Join Our Telegram channel to stay up to date on breaking news coverage

Polygon (MATIC) price is hovering just above $0.54, with a recent drop to June lows. This attracted bullish investors despite overall crypto market uncertainty. MATIC price is down about 20% weekly, including a 4% drop in the past 24 hours, and now auctions for $0.5419. This is MATIC’s lowest value this year, close to June’s $0.59 low. The dip is tied to the broader market crash, including Bitcoin’s drop to $26,000 and $2 billion in liquidations.

Bitcoin just saw one of its largest daily liquidations by volume in history.

Starting at 4:30 PM yesterday, #Bitcoin fell 7.5% in 20 MINUTES, erasing $42 billion in market cap.

This mass-liquidation event involved more outflows in 1 day than during the FTX collapse in November… pic.twitter.com/KmVNkXoOLw

— The Kobeissi Letter (@KobeissiLetter) August 18, 2023

Investor Sentiment Sours as Token Holders Grapple with Steep Losses

This abrupt market crash rattled investors, as MATIC holders’ weekly presence hit lows not seen since September 2022. According to IntoTheBlock data, currently, Polygon investors are facing substantial losses. Over 90.54% of addresses experience losses, indicating a slow recovery process.

The broader crypto market’s recent weeklong crash affected MATIC’s native token, resulting in growing investor losses.

Polygon vs. Ethereum

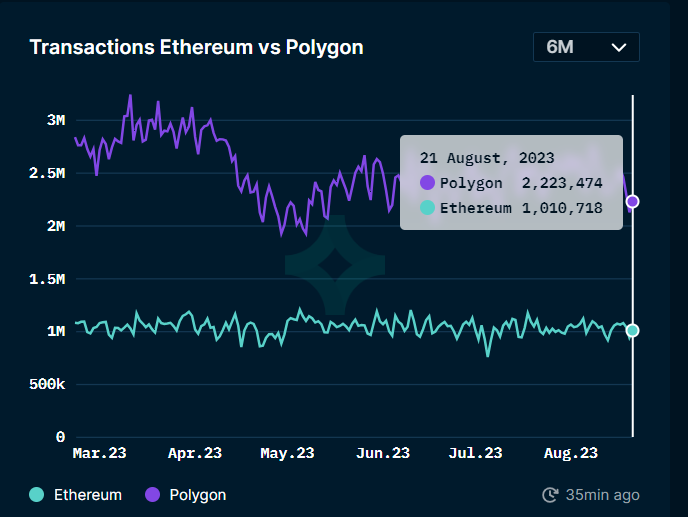

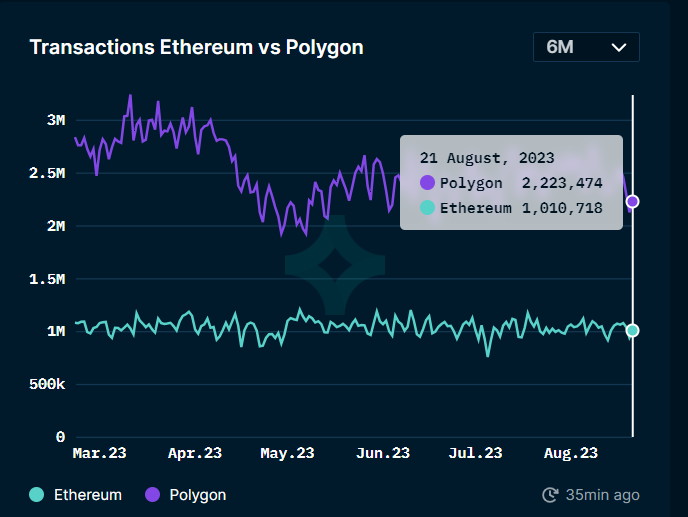

Nansen’s data highlights a stark contrast in the past 24 hours: around 2.2 million transactions occurred on the Polygon chain, while Ethereum recorded 1 million.

Notably, on August 22, the count of contracts activated on the Polygon chain reached 341,000. This is significantly higher than Ethereum’s 4,000 – a remarkable 8246% increase.

The metrics above suggest that MATIC might not be lagging behind its counterparts. This is despite Ethereum’s minor -0.23% price drop today and a 4% decline in MATIC token value.

MATIC Price Analysis

The daily price chart for the Polygon MATIC token hints at an Immediate Breakout Buy Setup. This setup indicates that prices have already broken out above a trendline and are undergoing a retest of the form. If the price action adheres to this pattern, it is expected to decrease until it reaches the trendline from above. However, at that point, the setup suggests a potential upward rebound. Following this pattern, there could be an approximate 111% increase from the current price to $1.1458, with a sole resistance at $0.9424.

Contrarily, other technical indicators forecast further declines. The position of the Moving Average Convergence Divergence (MACD) histograms is in the red zone. This, coupled with the Relative Strength Index (RSI) in the oversold zone, implies a bearish trend. If the decline persists, expect an initial support level at $0.5070. Should prices breach and close below this level, the trendline will provide the next support.

In line with the pattern, a rebound to $1.1458 is projected. Nevertheless, an alternative scenario suggests a continuation of price declines. In this case, the next critical support beneath the trendline lies at $0.3162, representing a 40% drop in value from the current price level.

While MATIC is declining, there might be another attractive option to look for investment.

Alternative to MATIC

Sonik Coin ($SONIK), a recently introduced meme token, is sprinting at astonishing speeds. The project has secured the fastest route to a $100 million market valuation.

This Sonic the Hedgehog-inspired token offers more than mere meme currency status. It boasts a robust stake-to-earn mechanism that rewards committed investors.

🚀 Welcome to the world of $SONIK! 🦔💨

Get ready to experience the fastest #Crypto meme coin in action! 🔥

🌐 Join our #Presale now and be part of #MemeCoin history!

👉https://t.co/NkNhQrZ41q #Sonik #AltGem #Altcoin pic.twitter.com/BsnUlKCZfZ

— SONIK COIN (@Sonikcoin) August 3, 2023

From inception, Sonik Coin’s founders have underscored their community-centric approach, avoiding the need for funding rounds. To stand out from the meme coin crowd, Sonik Coin has innovated with a distinctive staking structure designed to incentivize its community.

By staking $SONIK tokens, holders gain a 40% share of the total token supply and initiate passive income. The dedicated dashboard allows users to monitor staking returns. Those who stake $SONIK could potentially earn substantial annual percentage yields.

Over 555 million $SONIK tokens are locked in staking, delivering an annualized percentage yield exceeding 4,300%, as reported on the project’s website. Tokenomics are meticulously crafted, allocating 10% of tokens for exchange liquidity to mitigate post-launch price fluctuations.

SONIK Presale

The ongoing Sonik Coin Presale presents a prime opportunity to enter at the ground level. The first 300 billion $SONIK are earmarked for early investors with a 50% bonus. The presale aims to raise nearly $2.1 million by offering 50% of its total token supply. This figure symbolizes Sonik’s top speed comparable to that of light.

🦔💨 Ready, set, #SONIK!

gotta buy now – https://t.co/s1fTdXDQCK#MemeCoin #CryptoMemes #Presale pic.twitter.com/iyPnaujjti

— SONIK COIN (@Sonikcoin) August 20, 2023

Supporters of meme currency can access $SONIK tokens at just $0.000014 each post-presale. The rapid pace has already gathered $300,751.3 in funding. Investors can participate with up to $2 million in either $ETH or $USDT.

speedy lil’ ba**ard pic.twitter.com/Lb9yj2lGoe

— SONIK COIN (@Sonikcoin) August 22, 2023

Upon hitting the hard cap, $SONIK will debut on Uniswap, the largest decentralized exchange globally per CoinGecko. The cryptocurrency has gained significant attention on Twitter. It has received commendations for its lucrative features and earning a spot among the top new investment-worthy currencies.

Also Read:

- Crypto News Channel Reviews The Sonik Coin Presale – Next 10x Meme Token?

- Crypto Market Declines, Yet Sonik Coin’s Presale Secures $100K in Less Than a Day – Will Staking for $SONIK Push its Value to $100 Million?

- Sonik Coin Price Prediction – Can $SONIK 10x From Its Presale

- Sonik Coin’s New Crypto Presale: Can it 50x and Reach $100M MCAP?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage