resistance level at 43.00 and currently stands at 43.26, indicating a rise in momentum. The next notable points of resistance are at 50.00 and 57.00, respectively. If bulls manage to surpass these levels, Bitcoin is likely to trade above $27,500 in the coming weeks.

Related Articles

- Cryptocurrency Market Volatility Persists Amid Bitcoin’s Price Dip and Fed Meeting Anticipation

- Crypto Market Outlook Today

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage