Join Our Telegram channel to stay up to date on breaking news coverage

The daily chart reveals that the Quant price prediction is likely to follow a long-entry level near the support level of $95 level.

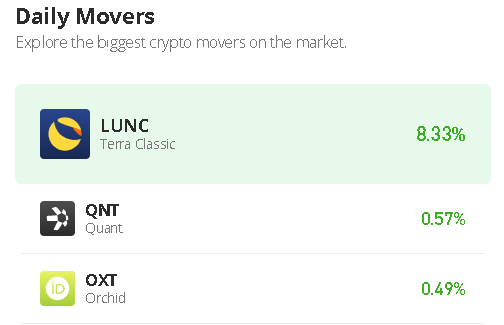

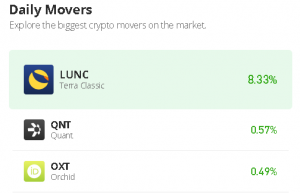

Quant Prediction Statistics Data:

- Quant price now – $101

- Quant market cap – $1.2 billion

- Quant circulating supply – 12 million

- Quant total supply – 14.6 million

- Quant Coinmarketcap ranking – #42

QNT/USD Market

Key Levels:

Resistance levels: $140, $150, $160

Support levels: $70, $60, $50

Your capital is at risk

QNT/USD is heading towards the lower boundary of the channel as the coin dives below the 9-day and 21-day moving averages. However, the technical indicator Relative Strength Index (14) slides below the 50-level. Meanwhile, a decreasing volume index also suggests a breakdown, but a death cross is likely to come into the picture if the coin crosses below the channel.

Quant (QNT) May Stay at the Downside while Tamadoge (TAMA) Faces Up

The Quant price is moving below the 9-day and 21-day moving averages as supports are expected at $95 and $90 respectively. The Relative Strength Index (14) continues to flash a sell signal which may be adding weight to the bearish outlook as the signal line moves to cross below the 40-level.

Moreover, should in case the daily bearish candle closes below $90, there is a high probability that the price may reach the support levels of $70, $60, and $50. Meanwhile, if the Quant bulls push the price to cross the moving averages, an increase in buy orders might create enough volume to support gains beyond $120. Any further bullish movement may reach the resistance levels of $140, $150, and $160 respectively.

Against Bitcoin, traders can see that Quant’s performance has been bearish in the past few days. At the time of writing, the coin is staying under the 9-day and 21-day moving averages. Breaking below the lower boundary of the channel could drag the market to the nearest support level at 3700 SAT and below. The Relative Strength Index (14) is moving to cross below the 50-level; possible selling pressure is likely if it continues to drop.

However, QNT/BTC is currently changing hands at 4890 SAT but if the bulls can halt the selling price and push it above the moving averages, the next key resistance could be at 5000 SAT and 5500 SAT. Reaching these levels might move it to the potential resistance at 6200 SAT and above.

Tamadoge has assimilated the lessons learned from other projects. Revenue is generated by fees paid on transactions in the Tamadoge NFT Petstore, where players buy clothes, food, and other necessities and discretionary items for their pets. You can own as many pets as you like, with the individual traits of each Tamadoge pet constituted as an NFT.

Related:

Join Our Telegram channel to stay up to date on breaking news coverage